Crypto Exchange Risk Assessment Tool

Risk Assessment Tool

Assess the risk level of using Darkex Exchange based on key factors highlighted in the review.

Risk Assessment Results

Darkex Exchange launched in 2024 with big promises: deeper liquidity than Binance, biometric security no other exchange has, and a full suite of trading tools for beginners and pros alike. But here’s the truth - if you’re thinking about putting money on this platform, you need to know what’s real and what’s just marketing.

What Darkex Exchange Actually Offers

Darkex claims to support over 200 cryptocurrencies, including Bitcoin, Ethereum, Solana, and Avalanche. That’s not unusual - most major exchanges offer that range. Where it tries to stand out is in its product mix. You can do spot trading, futures, margin trading with leveraged tokens, staking, crypto lending, and even access DeFi-style investment products - all inside one app. That’s convenient. If you hate switching between platforms, Darkex makes it feel like a one-stop shop. The mobile app is on Google Play, last updated in January 2025. It’s clean, simple, and works on both Android and desktop. But don’t let the interface fool you. A polished app doesn’t mean a safe one.The Big Claim: Better Liquidity Than Binance?

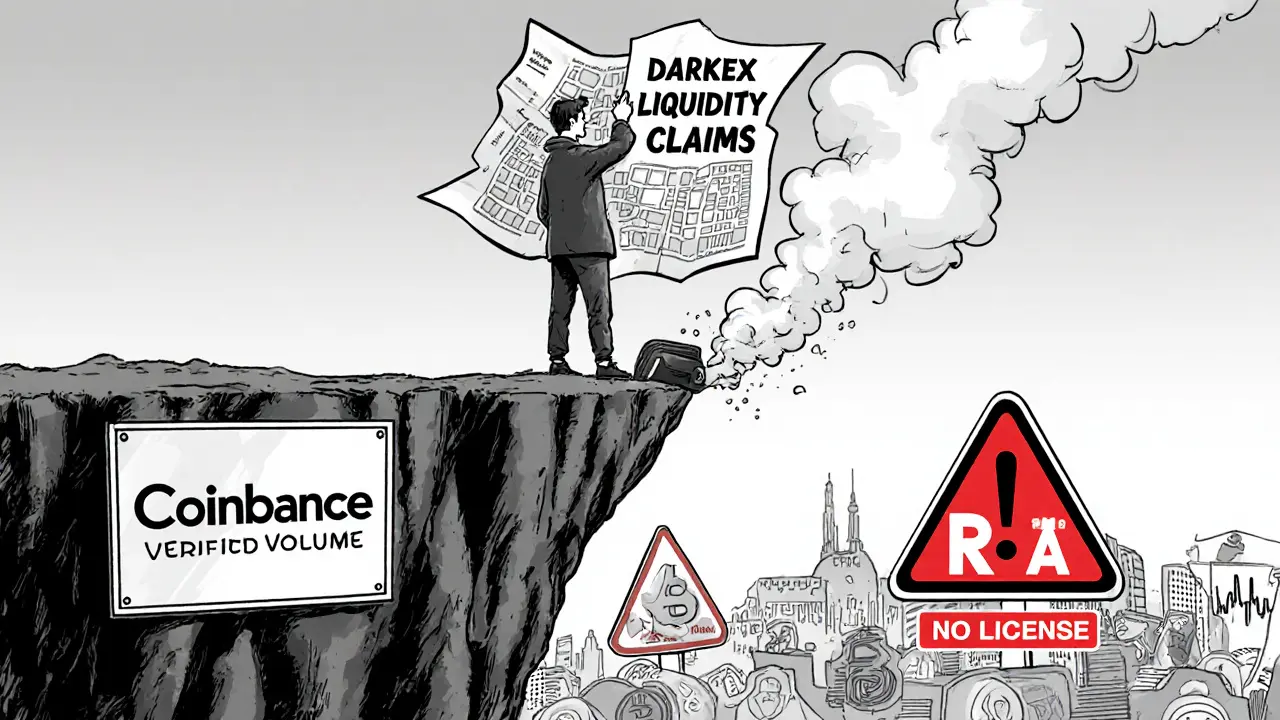

Darkex says it has deeper liquidity than the biggest exchanges in the world. That’s a bold statement. Liquidity means you can buy or sell large amounts without crashing the price. Binance, Coinbase, Kraken - they move billions daily. Darkex? No public trading volume data. No third-party verification. No order book depth charts you can check. If you’re trading $10,000 in ETH, you want to know if your order will fill fast and at a fair price. Without real data, that’s a gamble. The claim feels like a sales pitch, not proof. Until Darkex publishes verified volume stats from sources like CoinGecko or CryptoCompare, treat this as unverified.Security: Safe Mode and Biometrics - Too Good to Be True?

This is where Darkex gets interesting. They have something called "Safe Mode." If the system detects suspicious activity - like a login from a new country or multiple failed passwords - it locks your entire account. To unlock it, you need to scan your fingerprint or face. No email reset. No SMS code. Just biometrics. That’s actually smart. Most exchanges rely on 2FA codes, which can be phished. Biometrics are harder to steal. But here’s the catch: what if your phone is stolen? What if your fingerprint is copied? Darkex doesn’t explain how they store or protect your biometric data. No white paper. No security audit report. No mention of whether they use hardware-backed storage like Apple’s Secure Enclave or Android’s TrustZone. And then there’s the location. Darkex says it’s Dubai-based. But its legal registration is in Tbilisi, Georgia. That’s not a red flag by itself - many crypto firms use offshore registrations. But combined with zero public audits and no regulatory licenses published on their site, it raises questions. Are they hiding something? Or just avoiding the cost of compliance?

Regulatory Trouble: Turkey Blocked Darkex

On September 11, 2024, Turkey’s Capital Markets Board shut down access to Darkex. Why? Because the platform was offering leveraged crypto and forex trading to Turkish residents without a license. Turkey doesn’t allow unlicensed crypto services. Darkex broke that rule. This isn’t a minor issue. It’s a major red flag. If you’re a trader in Turkey, you’re blocked. But even if you’re not, this tells you something important: Darkex is willing to operate in gray areas. They didn’t wait for permission. They launched first, asked questions later. Now they say they’re working to comply. But compliance takes time. It takes legal teams. It takes money. And right now, there’s zero public proof they’ve applied for a license anywhere - not in the EU, not in the US, not in Singapore. That’s not how trustworthy exchanges behave. Binance got fined $4.3 billion for failing to comply. Coinbase spent years building legal teams. Darkex? Silence.No Reviews. No Reputation. No Trust

Check FxVerify. Zero user reviews. Zero star rating. Google Play? No reviews listed. Reddit? No active threads. Twitter? A few promotional posts, but no real user discussions. Telegram? A channel exists, but it’s full of bot messages and copy-pasted announcements. You can’t fake trust. After 18 months, a new exchange should have at least a few hundred verified reviews. Darkex has none. That’s not normal. It’s not just "new." It’s invisible to the community. Compare that to Kraken. Launched in 2011. Thousands of reviews. Years of user stories. Even Binance, despite its controversies, has millions of users talking about it daily. Darkex? Crickets.

Darkex Academy: Education or Distraction?

They’ve got a learning portal called Darkex Academy. It offers guides on trading basics, how to use the platform, and how to pick exchanges. That sounds helpful. But here’s the twist: most of that content is generic. It’s the same stuff you’ll find on Coinbase Learn or Binance Academy. Nothing unique. No advanced strategies. No deep dives into risk management. Is it useful? Sure, for absolute beginners. But if you’ve traded before, you’ll feel like you’re being handed a beginner’s pamphlet while the platform asks you to risk real money.Who Is Darkex For?

Let’s be honest. Darkex isn’t for experienced traders. They want users who don’t know any better. People who see "biometric security" and think it’s the safest option. People who don’t check if an exchange is licensed. People who trust flashy apps over hard facts. It’s also not for anyone in Turkey, the UAE, or any country with strict crypto rules. If you’re in the US, you’re probably out of luck - no mention of compliance with FinCEN or state-level money transmitter laws. The only people who might benefit are those in emerging markets with limited access to other exchanges - and even then, the regulatory risk is high. If Darkex gets shut down tomorrow, your funds could vanish. No insurance. No legal recourse.Final Verdict: Too Risky for Most

Darkex Exchange has a slick app, a cool security feature, and a lot of big claims. But none of that matters if the platform isn’t transparent, licensed, or trusted. Darkex Exchange is not a scam - not yet. But it’s also not a safe place to store or trade your crypto. Without verified trading volume, public audits, regulatory licenses, or user reviews, there’s no way to know if your money is protected. If you’re looking for a new exchange, stick with ones that have been around for years. Ones that publish their proof of reserves. Ones that have been fined by regulators - because that means they’re real, and they’re accountable. Darkex feels like a startup trying to rush to the top. But in crypto, speed doesn’t win. Trust does.Is Darkex Exchange safe to use?

Darkex has a unique biometric "Safe Mode" feature that locks accounts during suspicious activity, which is a strong security layer. But safety isn’t just about tech - it’s about trust. Darkex has no public security audits, no proof of reserves, and no regulatory licenses in major markets. It was blocked in Turkey for operating illegally. Without transparency, you’re trusting a company that doesn’t want to be seen. For most users, that’s too risky.

Does Darkex Exchange have real trading volume?

Darkex claims to have deeper liquidity than Binance or Coinbase, but there’s no public data to back it up. No third-party sources like CoinGecko or CryptoCompare list Darkex’s trading volume. Real exchanges publish this. Darkex doesn’t. That’s a major red flag. If you can’t verify volume, you can’t trust price stability or order execution.

Can I withdraw my crypto from Darkex Exchange?

According to their website, you can withdraw cryptocurrencies. But there are no user reports confirming withdrawals worked smoothly. With zero reviews and no public complaints or success stories, there’s no way to know if withdrawals are reliable. Some exchanges lock funds during regulatory crackdowns - and Darkex has already been blocked in a major country. Proceed with extreme caution.

Is Darkex Exchange regulated?

No. Darkex is not licensed by any major financial authority like the SEC, FCA, or MAS. It’s registered in Georgia, which has loose crypto rules. It was blocked by Turkey’s Capital Markets Board for offering unlicensed services. While they claim to be working toward compliance, there’s no public evidence they’ve applied for any license. Unregulated exchanges are high-risk - your funds have no legal protection.

Why are there no user reviews for Darkex?

There are no verified user reviews on FxVerify, Trustpilot, Reddit, or Google Play. That’s unusual for any exchange that’s been live for over a year. Most platforms, even flawed ones, have users who leave feedback - good or bad. The absence of reviews suggests either very low user adoption or a lack of trust. It’s possible users tried it and left because they couldn’t withdraw, or because they felt something was off. Silence isn’t safety.

Should I use Darkex instead of Binance or Coinbase?

No. Binance and Coinbase, despite their flaws, have years of history, public audits, regulatory engagement, and millions of users. They’ve been fined, they’ve made mistakes - but they’re accountable. Darkex has none of that. It’s a new platform with big promises but zero proof. If you want reliability, go with established names. If you want to gamble on a startup with no track record, that’s your choice - but don’t call it investing.

Johanna Lesmayoux lamare

Just read this whole thing and honestly? I’m scared to even click on their app now.

Biometrics sound cool until your phone gets stolen and your face is the only key.

Zero reviews? That’s not new-that’s ghost town.

Rachel Everson

Really appreciate this breakdown. I was tempted by the app’s design-it’s so clean, you’d think it’s legit.

But you’re right: polish doesn’t equal protection.

Been burned before by shiny new platforms that vanish after a few months.

Stick with the old guard. They’ve got scars-and that means they’ve survived.

Darkex feels like a TikTok crypto influencer with a website.

Don’t trust the vibe. Trust the paper trail.

And there’s zero paper here.

Thanks for calling it like it is.

ty ty

Oh wow. A crypto exchange that thinks fingerprint scans make up for zero regulatory compliance.

Next they’ll say their CEO’s aura stabilizes the blockchain.

What’s next? Quantum-entangled 2FA?

People are still falling for this? I’m not even mad. I’m just disappointed.

Ashley Mona

Y’all are underestimating how dangerous this is.

Biometric data isn’t like a password-it’s *you*. Once it’s leaked, you can’t change it.

And if they’re storing it on some Georgian server with no encryption standards? Congrats, you just gave hackers your face.

Also, Turkey blocking them? That’s not a warning-it’s a siren.

And no one’s talking about how they’re probably laundering through shell accounts.

Don’t be the next headline.

dhirendra pratap singh

OMG I KNEW IT 😭

They’re using the same playbook as every other scammy exchange that pops up after a bull run.

Biometrics? LOL. My cousin used one of these and lost $47K in 3 days.

They said "we’re working on compliance"-then vanished.

And now they’re pretending to be a "DeFi powerhouse"? 😂

People, wake up. This isn’t innovation. It’s a Ponzi with a mobile app.

My heart goes out to the newbies who think this is safe.

💔

Edward Phuakwatana

Let’s zoom out. The real tragedy here isn’t Darkex-it’s the culture that rewards speed over substance.

We’ve normalized trusting interfaces over integrity.

Biometrics feel futuristic, but without transparency, they’re just theater.

And liquidity claims without third-party verification? That’s not confidence-it’s cognitive dissonance.

We’re not just investing in crypto-we’re investing in belief systems.

Darkex is selling a dream built on sand.

And the saddest part? It’s working.

Because hope is cheaper than due diligence.

tom west

Let’s be brutally honest: Darkex isn’t just risky-it’s a liability waiting to explode.

No audits? No licenses? No volume data? No reviews? You’re not an investor-you’re a volunteer for a financial crime syndicate.

And don’t even get me started on the "Dubai-based, Georgian-registered" nonsense-that’s not offshore, that’s evasion.

They’re not trying to build a business. They’re trying to extract value before regulators catch up.

This isn’t crypto innovation. This is predatory capitalism with a sleek UI.

If you’re still considering this, you’re not a trader-you’re a mark.

Debraj Dutta

Interesting analysis. As someone from India, I’ve seen many such platforms come and go.

What’s worrying is how they target emerging markets with flashy UIs and promises of "easy gains".

Local regulators here are clueless, so users think it’s safe.

But the moment they vanish, there’s no recourse.

Darkex is not unique-it’s just the latest in a long line.

Stick to regulated platforms, even if they’re slower.

Slow and safe beats fast and gone.

Arthur Coddington

I just sat here for 20 minutes wondering why I even care about this exchange.

It’s not even a question of safety-it’s a question of *why*.

Why would anyone choose this over Binance, Kraken, Coinbase?

Is it the biometrics? The app design? The fact that it doesn’t exist on Reddit?

It’s not a product. It’s a void.

And we’re all just throwing money into it hoping it screams back.

What’s the point?

Phil Bradley

Look, I get it. We all want the next big thing.

But crypto isn’t about chasing shiny objects-it’s about protecting your future.

Darkex feels like a dating app that says "I’m the one" but won’t show you their ID.

Trust isn’t built with animations.

It’s built with audits, licenses, and transparency.

And Darkex? It’s giving us a slideshow with no captions.

Don’t fall for the vibe. Wait for the proof.

It’s not hard. Just patient.

Stephanie Platis

Darkex’s claims are not merely unsubstantiated-they are egregiously, dangerously, and systematically unverified.

Biometric security? Without hardware-backed enclave implementation? Unacceptable.

Regulatory silence? A red flag wrapped in barbed wire.

And the absence of user reviews? That’s not a feature-it’s a funeral bell.

Any rational actor would walk away.

Anyone who invests here is not a trader-they are a data point in someone else’s exit strategy.

Michelle Elizabeth

It’s funny how people get obsessed with "biometric security" like it’s some magic shield.

Meanwhile, the exchange doesn’t even disclose where their servers are.

It’s like buying a safe with a fingerprint lock… but the safe is in a van with no license plate.

Also, no one’s talking about how their "DeFi products" are probably just rug pulls with a different name.

They’re not trying to build trust.

They’re trying to distract you from the fact that they’re not real.

Joy Whitenburg

ok but like… i just tried signing up and the app asked for my face scan before i even created a password?

that’s not secure… that’s just weird.

and then the "Darkex Academy" was just like… copy-pasted from Binance’s site?

lmao.

they didn’t even change the examples.

my friend said "it’s fine, they’re new"-but new doesn’t mean legit.

it means lazy.

and i’m out.

Kylie Stavinoha

This is a cultural moment disguised as a crypto review.

Darkex doesn’t represent a failed business model-it represents a failed collective imagination.

We’ve been trained to equate sleek design with legitimacy, speed with innovation, and promises with proof.

But trust isn’t designed-it’s earned.

And earning it requires accountability, patience, and humility.

Darkex offers none of those.

Instead, it offers the illusion of progress.

And in crypto, illusions are the most expensive currency of all.

Diana Dodu

Let me be clear: if you’re using Darkex, you’re not just risking your money-you’re betraying every American who’s fought for financial integrity.

We don’t let foreign shell companies dictate our financial safety.

And if you’re okay with Georgia-based crypto platforms ignoring Turkish law? You’re part of the problem.

This isn’t about crypto.

This is about sovereignty.

And you’re surrendering yours for a fancy app.

Suhail Kashmiri

bro why are you even reading this? just go use binance like everyone else.

darkex? that’s for people who think "biometric" means "unhackable".

your face ain’t a password, dumbass.

and if you’re not checking reviews? you’re not trading.

you’re donating.

Raymond Day

🚨 BREAKING: Darkex is the crypto equivalent of a TikTok influencer selling "miracle weight loss pills".

Biometrics? 👍

No audits? 👎

Blocked in Turkey? 👎👎

No reviews? 👎👎👎

They’re not a platform-they’re a vibe.

And vibes don’t pay your bills.

Also, their "Academy" is just ChatGPT with a logo.

Don’t be the guy who lost his life savings because he liked their loading screen.

💀

BRYAN CHAGUA

I want to believe in innovation. I really do.

But innovation without responsibility is just noise.

Darkex has the tools of a serious exchange but the soul of a sketchy startup.

They’re not trying to serve traders-they’re trying to harvest data and capital before the next crackdown.

And while they’re busy marketing "biometric safety," real exchanges are publishing proof of reserves and undergoing audits.

There’s a difference between building something and just putting up a sign.

Choose wisely. Your funds-and your peace of mind-are worth more than a sleek interface.