PolkaBridge isn't a crypto exchange in the way you think of Binance or Coinbase. It doesn't have a customer support desk, a mobile app you download from the App Store, or a clean interface that lets you buy Bitcoin with a credit card. Instead, it's a PolkaBridge a decentralized application (dApp) built on the Polkadot network that enables cross-chain token swaps without wrapped assets. Think of it less like a bank and more like a stubborn, underfunded bridge between blockchain worlds - one that works only if you're willing to walk across it with a tiny backpack of tokens and accept that you might lose half your stuff on the way.

The core idea sounds smart: let users swap tokens directly between Ethereum, Binance Smart Chain, Polygon, Solana, and Polkadot - all without needing to lock assets into wrapped versions like wETH or wBTC. That’s a real problem in DeFi. Most platforms force you to convert your native token into a synthetic version just to move it across chains. PolkaBridge claims to skip that step. But theory doesn’t pay bills. And in practice, the bridge is nearly empty.

How PolkaBridge Actually Works

PolkaBridge runs as a decentralized exchange (DEX) using an Automated Market Maker (AMM) model. That means there are no order books. Instead, liquidity pools - pools of tokens locked in smart contracts - determine prices. When you swap PBR for ETH, you’re trading against a pool of those tokens. The more liquidity in the pool, the smoother the trade. The less liquidity? Slippage skyrockets.

Here’s the catch: PolkaBridge’s liquidity is almost nonexistent. According to CoinGecko, its 24-hour trading volume sits at a mere $18.37. That’s less than the cost of a coffee in Madison. For comparison, Uniswap V3 moves over $1 billion in the same timeframe. This isn’t just low - it’s dangerously low. If you try to swap more than $50 worth of PBR, you’ll likely get a price that’s 10%, 20%, or even 50% worse than what you expected. That’s not slippage. That’s a tax.

Trading pairs are limited too. The main one is PBR/WETH on Uniswap V2. You’ll also find PBR/USDT on Gate.io, but that’s it. No major exchange lists it. No institutional support. No stablecoin pairs beyond the basics. If you want to trade anything else - say, SOL to DOT - you’re out of luck. PolkaBridge doesn’t offer direct swaps between those. You’d have to go through PBR as a middleman, and even then, the pool is so thin it’s not worth the gas fees.

The PBR Token: Deflationary, But Not Valuable

PolkaBridge’s native token, PBR, is designed with a deflationary model. Every transaction carries a 0.5% fee. 0.45% goes to liquidity providers. 0.05% gets burned. That sounds good on paper - reducing supply should increase value, right?

But here’s the reality: with only $18.37 traded daily, the burn rate is negligible. You’re burning pennies while the whole system is on life support. The circulating supply is 72 million PBR tokens. The market cap? Just over BTC 0.6966 - or about $40,000 at current rates. That puts it at #7351 on CoinGecko. Out of over 25,000 cryptocurrencies. That’s not niche. That’s invisible.

Price predictions are all over the map. PricePrediction.net says PBR might hit $0.0018 by the end of 2025. WalletInvestor says it’ll drop below $0.001. CoinLore warns that low-volume coins like this can swing wildly - one tweet, one whale dump, and your holdings could vanish overnight. The all-time high was $3.28. Today? It’s trading at $0.0005. That’s a 99.98% drop. If you bought at the top, you’d need a miracle to break even.

Why PolkaBridge Fails Where Others Succeed

There are other cross-chain solutions out there - Thorchain, Multichain, Socket. They all have one thing PolkaBridge lacks: liquidity. Thorchain’s TVL (total value locked) is over $100 million. Multichain’s is $300 million. PolkaBridge’s? Less than $1 million, and shrinking.

Why? Because no one trusts it. No one uses it. And why would they? The interface is clunky. The documentation is buried. There’s no active community on Reddit or Twitter. Slashdot’s comparison page shows 0 ratings. That’s not a sign of neutrality - it’s a sign of abandonment.

Even the technical integrations are outdated. PolkaBridge supports Ethereum, Polkadot, BSC, Polygon, and Solana - but it doesn’t integrate with newer chains like Avalanche or Base. It doesn’t support Layer 2s like Arbitrum or Optimism. It’s stuck in 2021 while the rest of DeFi moved on.

Who Is This For? (Spoiler: Almost No One)

PolkaBridge might be useful if:

- You’re a researcher studying low-liquidity DeFi protocols

- You have a few hundred dollars to lose and want to experiment with cross-chain mechanics

- You’re holding PBR from 2022 and are emotionally attached to it

It’s not useful if:

- You want to swap ETH for SOL without waiting 30 minutes for a 40% slippage warning

- You need reliable customer support

- You’re new to crypto

- You care about security audits (and there’s no public audit report available)

The platform requires you to connect a wallet like MetaMask or Polkadot.js. That’s standard for DEXs. But the process is a maze. You need to understand gas fees on Ethereum, transaction limits on BSC, and how to switch networks manually. There’s no guide. No tutorial. No onboarding. Just a button that says "Connect Wallet."

Security: No Red Flags, But No Reassurance Either

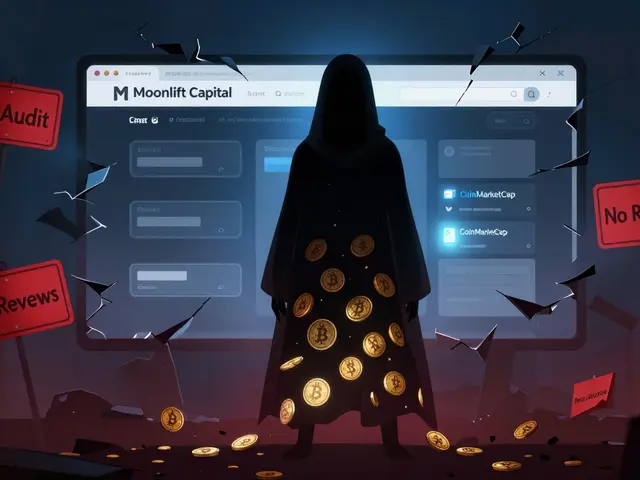

There’s no evidence of a hack. No exploit. No rug pull. That’s good. But there’s also no proof of security. No public audit reports. No bug bounty program. No transparency around the team. The website doesn’t list who built it. No LinkedIn profiles. No GitHub commits. That’s not anonymity - it’s obscurity.

Smart contracts are always risky. But when they’re running with $40,000 in total value and zero oversight? You’re not taking a risk. You’re gambling.

Final Verdict: A Ghost Bridge

PolkaBridge was built with a real goal: to solve cross-chain fragmentation. But execution failed. The team didn’t secure funding. The community didn’t grow. The liquidity never materialized. And now, it’s a ghost.

There’s no future here unless something changes - and there’s zero sign that it will. No major partnerships. No upgrades. No marketing. No press. Just a website that still loads, and a token that keeps ticking down.

If you’re thinking of buying PBR, don’t. If you’re thinking of using it to swap tokens, don’t. If you’re curious about cross-chain tech, try Thorchain or Multichain instead. They’re alive. They’re liquid. They’re actually used.

PolkaBridge? It’s a footnote in DeFi history. And if you’re lucky, that’s all it ever will be.

Is PolkaBridge a safe crypto exchange?

PolkaBridge isn’t a traditional exchange - it’s a decentralized app. There’s no evidence of a hack or scam, but there’s also no public audit of its smart contracts. With only $40,000 in total value locked and no team transparency, it’s impossible to verify security. It’s not outright dangerous, but it’s not safe either - it’s just unmonitored.

Can I use PolkaBridge to swap ETH for SOL directly?

No. PolkaBridge doesn’t support direct ETH-to-SOL swaps. You’d need to first convert ETH to PBR, then PBR to SOL. But the liquidity in both pools is so low that the slippage would be extreme - likely over 30%. It’s not practical. Use Thorchain or Multichain instead.

Why is PolkaBridge’s trading volume so low?

The platform lacks marketing, community support, and liquidity incentives. Most users abandoned it after 2022. With only two major listings (Uniswap V2 and Gate.io) and no integrations with popular wallets or DeFi tools, there’s simply no reason for traders to use it. The $18.37 daily volume reflects total disuse.

Is PBR a good investment?

No. PBR has lost over 99% of its value since its all-time high. Price predictions range from $0.00005 to $0.002 by 2025 - far below its current price. With no roadmap, no team visibility, and zero liquidity, it’s a speculative gamble, not an investment. Experts at CoinLore and WalletInvestor all warn against it.

How do I buy PBR tokens?

You can buy PBR on Uniswap V2 using ETH or on Gate.io using USDT. First, get ETH or USDT on a centralized exchange like Binance. Transfer it to a MetaMask or Polkadot.js wallet. Then connect that wallet to the PolkaBridge DEX and swap. But be warned - even small trades will have extreme slippage due to low liquidity.

Charrie VanVleet

Honestly, I love how PolkaBridge is just out here trying. Not every project needs to be a billion-dollar exchange. Sometimes it’s the weird little bridges that end up changing everything. I’ve used it a few times for small swaps, and yeah, slippage sucks-but I’ve seen worse. Keep building, even if no one’s watching. 🤞