Bitcoin: What It Is, How It Works, and Why It Still Matters

When you hear Bitcoin, the first decentralized digital currency that operates without banks or central control. Also known as BTC, it was created in 2009 to let people send money directly to each other, anywhere in the world, with no middleman. Unlike traditional money, Bitcoin doesn’t exist as paper or coins. It’s a digital ledger—called a blockchain, a public, tamper-proof record of all Bitcoin transactions spread across thousands of computers—that updates every 10 minutes. This system makes it nearly impossible to cheat, double-spend, or reverse payments.

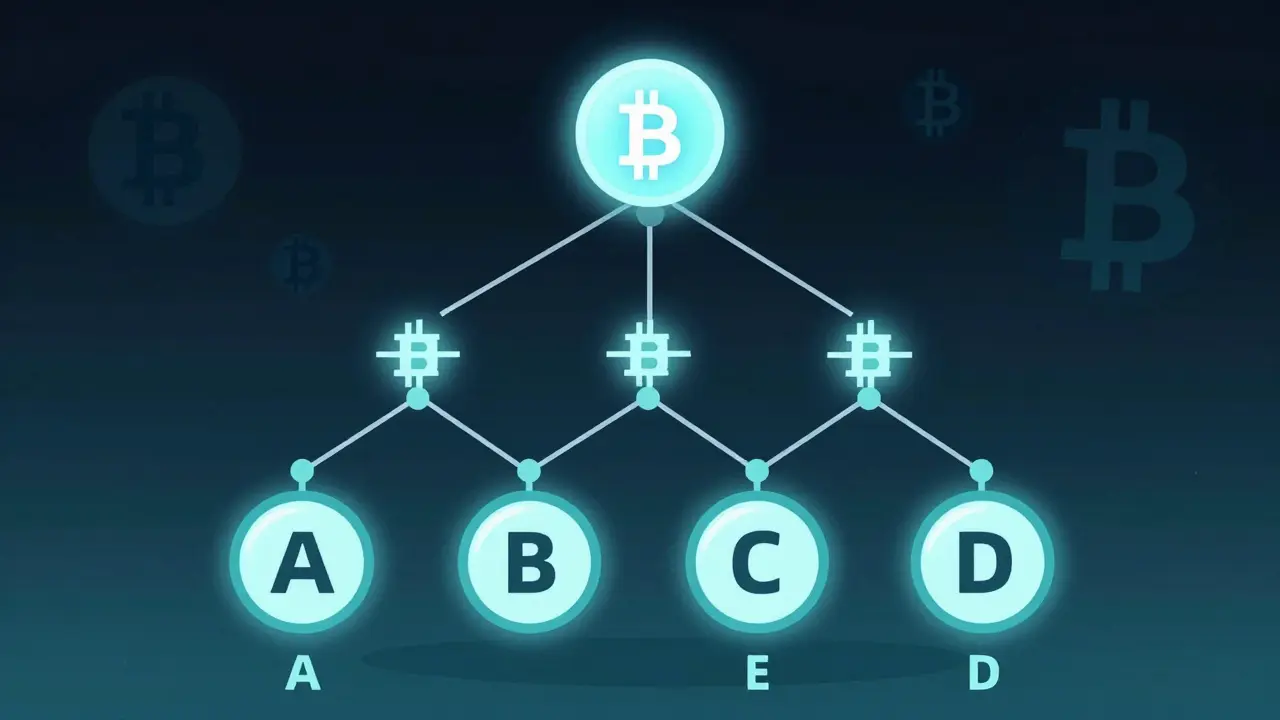

What keeps Bitcoin running? Proof-of-Work, a security mechanism that forces miners to solve complex math puzzles using powerful hardware. These miners compete to validate transactions and add them to the blockchain. In return, they get newly created Bitcoin and small fees. This process is powered by the SHA-256, a cryptographic hash function that turns any input into a fixed-length string of letters and numbers, making it nearly impossible to reverse-engineer. It’s not flashy, but it’s worked for over 15 years without a single major breach. That’s why even when new coins promise faster speeds or lower fees, Bitcoin still holds the most trust.

Bitcoin isn’t perfect. It’s slow for daily payments, uses a lot of electricity, and its price swings wildly. But it’s also the only crypto that’s survived bans in Vietnam, China, and the Philippines—and still gets used anyway. People trade it to avoid capital controls, send money across borders without banks, or just hold it as digital gold. Some see it as a hedge against inflation. Others use it to fund decentralized apps or move value where traditional finance won’t go. The posts below show how Bitcoin fits into real-world rules, risks, and revolutions—from Canada’s first Bitcoin ETF to why businesses get fined for accepting it, and how its core tech keeps it alive even when everything else fails.