Celo crypto: What it is, how it works, and why it matters for mobile DeFi

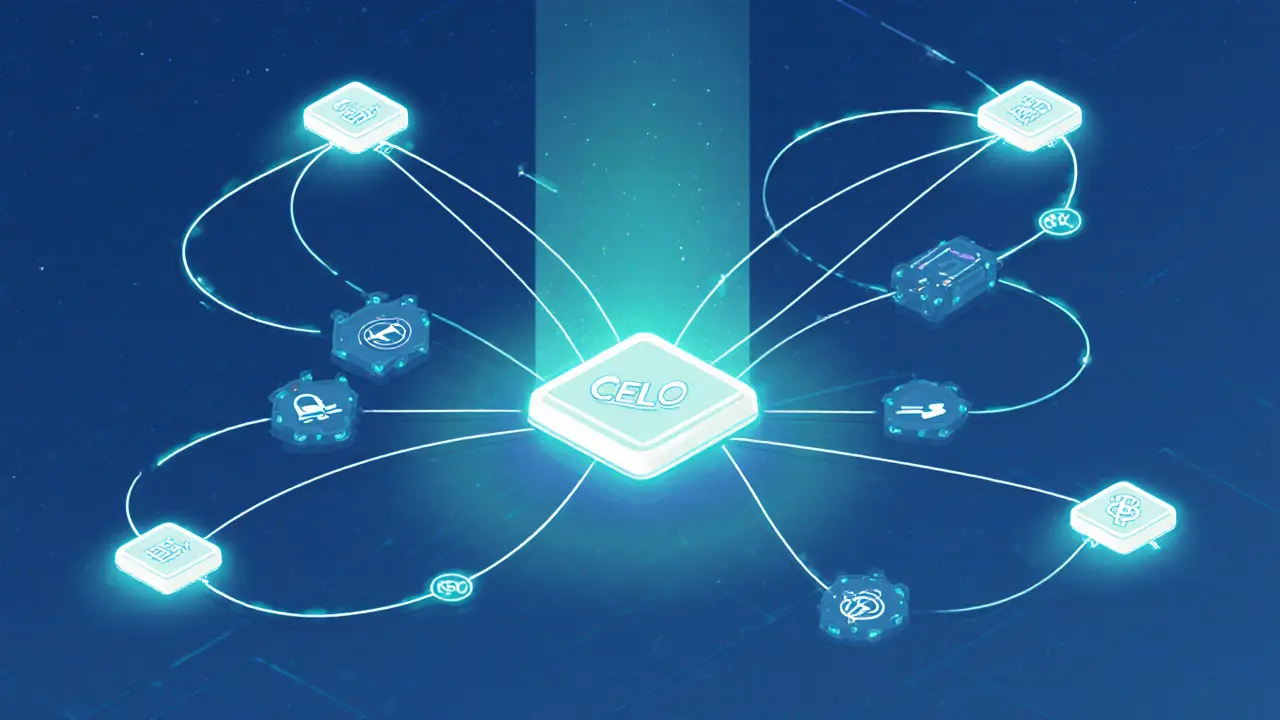

When you hear Celo crypto, a blockchain designed to bring financial tools to anyone with a smartphone. Also known as Celo blockchain, it’s not just another Ethereum fork—it’s built from the ground up to work on low-end phones in places where internet access is spotty and banking is hard to reach. Unlike most blockchains that need powerful hardware, Celo lets you send money, borrow, or earn interest using just a basic Android device. That’s why it’s popular in countries like Kenya, Brazil, and the Philippines, where mobile money is already common but crypto wallets aren’t.

One of its biggest features is cUSD, a stablecoin pegged to the US dollar that runs natively on Celo. This isn’t some sidechain token—it’s the main currency people use to pay for goods, send remittances, or lend money through apps like Moola Market, a decentralized lending protocol built on Celo for users who need small loans without bank approval. You don’t need a credit score. You just need a phone number to get started. That’s the whole point: making finance simple, fast, and open to anyone with a SIM card.

Celo also uses a unique proof-of-stake system called Celo Proof-of-Stake (Celo PoS), which is faster and cheaper than Ethereum’s old model. Transactions cost pennies, confirm in seconds, and don’t need complex wallets. That’s why projects like Moola Market and other DeFi apps on Celo can focus on usability instead of fighting high gas fees. It’s not trying to be the biggest blockchain—it’s trying to be the most usable one for people who’ve been left out of traditional finance.

You’ll find posts here that cut through the noise. Some explain how Moola Market works, others warn about fake airdrops pretending to be tied to Celo. There are reviews of real tools, scams to avoid, and clear breakdowns of how cUSD stays stable. No hype. No promises of quick riches. Just what you need to know if you’re using or considering Celo crypto in 2025.