Crypto Exchange Iran: What You Need to Know About Trading Crypto in Iran

When it comes to crypto exchange Iran, a term referring to online platforms where users in Iran buy, sell, or trade cryptocurrencies despite local restrictions. Also known as Iranian crypto trading platforms, these services operate in a legal gray zone—neither fully banned nor officially supported by the government. Many Iranians turn to peer-to-peer marketplaces or offshore exchanges because local banks block crypto transactions, and no major global exchange like Binance or Coinbase offers direct services there.

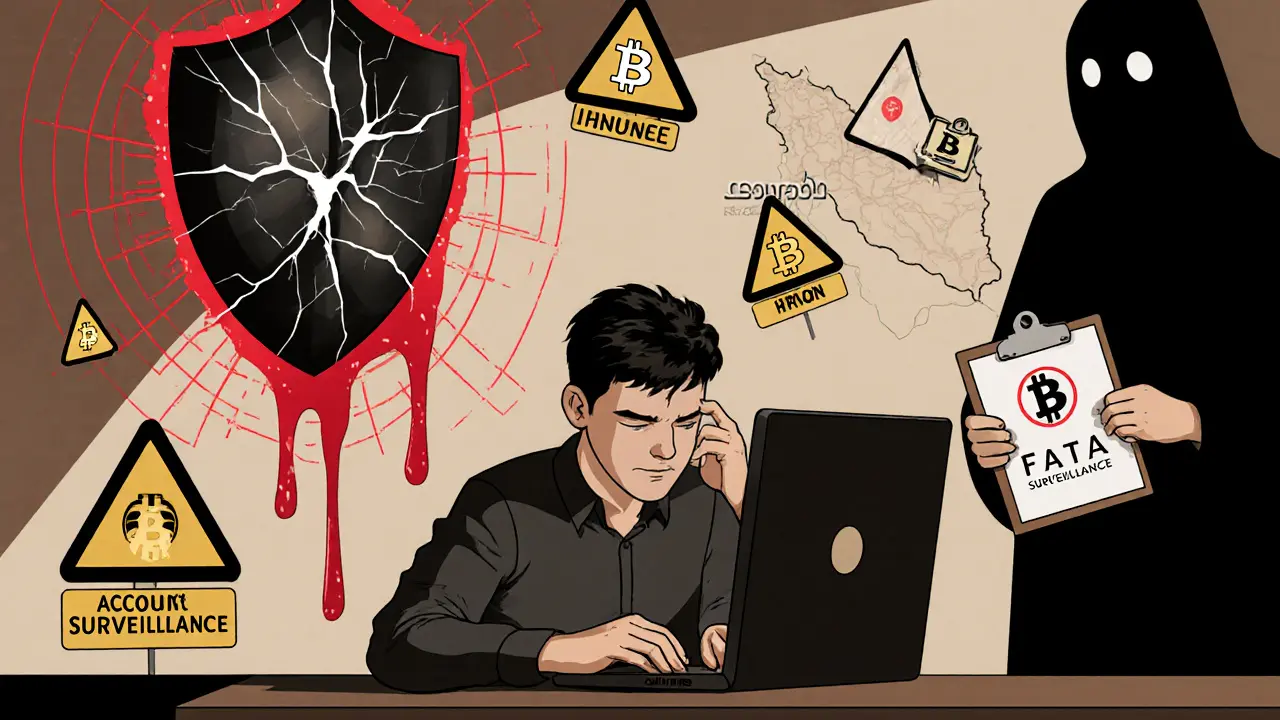

That doesn’t mean it’s impossible. People in Iran use platforms like P2P exchanges, peer-to-peer trading systems that connect buyers and sellers directly without a central authority. Also known as local crypto traders, they let users pay via local bank transfers, mobile wallets, or even cash deposits. This is how most Iranians access Bitcoin, USDT, and other coins. But it comes with risks: scams, frozen accounts, and sudden regulatory crackdowns are common. The government has cracked down on unlicensed exchanges before, and some users have lost funds when platforms vanished overnight.

Another key issue is crypto wallets Iran, non-custodial digital wallets that let users store and manage their crypto without relying on local exchanges. Also known as self-custody wallets, they’re essential for anyone serious about holding crypto safely in Iran. Popular choices include MetaMask, Trust Wallet, and hardware options like Ledger—anything that doesn’t require KYC or tie to an Iranian bank. Without these, you’re at the mercy of third parties who can freeze your balance or disappear.

Regulations in Iran shift constantly. In 2024, the central bank allowed mining under strict conditions, but trading remains unregulated. That means if you use a platform like Bitsonic, a Korean-only exchange with no English support and limited transparency. Also known as regional crypto exchanges, it’s not accessible to Iranians—but similar local or offshore platforms fill the gap. You’re often dealing with anonymous operators, no customer support, and no legal recourse. That’s why most users stick to small amounts, avoid keeping funds on exchanges, and never trust promises of high returns or "guaranteed" airdrops.

What you’ll find below are real reviews and warnings about platforms that Iranians actually use—or should avoid. From fake exchanges pretending to serve Iran, to legit P2P methods that work, we’ve pulled together what’s proven and what’s pure risk. No fluff. No hype. Just what you need to know before you trade.