Crypto Trading in Iran: Rules, Risks, and Real Workarounds

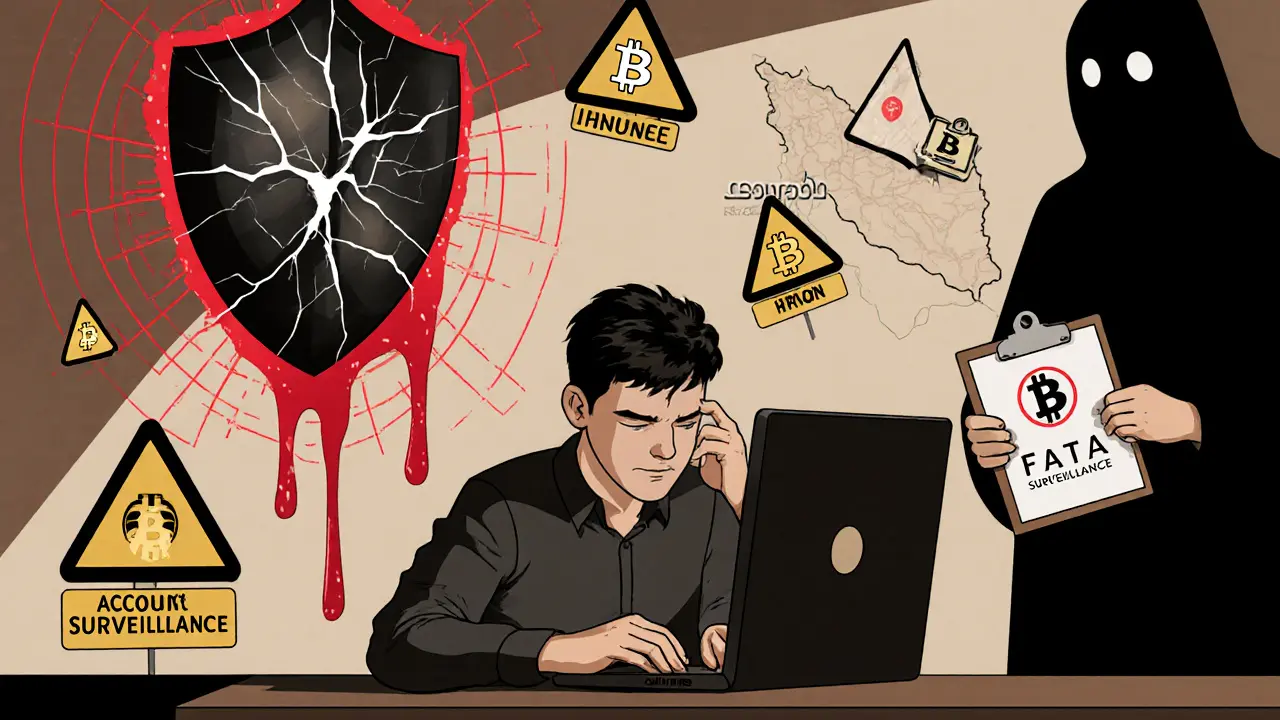

When it comes to crypto trading in Iran, the practice of buying, selling, or exchanging digital currencies within Iran’s legal and economic boundaries. Also known as Iranian cryptocurrency trading, it’s not illegal—but it’s tightly controlled, poorly regulated, and full of traps for the unprepared. The Iranian government doesn’t ban crypto outright, but it blocks foreign exchanges, restricts bank transfers, and warns citizens against using unapproved platforms. That doesn’t stop people from trading—it just pushes them into riskier corners of the market.

Most Iranians who trade crypto rely on P2P crypto Iran, peer-to-peer networks where individuals directly exchange cryptocurrency for Iranian rials, often through Telegram or local apps. Platforms like LocalBitcoins and Paxful are blocked, so traders use private groups and escrow services that aren’t monitored by any authority. This works—but it’s dangerous. Scammers pose as buyers, fake payment screenshots are common, and once you send crypto, there’s no chargeback. You’re completely on your own.

crypto regulations Iran, the unofficial but enforced rules around digital asset use, including bans on foreign exchange access and pressure on banks to cut crypto ties. The Central Bank of Iran has repeatedly told financial institutions to avoid crypto-related transactions. That means you can’t link your bank account to Binance or Coinbase. Even if you use a VPN, your funds might get frozen if the bank detects crypto activity. The government also cracks down on mining, especially when electricity use spikes. So while you can hold crypto, moving it in or out is a minefield.

Many Iranians turn to crypto exchange Iran, local platforms that operate in Farsi, accept rials, and avoid international compliance rules. These aren’t regulated like Binance or Kraken. They have no audits, no customer support, and often vanish overnight. Some are outright scams. Others are real—but risky. You might find a decent platform, but you’ll never know if it’s the next TradeOgre or LongBit, shut down by authorities with no warning.

There’s one thing that keeps crypto alive in Iran: inflation. The rial has lost over 90% of its value since 2018. People don’t trade crypto for fun—they trade to protect their savings. Bitcoin, USDT, and Ethereum are seen as lifelines. But that also makes them targets. If you’re holding crypto in Iran, you’re not just an investor—you’re a financial rebel. And rebels get watched.

What you’ll find in these posts isn’t theory. It’s real cases: exchanges that got seized, airdrops that were fake, wallets that got drained, and people who lost everything because they trusted the wrong platform. You’ll learn how to spot a scam exchange, why KYC rules matter even when they’re ignored, and how to move crypto without getting flagged. No fluff. No promises. Just what works—and what gets you caught.