DeFi Protocol: What It Is and Why It Matters in Crypto Today

When you hear DeFi protocol, a decentralized system that lets you lend, borrow, or trade crypto without banks or middlemen. Also known as decentralized finance, it’s the backbone of platforms where your money works for you—no permission needed. Unlike traditional banks, DeFi protocols run on blockchain code called smart contract, self-executing programs that automatically handle transactions when conditions are met. These contracts don’t rely on humans to approve loans or track balances. They just run. And that’s what makes them fast, open, and risky.

Most DEX, a decentralized exchange that lets you swap crypto directly from your wallet without depositing funds like Uniswap or Shadow Exchange are built on DeFi protocols. They use liquidity pool, a shared reserve of crypto tokens locked in code to enable trading instead of order books. You add your tokens to these pools and earn fees—but you also face impermanent loss, a hidden risk where your holdings lose value even if prices go up. That’s not theory. It’s real. People have lost thousands because they didn’t understand how these pools work. And it’s not just about trading. DeFi protocols power lending like Moola Market, where you borrow cUSD using crypto as collateral, or staking systems that punish bad actors with slashing penalties.

But here’s the catch: DeFi isn’t magic. It’s code. And code can break. When exchanges like Bvnex or LongBit vanish, it’s often because they pretended to be DeFi while hiding behind fake audits and no transparency. Real DeFi doesn’t need a website to prove it’s real—it’s on-chain. You can check every transaction. You can see the contract. If you can’t, it’s not DeFi. The same goes for fake airdrops. No one is giving away free tokens for signing up on a sketchy site. Real rewards come from using actual protocols, not clicking pop-ups. And when regulators step in—like South Korea fining Upbit $34 billion or Canada seizing $40 million from TradeOgre—it’s because these systems were built to avoid KYC, not to empower users.

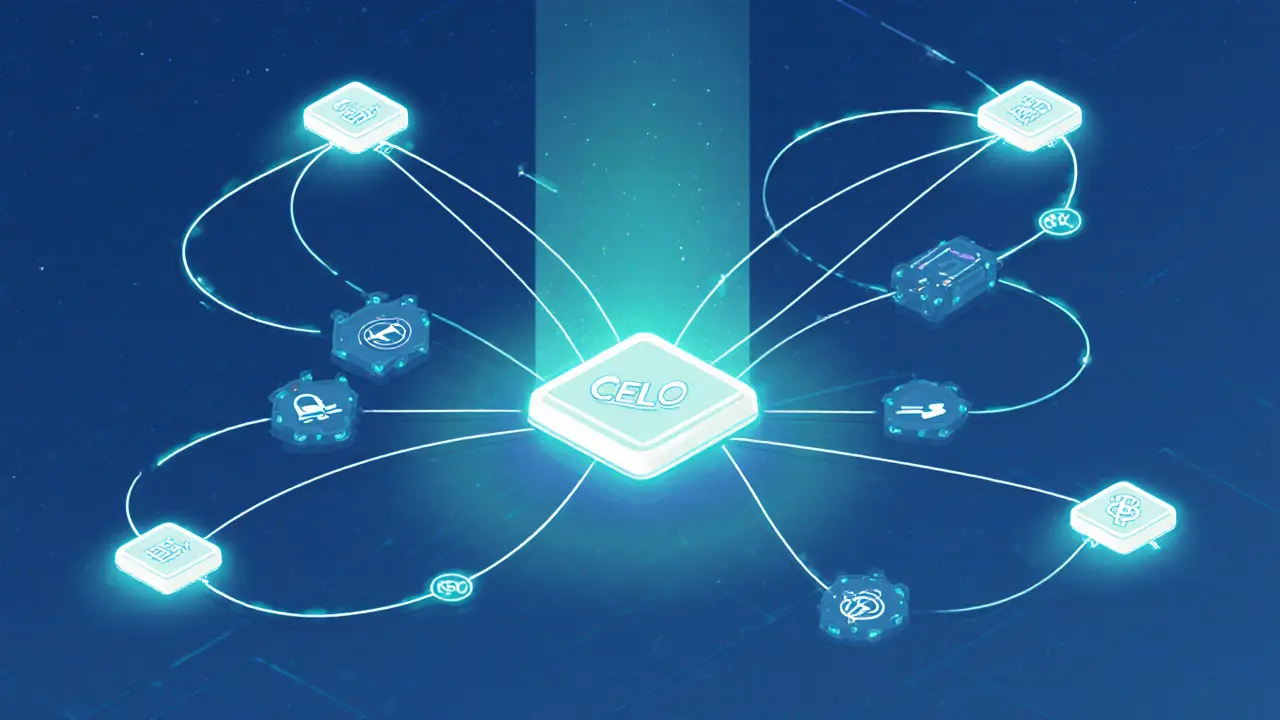

What you’ll find here aren’t marketing fluff or hype-driven guides. These are real stories: how a lending protocol on Celo struggles to attract users, why a gaming token crashed 99.5%, and how a DEX on Sonic blockchain slashed fees by 95%. You’ll see what works, what fails, and why most people lose money not because the tech is broken—but because they don’t understand how it actually functions. No jargon. No promises. Just what’s happening, who’s affected, and what you need to know before touching a single token.