Ownership Rights in Crypto: What You Really Own and What You Don't

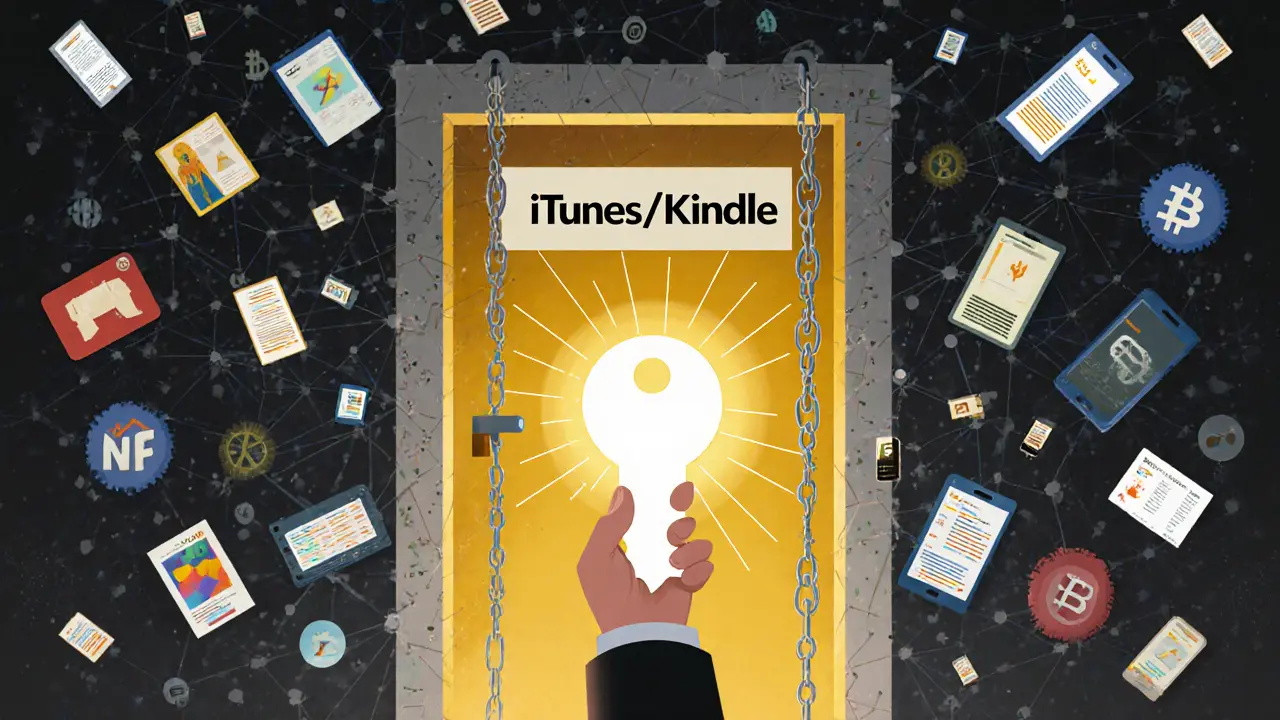

When you hold a crypto token, do you really ownership rights, the legal and technical ability to control, transfer, or benefit from a digital asset without interference. Also known as asset control, it's the foundation of decentralized finance—but most people don’t have it. You might think buying a token means you own it. But if you keep it on an exchange, you’re really just holding a balance in someone else’s ledger. True ownership means you control the private keys, not a username and password.

That’s why KYC compliance, the process exchanges use to verify your identity before letting you trade or withdraw crypto often breaks real ownership. When Upbit faced $34 billion in fines for failing KYC rules, or Canada seized $40 million from TradeOgre, it wasn’t just about money—it was about who controls the assets. Exchanges that require KYC don’t just collect your ID; they can freeze your funds, block withdrawals, or even seize your tokens under government pressure. Real ownership rights vanish the moment you hand control to a third party.

Even in DeFi, ownership is tricky. If you provide liquidity to a pool, you don’t own the underlying assets—you own a share of a smart contract. And if that contract has flaws, or the project gets shut down, your share might be worthless. Impermanent loss, slashing penalties, and non-custodial scams all show how easily the illusion of ownership can collapse. The DeFi asset control, the ability to manage crypto assets without intermediaries, using self-custody wallets and on-chain protocols isn’t just a feature—it’s a survival skill.

Look at the airdrops listed here: CANDY, HGT, CovidToken, BABY, CFL365. None of them give you ownership rights—they give you promises. A real airdrop doesn’t ask for your seed phrase. It doesn’t require you to sign a contract that lets them freeze your wallet. It just sends tokens to your address. If you don’t control that address, you don’t control the tokens. And if you can’t withdraw them, you don’t own them.

Ownership rights in crypto aren’t about how many tokens you have. They’re about who holds the keys, who answers to whom, and whether you can move your assets without permission. The posts below show you exactly where those rights are being taken away—and where they’re still intact. You’ll see how exchanges, regulators, and scams chip away at control. And you’ll learn how to spot the real ownership—and avoid the fake ones.