RADS token: What it is, where it's used, and why it matters in DeFi

When you hear RADS token, the native cryptocurrency of the Radix blockchain designed for scalable DeFi applications. Also known as Radix token, it’s not just another coin—it’s the fuel for a network built to solve the biggest problems in decentralized finance: speed, cost, and security. Unlike Ethereum or Solana, Radix doesn’t rely on complex smart contracts that can break or get hacked. Instead, it uses a unique architecture called Cerberus that lets thousands of transactions happen at once without slowing down. That’s why RADS isn’t traded just for speculation—it’s used to secure the network, pay for transactions, and let people vote on future upgrades.

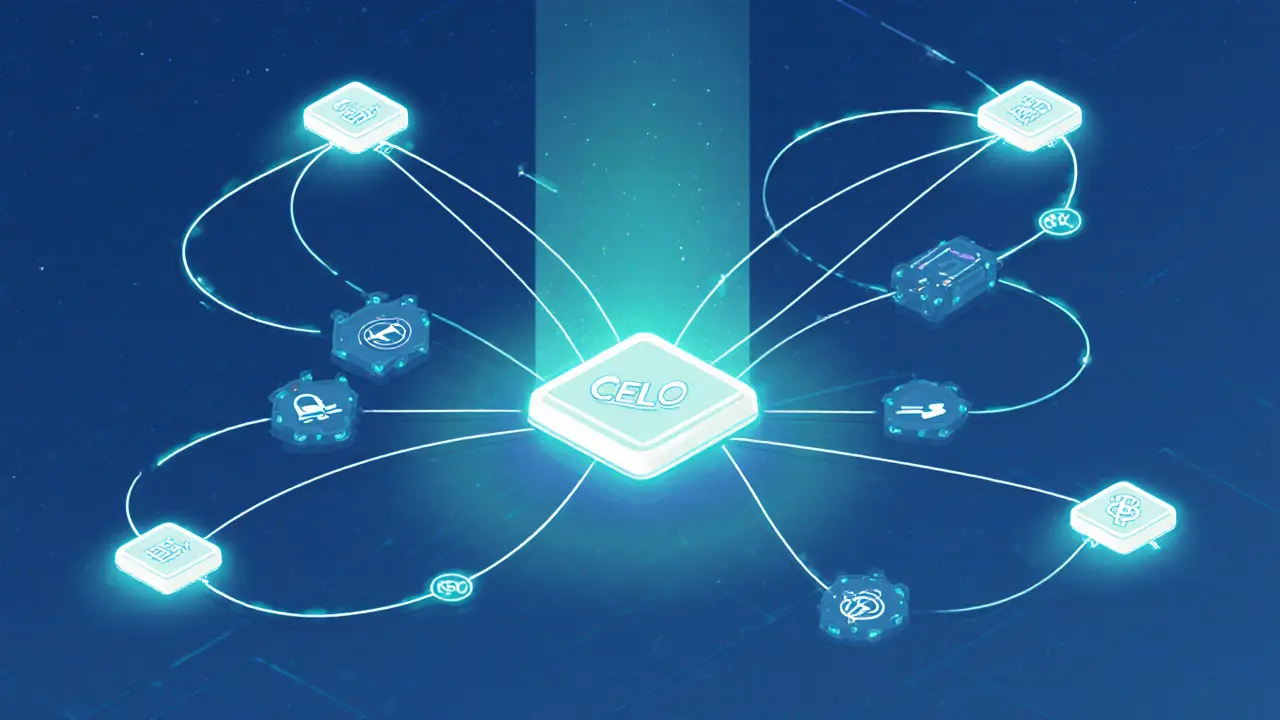

Related to RADS are DeFi tokens, cryptocurrencies that power lending, trading, and yield platforms without banks, and blockchain governance, the system that lets token holders decide how a project evolves. RADS sits right at the center of both. Holders can stake RADS to help validate transactions and earn rewards, or use it to vote on proposals like new features or fee changes. This isn’t theoretical—it’s how real communities run decentralized projects. You won’t find RADS on every exchange, but where it is, it’s often paired with stablecoins like USDC or wBTC for trading and liquidity mining. And unlike meme coins with no purpose, RADS has a clear job: make DeFi work for everyone, not just the wealthy.

What you’ll find in the posts below isn’t hype. It’s real talk about what RADS actually does, how it compares to other tokens, and whether it’s still worth paying attention to in 2025. You’ll see how it stacks up against projects that promised the moon but delivered nothing. You’ll learn why some people still hold it, and why others walked away. No fluff. No fake airdrops. Just facts about a token that’s quietly building something different.