Staking Penalties: What They Are and How to Avoid Them

When you stake cryptocurrency, you’re locking up your coins to help secure a blockchain network—and earning rewards for it. But if something goes wrong, you could face staking penalties, fines or loss of rewards imposed by blockchain networks when validators or stakers fail to follow the rules. These aren’t optional fees. They’re automatic, built into the protocol, and can cost you real money. Think of it like parking your car in a no-parking zone: the system doesn’t warn you twice. It just hits you with a fine.

Staking penalties happen for a few clear reasons: going offline too long, signing conflicting blocks, or not meeting the minimum uptime requirements. Networks like Ethereum, Cosmos, and Solana all have their own rules, but the core idea is the same: if you don’t do your part, you lose part of your stake. In extreme cases, like the Upbit penalties, a $34 billion fine for failing KYC compliance, regulators step in—but even without regulators, the blockchain itself can punish you. And it doesn’t care if you didn’t know. That’s why understanding how penalties work isn’t optional—it’s survival.

Some people think staking is just passive income. It’s not. It’s active participation. You need to monitor your validator, keep software updated, and avoid risky setups. A single misconfigured node or an unpatched system can trigger a penalty. And while some networks allow you to recover lost rewards after a cooldown, others slash your stake permanently. The impermanent loss, a risk in DeFi liquidity pools that erodes gains even when prices rise gets all the attention, but staking penalties are quieter—and just as dangerous. They don’t show up in price charts. They show up in your wallet balance after a weekend of downtime.

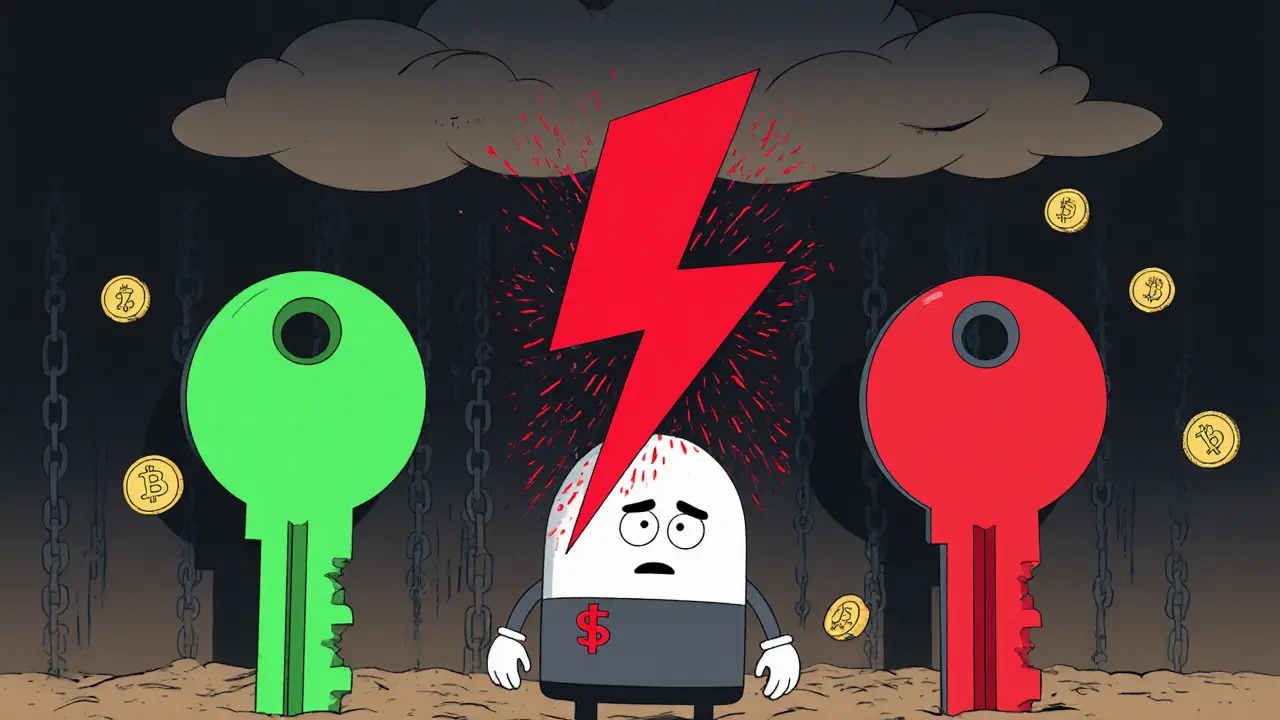

What you’ll find below aren’t just articles about penalties. You’ll see real cases: how South Korea cracked down on exchanges for non-compliance, how Canada seized crypto from unregulated platforms, and how fake airdrops trick people into handing over private keys. These aren’t random stories. They’re all connected. Whether it’s a validator going offline or a scammer pretending to be a staking service, the same rule applies: if you don’t control your keys, you don’t control your money. And if you don’t understand the rules, you’re already at risk.