vFIL crypto: What It Is, How It Works, and Why It Matters

When you hear vFIL crypto, a tokenized version of Filecoin used in decentralized finance to unlock liquidity without moving the underlying FIL. Also known as virtual FIL, it lets you use your Filecoin holdings in lending pools, yield farms, and collateralized loans—without touching the actual blockchain storage network. This isn’t just a wrapper or a fake token. It’s a bridge between two worlds: the real-world utility of Filecoin’s decentralized storage and the fast-moving mechanics of DeFi.

vFIL crypto relates directly to Filecoin, a blockchain network built to create a decentralized cloud storage marketplace where users rent out unused hard drive space. While Filecoin (FIL) rewards miners for storing data, vFIL lets you borrow, lend, or stake that value without locking up your storage power. That’s why you’ll see vFIL in protocols like DeFi lending platforms, applications that let users earn interest by supplying crypto assets as collateral. These platforms treat vFIL like any other asset—except it’s backed by real storage capacity, not speculation.

People who hold FIL often don’t want to sell it. They believe in the long-term value of decentralized storage. But they still need cash flow or want to earn yield. That’s where vFIL steps in. Instead of selling FIL on an exchange and risking price drops, you lock it in a smart contract and get vFIL in return. Then you use vFIL to earn interest on Aave, supply liquidity on Uniswap, or even borrow against it. It’s like having a digital IOU that’s backed by something real—your contribution to the internet’s storage infrastructure.

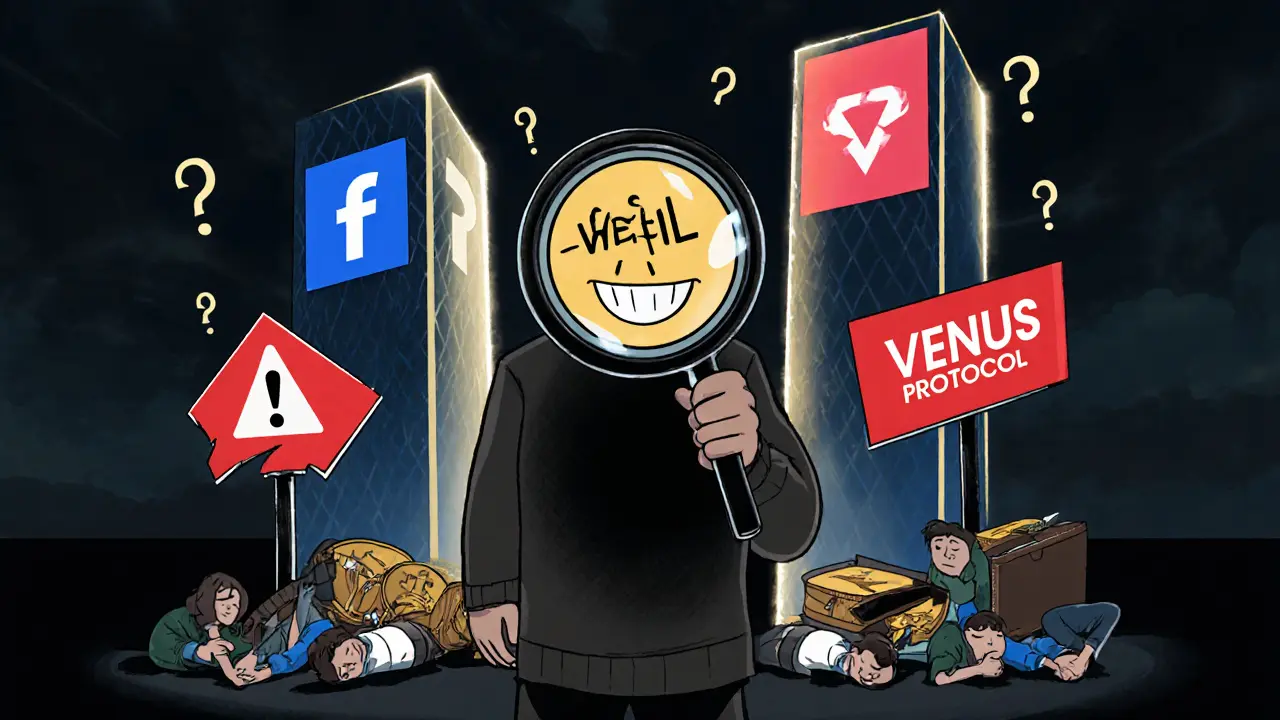

But it’s not without risk. If the price of FIL crashes hard, your collateral might get liquidated. If the protocol behind vFIL has a bug, you could lose access. And if the network behind Filecoin slows down, the value of vFIL could drop faster than expected. That’s why most users treat vFIL like a high-risk, high-reward tool—not a savings account.

You’ll find real examples of this in the posts below. Some cover how vFIL is used in DeFi protocols on Ethereum and Polygon. Others warn about fake vFIL tokens pretending to be legitimate. There are guides on how to safely mint vFIL, how to track its real-time value, and even how it connects to broader trends in decentralized storage adoption. No hype. No fluff. Just what’s working, what’s broken, and what you need to know before touching it.