Vietnam Crypto Ban: What It Means for Users and How It Compares to Other Countries

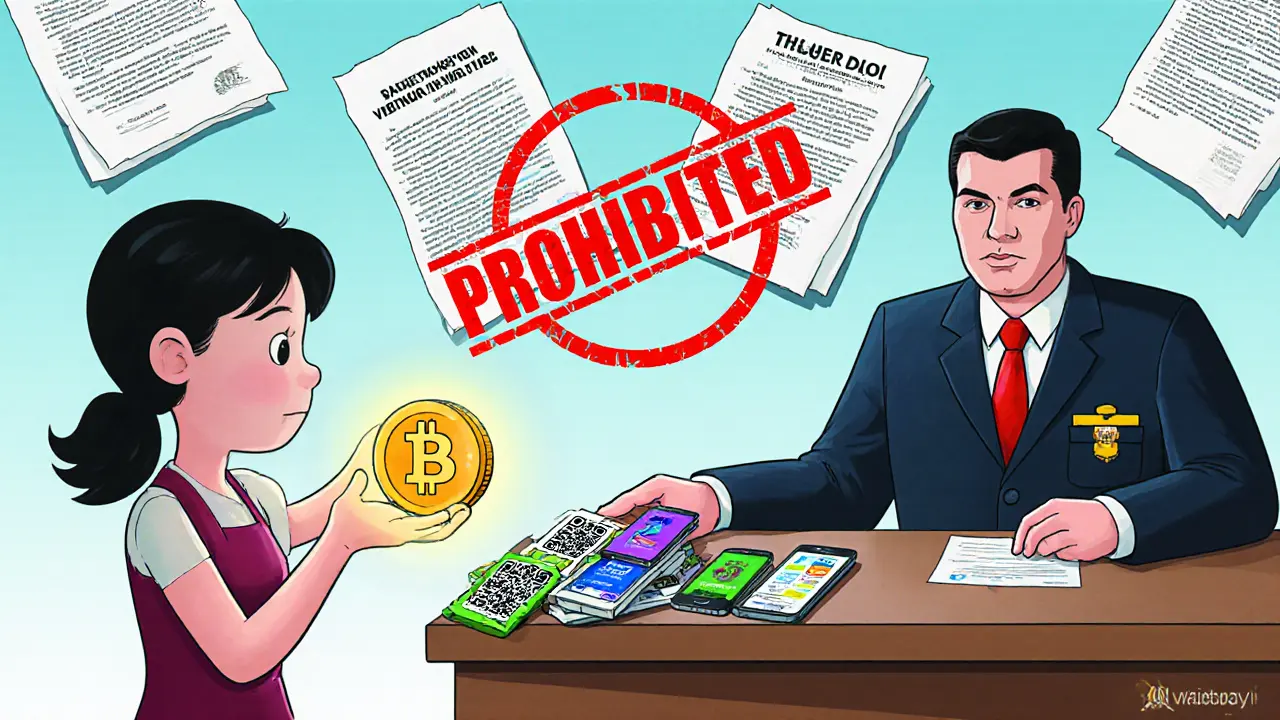

When you hear Vietnam crypto ban, a government policy that prohibits the use of cryptocurrency as payment and restricts trading activities. Also known as crypto trading restrictions in Vietnam, it was officially announced in 2021 and remains one of the strictest stances in Southeast Asia. But here’s the twist: while the law says crypto can’t be used to buy goods or services, people still trade it—just quietly. The government doesn’t jail traders, but banks freeze accounts linked to exchanges, and fines can hit up to 100 million VND (about $4,000). It’s not a full blackout—it’s a gray zone where the rules exist but aren’t always enforced.

The Vietnam crypto ban, a policy designed to protect financial stability and prevent money laundering. Also known as cryptocurrency prohibition in Vietnam, it targets exchanges, payment processors, and financial institutions—not individual holders. That’s why you’ll still see Vietnamese users on Binance or OKX. They just don’t link their bank accounts. The real target is the infrastructure: banks can’t process crypto transactions, and local platforms can’t operate legally. Compare that to China, a country that completely shuts down all crypto activity, including mining and peer-to-peer trading. Also known as China crypto ban, it enforces total isolation from global crypto markets. Vietnam’s version is more like a wall with a backdoor. Meanwhile, South Korea, a country that requires real-name bank accounts and taxes crypto gains, but still allows full trading. Also known as Korea crypto regulations, it treats crypto like stocks—with oversight, not prohibition. Vietnam doesn’t tax crypto. It just says you can’t use it to pay for coffee.

What’s missing in Vietnam’s policy? Clarity. There’s no official list of banned platforms. No clear path for legal compliance. And no protection for users who lose funds on unlicensed exchanges. That’s why you’ll find posts here about frozen assets in the Philippines and strict AML rules in the EU—Vietnam’s approach is the opposite: vague, reactive, and inconsistent. If you’re in Vietnam, you can still buy Bitcoin. You just can’t do it through your bank. You can’t use it online. And if you get caught promoting it, you risk a fine. But millions still do it anyway—because the demand is there, and the enforcement isn’t.

What you’ll find in the posts below are real cases, comparisons, and warnings about what happens when governments try to control money that doesn’t need their permission. From crypto bans in China to frozen assets in the Philippines, these aren’t just headlines—they’re lessons in how regulation shapes behavior, not technology.