YodeSwap DEX: What It Is, How It Works, and What You Need to Know

When you trade crypto without a middleman, you're using a YodeSwap DEX, a decentralized exchange that lets users swap tokens directly from their wallets using smart contracts. Also known as a non-custodial DEX, it removes the need to trust a company with your funds—your keys, your crypto. Unlike centralized exchanges like Upbit or Poloniex, YodeSwap doesn’t hold your money. Instead, it runs on blockchain code that executes trades automatically when conditions are met.

This kind of system relies on liquidity pools, smart contract-based reserves where users lock in pairs of tokens to enable trading. Also called automated market makers, these pools replace traditional order books with math-driven pricing. But there’s a catch: if the price of the tokens in the pool moves too much, you could lose value—this is called impermanent loss. It’s not a bug, it’s how AMMs work. And if you’ve ever seen a post about Bvnex or TradeOgre shutting down, you know why trustless doesn’t always mean safe. Many DEXes, including YodeSwap, are built on networks like Ethereum or BSC. That means gas fees, slippage, and token approval risks are part of the deal. You’re not just trading—you’re interacting with code that can’t be undone.

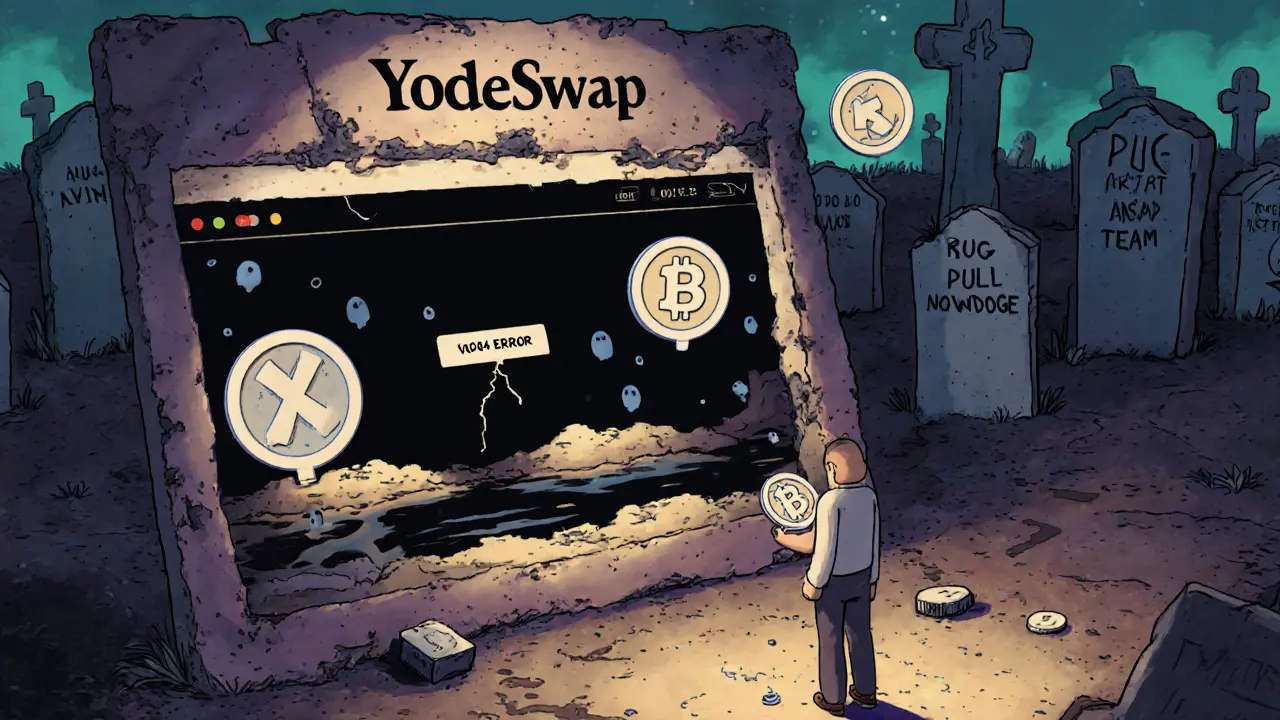

People use YodeSwap DEX because they want control. No KYC. No account freezes. No sudden bans like what happened to TradeOgre in Canada or LongBit’s fake site. But that freedom comes with responsibility. You need to know how to check token contracts, spot rug pulls, and understand the difference between a real project and a meme coin like BULEI. The same users who avoid centralized exchanges often end up losing money because they don’t understand how liquidity pools behave under volatility. That’s why posts about impermanent loss and token audits show up so often here.

What you’ll find below are real reviews, breakdowns, and warnings about DEXes like YodeSwap—and the broader ecosystem they live in. From scams pretending to be DEXes like AnimeSwap to the hidden risks of providing liquidity, these posts don’t sugarcoat it. You’ll see what works, what fails, and why some projects vanish overnight. No fluff. Just what you need to trade smarter, not harder.