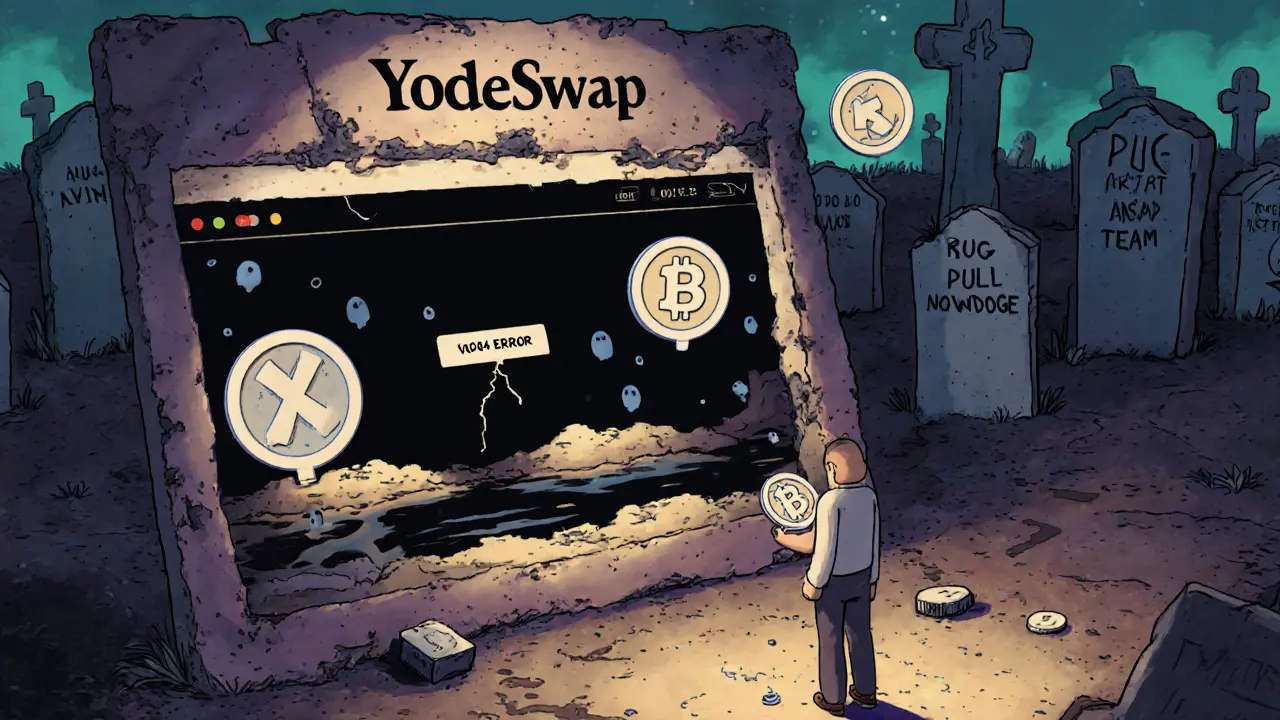

YodeSwap Review: What You Need to Know Before Using This DeFi Platform

When you hear YodeSwap, a decentralized exchange that claimed to offer low-fee trading and high rewards. Also known as YodeSwap DEX, it was promoted as a simple way to trade tokens on BSC without the hassle of big exchanges. But here’s the truth: there’s no verified team, no audit records, and no active liquidity. What you’re seeing now are ghost sites and fake social media accounts trying to pull in the last few curious traders.

YodeSwap isn’t just another failed project—it’s a textbook example of how DeFi scams hide in plain sight. It promised high APYs from liquidity pools, but no one could prove where the funds were stored. Unlike real DEXes like PancakeSwap or Uniswap, YodeSwap never published a smart contract address that could be verified on BscScan. No developer wallet, no tokenomics document, no GitHub activity. Just a website, a Telegram group, and a lot of promises. If a platform doesn’t let you check its code or track its transactions, it’s not a DeFi platform—it’s a digital slot machine.

Related entities like decentralized exchange, a platform that lets users trade crypto directly from their wallets without a middleman should be built on transparency. Real DEXes show their contracts, list their teams, and update their communities. Meanwhile, crypto exchange scam, a fake platform designed to steal funds by mimicking legitimate services thrives on silence. It doesn’t answer questions. It doesn’t fix bugs. It disappears when the money stops flowing in. And that’s exactly what happened with YodeSwap.

You’ll find posts below that dig into similar cases—exchanges that vanished, tokens that dropped to zero, and airdrops that never existed. These aren’t random stories. They’re warning signs. If you’re looking at YodeSwap or something like it, ask yourself: who’s behind this? Where’s the proof? And if this were real, why wouldn’t they want you to know?