DAO Voting Power Calculator

DAO Voting Power Calculator

See how your voting power compares to the DAO's overall token distribution.

Why This Matters

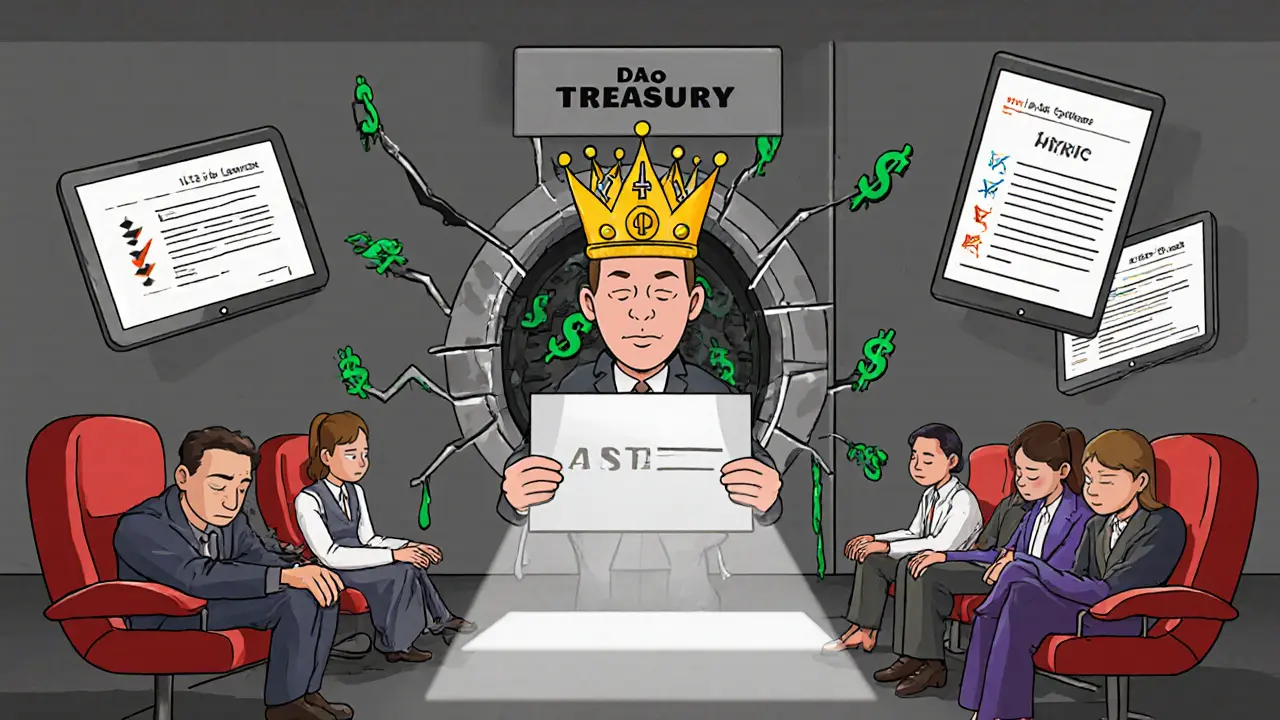

DAOs often suffer from plutocracy - where a small percentage of token holders control the majority of voting power. As the article mentions, "In Uniswap DAO, the top 15-20% of token holders own 78% of votes." This calculator shows how even a small percentage of tokens gives disproportionate voting power.

The chart below shows how voting power is distributed across different groups of token holders. This explains why voter apathy is so common - most members have virtually no voting power to influence decisions.

Decentralized Autonomous Organizations, or DAOs, were once seen as the future of work - digital cooperatives run by code, not CEOs. Today, they’re real. Over 13,000 active DAOs manage $40 billion in assets. Some pay contributors in crypto. Others govern entire DeFi protocols. But for every success story, there’s a failed vote, a stolen treasury, or a community that gave up after months of endless debates.

How DAOs Actually Work (Without the Hype)

A DAO isn’t a company with a boardroom. It’s a set of smart contracts on a blockchain that automatically enforce rules. If you hold its governance token, you can vote on proposals: how to spend money, who to hire, what features to build. No manager signs off. No HR department approves. Everything happens on-chain. Most DAOs use DAO is a blockchain-based organizational structure that uses smart contracts to automate governance and treasury management. Tools like Snapshot is a non-custodial voting platform used by 78% of DAOs for off-chain polling handle voting without paying gas fees. Gnosis Safe is a multi-signature wallet used by 68% of DAOs to secure treasury funds holds the money. And Ethereum L2s like Arbitrum and Polygon reduce transaction costs to under $5 per vote make it affordable. You don’t need to be rich to join. A 19-year-old in Nigeria earned $120,000 last year by writing docs for Gitcoin DAO is a community-run funding mechanism that distributed $50 million in 2025 through quadratic funding. But you do need to understand gas fees, tokenomics, and how to read a proposal. Most new members take 3-6 months to become useful contributors.Benefits of DAOs: Transparency, Access, and Automation

The biggest win? Transparency. Every dollar moved, every vote cast, every proposal written is public. Unlike traditional companies where financial reports are buried in PDFs, DAO treasuries are live on-chain. Juicebox is a protocol that lets anyone see exactly how funds are allocated in real time shows you who got paid, why, and when. No black boxes. No hidden bonuses. Then there’s global access. DAOs don’t care where you live. Contributors come from 187 countries. Traditional corporations struggle to hire in more than 40-60. A designer in Jakarta, a developer in Nairobi, and a marketer in Warsaw can all vote on the same proposal - and get paid equally in crypto. Automation cuts out middlemen. Payroll? Done by smart contract. Funding? Triggered when milestones are met. No delays. No approvals needed from someone in another timezone. MakerDAO is a decentralized lending protocol that executes governance decisions in under 72 hours upgrades its lending rates automatically based on community votes. No CFO required. And the numbers back it up. Harvard Business Review found that 100% of DAO financial transactions are publicly verifiable. In traditional corporations? Just 12-18%. DAOs also outperform in innovation speed for digital-native tasks. Chainlink has achieved 98% success rate in oracle upgrades through DAO governance. That’s faster and more reliable than most corporate IT teams.

Limitations of DAOs: Slow, Unfair, and Legally Gray

But here’s the problem: DAOs are slow. Really slow. The average proposal takes 14-21 days to execute. In a traditional company, a decision like switching cloud providers might take two days. In a DAO? You need to write the proposal, wait for feedback, wait for voting, wait for consensus, then wait for the smart contract to deploy. By then, the opportunity is gone. And it’s not just slow - it’s unfair. Token-based voting gives power proportional to how many tokens you hold. In Uniswap DAO is the governing body of the largest decentralized exchange, with 75% voter turnout in 2025, the top 15-20% of token holders own 78% of votes. That’s not democracy. That’s plutocracy. A single whale can swing a vote. Dr. Primavera De Filippi from Harvard put it bluntly: “The myth of perfect decentralization has been thoroughly debunked.” Voter apathy makes it worse. Most DAOs see participation rates below 18%. In one case, a member spent three months writing a proposal - only 4.7% of token holders voted. No one cared. That’s not engagement. That’s resignation. Then there’s the legal mess. Only 12 U.S. states and 3 countries recognize DAOs as legal entities. The rest? Legal gray zones. If a DAO gets hacked and loses $10 million, who’s liable? The developers? The voters? The person who wrote the code? The SEC hasn’t said. But Commissioner Hester Peirce warned: “DAO participants may face unexpected liability.” Security is another nightmare. In 2025 alone, DAOs lost $90 million to smart contract exploits. Even big names like Nouns DAO lost $1.2 million in 2023 due to a governance exploit. Audits help - 42% of DAOs now use formal verification - but they’re not foolproof. And most DAOs don’t even have a legal entity to sue anyone after the fact.Who DAOs Work For (and Who They Don’t)

DAOs shine in digital-native environments. If your job is tweaking protocol parameters, allocating community grants, or managing open-source development - DAOs are ideal. Arbitrum DAO manages a $4.2 billion treasury with near-zero overhead. Gitcoin DAO funds public goods with quadratic funding, a system that rewards broad participation. These aren’t theoretical. They’re running right now. But try to run a crisis response in a DAO. In 2023, when Nouns DAO was targeted by a phishing attack, it took days to coordinate a response. By then, $1.2 million was gone. A traditional company would have frozen accounts in minutes. DAOs can’t move that fast. They’re built for deliberation, not speed. They also struggle with accountability. Who do you blame when a proposal fails? No one. No one owns the outcome. No one gets fired. No one gets promoted. That’s liberating for some. For others, it’s maddening.

What’s Changing in 2025

DAOs aren’t stuck. They’re evolving. AI is now part of the stack. 47% of DAOs use AI assistants that summarize proposals, predict voting trends, and flag risky language. That’s helping reduce voter fatigue. Legal structures are improving too. The DAO 3.0 framework combines Wyoming LLCs with on-chain governance to offer legal protection is being adopted by over 1,200 DAOs. The EU’s MiCA regulations now offer partial clarity. And BlackRock announced a $500 million DAO investment fund in April 2025 - signaling institutional interest. But the biggest shift? Hybrid models. Vitalik Buterin and others now agree: pure on-chain voting doesn’t scale. The future is a mix - off-chain discussion in Discord, on-chain voting only for final decisions. That’s how Ethereum Magicians forum is becoming the de facto deliberation space for Ethereum-related DAOs works. Debate first. Vote later.Should You Join a DAO?

If you’re looking for a 9-to-5 job with benefits? Don’t. DAOs don’t offer health insurance or paid leave. They offer flexibility, crypto pay, and the chance to shape something global. If you’re tired of corporate bureaucracy and want real influence? Maybe. But be ready for slow decisions, low turnout, and the emotional toll of being ignored. If you’re a developer, writer, designer, or community builder? DAOs are one of the few places where your work can directly impact millions - and get paid for it. No middleman. No approval chain. Just code, votes, and crypto. The truth? DAOs aren’t perfect. But they’re the closest thing we have to digital democracy. And like any democracy, they only work if people show up.Are DAOs legal?

Only in a few places. As of 2025, 12 U.S. states (like Wyoming) and three countries (including the UAE) have specific laws recognizing DAOs as legal entities. Everywhere else, they operate in a gray zone. This means DAO members could be held personally liable if something goes wrong - even if they didn’t write the code.

Can anyone join a DAO?

Yes, technically. Most DAOs are permissionless - you don’t need an invitation. But you usually need a governance token to vote. Some DAOs give tokens to contributors after proving their work. Others require you to buy them. Without tokens, you can still participate in discussions, but you can’t shape decisions.

How do DAOs make money?

DAOs don’t “make money” like a company. They manage treasuries funded by token sales, protocol fees, or donations. For example, Uniswap earns fees from trades and sends a portion to its DAO treasury. Then, members vote on how to spend it - on developers, marketing, grants, or even buying NFTs. Some DAOs also invest in DeFi protocols to earn yield.

Why do most DAOs fail?

Most fail because of poor governance, not bad code. Common reasons: low voter turnout, power concentrated in a few wallets, no clear decision-making process, and no legal structure. The ConstitutionDAO raised $47 million in seven days but failed to buy the Constitution because members couldn’t agree on next steps. That’s a governance failure, not a technical one.

What’s the future of DAOs?

The future is hybrid. Pure on-chain voting won’t scale. The most successful DAOs now combine off-chain discussion (Discord, forums) with on-chain voting for final decisions. AI tools are helping members understand proposals faster. Legal frameworks are slowly catching up. And institutions like BlackRock are investing. But unless DAOs fix voter apathy and plutocracy, they’ll remain niche tools - not replacements for companies.

Ruby Gilmartin

Let’s be real - DAOs are just crypto bros with a spreadsheet and delusions of grandeur. You call it ‘transparency’? It’s just public failure. Every ‘democratic vote’ is a whale auction. And don’t get me started on the legal liability - you think some guy in Nairobi voting on a treasury move is protected? LOL. Wake up. This isn’t the future. It’s a Ponzi with better UX.

Douglas Tofoli

ok so i just joined my first dao (gitcoin) and wow like… i wrote a tiny docs fix and got paid in dai?? 🤯 no boss, no hr, just code and vibes. also i typoed ‘proposl’ in the forum and someone literally replied ‘lol ty’ and upvoted me. this is the future?? idk but i’m in 😊

William Moylan

DAOs are a CIA psyop to replace governments with blockchain surveillance. They’re not decentralized - they’re controlled by a handful of VC firms hiding behind ‘tokenomics’. You think that ‘AI proposal summarizer’ is helping you? Nah. It’s training on your votes to predict your behavior. The SEC knows. BlackRock knows. They’re buying DAOs to own the next layer of control. Wake up. They’re not building democracy. They’re building a new kind of dictatorship. With gas fees.

Michael Faggard

DAOs are a paradigm shift in organizational architecture. The elimination of hierarchical mediation enables emergent coordination via incentive-aligned smart contracts. You can’t optimize for velocity and decentralization simultaneously - that’s the fundamental trade-off. But with L2s, off-chain deliberation, and AI-augmented governance, we’re approaching a Nash equilibrium for collective decision-making. This isn’t hype. It’s systems theory in action. The bottleneck isn’t tech - it’s human cognitive load. Fix that, and DAOs scale.

Elizabeth Stavitzke

Oh wow, a Nigerian teen made $120k writing docs? How cute. In America, we call that ‘internship’ - and we pay in college credits and caffeine. You think this ‘global access’ is equity? It’s just outsourcing with better PR. DAOs don’t empower the Global South - they extract labor at 1/10th the cost and call it ‘decentralization’. Meanwhile, the real power? Still in Silicon Valley. The blockchain just made it shinier.

Ainsley Ross

As someone who’s contributed to three DAOs across three continents, I’ve seen the magic - and the mess. The transparency is revolutionary. But the emotional toll? Real. I’ve spent weeks writing proposals only to see 3 votes. It hurts. But I keep showing up because I believe in the model. DAOs aren’t perfect - but they’re the first system where a single mother in Manila can outvote a hedge fund. That’s worth fighting for. 🌍❤️

Brian Gillespie

Slow. Unfair. But real.

Wayne Dave Arceo

You people don’t understand the math. Token-weighted voting isn’t plutocracy - it’s economic efficiency. Why should someone who holds 0.0001% of the token have equal say to someone who staked their life savings? That’s not democracy. That’s socialism with crypto. And the ‘whales’? They’re the ones who took the risk. The rest are free riders. Also, DAOs are 100% legal in Wyoming. If you’re not in a jurisdiction that recognizes them, you’re not a participant - you’re a tourist.

Joanne Lee

I’m curious - how do DAOs plan to handle liability in cases of multisig compromise? If a treasury is drained due to a governance exploit, and no single actor can be identified, what legal recourse exists for affected contributors? Is there any precedent for collective accountability? I’m not skeptical - I’m seeking clarity.

Laura Hall

Hey newbies - don’t get discouraged if your first proposal gets ignored. I started by commenting on Discord threads for 6 months before I got a token. Now I’m on the treasury committee. DAOs aren’t a sprint. They’re a long game. Also, if you’re writing docs, building tools, or moderating - you’re already contributing. No one’s keeping score. But we see you. 🤝

Arthur Crone

DAOs are dead. The only thing they’re automating is their own collapse. 98% success rate? Funny. That’s the same number they gave for Enron’s ‘risk management’. You think the code is clean? The audits are paid for by the same whales who profit from the exploits. And the ‘hybrid model’? That’s just a fancy way of saying they’re going back to centralized control. They just added blockchain glitter to make it look new.

Rebecca Saffle

They say DAOs are for the people. But I’ve watched rich guys in Miami buy up tokens on the first day, then vote to kick out the devs who built the thing. The ‘community’? Just a marketing term for the people they exploit. And now they’re using AI to manipulate votes? That’s not innovation. That’s manipulation with a blockchain logo. I’m done.

Adrian Bailey

so i’ve been in 5 DAOs and honestly? the ones that work are the ones where the discord is more active than the voting portal. like, i’ve seen proposals get 100+ comments in discord, 3 votes on-chain. and the devs just go with the vibe. it’s weird but it works. also, i typoed ‘proposl’ again and no one cared. that’s the beauty. no one’s grading you. you just show up and do stuff. also i made $3k last month just helping with onboarding. not bad for a guy who still uses windows 10 lol 🤷♂️

Rachel Everson

If you’re a writer, designer, or dev - DAOs are your playground. No gatekeepers. No approval chains. Just ship something, get paid, and move on. I’ve done more meaningful work in 6 months with Gitcoin DAO than in 3 years at a ‘real’ company. The pay’s in crypto, sure - but the freedom? Priceless. Just don’t expect a 401(k). You’re not an employee. You’re a co-creator.

Johanna Lesmayoux lamare

Most DAOs fail because people think ‘decentralized’ means ‘no rules’. But you still need leadership. You still need structure. You just need it to be emergent, not imposed. The magic isn’t in the code - it’s in the culture.

ty ty

Why do you think the U.S. government doesn’t recognize DAOs? Because they’re scared. Not of the tech. Of the people. When workers can organize without a union, without a boss, without a paper trail - that’s a threat. DAOs aren’t the future of work. They’re the future of revolution. And they’re coming for your job next.