When you see a crypto exchange promising 40% annual returns on your deposits, it should set off alarms-not excitement. That’s exactly what BIB Exchange claims to offer. It’s not just another trading platform. It’s a high-risk operation with a growing list of red flags, official fraud warnings, and users who can’t get their money out.

What BIB Exchange Claims to Be

BIB Exchange says it’s a global crypto trading platform built on Binance Smart Chain, serving over 2 million users. It offers spot trading, futures, options, NFT minting, and staking. Its native token, $BIB, is used for rewards and fees. The site-bibvip.com-looks polished. It has sleek graphics, multi-language support, and a long list of security features: DDoS protection, multi-layer wallets, automatic risk management, and QR-based NFT transactions.

But appearances don’t equal legitimacy. Legitimate exchanges don’t need to sell you a 40% APY “Fund Investment” product. They don’t need to push “Wealth Box” or “Easy Earn” as if they’re savings accounts. They focus on trading tools, liquidity, and security-not miracle returns.

The 40% APY Trap

Let’s break down the numbers. BIB Exchange advertises:

- 40% APY in USDT (Fund Investment)

- 7.0% APY in USDT (Periodic Wealth Management)

- 2.6% APY in $BIB ($BIB Pledge)

- 1.47% APY in BTC (Easy Earn)

Compare that to Binance, Kraken, or Coinbase-all offer staking yields between 1% and 8%. Even high-yield DeFi protocols rarely exceed 15% without extreme risk. A 40% return? That’s not investing. That’s a Ponzi scheme waiting to collapse.

These kinds of returns are unsustainable. They don’t come from trading fees or liquidity mining. They come from new deposits. When new users stop joining, the platform runs out of money to pay earlier users. That’s when withdrawals freeze.

Regulatory Warning: Official Fraud Alert

The Washington State Department of Financial Institutions (DFI) issued a public alert in 2025 stating that BIB Exchange “may have engaged in fraud.” That’s not a rumor. That’s a government agency warning its citizens.

The DFI specifically flagged these domains as fraudulent:

- www.bibcoinltd.com

- m.bibcoinltd.com

- www.bibvip.com (the main BIB Exchange site)

The agency received multiple complaints from users who couldn’t withdraw their funds-even after trying repeatedly. One investor lost everything, including “purported gains.” That’s not a glitch. That’s a scam.

The DFI labeled these activities as “Advanced Fee Fraud” and “Asset Recovery Scam.” That means: you’re told you can get your money back… if you pay another fee. Then another. Then another. Until you’re broke.

Withdrawal Problems: The Ultimate Red Flag

Every legitimate exchange lets you withdraw your crypto. That’s the whole point. If you can’t move your assets, you don’t own them. You’re just holding a digital IOU.

Users on Reddit, Telegram, and crypto forums report the same pattern with BIB Exchange:

- Deposits go through instantly

- Earnings appear in your account

- When you try to withdraw, you get “system maintenance,” “KYC verification,” or “security review”

- After days or weeks, the withdrawal fails or disappears

There’s no customer support that answers. No email replies. No live chat that works. The platform disappears when you ask for your money.

False Licensing Claims

BIB Exchange says it operates under U.S. MSB License #31000219137978. Sounds official, right?

Wrong.

MSB registration with FinCEN is not a license to operate a crypto exchange. It’s a basic anti-money laundering registration for money transmitters-like Western Union. It doesn’t mean the platform is regulated, audited, or insured. It doesn’t protect your funds. And it doesn’t prevent fraud.

Legitimate exchanges like Coinbase are licensed in multiple states and regulated by the SEC, CFTC, and state agencies. BIB Exchange has none of that. Just a FinCEN number and a website.

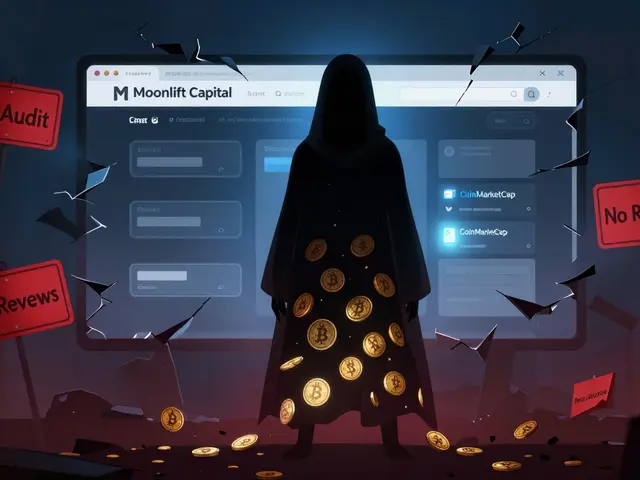

No Presence on Major Tracking Sites

Check CoinMarketCap or CoinGecko. Search for BIB Exchange. Nothing.

Why? Because these sites only list exchanges with verifiable trading volume, liquidity, and transparency. BIB Exchange doesn’t meet the bar. It doesn’t want to be checked. It doesn’t want you to compare it to real exchanges.

It also doesn’t list its team, headquarters, or legal entity. No address. No phone number. No corporate registration details. Just a website and a promise.

Security Claims vs. Reality

BIB Exchange says it uses “30+ security mechanisms.” That sounds impressive-until you realize that real security means letting users access their own money.

If your funds are locked, no amount of DDoS protection or “multi-layer verification” matters. Security isn’t about fancy tech. It’s about trust, transparency, and access.

Legit exchanges have:

- Insurance funds (like Coinbase’s cold storage insurance)

- Third-party audits (like Binance’s Proof of Reserves)

- Clear jurisdiction for legal recourse

BIB Exchange has none of these. Only promises.

What You Should Do Instead

If you want to trade crypto safely, stick to platforms with:

- Clear regulatory status (SEC, CFTC, or equivalent)

- Verified trading volume on CoinMarketCap or CoinGecko

- Transparent fee structures

- Proven track record of withdrawals

- Real customer support with response times under 24 hours

Examples: Coinbase, Kraken, Binance (where available), Gemini, Bitstamp.

Never invest more than you can afford to lose. And if a platform promises returns that sound too good to be true-they are.

Final Verdict: Avoid BIB Exchange

BIB Exchange is not a crypto exchange. It’s a fraudulent operation under the guise of one. The Washington State DFI’s warning is not a cautionary note-it’s a red alert. The withdrawal issues, the impossible yields, the fake licensing, the lack of transparency-all point to one conclusion.

Do not deposit funds. Do not trade. Do not even create an account.

If you already have money on BIB Exchange, stop trying to withdraw it. The platform will keep you trapped with false promises. Report it to your state’s securities regulator. Warn others. And move your future investments to platforms that actually protect their users.

There are thousands of legitimate crypto exchanges. You don’t need to risk everything on one that’s been flagged by the government as a scam.

Write a comment