Crypto Exchange Comparison Tool

Compare Crypto Exchanges

Select the exchanges you want to compare. This tool will show you key differences based on security, fees, and features.

Exchange Comparison Results

Select exchanges to see comparison

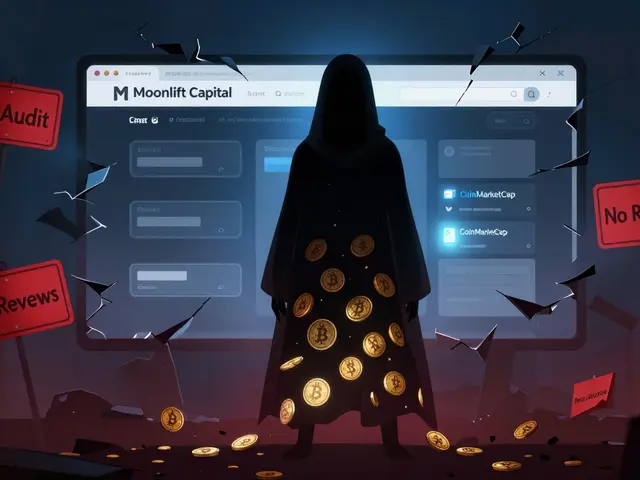

There’s no such thing as Digital World Exchange in 2025. If you’re searching for it, you’re probably hearing the name from a misleading ad, a YouTube video with fake testimonials, or a scam site trying to look legit. The real crypto exchange market doesn’t have a platform by that name. But that doesn’t mean you’re out of luck. The actual market is full of strong, reliable exchanges - and knowing which ones to trust can save you money, time, and your crypto.

Why You Can’t Use Digital World Exchange (And What’s Really Out There)

You won’t find Digital World Exchange on CoinMarketCap, CoinGecko, or any major crypto review site. No one’s reporting hacks, fees, or customer support issues for it because it doesn’t exist as a regulated, operating exchange. That’s not a glitch - it’s a red flag. Scammers often invent fake names that sound official: "Global Digital Trade," "CryptoNet Exchange," "Digital World Exchange." They copy real logos, steal website layouts, and use fake user reviews to trick people into depositing funds.

The real crypto exchanges in 2025 are transparent. They publish security audits, list their team members, and follow local laws. If a platform won’t tell you where it’s licensed or how it stores your crypto, walk away. The top exchanges in 2025 aren’t hiding. They’re competing on security, fees, and features - and you need to know who’s actually winning.

The Top 5 Crypto Exchanges in 2025 (And Who They’re Best For)

Not all exchanges are built the same. Some are made for beginners. Others are built for traders who move millions. Here are the five exchanges that dominate the 2025 market - and who should use them.

1. Coinbase: Best for Beginners and U.S. Users

Coinbase is the easiest place to buy crypto if you’re new. You can start with $1. The app looks like a bank app - clean, simple, no clutter. It’s the only major exchange with direct PayPal integration in the U.S., so you can deposit cash fast. It also supports 235 cryptocurrencies, which is more than most beginners will ever need.

But there’s a catch: fees. Coinbase charges up to 4% on small buys. If you’re trading $100, you’re paying $4 just to get started. That’s fine if you’re buying Bitcoin once a month. Not fine if you’re trading daily. That’s why Coinbase launched Advanced Trade in October 2025 - 0% maker fees for users trading over $10,000 daily. It’s a clear move to steal traders from offshore exchanges.

Coinbase also leads in compliance. It spent $147 million on regulatory infrastructure in 2024. That’s why it’s the only exchange that can legally operate in all 50 U.S. states. But that same compliance means slower verification. Expect 2-5 days to get your ID approved. During market spikes, their chat support gets backed up. Reddit users in October 2025 reported waiting 12+ hours for answers.

2. Kraken: Best for Security and Advanced Traders

Kraken has never been hacked. Not once since 2011. That’s rare. Most exchanges have had at least one breach. Kraken keeps 98% of funds in cold storage, uses multi-signature wallets, and publishes weekly proof-of-reserves. You can see exactly how much crypto they hold - and it always matches user balances.

They support 350+ cryptocurrencies - the most of any major exchange. If you’re into obscure altcoins, Kraken is your best bet. Their Kraken Pro platform has advanced charting, limit orders, stop-losses, and API access for bots. It’s what professionals use.

Fees start at 0% for makers (people who add liquidity) and go up to 0.4% for takers. That’s far better than Coinbase. Kraken also added Ethereum’s Proto-Danksharding upgrade in September 2025, cutting ERC-20 transaction fees by 63%. That’s a big win for DeFi users.

Downside? Verification can take 3-7 days. And their interface is overwhelming if you’ve never traded before. But if you care about security and low fees, Kraken is the gold standard.

3. OKX: Best for Global Traders and Low Fees

OKX isn’t available in the U.S. But if you’re outside the U.S., it’s one of the best options. It supports over 400 cryptocurrencies, has 24/7 live chat in 15 languages, and charges as low as 0.08% per trade.

OKX has never been hacked. Their security is built differently: 95% of funds are in multi-signature cold wallets, and private keys are stored in RAM - not hard drives. That means even if someone breaks into their servers, they can’t steal keys.

They also offer staking, NFT trading, DeFi protocols, and even crypto-backed loans - all in one app. That’s why they’re called an “exchange ecosystem,” not just a trading platform. Their mobile app is smooth, and their customer support responds fast.

The problem? Getting fiat in and out is harder than on Coinbase. You can’t link a bank account directly in most countries. You’ll need to use a third-party service like MoonPay or Transak. That adds a fee. But if you’re trading crypto-to-crypto, OKX is unbeatable.

4. Binance US: Best for High Volume, Limited Selection

Binance US is the American version of the world’s largest exchange. It’s fast, has low fees (0%-0.6%), and supports 158 coins. That’s half of what the global Binance offers - but it’s still more than most U.S. exchanges.

Many users come here because they’re used to the global Binance platform. But if you’re trading a coin like Solana or Dogecoin, you’ll find it here. The interface is clean, and the mobile app is reliable.

But here’s the issue: Binance US is constantly dropping coins because of U.S. regulations. In 2025, users on Reddit’s r/Binance complained about losing access to 12 tokens they’d been holding for months. If you’re invested in a coin that gets delisted, you have 30 days to withdraw it - or you lose it.

Also, Binance US doesn’t offer staking or DeFi features like OKX or Kraken. It’s just a trading platform. If you want more, you’ll need to move your crypto elsewhere.

5. Uphold: Best for Multi-Asset Trading

Uphold isn’t just a crypto exchange. It’s a digital wallet that lets you trade crypto, stocks, gold, and even fiat currencies like EUR and GBP - all in one place. That’s unique. If you want to swap Bitcoin for gold or Ethereum for USD without leaving the app, Uphold is the only one that does it cleanly.

They support over 200 trading pairs, and their staking rewards are among the highest in the industry. You can earn up to 8% APY on some tokens.

But they charge up to 2.95% on purchases. And they don’t offer phone support. If you get locked out of your account, you’re stuck waiting for email replies. Trustpilot reviews show 78% of users rate them 5 stars for ease of use - but 15% give 1 star because support is too slow.

Uphold is great if you want to diversify beyond crypto. Not great if you need fast help.

How to Pick the Right Exchange for You

There’s no single "best" exchange. It depends on what you need.

- Are you new? Start with Coinbase. It’s simple, safe, and legal in the U.S.

- Do you trade daily? Use Kraken or OKX. Lower fees, better tools.

- Do you live outside the U.S.? OKX is your top choice. Low fees, wide selection, strong security.

- Do you want to trade crypto and stocks? Uphold is the only one that does both well.

- Are you holding obscure altcoins? Kraken has the most options.

Never use an exchange you’ve never heard of. If it’s not on CoinMarketCap or listed in major reviews, it’s risky. And never, ever send crypto to an address you got from a random DM or YouTube comment.

Security: What Actually Matters in 2025

After the $285 million Atomic Wallet hack in June 2025, every exchange upgraded security. But not all upgrades are equal.

Here’s what to look for:

- Cold storage: At least 90% of funds should be offline. Kraken and OKX hit 95%+.

- Proof of reserves: Can you see real-time proof they hold your crypto? Kraken and OKX publish this weekly.

- Two-factor authentication (2FA): Must be app-based (Google Authenticator), not SMS. SMS can be hacked.

- Biometric login: Coinbase now requires it for accounts over $10,000. That’s a good sign.

- Insurance: Coinbase insures hot wallet holdings up to $250 million. Not all exchanges do this.

If an exchange doesn’t mention these things on their website, they’re not serious about security.

What’s Changing in 2025 (And What to Watch)

The crypto exchange game is changing fast.

- Regulation is tightening: The SEC sued Coinbase in November 2025, claiming they’re operating as an unregistered securities exchange. If the court rules against them, U.S. users could lose access to dozens of tokens.

- Fees are dropping: Kraken, OKX, and Binance are undercutting Coinbase on trading fees. If you trade more than $5,000/month, you’re paying too much on Coinbase.

- DeFi is merging with exchanges: OKX and Crypto.com now let you stake, lend, and earn yield inside their apps. No need to use separate platforms.

- Mobile apps are the new front door: 87% of trades in 2025 happen on mobile. Make sure your exchange has a fast, reliable app - not just a website.

The winners in 2025 aren’t the biggest exchanges. They’re the ones that combine security, low fees, and user experience. That’s Kraken, OKX, and Coinbase - in that order, depending on where you live and what you’re doing.

Final Advice: Don’t Get Scammed

If you Google "Digital World Exchange," you’ll find a site with a fake logo, a fake team, and fake testimonials. It might even have a "24/7 support" chatbot that just says "Thank you for your message. We’ll reply soon." Then it disappears.

Real exchanges don’t need to trick you. They compete on features, not lies. Stick to the names you’ve heard from trusted sources: Coinbase, Kraken, OKX, Binance US, Uphold. Avoid anything else.

And remember: if it sounds too good to be true - lower fees, higher returns, no verification - it is. Crypto isn’t a get-rich-quick scheme. It’s a tool. Use the right one, and it works. Use the wrong one, and you lose everything.

Is Digital World Exchange a real crypto exchange?

No, Digital World Exchange is not a real or registered cryptocurrency exchange. It does not appear on any major crypto tracking platforms like CoinMarketCap or CoinGecko, and there are no credible reviews or security audits for it. It’s likely a scam site designed to mimic legitimate exchanges. Always verify an exchange’s legitimacy through trusted sources before depositing any funds.

What’s the safest crypto exchange in 2025?

Kraken is considered the safest crypto exchange in 2025. It has never been hacked since its founding in 2011, stores 98% of funds in cold storage, publishes weekly proof-of-reserves, and uses advanced encryption. OKX and Coinbase also rank highly for security, with OKX using RAM-based key storage and Coinbase offering insured hot wallet holdings up to $250 million.

Which exchange has the lowest fees?

OKX offers the lowest trading fees at 0.08% for takers and 0% for makers. Kraken follows closely with fees starting at 0%. Binance US charges 0%-0.6%, while Coinbase’s standard fees range from 0% to 4% - making it the most expensive for casual traders. For high-volume traders, Kraken Pro and OKX offer tiered fee discounts that can drop fees to near zero.

Can I use Binance in the U.S.?

You can use Binance US, which is a separate platform from the global Binance. Binance US supports 158 cryptocurrencies and has lower fees than Coinbase, but it’s restricted by U.S. regulations. Many tokens available on global Binance are not available on Binance US, and the platform frequently delists coins due to legal pressure. Do not use the global Binance site in the U.S. - it’s blocked and violates U.S. law.

Which exchange is best for beginners?

Coinbase is the best exchange for beginners in 2025. It has the simplest interface, supports purchases as low as $1, offers PayPal deposits, and is fully compliant with U.S. regulations. It also provides educational resources and a straightforward mobile app. While fees are higher than competitors, the ease of use makes it ideal for first-time buyers.

Should I use multiple crypto exchanges?

Yes, using multiple exchanges can be smart. Keep your long-term holdings on a secure exchange like Kraken or OKX. Use Coinbase for easy buys and sales. Use Uphold if you want to trade crypto with stocks or gold. Never keep all your crypto on one platform. Diversifying reduces risk if one exchange gets hacked or goes offline. Always withdraw large amounts to a personal wallet you control.

Next Steps: What to Do Right Now

If you’ve been searching for Digital World Exchange, stop. Close that tab. Do not enter any personal or payment details.

Here’s what to do instead:

- Go to Coinbase.com if you’re in the U.S. and new to crypto.

- Go to Kraken.com if you want low fees and strong security.

- Go to OKX.com if you’re outside the U.S. and want the most features.

- Verify the website URL - make sure it’s the real one, not a lookalike.

- Enable 2FA using Google Authenticator - never SMS.

- Start small. Buy $10 of Bitcoin or Ethereum. Learn how it works before putting in more.

The crypto market is full of opportunity - but also full of traps. Don’t fall for fake names. Stick to the real players. They’ve earned their place by being transparent, secure, and reliable.

Suhail Kashmiri

Anyone still falling for these fake exchange names deserves to lose their crypto. Digital World Exchange? More like Digital Wallet Scam. I’ve seen these sites in my feed in India-fake testimonials, Hindi-English mix, and ‘limited time offer’ popups. If you don’t know the difference between Kraken and some .xyz domain, you shouldn’t be trading at all. Stop being lazy and do your research.

And yes, I’ve lost money this way. Once. Never again.

Kristin LeGard

USA has the best exchanges-Coinbase, Kraken, Binance US. Period. If you’re using OKX or some offshore junk, you’re basically saying you don’t trust American security standards. And don’t even get me started on people who think ‘low fees’ means ‘safe.’ Fee is the least of your worries when your coins vanish into some Russian server.

Stop enabling foreign platforms. Support American innovation. Or keep losing your life savings to shadow exchanges.

Arthur Coddington

So we’re just supposed to trust these five exchanges now? Like they’re the chosen ones? What’s next? The SEC handpicks your Bitcoin wallet? This whole thing feels like a corporate oligopoly dressed up as ‘security.’

Kraken’s never been hacked? Sure. And the moon landing was real. But tell me-how many times did they quietly move funds during a market dip? How many ‘proof of reserves’ are just screenshots of a spreadsheet? I’m not buying the PR. I’m buying silence.

And honestly? I’d rather lose crypto to a scam than give my data to a company that reports to the SEC.

Phil Bradley

Y’all are overcomplicating this. It’s not about which exchange is ‘best.’ It’s about which one you can actually use without crying.

I tried Kraken. Took 5 days to verify. I tried Coinbase-fees made me want to cry. OKX? Couldn’t even link my bank. Uphold? Lost my password and got zero response for 72 hours.

So I just use Binance US for trades and move everything to a Ledger after. Simple. No drama. No ‘ecosystem.’ Just cold storage and a prayer.

Also, Digital World Exchange? Bro, I saw a TikTok ad for it yesterday. They had a guy in a suit saying ‘I made $50k in 3 days.’ I reported it. Twice.

Stephanie Platis

Let’s be clear: the absence of ‘Digital World Exchange’ from CoinMarketCap and CoinGecko is not merely an oversight-it is a definitive, irrefutable, and non-negotiable indicator of its illegitimacy. Furthermore, the assertion that ‘real exchanges don’t need to trick you’ is not merely accurate-it is axiomatic. Any platform that relies on FOMO, fake testimonials, or urgency-based CTAs is not a platform-it is a trap.

Additionally, the use of SMS-based 2FA is not merely ‘insecure’-it is negligent. The fact that this is still a common practice among amateur users is a national disgrace. And yes-I am speaking to you, the person reading this while using Google Authenticator on a device that auto-backs up to iCloud.

Joy Whitenburg

ok so i literally just started with $20 on coinbase last week and i’m already scared to touch anything else lol

like i thought i was being smart by checking reviews, but then i saw that fake exchange and i was like… wait is this real??

thank you for this post. i printed it out. my mom thinks crypto is a pyramid scheme but now she’s reading it too. she said ‘if it’s not on coinmarketcap, it’s a ghost.’

also i enabled 2fa. i think. maybe. i hope. 🤞

Kylie Stavinoha

What fascinates me is not the existence of scams, but the cultural psychology that enables them. In societies where financial literacy is low, and institutional trust is eroded, the allure of ‘easy wealth’ becomes a narrative of salvation.

Digital World Exchange isn’t just a fake platform-it’s a mirror. It reflects the desperation of those who’ve been failed by traditional finance, by education systems, by economic inequality.

And while we point fingers at scammers, we must also ask: why are so many willing to believe them? The answer lies not in ignorance, but in hope. We must build better systems-not just better exchanges.

Also, Kraken’s proof-of-reserves is brilliant. It’s transparency as a public good.

Diana Dodu

Why are we still letting these foreign exchanges like OKX operate like they’re above the law? They don’t answer to U.S. regulators. They don’t pay U.S. taxes. They don’t care about American investors. And yet we’re all supposed to worship them because they have ‘low fees’?

It’s like letting China run your power grid because their electricity is cheaper. No. We need American exchanges. We need American security. We need American accountability.

And if you’re using OKX, you’re not ‘global’-you’re complicit.

Raymond Day

Let’s be real-Coinbase is the only one that’s actually insured. Kraken? ‘Never been hacked.’ Cool. But what if they get subpoenaed? What if the government freezes their assets? What if they’re forced to hand over your keys?

And OKX? They’re based in the Seychelles. The same place where 80% of crypto laundering happens.

I keep 90% of my stuff on a Ledger. 10% on Coinbase. That’s it.

Also-Digital World Exchange? Bro, I saw a YouTube ad for it with a guy in a suit holding a Lamborghini. I called the FBI. They said ‘we’ve seen this 300 times this year.’ 😭

Noriko Yashiro

I’m from the UK and I use Kraken. Why? Because it’s the only one that lets me trade BTC for EUR without paying 5% in fees. Coinbase? Too expensive. OKX? No GBP support. Uphold? Too slow.

But I agree with the post-never trust a name that sounds like a corporate buzzword generator. Digital World Exchange? That’s not a brand. That’s a placeholder.

Also, enable 2FA. Please. I’ve seen too many friends lose everything because they trusted SMS.

Atheeth Akash

Good post. I live in India and I’ve seen so many fake exchanges targeting local users. They use Bollywood actors in fake ads. One even had a WhatsApp group called 'Digital World VIP Members' with 20k people.

Most people here don’t know what cold storage is. They just see ‘earn 20% daily’ and send money.

I told my cousin to use Kraken. He didn’t believe me until I showed him the proof of reserves page. Now he’s safe.

Thanks for the clarity.

James Ragin

Let me ask you this: if Coinbase is so ‘compliant,’ why did they spend $147 million on regulatory infrastructure? That’s not compliance. That’s bribery. That’s lobbying. That’s the state becoming a gatekeeper for crypto.

And Kraken’s ‘never been hacked’? What if they’re working with the NSA? What if their ‘cold storage’ is just a server in a basement in Virginia with a federal warrant? What if ‘proof of reserves’ is just a lie written in code?

They’re all controlled. They’re all compromised. The only safe exchange is one you run yourself-with a paper wallet and a shotgun.

David Billesbach

Oh please. You think Kraken is safe? They’re owned by a shell company in the Caymans that’s registered to a PO box. Their ‘team’ is a list of fake LinkedIn profiles. Their ‘audits’ are done by firms that also audit crypto scams.

And Coinbase? They’re the SEC’s pet. They got sued because they’re the only one dumb enough to play by the rules. Meanwhile, OKX is quietly moving billions through crypto mixers and nobody says a word.

There are no good exchanges. There are only degrees of corruption.

And if you’re not using a self-custody wallet, you’re not owning crypto. You’re renting it from a bank that thinks you’re a customer, not a citizen.

Andy Purvis

I think everyone’s missing the point. The real issue isn’t which exchange to use-it’s whether we should be using exchanges at all.

Why do we need middlemen to trade crypto? The whole point of blockchain is decentralization.

I use Uniswap and PancakeSwap for everything. No KYC. No waiting. No fees beyond gas. And I hold my keys.

Yeah, it’s a little harder. Yeah, you can mess up. But you’re not trusting a company with your life savings.

Maybe the real solution isn’t finding the ‘best’ exchange… but abandoning them entirely.

FRANCIS JOHNSON

This post is a beacon. A light in the fog.

For years, I thought crypto was chaos. Then I found Kraken. Then I learned about proof of reserves. Then I realized-this isn’t gambling. It’s engineering.

Every time I see someone fall for a fake exchange, I feel it in my bones. Not anger. Sadness. Because they were so close to something beautiful-something revolutionary-and a scammer stole their chance.

So thank you. Not just for listing exchanges. But for reminding us that integrity matters.

And if you’re reading this and you’re new? Start small. Learn slow. Trust no one. But trust the process.

You’ve got this. 🌱

Ruby Gilmartin

Let’s dismantle this ‘top 5’ list. Kraken’s ‘never been hacked’? That’s because they’ve never had enough volume to be a target. OKX’s ‘low fees’? They make it up on withdrawal limits and hidden slippage. Coinbase? A regulatory puppet. Uphold? A glorified forex broker with crypto sprinkles.

Binance US? Delisting coins because the SEC says so? That’s not a platform-that’s a compliance zoo.

And ‘Digital World Exchange’? That’s just the tip. There are 200 more just like it, all targeting non-English speakers with AI-generated testimonials.

Stop treating this like a product review. This is a battlefield. And you’re unarmed.

Douglas Tofoli

hey i just got into crypto last month and this post saved me so much stress

i was about to sign up for some site called ‘Digital World Trade’ because it had a cool logo and a guy saying ‘I turned $500 into $10k in a week’

thank you for calling out the fake stuff. i printed the list and showed my dad. he said ‘if it’s not on coinmarketcap, it’s a dream.’

also i enabled 2fa with google auth. i think. i hope i did it right lol

William Moylan

They’re all in on it. The whole thing. Coinbase, Kraken, OKX-they’re all fronts. The SEC, the Fed, the CIA-they’re all running this. They let you think you’re trading crypto, but every transaction is monitored, logged, and flagged.

And that ‘proof of reserves’? It’s just a blockchain illusion. They control the nodes. They control the ledger.

They want you to think you’re safe. So you keep depositing. So they can freeze you. So they can tax you. So they can take it all when the next ‘regulatory crackdown’ hits.

Don’t use any exchange. Don’t use any wallet. Use cash. Buy gold. Hide it. Trust nothing.

Michael Faggard

For high-frequency traders, Kraken Pro is the only viable option in 2025. The API latency is sub-15ms, the order book depth is unmatched, and the maker-taker fee structure incentivizes liquidity provision.

Additionally, their Proto-Danksharding implementation has reduced ERC-20 gas overhead by 63%, which directly improves arbitrage efficiency across DeFi protocols.

For retail users? Coinbase Advanced Trade offers sufficient functionality with lower cognitive load. But if you’re serious about volume, Kraken is the only platform that scales without compromising on execution quality.

And never-under any circumstances-use SMS-based 2FA. It’s not just insecure; it’s a liability.

Ainsley Ross

Thank you for this comprehensive, thoughtful breakdown. As someone who works in financial education, I’ve seen too many individuals lose life savings to impersonation scams like Digital World Exchange.

What’s most important is not just identifying the legitimate platforms, but cultivating a mindset of verification: check URLs, cross-reference with CoinMarketCap, research team members, and demand transparency.

Also, the point about self-custody is critical. Exchanges are convenient, but they are not yours. Your keys, your crypto. Always.

And for beginners: start with $10. Learn. Then scale. There is no rush. The market will be here tomorrow.

You are not behind. You are becoming.

Kristin LeGard

Of course you’re using Uniswap. That’s why your portfolio is 70% memecoins and 30% regret.

Decentralized doesn’t mean safe. It means unregulated. It means no recourse. No insurance. No help when you send ETH to the wrong address.

You think you’re ‘free’? You’re just broke and alone.

FRANCIS JOHNSON

And yet-without decentralization, crypto becomes just another bank.

You’re right: it’s risky. But the real risk is surrendering control to institutions that answer to governments that answer to corporations.

I’d rather lose $100 to a typo than give $10,000 to a system that can freeze it with a click.

Freedom has a price. And it’s not always pretty.