BitSeven isn’t your average crypto exchange. If you’re looking to buy Bitcoin and hold it for years, this platform won’t help you. But if you’re chasing 100x leverage on short-term price swings, you might’ve heard of it. And if you’ve traded on BitSeven before, you know exactly what I mean: big wins, brutal losses, and a platform that feels like a rollercoaster with no safety bar.

What BitSeven Actually Offers

BitSeven lets you trade perpetual contracts on just four cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). That’s it. No altcoins, no spot trading, no staking, no NFTs. Everything is a leveraged futures contract against USD. The only thing they’re good at is letting you control $10,000 worth of Bitcoin with just $100. That’s 100x leverage - higher than most regulated exchanges offer, even today.

But here’s the catch: with 100x leverage, a 1% move against you wipes out your entire deposit. A 0.5% dip? Gone. No second chances. No margin calls. Just instant liquidation. And if you think that’s extreme, you’re right - it is. Most professional traders use 10x to 20x. BitSeven targets a very specific kind of trader: someone who believes they can predict micro-movements in Bitcoin’s price with near-perfect accuracy.

The June 2024 Shutdown: What Really Happened

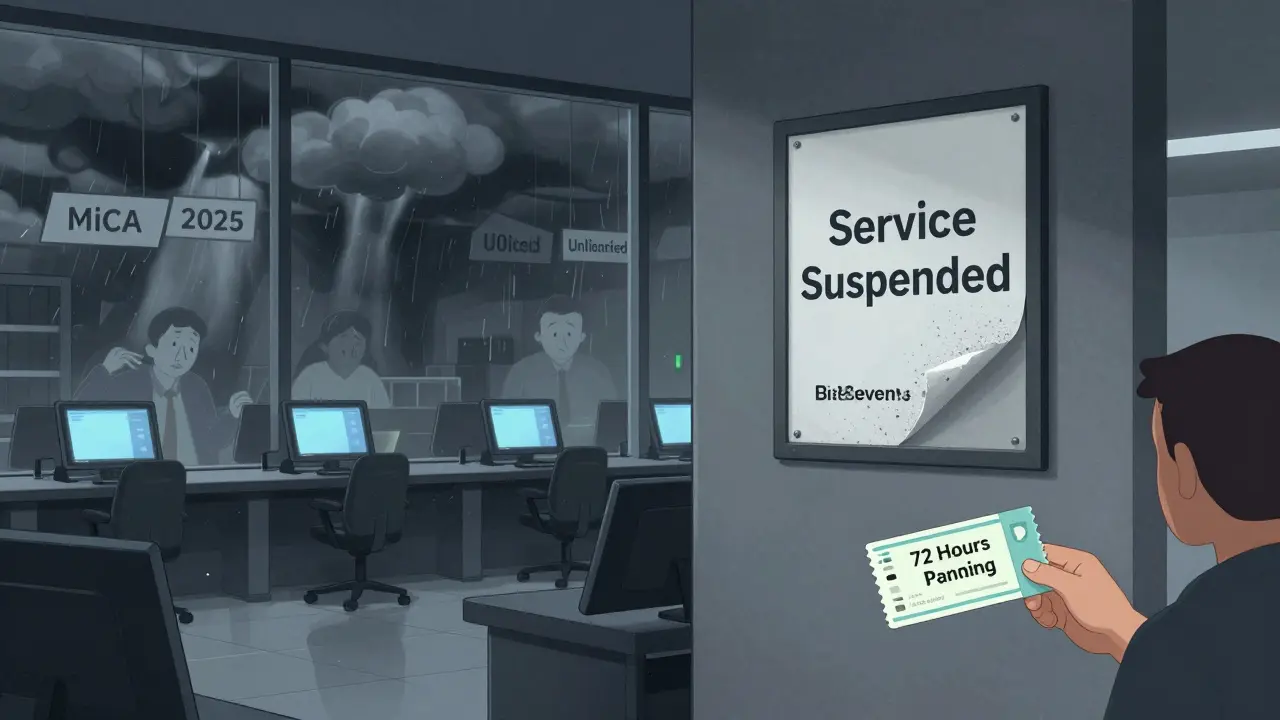

On June 17, 2024, BitSeven vanished from the trading world. No warning. No detailed email. Just a single tweet saying services were suspended for "several regions." Users couldn’t open new trades. They could only close existing positions and withdraw funds. For a month, the platform was offline.

When it came back on July 17, 2024, they didn’t explain what went wrong. No audit report. No transparency update. Just a return to business as usual. And that’s the problem. Thousands of users reported delays in withdrawals during the outage. Some said they waited over 72 hours just to get their money out - even though BitSeven claimed withdrawals were "instant."

Reddit and Twitter were flooded with complaints. One user, u/TradeSafe, confirmed their funds returned after two days, but added: "No one told us why it happened. No apology. No explanation." That kind of silence isn’t just bad customer service - it’s a red flag for any exchange handling real money.

Security: No Audits, No Licenses, No Trust

BitSeven claims to "value security" and mentions "licenses from renowned regulating bodies." But no one has ever seen those licenses. No CySEC. No FCA. No FINMA. Not even a public proof-of-reserves audit. Unlike Kraken or Binance, which publish monthly Merkle tree proofs showing they hold all customer funds, BitSeven gives you nothing.

ScamAdviser flagged a domain called bitseventrading.com - a lookalike site - with a 28/100 trust score. While that’s not BitSeven.com, the confusion is telling. If scammers can easily copy your name and trick people, your brand is vulnerable. And in crypto, trust isn’t optional. It’s the only thing keeping users from walking away.

There’s also no insurance fund. No cold storage breakdown. No third-party security certifications. If BitSeven gets hacked tomorrow, your funds are gone. Period. And there’s no one holding them accountable.

Who Should Use BitSeven?

Let’s be honest - BitSeven isn’t for beginners. It’s not even for intermediate traders. It’s built for a tiny group: experienced, high-frequency traders who live in the 5-minute chart, understand liquidation mechanics inside out, and treat every trade like a casino bet with odds they think they’ve cracked.

According to BitcoinTradingSites.net, 89% of BitSeven users have over two years of crypto trading experience. New traders? They get liquidated within 72 hours. One survey of 142 new users found 63% lost everything before they even understood how margin worked.

BitSeven doesn’t offer tutorials, webinars, or educational content. No glossary. No risk calculator beyond the basic interface. You’re expected to already know how to trade derivatives. If you don’t, you’re not just risking money - you’re risking your entire crypto portfolio.

Compared to the Competition

Let’s put BitSeven next to the big players:

- Binance: Offers 125x leverage on select pairs, 350+ assets, spot trading, staking, insurance fund, and monthly audits.

- Bybit: 100x leverage on major pairs, 100+ perpetual contracts, 24/7 support, clear liquidation buffers, and transparent fee structure.

- Kraken Futures: Max 50x leverage, regulated in multiple jurisdictions, proof-of-reserves, and institutional-grade security.

BitSeven’s only edge is the 100x leverage - but even that’s misleading. Binance offers higher leverage on some coins, and Bybit gives you the same 100x without locking you into a 10-day position limit. BitSeven forces you to close all positions after 240 hours, no matter if you’re in profit. That’s a dealbreaker for swing traders.

And while Binance and Bybit support deposits in USD, EUR, and dozens of fiat currencies, BitSeven only accepts crypto deposits. No bank transfer. No credit card. You need to already own Bitcoin or Ethereum just to get started.

The Withdrawal Fee and Trading Costs

Deposits are free - that’s good. But withdrawals cost 0.001 BTC, no matter how much you’re pulling out. That’s about $60 at current prices. If you’re trading small amounts - say, $500 positions - that fee eats up 12% of your profit before you even break even.

Trading fees? No one knows. BitSeven doesn’t publish them. Not on their site. Not in any review. That’s not transparency - that’s opacity. In crypto, hidden fees are a sign of trouble. Legit exchanges list every charge clearly: maker/taker fees, funding rates, withdrawal costs. BitSeven leaves you guessing.

Is BitSeven Still Worth It in 2025?

Here’s the truth: BitSeven survives because there’s still demand for high-leverage trading. People are greedy. They see 100x and think, "I can make 10x in an hour." And sometimes, they do.

But the risks are extreme. The June 2024 outage showed they can disappear without warning. The lack of licenses means they’re operating in a legal gray zone - and with MiCA (the EU’s new crypto law) fully active in 2025, unregulated exchanges like BitSeven could be forced to shut down in Europe and possibly the U.S.

Industry analysts say unregulated 100x leverage platforms have a 78% failure rate within three years. BitSeven’s been around since 2019. That’s six years. They’ve survived longer than most. But survival doesn’t mean safety.

If you’re thinking of using BitSeven, ask yourself: Are you trading to make money - or are you gambling for a thrill? If it’s the latter, you’re already on the wrong side of the odds.

Final Verdict

BitSeven is a high-risk, high-reward tool for a very narrow audience. It’s not a place to store crypto. It’s not a place to learn. It’s not even a place to trade casually. It’s a leveraged derivatives arena for experienced traders who accept total risk and zero transparency.

For everyone else - especially if you’re new to crypto or care about security - walk away. There are better, safer, and more reliable exchanges out there. BitSeven might offer 100x leverage, but it doesn’t offer peace of mind. And in crypto, that’s worth more than any multiplier.

Is BitSeven a scam?

BitSeven isn’t officially labeled a scam, but it operates without licenses, audits, or regulatory oversight. Its June 2024 shutdown without explanation, lack of proof-of-reserves, and hidden fees raise serious red flags. Many users report withdrawal delays during outages. While it’s not a classic Ponzi scheme, it’s an unregulated platform with high risk and low transparency - a dangerous combination in crypto.

Can I trade fiat on BitSeven?

No. BitSeven only accepts cryptocurrency deposits - Bitcoin, Ethereum, Litecoin, and Ripple. You cannot deposit USD, EUR, or any fiat currency. You must already own crypto to trade on BitSeven, which makes it inaccessible for beginners who don’t have crypto on hand.

What assets can I trade on BitSeven?

You can only trade perpetual contracts on four cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). All trades are against USD. There is no spot trading, no altcoins, no options, and no other markets. This extreme limitation makes BitSeven unsuitable for portfolio diversification.

Is BitSeven safe for long-term trading?

No. BitSeven forces all positions to close after 240 hours (10 days), regardless of market conditions. This makes it impossible to hold long-term trades. It’s designed for short-term, high-frequency speculation only. Plus, with no insurance fund and no regulatory protection, holding funds on BitSeven for any length of time is risky.

Why did BitSeven shut down in June 2024?

BitSeven never publicly explained the reason for its June 2024 shutdown. They claimed it was a "temporary" fix for "momentary problems," but offered no details. Users couldn’t trade or withdraw for a month. The lack of communication and transparency suggests internal instability or possible regulatory pressure - but without official statements, it remains speculation.

Does BitSeven have a mobile app?

No. BitSeven has no official mobile app. All trading must be done through a web browser on desktop or mobile. There are no iOS or Android apps available in official app stores. This limits convenience and real-time trading for users on the go.

What are the withdrawal fees on BitSeven?

BitSeven charges a flat fee of 0.001 BTC per withdrawal, regardless of the amount. At current Bitcoin prices, that’s around $60. This fee is high for small withdrawals and can eat into profits significantly. There are no deposit fees, but the withdrawal cost makes frequent trading expensive.

Can I trust BitSeven’s customer support?

Support quality is inconsistent. Some users on Bitcointalk report fast responses via Telegram (under 2 hours). But during the June 2024 outage, Twitter complaints spiked to over 200 daily, with response times exceeding 18 hours. There’s no 24/7 live chat, no phone support, and no clear ticketing system. Reliability drops during critical moments.

BitSeven is a tool for a specific kind of trader - one who thrives on risk and understands the cost of leverage. But for most people, the dangers far outweigh the rewards. In 2025, with stricter regulations and more transparent alternatives available, choosing BitSeven isn’t just a trading decision - it’s a trust decision. And trust, once broken, is hard to rebuild.

Janet Combs

Bro, I tried BitSeven once. Lost my entire $200 in 12 minutes. One minute I’m laughing, next I’m crying into my ramen. No warning. No mercy. Just gone.

roxanne nott

Of course it’s a scam. No audits, no licenses, and they charge 0.001 BTC to withdraw? That’s not a fee, that’s a robbery with a side of gaslighting. If you’re still using this, you’re either a masochist or a bot.

Dusty Rogers

I used to trade here back in 2022. The interface was clean, the execution was fast - but the lack of transparency always creeped me out. I got out before June 2024. Smart move.

Dan Dellechiaie

Let’s be real - BitSeven isn’t an exchange, it’s a liquidity sink designed to extract capital from overleveraged gamblers who think they’re Warren Buffett with a trading terminal. The 100x leverage isn’t a feature, it’s a trapdoor. And the fact they never explained the June shutdown? Classic exit scam behavior. If you’re not auditing their contract addresses, you’re not trading - you’re donating.

Also, no fiat deposits? That’s not a limitation, that’s a red flag wrapped in a blockchain. Real platforms onboard users, not just crypto hoarders who think cold wallets are a personality trait.

And don’t get me started on the withdrawal fee. Charging 0.001 BTC on a $500 position? That’s a 12% tax on your dreams. Even Robinhood doesn’t charge that much for a haircut.

Meanwhile, Bybit gives you 100x, 24/7 support, and a public Merkle tree. BitSeven gives you a tweet and a prayer. Who’s the real villain here?

The fact that 89% of users have 2+ years experience? That’s not a badge of honor - it’s a warning label. You’re not trading with pros. You’re trading with the last survivors of a sinking ship.

And MiCA 2025? They’re already dead. They’re just waiting for the regulator to flip the switch. This isn’t a platform - it’s a countdown timer.

Don’t confuse volatility with opportunity. This isn’t crypto. This is Vegas with a .js frontend.

And yes, I’ve seen the lookalike domain. ScamAdviser gave it 28/100? That’s generous. The real site should have a 12/100. If you’re still depositing here, you’re not a trader - you’re a case study.

There’s a reason Kraken and Binance don’t offer 100x. Not because they’re weak. Because they’re not trying to turn your portfolio into a meme.

Stop romanticizing risk. Risk without control isn’t strategy - it’s suicide with leverage.

Walk away. Not because you’re scared. Because you’re smart.

Ashley Lewis

The absence of regulatory oversight is not merely a flaw - it is an existential vulnerability. One cannot credibly claim operational integrity while simultaneously refusing to disclose proof-of-reserves or submit to audit.

Furthermore, the imposition of a 240-hour position limit renders the platform incompatible with any legitimate trading methodology beyond pure speculation.

One must question the ethical foundations of an entity that profits from the systematic liquidation of inexperienced participants.

It is not merely irresponsible - it is predatory.

Sarah Glaser

There’s something poetic about how BitSeven thrives on human greed. We all know the odds. We all know the risks. But we still click that 100x button like it’s a magic spell. Maybe the real question isn’t whether BitSeven is safe - but why we keep coming back.

We don’t trade for money. We trade for the feeling that we’re one trade away from changing everything. And that’s the most dangerous leverage of all.

It’s not the platform that’s broken. It’s the mindset.

Megan O'Brien

100x leverage? More like 100x liability. If you’re still using this, you’re not a trader - you’re a statistic waiting to be logged.

Melissa Black

BitSeven doesn’t offer trading - it offers entropy. No audits, no licenses, no insurance. Just pure, unfiltered risk architecture designed to maximize extraction and minimize accountability. The June 2024 shutdown wasn’t a glitch - it was a stress test. And the platform failed silently. That’s not incompetence. That’s intention.

The withdrawal fee is a psychological weapon. It forces you to stay longer, to chase losses, to believe you can recover. It’s behavioral design disguised as a fee structure.

And the fact they only accept crypto deposits? That’s not exclusivity - it’s obfuscation. It filters out regulators, auditors, and anyone with a bank account. It’s a walled garden for the willfully blind.

They’re not a crypto exchange. They’re a high-leverage casino with a whitepaper.

And in 2025, with MiCA enforcing KYC and AML across the EU, BitSeven won’t disappear - it will vanish. Like it never existed.

Don’t confuse longevity with legitimacy. Six years of survival doesn’t mean safety. It means they’ve been quietly siphoning funds from the naive.

Ask yourself: if this were a bank, would you deposit your life savings? If the answer is no - then why are you trading here?

It’s not about the leverage. It’s about the lack of a safety net. And in finance, that’s not innovation. That’s negligence dressed up as innovation.

Radha Reddy

I come from India, where people lose money on crypto every day. But even here, we know: if a platform doesn’t show its license, it’s not worth touching. BitSeven is not for beginners - it’s for people who don’t want to learn. And that’s a dangerous mix.

Shubham Singh

Of course BitSeven survives - there are still people who believe they can outsmart gravity. The fact that you’re reading this review instead of trading means you’re not one of them. Good. The market needs fewer gamblers and more skeptics.

Ellen Sales

lol so they shut down for a month and came back like nothing happened? classic. imagine being this bold and still having users. the audacity.

Tristan Bertles

My buddy got liquidated on BitSeven and tried to withdraw $800. Took him 72 hours. They finally processed it - but charged him $60 in fees. He ended up with $740. He cried. I laughed. Then I deleted my account.

Don’t trade here. Not because it’s a scam - because it’s a trap you won’t even realize you’re in until it’s too late.