Block Reward Calculator

Mining Profitability Calculator

Profitability Analysis

Calculating...When you send Bitcoin or ETH from one wallet to another, no bank processes it. No central authority approves it. Instead, a global network of strangers-miners or validators-compete to confirm your transaction. And they get paid for it. That payment? The block reward. It’s the engine behind every blockchain. Without it, the whole system collapses.

What Exactly Is a Block Reward?

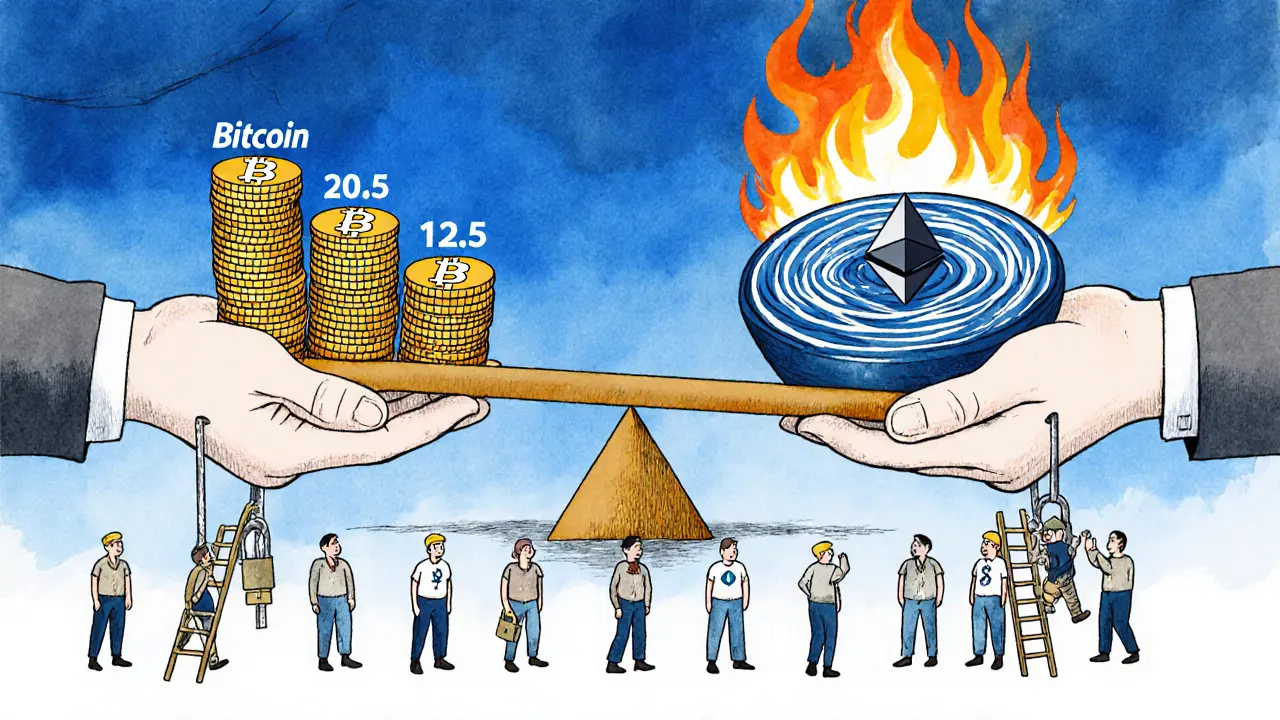

A block reward is what miners or validators earn for adding a new block to the blockchain. It’s not just one thing-it’s two parts. First, there’s the block subsidy: brand-new coins created out of thin air and given to the winner. Second, there are the transaction fees paid by users who want their transactions included in that block. In Bitcoin’s case, every 10 minutes, a new block is added. The miner who solves the math puzzle first gets paid. In 2009, that reward was 50 BTC. Today, it’s 6.25 BTC. The next halving in April 2024 will cut it to 3.125 BTC. That’s not a mistake. It’s by design. Ethereum doesn’t work the same way. After The Merge in September 2022, it stopped using mining. Now, validators stake ETH to participate. They earn rewards based on how much ETH is staked across the whole network. If more people stake, rewards go down. If fewer stake, rewards go up. It’s adaptive, not fixed.Why Block Rewards Exist

Satoshi Nakamoto didn’t invent block rewards to give people free money. He invented them to solve a problem: how do you get people to secure a network without a central boss? Think of it like this: securing a blockchain is expensive. It takes electricity, hardware, cooling, and time. If no one got paid, why would anyone do it? Block rewards turn security into a profitable job. Miners invest in rigs. Validators lock up their ETH. They do it because the reward is worth more than the cost. And here’s the clever part: the reward is tied to the network’s value. When Bitcoin’s price goes up, miners make more money. That attracts more miners. More miners mean more security. The system feeds itself. But it’s not perfect. As block subsidies shrink, the system has to rely more on transaction fees. And that’s where things get risky.Bitcoin’s Halving Cycle: Scarcity by Code

Bitcoin’s block subsidy halves roughly every four years. That’s hardcoded into the protocol. It happened in 2012, 2016, 2020, and will happen again in April 2024. Each halving cuts the new coin supply in half. Why? To mimic gold. Gold doesn’t get mined faster just because demand goes up. Bitcoin does the same thing. It’s designed to be scarce. Only 21 million will ever exist. The last one is expected around 2140. Right now, block subsidies make up 98.5% of miner income. Fees make up just 1.5%. After the 2024 halving, fees will rise to about 12.7% of total revenue. By 2030, it could be over 50%. By 2140? 100%. That’s the big question: will users pay enough in fees to keep miners motivated? In 2021, during the NFT boom, Bitcoin fees spiked to over $55 per transaction. People panicked. Some abandoned transactions. Others switched to cheaper chains. That’s a warning sign. If fees stay high, Bitcoin becomes unusable for small payments. If fees stay low, miners starve.

Ethereum’s Shift: From Inflation to Fee Burning

Ethereum’s block reward model is the opposite of Bitcoin’s. Instead of halvings, it has variable issuance. Before The Merge, Ethereum issued about 4.3% new ETH per year. Now, it’s between 0.2% and 0.5%-depending on how much ETH is staked. But here’s the twist: Ethereum doesn’t just pay validators. It burns fees. Thanks to EIP-1559, most transaction fees are destroyed. That means less ETH in circulation. When the network is busy, ETH can actually become deflationary. So Ethereum’s economics are about balance: pay validators just enough to keep them honest, but don’t flood the market with new coins. And if users are paying a lot in fees? The network gets even scarcer. That’s why Ethereum’s security cost is only about $500 million a year-far less than Bitcoin’s $35 billion. But it’s also more flexible. If staking drops, rewards rise. If staking surges, rewards fall. No need to wait four years for a change.Other Chains, Other Rules

Not every blockchain follows Bitcoin or Ethereum’s playbook. Litecoin, for example, is like Bitcoin’s faster cousin. It halves every 840,000 blocks (every 4 years, but with 2.5-minute blocks). It has a max supply of 84 million-four times Bitcoin’s. Its reward is currently 12.5 LTC per block. Monero took a different path. After its main emission ended in 2022, it switched to a tail emission: a constant 0.6 XMR per block forever. Why? To keep miners paid, even when transaction volume is low. No risk of security collapse. Then there are chains like Solana or Avalanche that use hybrid models-sometimes paying block rewards, sometimes relying on inflationary token distributions. The point? There’s no one-size-fits-all. Each chain picks a trade-off: predictability vs. flexibility, scarcity vs. sustainability.The Centralization Problem

Block rewards sound fair. But in practice, they push mining and staking toward big players. After Bitcoin’s 2020 halving, only miners with access to electricity under 4 cents per kWh stayed profitable. That meant huge industrial farms in Texas, Kazakhstan, and Georgia. Small miners with home rigs got squeezed out. Ethereum staking has a similar issue. To become a validator, you need 32 ETH-worth about $100,000 as of 2025. Most people can’t afford that. So they join staking pools. That means control is concentrated in a few large operators like Coinbase, Lido, and Kraken. Dr. Garrick Hileman from Cambridge University calls this a “centralization pressure.” The more capital you need to join, the fewer participants you get. And fewer participants mean less decentralization. That’s a threat to the whole idea of blockchain.

Will Transaction Fees Save the Day?

The biggest fear in crypto right now: what happens when block subsidies disappear? Bitcoin’s security relies on $35 billion in annual rewards. If that drops to zero, and fees don’t rise enough, miners might quit. The network could slow down-or worse, get attacked. Some experts say layer-2 solutions like the Lightning Network will fix this. They handle tiny payments off-chain, reducing pressure on the main chain. That means lower fees and higher volume. More volume = more fees = more security. Others aren’t so sure. MIT’s Digital Currency Initiative calculated that Bitcoin would need average fees of $50 per transaction to match today’s security levels. That’s not realistic. Most people won’t pay $50 to send $10. The truth? No one knows for sure. The 2024 halving will be the first real test. If fees jump after that, the system might hold. If they don’t, we’ll see miners leaving, hashrate dropping, and security weakening.What This Means for You

If you’re a user: understand that fees aren’t random. They’re tied to network demand and block reward structure. High fees mean the network is busy-and maybe under strain. If you’re a miner or validator: your profitability depends on three things-electricity cost, hardware efficiency, and reward size. Track them constantly. Many new miners lose money because they ignore the math. If you’re an investor: block reward changes affect supply. Bitcoin’s halvings have historically preceded bull markets. Ethereum’s fee burning can reduce supply. Both can push prices up. But don’t assume it’s guaranteed. And if you’re just curious: remember this. Block rewards aren’t just about money. They’re about trust. They’re what make a decentralized network work without a CEO, a board, or a government. That’s the real innovation.Future Challenges

The next big challenge isn’t just technical-it’s economic. Bitcoin’s model is simple: reduce supply over time. Ethereum’s is complex: adjust supply based on demand. Both have strengths. Both have risks. The Frankfurt School Blockchain Center put it best: “Can the fee market scale sufficiently to provide adequate security when block subsidies become negligible?” That’s the question that will decide whether blockchains survive as decentralized systems-or become just another form of corporate-controlled tech. Right now, the answer is still open. But the next few years will tell us a lot.What is a block subsidy?

A block subsidy is the newly minted cryptocurrency awarded to miners or validators for adding a new block to the blockchain. It’s separate from transaction fees and is the primary way new coins enter circulation. In Bitcoin, the subsidy started at 50 BTC and is halved every four years. As of 2025, it’s 6.25 BTC per block.

How do transaction fees affect block rewards?

Transaction fees are added to the block reward and paid to the miner or validator who includes them. As block subsidies shrink over time (like Bitcoin’s halvings), fees become a larger share of total income. If fees don’t rise enough, miners may lose incentive to secure the network, risking security.

Why did Ethereum switch from proof-of-work to proof-of-stake?

Ethereum switched to proof-of-stake (PoS) in September 2022 to reduce energy use, lower issuance rates, and improve scalability. PoS replaced mining with staking, where validators lock up ETH to participate. This cut annual issuance from ~4.3% to under 0.5% and introduced fee burning via EIP-1559, making ETH potentially deflationary.

What happens to Bitcoin after the last coin is mined?

After the last Bitcoin is mined around 2140, block rewards will consist entirely of transaction fees. Miners will still be incentivized to secure the network, but only if users are willing to pay high enough fees. This is the biggest long-term uncertainty in Bitcoin’s design.

Are block rewards the same across all cryptocurrencies?

No. Bitcoin uses halvings and a fixed supply. Ethereum uses variable PoS rewards and fee burning. Litecoin halve every 4 years but have a 4x higher supply cap. Monero uses a permanent tail emission. Each chain chooses a different economic model based on its goals-scarcity, sustainability, or flexibility.

Andy Purvis

Block rewards are just the bait to get people to run the machines

Once everyone's hooked, the real game begins with fees

It's always been about control, not decentralization

FRANCIS JOHNSON

Let’s not romanticize this - block rewards are a brilliant economic hack, not magic

They solve the Byzantine Generals Problem by aligning incentives with self-interest

It’s the first time in human history we’ve created a trustless system that pays its own guards

And yes, the halving is poetry - scarcity coded into mathematics

But let’s be honest: if fees don’t scale, Bitcoin becomes a museum piece

Not because the tech failed - but because human behavior didn’t adapt

Ethereum’s burn mechanism is smarter - it turns user activity into deflationary pressure

That’s not just economics - it’s digital alchemy

And Monero’s tail emission? Genius

It acknowledges that security needs constant fuel - not just a one-time spark

Bitcoin’s model assumes users will pay more as the network grows

But what if they don’t? What if we hit a ceiling of $10 fee tolerance?

Then we get fragmentation - layer 2s, sidechains, altcoins - and the dream fractures

Still - this is the most elegant social contract ever written in code

And we’re just at the first paragraph

Ruby Gilmartin

Anyone who thinks Bitcoin’s fee market will scale is delusional

MIT’s numbers aren’t speculative - they’re mathematical inevitability

Miners won’t risk $35B in hardware for $500M in fees

And layer-2s? Just centralized ponzi schemes with fancy names

Bitcoin’s death spiral isn’t coming - it’s already here, masked by speculation

Meanwhile Ethereum’s model is the only one with actual economic teeth

But even that’s fragile - staking pools are just Wall Street in crypto clothing

Monero’s tail emission is the only sane model - everything else is gambling with security

Douglas Tofoli

bro i just wanna send 5 bucks to my buddy for coffee

why does it cost $4.50 in fees??

also i love how eth burns fees like it’s throwing money into a volcano 🌋🔥

bitcoin is like a rich uncle who gives you cash but then charges you $20 to open the envelope

William Moylan

They’re hiding the truth - the block reward system is a Fed-style inflation scam with blockchain lipstick

Who controls the mining rigs? Big tech, the military-industrial complex - you think it’s decentralized?

And Ethereum? Staking pools run by Coinbase - same centralized control

They want you to think this is freedom - it’s just another layer of financial slavery

The halving? A distraction - the real goal is to push you into DeFi and pay them in fees

Wake up - the blockchain was never meant to be free

It was built to replace the Fed - with worse control

Michael Faggard

Let’s break this down like a pro: block rewards are the incentive layer of consensus

Without them, you have a distributed ledger - not a blockchain

Bitcoin’s halving is a hard-coded disinflationary mechanism - it’s the closest thing to digital gold

Ethereum’s variable issuance + fee burning = dynamic supply control - far more sophisticated

But here’s the real insight: security cost must scale with value

Right now, Bitcoin’s security budget is $35B/year - that’s more than most countries spend on defense

That’s not an accident - it’s the price of trustlessness

The problem isn’t fees - it’s adoption velocity

If we hit 1B active users, even $1 fees = $1B/year - problem solved

Layer 2s aren’t a workaround - they’re the next evolutionary step

Think of Bitcoin as the gold reserve - L2s as the cash economy

It’s not broken - it’s just maturing

Elizabeth Stavitzke

Oh wow, another article pretending Bitcoin is revolutionary

Let me guess - you also think the Fed is ‘just a central bank’ and not a cartel?

Miners in Kazakhstan? Validators owned by Coinbase? How poetic

Decentralized? More like ‘corporate-controlled with a blockchain-shaped logo’

And you call this innovation? It’s just capitalism with more buzzwords

Meanwhile, the real world runs on electricity, not ETH staking rewards

Maybe try building something useful instead of writing essays about digital scarcity

Ainsley Ross

Thank you for this comprehensive and nuanced exploration of blockchain incentive structures.

It is rare to encounter such thoughtful analysis in public discourse.

The comparison between Bitcoin’s halving and Ethereum’s adaptive issuance reveals profound philosophical differences in design philosophy.

Monero’s tail emission is a masterclass in long-term sustainability thinking.

It is worth noting that centralization pressures are not inherent flaws - they are emergent properties of economic scale.

True decentralization requires not just technical architecture, but also equitable access to capital and infrastructure.

Perhaps the next frontier is not in protocol design, but in policy frameworks that promote miner and validator diversity.

Thank you again - this is the kind of writing that elevates the conversation.

Brian Gillespie

Halving’s coming. Fees will rise. Miners will leave. We’ll see.

Wayne Dave Arceo

Only an idiot thinks Bitcoin’s fee market will scale to replace subsidies

MIT’s math is clear - you need $50 per transaction to match current security

That’s not economics - that’s suicide

Ethereum’s model is superior because it doesn’t rely on fantasy

And Monero? Finally someone with real-world sense

Bitcoin is a relic - a digital artifact preserved by speculators, not engineers

Anyone still defending it as ‘sound money’ hasn’t looked at the numbers since 2021

Joanne Lee

I find the economic trade-offs between predictability and flexibility fascinating.

Bitcoin’s fixed schedule offers certainty, but at the cost of adaptability.

Ethereum’s dynamic model responds to real-time network conditions - a more organic approach.

It’s interesting to consider whether one model is inherently more resilient than the other, or if resilience emerges from community behavior rather than protocol design.

Also, the cultural implications of fee burning as a deflationary mechanism deserve deeper exploration.

Thank you for raising these nuanced points - they’re rarely discussed with this level of care.

Laura Hall

Y’all are overcomplicating this

Block rewards = pay to play

Miners want money, users want cheap tx

Simple as that

Bitcoin’s halving is just a countdown clock

Ethereum’s burning fees? That’s just a fancy way of saying ‘we’re making ETH scarcer’

And yeah, staking pools are kinda centralized - but that’s just how big things work

Don’t hate the game, hate the players

Also I’m just here for the memecoins but this is kinda interesting lol 🤓

Arthur Crone

Block rewards are a Ponzi scheme dressed up as innovation

Miners are the suckers who buy the rigs

Users are the suckers who pay the fees

Investors are the suckers who buy the hype

It’s all just a redistribution of wealth under the banner of ‘decentralization’

Wake up - the blockchain is just the new dot-com bubble

And you’re all still holding the bag

Michael Heitzer

This is the most beautiful economic experiment humanity has ever built

It’s not about money - it’s about trust without a middleman

Bitcoin’s halving is like a sunrise - predictable, inevitable, breathtaking

Ethereum’s fee burning? That’s the moon - quiet, elegant, constantly changing

And Monero’s tail emission? That’s the tide - never stopping, always there

People think this is about crypto prices - it’s not

It’s about whether we can build systems that outlive governments

That’s the real revolution

And yes, the centralization pressure is real

But so is the counter-movement - home stakers, open-source miners, community-run nodes

It’s not over - it’s just getting interesting

Rebecca Saffle

Bitcoin’s going to collapse when the miners quit

They’re already leaving because of energy costs

And don’t even get me started on how the U.S. government is quietly controlling the hash rate

Ethereum’s just a corporate tool - Lido and Coinbase are the new banks

Monero? Still the only one with integrity

But even that won’t last - regulation is coming

And when it does, you’ll all be begging for the old system back

Mark my words - this whole thing is a house of cards

Adrian Bailey

Okay so I’ve been reading up on this for like 3 weeks now and I think I finally get it

So Bitcoin’s like a vending machine that gives you less candy every 4 years

But the machine still needs electricity to work

So if you don’t put enough coins in, the machine stops

And now they’re saying we gotta pay more per candy

But most people only want one candy

So the machine’s gonna break

Meanwhile Ethereum is like a subscription box that sometimes gives you free stuff and sometimes burns your old box to make the new one rarer

And Monero? Just keeps giving you one candy every day forever

And yeah I know the staking pools are kinda centralized but like… I don’t have $100k to stake so what’s the alternative

Also I just bought 0.001 ETH and I’m so proud of myself 🤗

Rachel Everson

This is such a clear breakdown - thank you!

One thing I’d add: the real test isn’t just fees vs. subsidies - it’s whether users are willing to pay for security

That’s a behavioral economics question, not just a math one

And if we’re being honest, most people don’t care - they just want fast, cheap transactions

So the real solution might be layered: Bitcoin as settlement layer, L2s for daily use

That’s not failure - that’s evolution

Keep sharing this kind of stuff - it’s what the space needs

Johanna Lesmayoux lamare

Interesting. I wonder how this affects developing nations where electricity is expensive.

ty ty

You think this is decentralized? LMAO

It’s all owned by a few guys in Silicon Valley

And you’re all just their sheep

Buy the coin. Pay the fee. Get the scam

Wake up, sheeple

BRYAN CHAGUA

Thank you for this thoughtful, well-researched piece.

It’s rare to see such balanced analysis in a space dominated by hype.

The comparison between Bitcoin’s scarcity model and Ethereum’s adaptive one highlights how different values shape technology.

I’m particularly moved by the idea that block rewards are not just economic tools - they’re social contracts.

They represent a collective agreement to maintain a system without a central authority.

That’s profound.

And while challenges remain, I remain hopeful - not because I believe in price, but because I believe in the possibility of a better system.

Keep writing. Keep sharing. The world needs this.