When you’re building a crypto project, the last thing you want is to launch a smart contract that gets drained of millions because of a simple bug. That’s why professional security audits aren’t optional-they’re survival. But here’s the truth most beginners don’t hear: crypto security audit costs don’t come with a sticker price. They come with hidden layers, surprises, and sometimes, life-or-death consequences.

How Much Do Crypto Audits Actually Cost?

There’s no single number. A basic ERC-20 token audit might start at $1,000. A DeFi protocol handling $500 million in locked assets? That could hit $250,000. The difference isn’t just about size-it’s about risk exposure.

- Basic tokens (ERC-20, SPL): $1,000-$20,000. Simple minting, transferring, no governance, no staking. If your token does nothing but move value, this tier applies.

- Intermediate projects (NFTs, staking, governance): $15,000-$50,000. Add custom logic, user roles, reward distributions, or token vesting schedules, and the audit gets way more complex.

- DeFi protocols (DEX, lending, yield aggregators): $40,000-$100,000. These are financial systems. One logic flaw can trigger cascading liquidations or exploit loops. Auditors spend weeks reverse-engineering interactions between contracts.

- Enterprise-grade (cross-chain bridges, DAO treasuries, multi-chain systems): $100,000-$300,000+. These involve multiple blockchains, complex access controls, and high-value assets. Firms often send teams of 3-5 auditors for 8-16 weeks.

These aren’t guesses. They’re based on real quotes from firms like Trail of Bits, OpenZeppelin, and Zealynx.io in 2025. But here’s the catch: the price you see advertised is rarely the final price.

Why the Price Tag Keeps Rising

It’s not just about lines of code-it’s about how hard those lines are to break.

Simple ERC-20 tokens have predictable patterns. Auditors have seen them a thousand times. They use automated tools to scan for known vulnerabilities like reentrancy or overflow issues. That’s fast and cheap.

But when you add staking, governance votes, fee redistribution, and liquidity pools that interact across multiple contracts? That’s a maze. Every interaction is a potential attack vector. Auditors have to simulate real-world scenarios: What if someone drains the treasury in 100 micro-transactions? What if a user manipulates the price feed to trigger a liquidation cascade?

Platform matters too. Solidity on Ethereum is well-understood. There are thousands of auditors. That keeps prices competitive.

Rust on Solana? Fewer experts. More demand. That’s why Solana audits now cost 20-30% more than equivalent Ethereum contracts, according to industry reports. Same logic applies to newer chains like zkSync or Polygon zkEVM-specialized skills mean higher rates.

What’s Not Included in the Quote

Most firms quote you a starting price: “$5,000 for a basic audit.” Sounds affordable. Then you get the report. It lists 12 issues. You fix them. You ask for a re-audit. They charge you again. And again. And again.

Industry insiders say you should budget 20-30% extra on top of your initial quote. Why? Because almost every audit finds problems that need fixing. And fixing them often changes the code enough to require a second review.

Some firms include one re-audit. Others charge per revision. A $15,000 audit can easily become $22,000 once you factor in remediation cycles. Don’t be fooled by lowball offers. If a company says “we’ll fix it for free,” ask: “What’s your process for verifying fixes?” If they can’t explain it, walk away.

Who You Hire Matters More Than How Much You Pay

There’s a reason top DeFi projects pay $100,000+ for audits from Trail of Bits or ConsenSys Diligence. It’s not branding-it’s track record.

In 2024, a $5,000 audit missed a critical flaw in a yield aggregator. The exploit drained $87 million. The audit firm had no public history of DeFi audits. The team was two people working out of a shared laptop.

Compare that to a project audited by OpenZeppelin. Their report included not just code issues, but economic attack vectors: how token inflation could destabilize the protocol under stress. They modeled 17 different user behaviors. That’s the difference between a checkbox and a safety net.

Community feedback on Reddit and Twitter is clear: cheap audits often fail. Expensive ones save lives. Developers who’ve lost money say the same thing: “I thought I was saving cash. I was just betting my project’s future.”

Time Is Money-And It’s Not Just the Audit

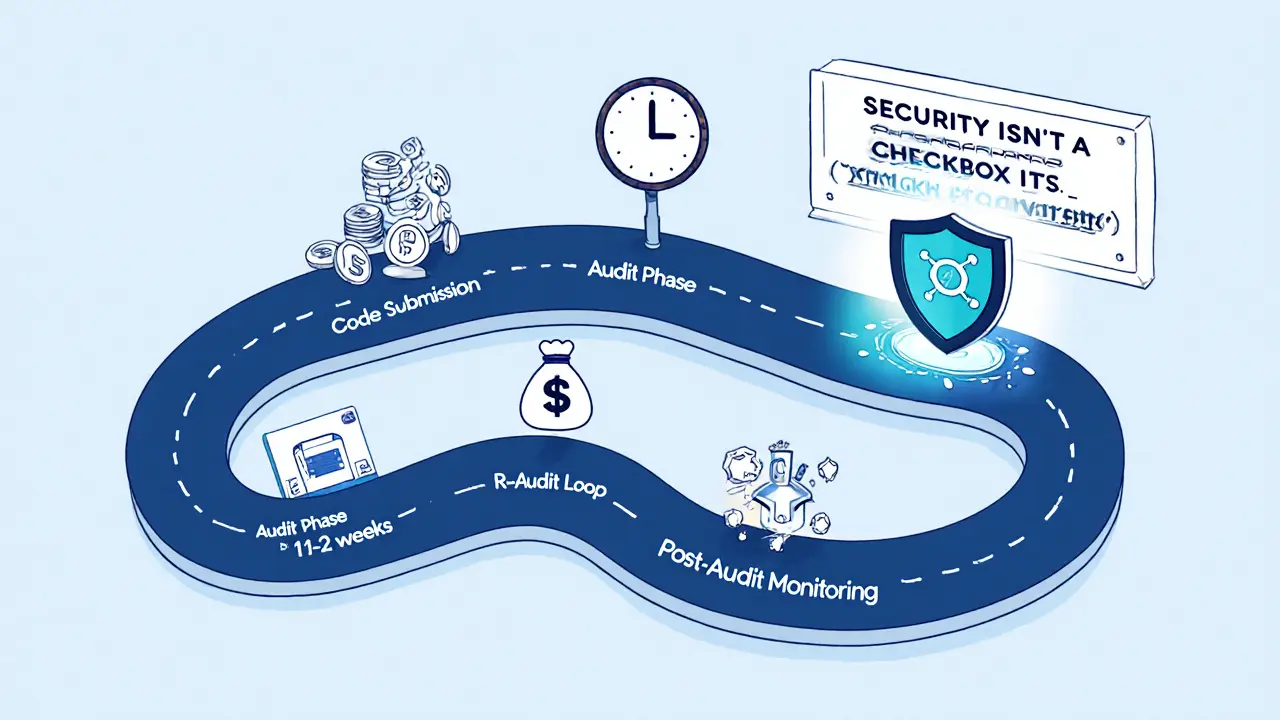

Most audits take 2-4 weeks for simple tokens. For DeFi? 6-12 weeks is normal. Enterprise projects? 4-6 months.

But here’s what no one tells you: the clock starts ticking the moment you send your code. If your code is messy, undocumented, or poorly structured, the auditor spends extra time just figuring out what it does. That’s billed.

Projects that do their homework-documenting functions, writing clear comments, following OpenZeppelin standards-get faster, cheaper audits. One team reduced their audit time by 40% just by cleaning up their code before submission.

And if you need it fast? Expedited audits cost 25-50% more. That’s standard. If you’re launching in 10 days and your code isn’t ready, you’re not paying for speed-you’re paying for panic.

Where Do Audit Costs Fit in Your Budget?

Most teams budget 5-10% of total development costs for security. DeFi projects? 10-15%. Why? Because the risk isn’t theoretical.

In 2025 alone, over $1.2 billion was lost to exploits on unaudited or poorly audited contracts. The average DeFi exploit cost $45 million. That’s not a line item. That’s your project’s obituary.

Think of it this way: if your project raised $2 million, spending $150,000 on a top-tier audit isn’t an expense-it’s insurance. And insurance that pays off if you never need it.

What Comes After the Audit?

Many firms stop at the report. The best don’t.

Premium providers offer post-audit monitoring: alerting you if a new vulnerability is discovered in a dependency, or if a forked version of your contract is deployed maliciously. Some even offer quarterly security reviews as your protocol evolves.

And yes-audits aren’t one-time. Every major upgrade needs another review. Every new feature. Every integration with a new chain. Security isn’t a checkbox. It’s a habit.

How to Avoid Getting Ripped Off

- Ask for the auditor’s public track record. Have they found exploits in other projects? Can you see their past reports? (Many firms publish redacted versions.)

- Get a written scope. What’s included? How many re-audits? What happens if you miss a deadline?

- Don’t pick the cheapest. The $1,000 audit might be a bot. The $5,000 one might be a freelancer with no experience in your chain.

- Check their team. Who’s actually doing the work? Are they certified? Have they spoken at blockchain security conferences?

- Read community reviews. Look on GitHub, Twitter, and Reddit. Did other projects have bad experiences?

There’s no magic formula. But if you’re spending more than $20,000 on an audit, you’re not buying a service-you’re buying trust. And trust costs more than code.

Is There a Future Without High Audit Costs?

Automated tools are getting better. In 2024, AI-powered scanners cut basic audit times by 15-20%. But they still miss logic flaws. They can’t understand your business intent. They don’t know if your tokenomics are designed to be exploited.

As DeFi grows, so do the attacks. Zero-knowledge protocols, cross-chain bridges, and multi-signature treasuries are getting more complex. That means auditors need deeper expertise-and that means higher prices.

Experts predict a 10-15% annual increase in audit costs through 2027. Why? Because the cost of failure keeps rising. And no one wants to be the next $200 million exploit headline.

So yes-audits are expensive. But they’re cheaper than regret.

How much does a basic crypto audit cost in 2025?

A basic audit for a simple ERC-20 or SPL token typically costs between $1,000 and $20,000. The lower end ($1,000-$5,000) usually applies to very simple tokens with minimal logic, while $10,000-$20,000 covers more complex tokenomics or basic access controls. Always confirm what’s included-many low-cost audits exclude re-audits after fixes.

Why are Solana audits more expensive than Ethereum audits?

Solana audits cost more because there are fewer auditors with deep Rust and Solana program expertise. Ethereum has been around longer, with thousands of Solidity developers and auditors. The supply-demand imbalance pushes prices up. A Solana NFT contract might cost 20-30% more than an equivalent Ethereum one, even if they have similar complexity.

Can I skip the audit to save money?

You can, but you’re gambling with your project’s future. In 2024-2025, over $1.2 billion was lost to exploits on unaudited contracts. Many of these were small projects that thought they were too minor to be targeted. They were wrong. A single vulnerability can erase months of work-and your reputation. Audits are not optional for any project handling real value.

What’s included in a typical audit report?

A full audit report includes a list of vulnerabilities ranked by severity, technical explanations of each flaw, proof-of-concept examples, and remediation steps. Top firms also include business logic risks-like how token inflation could break the economy of your protocol. Some even provide a risk score and estimated exploit likelihood.

How long does a crypto audit take?

Basic token audits take 2-4 weeks. Intermediate projects (NFTs, staking) take 4-8 weeks. Complex DeFi protocols or multi-chain systems can take 8-16 weeks. Timelines often stretch if critical issues are found and require code changes. Rushing an audit increases the chance of missing flaws.

Do I need more than one audit?

For high-value projects-especially DeFi protocols or bridges-it’s strongly recommended. Many institutional projects now require two independent audits from different firms. This reduces the chance of a blind spot. One firm might miss a subtle economic exploit that another catches. It’s an extra cost, but it’s insurance against catastrophic failure.

Can I do my own audit using free tools?

Free tools like Slither or MythX can catch basic issues like reentrancy or integer overflows. But they can’t understand business logic, tokenomics, or complex interactions between contracts. Many exploits in 2024-2025 happened on contracts that passed automated scans. Human auditors spot what machines can’t: intent, incentive structures, and hidden attack paths.

Are audit costs tax-deductible?

In many jurisdictions, professional security audits are considered a legitimate business expense for crypto startups, especially if the project is structured as a legal entity. However, tax treatment varies by country. Consult a tax professional familiar with blockchain regulations in your region. Never assume-document everything.

Write a comment