Crypto Income Tax Calculator

How Indonesia's New Crypto Tax Rules Work

Under Indonesia's new regulations effective August 1, 2025, Value Added Tax (VAT) on crypto trades has been eliminated. However, capital gains from crypto sales are now subject to income tax based on your personal tax bracket. The tax authority now receives direct transaction reports from exchanges.

Enter your transaction details to calculate your tax liability under Indonesia's new regulations.

Before 2025, buying and selling Bitcoin in Indonesia was treated like trading soybeans or crude oil. You could do it legally, but it had no real connection to the financial system. That changed on January 10, 2025, when Indonesia stopped treating cryptocurrency as a commodity and moved it squarely into the financial sector. The shift wasn’t just a paperwork update-it rewrote the rules for everyone: traders, exchanges, investors, and even tax collectors.

The Old Rules: Crypto as a Commodity

For years, the Commodity Futures Trading Regulatory Agency (BAPPEBTI) ran the show. They didn’t care if you were trading Bitcoin, Dogecoin, or some obscure token from a Discord group. As long as it was on their approved list-over 850 assets by early 2025-you could trade it. The only real guardrails were anti-money laundering (AML) checks and basic Know-Your-Customer (KYC) rules. Exchanges didn’t need a financial license. They just had to register with BAPPEBTI and report suspicious activity. But there was a big catch: crypto was never legal as payment. You couldn’t use Bitcoin to buy coffee, pay rent, or order food online. The government made that clear from the start. So while trading was allowed, crypto had no real role in daily economic life. It was a speculative asset, not a tool.The Big Shift: OJK Takes Over

The turning point came with Law No. 4 of 2023, passed in January 2023 but only fully activated on January 10, 2025. This law transferred control of cryptocurrency from BAPPEBTI to the Financial Services Authority (OJK)-the same body that oversees banks, insurance, and stock markets. This wasn’t just a department swap. It meant crypto was now treated as a digital financial asset, not a commodity. That change brought heavy consequences:- Crypto exchanges now need a full OJK license to operate

- Minimum paid-up capital jumped to IDR 100 billion (about $6.3 million USD)

- Companies must maintain at least IDR 50 billion in equity at all times

- Capital cannot come from money laundering or terrorist funding sources

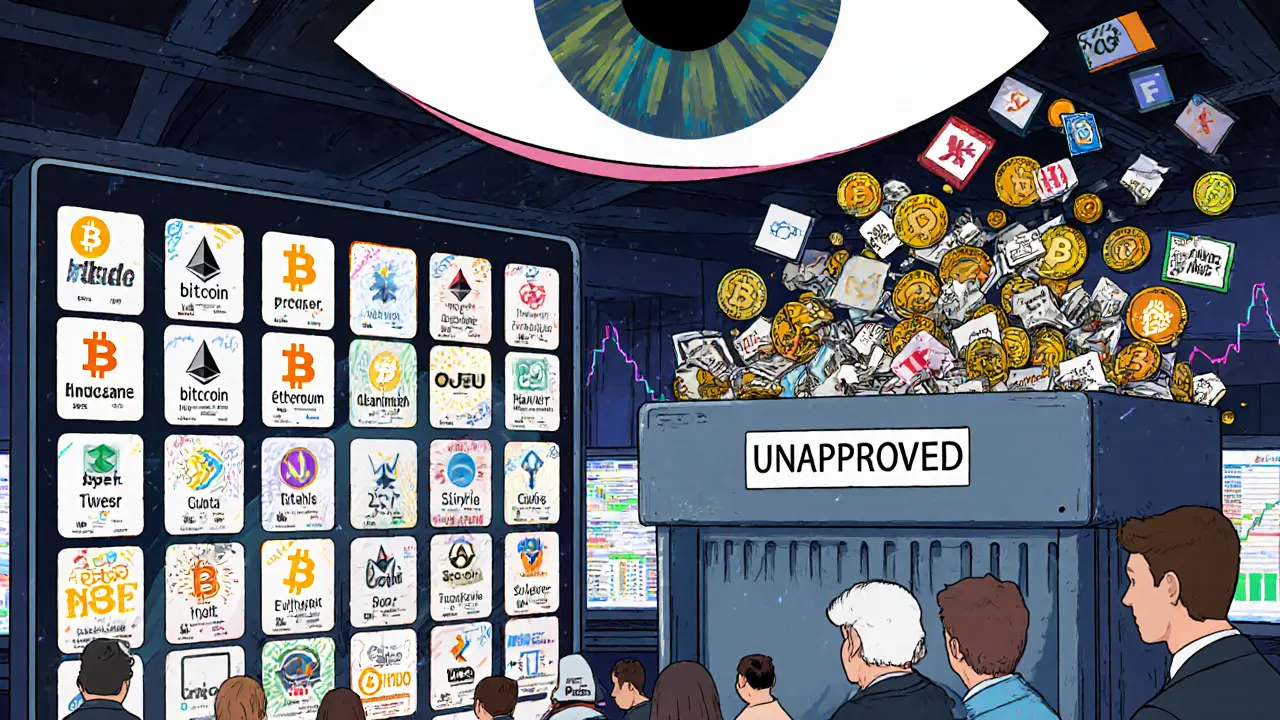

Asset Whitelist: Less Is More

Under BAPPEBTI, exchanges could list almost anything. That led to a flood of low-quality, high-risk tokens. OJK changed that. By April 2025, every exchange had to revalidate its entire list of tradable assets. Any token that didn’t meet OJK’s new standards-like transparency, liquidity, and technical security-had to be removed. The cutoff date for reapproval was February 2025. After that, listing a non-approved asset became a violation. The result? The approved list dropped from over 850 to under 120. Bitcoin, Ethereum, Solana, and a few others made the cut. Thousands of obscure tokens vanished from trading platforms. For investors, this meant fewer scams. For the market, it meant more credibility.

Taxation: VAT Gone, Income Tax Remains

The tax rules changed just as dramatically. On August 1, 2025, new regulations from the Ministry of Finance took effect. Before 2025, every crypto trade was subject to Value Added Tax (VAT). If you bought Bitcoin for IDR 100 million and sold it for IDR 150 million, you paid VAT on the full IDR 150 million sale. That made trading expensive and complicated. Now, under Minister of Finance Regulation No. 50 of 2025 (PMK 50), VAT on crypto trades is gone. The government no longer treats crypto as a good being delivered. Instead, it’s treated like a financial asset-similar to stocks or bonds. But income tax still applies. If you profit from selling crypto, you pay capital gains tax. The rate depends on your total income and tax bracket, just like any other investment. The new rules also simplified reporting. Exchanges now automatically report transaction data to the tax authority, reducing the burden on individual traders.Compliance: Real-Time Monitoring and Reporting

Crypto businesses now operate under intense scrutiny. OJK Regulation No. 27 of 2024 requires:- Real-time transaction monitoring

- Immediate reporting of suspicious activity to PPATK (Indonesia’s financial intelligence unit)

- Strict data protection for customer information

- Quarterly financial and operational reports to OJK

What’s Still Banned-and Why

Despite all the progress, one rule hasn’t changed: crypto cannot be used as payment. You still can’t pay your electric bill with Ethereum or buy a phone with Litecoin. The government’s stance is simple: crypto is too volatile. If your salary is paid in Bitcoin and its value drops 30% overnight, you can’t pay your rent. That risks economic instability. Stablecoins-tokens pegged to the rupiah or dollar-are the main exception being pushed by industry groups. Some fintech startups are lobbying to allow stablecoins for payments, arguing they’re less risky. But as of October 2025, the government has not approved any such use.Who Wins and Who Loses

The new rules have reshaped the market:- Investors now have safer platforms, clearer rules, and better protection. Fraud is harder to hide.

- Exchanges with deep pockets and strong compliance teams are thriving. Smaller players are struggling or disappearing.

- Traders face fewer scam coins and lower taxes, but must deal with more reporting and stricter KYC.

- Startups building crypto-based services face higher barriers. They need capital, legal teams, and time to get licensed.

What’s Next?

The transition is mostly done. The deadlines have passed. The licenses have been issued. But the real test is just beginning. Will OJK crack down on decentralized exchanges (DEXs) that operate outside Indonesia’s borders? Can they regulate DeFi protocols that don’t have a physical headquarters? How will they handle foreign investors who want to trade Indonesian crypto assets? One thing is clear: Indonesia is no longer a wild west for crypto. It’s becoming a regulated market-with rules, consequences, and oversight. That’s good for long-term growth. But it’s also a warning: if you’re still treating crypto like a get-rich-quick scheme, the system now has the tools to stop you.Is cryptocurrency legal in Indonesia in 2025?

Yes, cryptocurrency is legal to trade in Indonesia as a regulated digital financial asset under the oversight of OJK. However, it is still illegal to use crypto as a payment method for goods or services.

Who regulates crypto in Indonesia now?

As of January 10, 2025, the Financial Services Authority (OJK) regulates cryptocurrency. It replaced BAPPEBTI, which previously treated crypto as a commodity. OJK now oversees licensing, capital requirements, and market integrity.

Do I have to pay tax on crypto trades in Indonesia?

Yes, but not VAT. As of August 1, 2025, Value Added Tax (VAT) on crypto trades was removed. You still pay income tax on profits from selling crypto, based on your personal tax bracket. Exchanges now report your trades directly to the tax authority.

Can I still trade any crypto coin I want in Indonesia?

No. Only digital assets approved by OJK can be traded. By April 2025, exchanges had to remove all unapproved tokens. The approved list is now under 120 assets, down from over 850. This reduces risk and increases market quality.

What happens if a crypto exchange doesn’t follow the rules?

OJK can revoke their license, freeze assets, impose heavy fines, or refer them for criminal prosecution. Exchanges must meet strict capital and compliance standards. Failure to comply means they can no longer operate legally in Indonesia.

Are stablecoins allowed for payments in Indonesia?

No, not yet. While industry groups are pushing for legal recognition of stablecoins as payment tools, the government has not approved any such use. The official stance remains that crypto is not legal tender and cannot replace the rupiah.

How much capital does a crypto exchange need in Indonesia?

Crypto Asset Traders must have a minimum paid-up capital of IDR 100 billion (about $6.3 million USD) and maintain at least IDR 50 billion in equity. OJK can require more based on the platform’s size and risk profile. Capital cannot come from illegal sources.

Jenny Charland

lol so now crypto is just stocks with extra steps? 🤡

Emily Michaelson

This is actually a huge step forward for Indonesia. The old system was a free-for-all with 850+ tokens, half of which were rug pulls. The OJK move brings real investor protection. Fewer coins, more trust. That’s how you build a sustainable market, not just hype.

Anne Jackson

Finally! America’s been doing this for years. Why did it take Indonesia so long to stop letting random Discord guys sell garbage coins? If you can’t prove your token isn’t a scam, it shouldn’t be listed. Simple. No more crypto carnival.

David Hardy

Big win for legit traders. Less noise, more signal. And no more VAT? Yes please. 😎

Dave Sorrell

The capital requirements are substantial but necessary. A minimum of IDR 100 billion ensures that only serious operators with proper infrastructure can participate. This reduces systemic risk and increases market integrity. It is a responsible regulatory approach.

preet kaur

I’m from India and honestly, this feels familiar. We’ve been through similar chaos with crypto - too many scams, too little oversight. Indonesia’s move is brave. Not everyone will like it, but the ones who stay? They’re in it for the long haul. Respect.

stuart white

Let’s be real - this isn’t regulation. It’s a power grab by OJK to control the narrative. They’re not protecting investors; they’re protecting the banking cartel. The moment you ban decentralized finance and stablecoin payments, you’re not building a future - you’re burying it under bureaucracy. This is financial colonialism dressed as progress.

Belle Bormann

i think the tax change is greate. no vat means i can actually trade without paying extra. also the auto report thing is a god send. i hate doing taxes. btw did anyone else notice they misspelled 'rupiah' in the article? lol

Sky Sky Report blog

The reduction in listed assets from 850 to under 120 is a clear signal of intent. Quality over quantity. Transparency over speculation. This is how markets mature. Indonesia has chosen the harder path and it will pay off.

Omkar Rane

yo i live in delhi and i been watchin this whole thing unfold. back in 2022 i lost like 20k rupees on some meme coin called 'DogeShibaLion' or something. no one knew who made it. now? i feel way safer. the ojk thing is kinda like sebi but for crypto. and yeah i know they still ban payments but come on, crypto is too wild for daily use. even stablecoins? nah. let em grow up first. also typo in 'em' but you get the vibe 😅

Daryl Chew

This is all a distraction. OJK doesn’t care about investors. They’re working with the IMF and the Fed to track every crypto transaction so they can freeze your wallet if you ever protest. The 'anti-money laundering' stuff? That’s just the cover. They’re building a digital surveillance state. And the stablecoin ban? That’s because they know CBDCs are coming next. Don’t be fooled.