DEX Viability Checker

Is This DEX Viable?

Based on the failure of Cybex DEX, this tool helps you assess whether a decentralized exchange is likely to succeed or fail. Just input the key metrics from the article's guidelines.

High Viability

This exchange is likely sustainable. It has strong liquidity, active development, and engaged community - like Uniswap or PancakeSwap.

Moderate Risk

This exchange has some positive signs but lacks critical elements. It may need significant improvements before becoming sustainable.

High Risk

This exchange shows signs of imminent failure. It lacks liquidity, community engagement, and development activity - similar to Cybex DEX.

What Your Score Means

- 0-5 points High Risk

- 6-12 points Moderate Risk

- 13-20 points High Viability

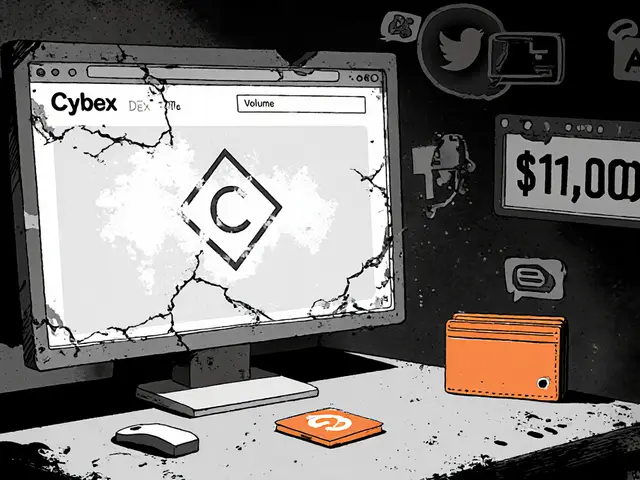

Cybex DEX was never meant to be a household name in crypto. But its quiet collapse in 2022 tells a louder story than most successful exchanges ever could. If you're looking at old forums or stumbled across its name while researching decentralized exchanges, you might wonder: Was this a good platform? Could you have made money on it? The answer isn’t just "no"-it’s a warning.

What Cybex DEX Actually Was

Cybex DEX launched in 2017 as a decentralized exchange built to let users trade cryptocurrencies without handing over control of their wallets. That’s the core promise of any DEX: no central authority, no custody, no bank-like gatekeepers. You connected your MetaMask or similar wallet, swapped tokens directly on-chain, and kept your keys. Sounds simple, right?

But here’s the catch-Cybex didn’t deliver anything new. It didn’t offer better fees, faster trades, or unique tokens. It didn’t even have a clear team structure that users could trust. The founders included James Gong, Yuri Milyutin, and Jianbo Wang, with a few consultants like David Lee. But there were no regular updates, no blog posts, no community manager. No transparency. Just a website that slowly stopped working.

The Numbers That Killed It

By November 2019, Cybex DEX was trading just $10,926 in 24 hours. A year later, in December 2021, it crept up to $13,006. That’s not growth-that’s barely breathing. Compare that to Uniswap, which was hitting over $1 billion daily in volume by 2021. Even smaller DEXs like PancakeSwap on Binance Smart Chain were doing millions.

Why does volume matter? Because liquidity is life in DeFi. If no one’s trading, your order won’t fill. If your order doesn’t fill, you lose money to slippage. If slippage is too high, you stop using the platform. And if everyone stops using it, the platform dies. Cybex DEX had no liquidity providers, no incentives, no rewards. It was a ghost town with a smart contract.

Why Users Didn’t Show Up

There’s no evidence anyone really used Cybex DEX. No Reddit threads. No Twitter discussions. No YouTube tutorials. No CoinMarketCap or CoinGecko user reviews. Nothing. That’s not just low adoption-it’s total abandonment.

Successful DEXs like Uniswap or Curve built communities. They had governance tokens. They held AMAs. They listened to feedback. Cybex DEX didn’t. It didn’t even have a proper help section. If you got stuck connecting your wallet, you were on your own. No Discord. No Telegram. No support email that ever got answered.

And here’s the kicker: it was accessible to U.S. users. Unlike many centralized exchanges that block Americans, Cybex didn’t care who you were. But no one came. Not because of regulation-because there was nothing worth using.

The Final Collapse

By the end of 2019, Cybex DEX’s social media accounts went silent. No tweets. No announcements. No even a "we’re taking a break" post. Then, in December 2022, the website stopped loading entirely. Google still indexed it, but the domain was dead. Cryptowisser flagged it as "dead" in their Exchange Graveyard. No recovery. No migration plan. No refund. Just… gone.

This isn’t unusual in crypto. Hundreds of projects die every year. But Cybex DEX stands out because it wasn’t a scam. It didn’t rug pull. It didn’t promise unrealistic returns. It just… disappeared. Like a startup that ran out of money and never told anyone.

What We Can Learn From Cybex DEX

If you’re thinking about using a new DEX today, ask yourself these questions:

- Is there real trading volume? (Look at CoinGecko or Dune Analytics, not the project’s own claims.)

- Are there active developers pushing updates?

- Is there a community talking about it on Twitter, Reddit, or Discord?

- Does it have a clear roadmap-or has it been silent for over a year?

- Are liquidity pools funded by real users, or just bots?

Cybex DEX failed because it treated crypto like a static product, not a living ecosystem. You don’t build a DEX and walk away. You nurture it. You reward liquidity providers. You fix bugs. You listen. You market. Cybex did none of that.

Today’s top DEXs-Uniswap, PancakeSwap, dYdX, 1inch-aren’t successful because they’re technically superior in every way. They’re successful because they understand that crypto is about people, not just code. They have teams that show up every day. Cybex didn’t.

What to Use Instead in 2025

If you’re looking for a reliable decentralized exchange today, here are your real options:

- Uniswap - The original Ethereum DEX. Deep liquidity, thousands of tokens, and constant updates.

- PancakeSwap - Dominates on Binance Smart Chain. Low fees, strong community, and frequent token launches.

- Curve - Best for stablecoin swaps with minimal slippage.

- dYdX - For advanced traders who want leverage and margin trading.

- 1inch - Aggregates multiple DEXs to get you the best price across the network.

All of these platforms have active teams, public GitHub repositories, and real user bases. They don’t just exist-they evolve.

Final Thoughts

Cybex DEX isn’t just a failed exchange. It’s a case study in what happens when you underestimate the human side of crypto. Technology alone doesn’t make a platform work. Community does. Consistency does. Transparency does.

If you’re investing time-or money-in a DEX, don’t look at its whitepaper. Look at its activity. Check its Twitter. Look at its volume. Read its GitHub commits. If it’s quiet, it’s dead. Or soon will be.

Cybex DEX is gone. But its lesson isn’t.

Is Cybex DEX still operational in 2025?

No, Cybex DEX is completely defunct. The website stopped loading in December 2022, and all social media channels have been silent since late 2019. There is no way to access the platform, and no recovery or refund process exists for former users.

Was Cybex DEX safe to use before it shut down?

Technically, yes-it was a non-custodial DEX, so users kept control of their private keys. But safety isn’t just about code. With near-zero trading volume, you’d have struggled to execute trades without massive slippage. Plus, the lack of support meant if something went wrong, you were on your own. It was safe in structure, but risky in practice.

Can I recover my funds from Cybex DEX?

No. Since Cybex DEX was decentralized and non-custodial, your funds were never held by the platform-they stayed in your wallet. If you still have access to your private key or seed phrase, you can recover any remaining assets using the same wallet you used with Cybex. But if you lost access to your wallet, those funds are permanently gone. The platform itself had no ability to restore or refund anything.

Why did Cybex DEX fail when other DEXs succeeded?

Cybex DEX failed because it lacked three critical ingredients: liquidity, community, and consistent development. While platforms like Uniswap offered high trading volumes, active governance, and frequent upgrades, Cybex had almost no trading, no user engagement, and no visible team activity after 2019. It didn’t adapt to market needs or build trust. In crypto, silence equals death.

Was Cybex DEX regulated or blocked in the U.S.?

No. As a decentralized exchange, Cybex DEX didn’t require user registration or KYC, so it wasn’t blocked by U.S. regulators. The issue wasn’t legality-it was viability. Even though U.S. users could technically access it, almost no one did. The platform’s failure had nothing to do with regulation and everything to do with poor execution.

Should I avoid all new DEXs that don’t have big names?

Not all new DEXs are risky, but you should treat them like startups: check their activity. Look at their 24-hour volume on CoinGecko, check their GitHub for recent commits, and see if they have an active Discord or Twitter. If the platform has been silent for six months, walks like a duck and quacks like a duck-it’s probably dead. Don’t assume a DEX is safe just because it’s decentralized.

Veeramani maran

cybex was a joke from day one lol no team updates no liquidity no nothing

Cydney Proctor

Of course it failed. You can’t just deploy a smart contract and call it a ‘DEX’-you need to actually engage with the ecosystem. Or perhaps, you’re just delusional enough to think code alone sustains value. Sad.

Kevin Mann

OMG I REMEMBER THIS. I actually tried to swap some ETH for some random token on Cybex back in 2019 and it took 47 minutes to confirm and then my transaction just vanished into the void. I thought my wallet was hacked. Turns out the whole platform was already dead. I cried. Not because of the money-because I believed in the dream. Now I just stick to Uniswap and pretend I never met Cybex. 😭

Kathy Ruff

This is one of the clearest breakdowns of DEX failure I’ve read. The real lesson isn’t about the tech-it’s about community. People don’t use platforms because they’re decentralized. They use them because they feel seen, heard, and supported. Cybex didn’t just lack liquidity-it lacked humanity. And in crypto, that’s fatal.

Grace Huegel

I used to follow Cybex’s Twitter. I thought maybe they’d come back. Every day I refreshed. Every day, nothing. I started to feel like I was the only one who cared. That’s the real tragedy-not the lost funds, but the silence. The loneliness of being the last person still checking a dead website.

Evan Koehne

Wow. So the lesson is… don’t build things that aren’t marketable? Groundbreaking. Next you’ll tell me breathing is important for survival.

Jessica Arnold

Cybex DEX wasn’t a failure of engineering-it was a failure of epistemology. It treated decentralization as a static architecture rather than a dynamic social contract. The blockchain doesn’t care about your code. It cares about your community’s trust. And trust, unlike liquidity, cannot be bootstrapped with a token airdrop.

Rob Ashton

I appreciate this thoughtful analysis. Many overlook the human element in DeFi, focusing solely on technical specs. Cybex’s collapse is a textbook case of neglecting user engagement and transparency. For newcomers to the space, this is essential reading. Always verify activity-not just claims.

Anthony Allen

So if I’m reading this right… Cybex died because no one showed up? But why didn’t anyone show up? Was it the UI? The lack of marketing? The fact that no one knew who ran it? I feel like this post answers the ‘what’ but not the ‘why.’

Sarah Scheerlinck

Anthony, you’re asking the right question. I think it’s because the team never made people feel like they belonged. Even if the tech was fine, if you don’t invite people in-with warmth, with updates, with personality-they’ll walk away. Crypto isn’t just about wallets. It’s about belonging.

Nitesh Bandgar

OMG THIS IS SO TRUE!!! I remember when Cybex was supposed to be the next big thing-everyone was whispering about it on Telegram… then-POOF-gone. No warning. No goodbye. Just… silence. Like someone turned off the lights and walked out. And now? No one even remembers its name. I feel like we’re all just ghosts haunting dead blockchains now…

Chloe Walsh

So what you're saying is if you don't post on Twitter every day your project dies? I mean duh. But what about the real innovators? The quiet builders? The ones who don't do influencer marketing? Are they doomed too? Or is this just another capitalist fairy tale dressed up as crypto wisdom?

Stephanie Tolson

Chloe, you’re not wrong to question the hype-but don’t confuse silence with integrity. The best builders don’t just post-they show up. They fix bugs. They answer questions. They update docs. Quiet doesn’t mean invisible. Cybex wasn’t quiet-it was absent. And absence is not a virtue in open source.

Robin Hilton

Let’s be real-this whole article is just FUD against non-US DEXs. You think Uniswap succeeded because they’re ‘better’? They got lucky. They were first. And they had VC backing. Cybex was a real grassroots effort. The system killed it-not the team. And now we’re all supposed to worship the same three big names? Pathetic.

Megan Peeples

Wait-so you’re saying that if a project doesn’t have a Discord server, it’s dead? And if it doesn’t have 100K Twitter followers, it’s a scam? What about privacy-focused, minimalist projects? Are they not valid? You’re reducing decentralized finance to a popularity contest. That’s the opposite of decentralization.

karan thakur

This is all a distraction. Cybex didn’t fail because of poor marketing. It failed because the entire crypto ecosystem is a Ponzi scheme controlled by the Fed and the IMF. They let Uniswap live because it’s a honeypot to track retail investors. Cybex was too independent. Too real. That’s why they erased it. You think this is about liquidity? No. It’s about control.

Vipul dhingra

You guys are overthinking this. Cybex failed because it was built on Ethereum and Ethereum is slow and expensive. Anyone with half a brain would’ve built on Solana or Polygon. No one cares about your ‘community’ if your gas fees are $50 to swap 10 bucks of shitcoin. It’s not about trust. It’s about speed. Duh.

Cierra Ivery

Oh my god. I just spent 20 minutes reading this entire essay on a dead DEX that nobody cared about. And now I feel like I’ve been emotionally manipulated into mourning a website. Thank you, author, for turning a technical footnote into a TED Talk on existential despair. Truly, you’ve outdone yourself.