When Bitcoin drops 15% in an hour and your position gets wiped out-even though you had 150% collateral-you’re not just unlucky. You’re caught in a cascade liquidation.

This isn’t a glitch. It’s a design flaw built into the way crypto markets work. Every time someone gets liquidated, it pushes prices lower. That triggers more liquidations. Then more. And faster. Within minutes, billions can vanish-not because people suddenly hate crypto, but because the system itself turns price drops into self-feeding explosions.

How Cascade Liquidations Actually Work

Cascade liquidations start with one simple thing: a price drop. But not just any drop. It has to hit a critical mass of leveraged positions all at once.

Most crypto traders use leverage-borrowing money to amplify their bets. A 5x leveraged position means you control $5,000 worth of Bitcoin with only $1,000 of your own money. That’s fine until Bitcoin drops 20%. Suddenly, your collateral isn’t enough to cover the loan. The exchange automatically sells your position to cover the debt. That’s a single liquidation.

Here’s where it turns dangerous: thousands of traders have positions clustered around the same liquidation price. When one gets hit, the forced sell-off pushes Bitcoin even lower. That pushes the next group over the edge. Then the next. And the next. Each wave of liquidations adds more selling pressure. The market doesn’t just dip-it collapses in a chain reaction.

During the October 2023 crash, over $19 billion in crypto positions were liquidated in less than 24 hours. That wasn’t because everyone panicked. It was because the system was designed to liquidate in bulk, and the order books were too thin to absorb it. On some DEXs, liquidity dropped by 70% in a single day. Slippage spiked over 300%. Your stop-loss didn’t trigger because there was no one left to buy at your price.

Why Crypto Is So Vulnerable

Traditional markets have circuit breakers. If the S&P 500 drops 7%, trading pauses. That gives everyone time to breathe. Crypto has none. Markets run 24/7, no breaks, no safety nets.

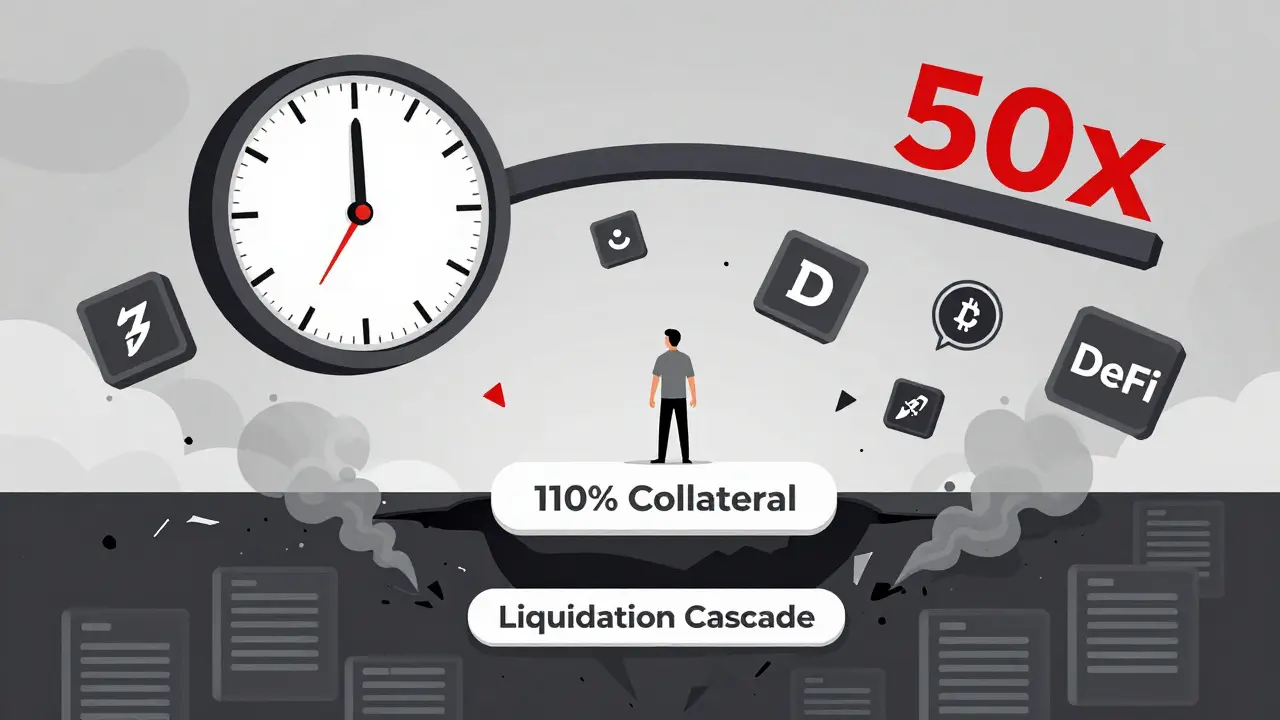

Plus, leverage here is insane. On some platforms, you can trade with 100x leverage. That means a 1% price move wipes you out. In stocks? You’re lucky to get 2x or 3x. Crypto traders are playing with fire-and the whole system is made of gasoline.

And it’s not just one platform. DeFi protocols are interconnected. If Terra’s UST stablecoin collapses, it drags down Aave, Compound, and MakerDAO because they all hold the same assets as collateral. One failure becomes a domino effect. That’s why the May 2022 crash didn’t just hurt one exchange-it broke dozens of DeFi apps at once.

Even worse, many traders use cross-asset collateral. You might put up ETH as collateral to borrow BTC. That sounds smart-it boosts capital efficiency. But when both ETH and BTC crash together, your collateral value plummets on two fronts. According to CoinShares, this multiplies cascade violence by 35-40%.

Real People, Real Losses

Reddit threads from late 2023 tell the same story over and over. User u/BTC_Trader87 posted about their 5x long BTC position. They had 150% collateral-the exchange’s minimum. When Bitcoin dropped 15% in 40 minutes, they got liquidated. Why? Because the market had no buyers. The price skipped from $42,000 to $38,000 in one trade. Their position was sold at $38,000, but the system calculated their liquidation price at $40,000. They lost everything. And they weren’t alone.

Another trader on Crypto Twitter said their stop-loss at -15% never triggered. The price dropped so fast, the order couldn’t execute. They ended up getting liquidated at -98%. That’s not a mistake. That’s how the system works when liquidity dries up.

Trustpilot reviews for Bybit and Binance show a pattern: users love the platforms when markets are calm. But during cascades, the complaints explode. “I followed all the rules,” one user wrote. “I still lost everything.”

What You Can Do to Protect Yourself

You can’t stop a cascade. But you can avoid being the one who gets crushed.

1. Never trade at the minimum collateral ratio. If the protocol says 110% is safe, aim for 150% or higher. During volatile periods, MixBytes recommends staying above 130%. Why? Because when prices drop fast, your health factor can crater before you even see it.

2. Avoid liquidation clusters. Tools like Coinglass and Hyblock show you where most positions are set to liquidate. If 80% of BTC leveraged positions are set to blow up at $41,000, don’t go near it. That’s a death trap.

3. Reduce leverage. 10x is dangerous. 5x is risky. 2x is survivable. Most traders don’t need 20x to make money. They just want to feel powerful. That feeling costs billions.

4. Monitor order book depth. If the top 100 bids on BTC are only $10 million total, you’re in a fragile market. When a big sell order hits, the price will crater. Use TradingView’s order book depth indicator. If it’s thin, get out.

5. Use a health factor monitor. Most DeFi wallets let you track your health factor. If it drops below 1.2, start reducing your position. Don’t wait for it to hit 1.0. That’s already too late.

Only 38% of DeFi users use these tools, according to DappRadar. The rest are flying blind.

What the Industry Is Doing to Fix It

Some changes are happening-slowly.

In Q3 2023, Bybit rolled out “liquidation threshold smoothing.” Instead of liquidating all positions at once, they spread them over five minutes. That cut cascade severity by 22%.

Binance added “liquidation smoothing” in February 2024. They stagger liquidations across 5-minute windows. Result? 27% less price impact.

Chainlink launched Price Feeds 2.0 in December 2023. It includes circuit breakers that pause price updates if an asset moves more than 15% in five minutes. Twelve major DeFi protocols have already adopted it.

The Ethereum Foundation is testing “dynamic collateralization ratios.” Instead of fixed minimums, your margin requirement increases automatically when volatility spikes. Early simulations show this could reduce cascade frequency by 30-50%.

The U.S. CFTC proposed new rules in January 2024 requiring exchanges to implement circuit breakers and liquidity safeguards specifically for crypto. If passed, this could be the first real regulatory step to curb cascades.

The Bigger Picture

Cascade liquidations aren’t going away. They’re a feature of highly leveraged, 24/7, interconnected markets. The question isn’t whether they’ll happen again-it’s how bad the next one will be.

Right now, the crypto derivatives market hits $3.8 trillion in quarterly volume. The Bitcoin futures market alone saw $12.7 billion in liquidations in October 2023. That’s more than the entire market cap of many public companies.

And institutional adoption is rising. 62% of major hedge funds now trade crypto derivatives. That means more leverage, more positions, more risk. If BTC and ETH both drop 30% at the same time, the Crypto Risk Consortium warns we could see $50 billion in liquidations. That’s not a crash. That’s a system failure.

But there’s hope. Protocol designers are learning. Exchanges are adding safeguards. Traders are getting smarter. The goal isn’t to eliminate volatility-it’s to make the system resilient enough that when volatility hits, it doesn’t destroy everything.

By 2026, Messari predicts that protocols with multi-layered cascade protections will capture 65% of the market. That’s not because they’re the flashiest. It’s because they’re the only ones you can trust when the market turns.

Until then, remember this: in crypto, the biggest risk isn’t the market going down. It’s the system turning a normal dip into a total wipeout. Know where the traps are. Stay above the liquidation lines. And never, ever trust a 50x leveraged trade.

What causes cascade liquidations in crypto markets?

Cascade liquidations are triggered when a price drop forces leveraged positions to be sold to cover collateral shortfalls. If many traders have positions near the same liquidation price, the initial sell-offs push prices lower, triggering more liquidations in a feedback loop. This is worsened by thin order books, high leverage (up to 100x), and interconnected DeFi protocols that share collateral assets.

Can you avoid being liquidated during a cascade?

Yes, but it requires proactive risk management. Keep your collateralization ratio at least 20-30% above the protocol’s minimum. Avoid trading near known liquidation clusters (use tools like Coinglass). Reduce leverage to 5x or lower. Monitor order book depth and your health factor constantly. Never assume your stop-loss will work-liquidity vanishes during cascades.

Why do liquidations happen even when I have enough collateral?

Because price moves too fast. During a cascade, order books empty out. A $10 million sell order can drop the price from $42,000 to $38,000 in one trade. Your position might have been safe at $40,000, but the system liquidates you at $38,000 because that’s the only price available. Slippage kills you-not your collateral ratio.

Are cascade liquidations unique to crypto?

No, but they’re far more severe in crypto. Traditional markets have circuit breakers, lower leverage (usually 2-3x), and thicker liquidity. Crypto has none of those safeguards. A 50% Bitcoin drop can trigger $28 billion in liquidations. A similar drop in the S&P 500 would trigger maybe $1 billion-mostly from ETFs and futures, not retail leverage.

What’s the difference between a liquidation and a cascade liquidation?

A single liquidation is one trader’s position being closed due to insufficient collateral. A cascade liquidation is when that one liquidation triggers dozens, then hundreds, then thousands more because the price keeps falling. It’s a chain reaction, not an isolated event. Cascades are systemic, not personal.

Will regulations stop cascade liquidations?

Not completely, but they can reduce their frequency and severity. The U.S. CFTC proposed rules in January 2024 requiring exchanges to implement circuit breakers and liquidity safeguards. If adopted, these could force platforms to slow down liquidations, spread them over time, and maintain minimum order book depth. That won’t prevent all cascades, but it could turn them from market-destroying events into manageable volatility spikes.

Chris O'Carroll

Bro. I had 5x on BTC at 42k. Got liquidated at 38k. No warning. No mercy. Just gone. The system doesn't care if you're 'smart' or 'careful'. It eats people like me for breakfast.

Christina Shrader

It’s not about luck-it’s about respecting the machine. I used to trade 10x. Now I stick to 2x and keep 200% collateral. I sleep better. My portfolio grows slower. But it doesn’t vanish in 40 minutes. Worth it.

Kelly Post

Let me break this down. Liquidation cascades aren’t accidents. They’re structural. Exchanges profit from liquidations. They know the order books are thin. They know leverage is insane. They know DeFi protocols are tangled like spaghetti. And yet they still push 100x leverage as a ‘feature’. This isn’t innovation-it’s predatory design. The fact that you think this is ‘market efficiency’ is the problem.

When you hear ‘risk management’ from a platform that makes money off your ruin, ask yourself: who’s really being managed?

Vinod Dalavai

Bro in India, same story. I lost 3 lakhs in one night. Thought I was safe with 150%. Turns out, no one was buying at my price. The chart just jumped. No warning. No chance. Now I only trade spot. And I check order book depth like it’s my job. 😅

Nishakar Rath

LMAO you guys are crying like babies because you got smoked by the market but you were betting with 50x leverage like a casino addict and now you're mad the house won. Stop being poor and learn to read charts or get out. Crypto isn't for the weak. If you need a safety net then go buy gold ETFs and stop wasting everyone's time

Jason Zhang

They say ‘don’t trade at minimum collateral’-but who the hell reads the fine print? I just clicked ‘borrow 5x’ and went to bed. Now I’m broke and the app says ‘risk warning accepted’. That’s not education. That’s exploitation.

Katherine Melgarejo

So let me get this straight-crypto’s entire financial system is basically a game of Jenga where everyone’s pulling blocks at once… and we’re surprised when it collapses? Wow. Groundbreaking.

Patricia Chakeres

Of course this is happening. The Fed’s printing money, the banks are rigged, and now crypto’s just the next stage of the elite’s wealth transfer. Cascade liquidations? That’s not a bug-it’s a feature. They want the small guys wiped out so they can buy the dip at 10 cents on the dollar. Wake up. This is a controlled demolition.

Lauren Bontje

Stop blaming the system. Americans are too lazy to learn real finance. You want safety? Go work at Walmart. Crypto rewards discipline. Not hand-holding. If you can’t handle volatility, don’t touch leverage. And stop whining on Reddit like a child who lost their Xbox.

Telleen Anderson-Lozano

There’s something deeply human here-this isn’t just about leverage or order books. It’s about trust. We were told crypto was decentralized, transparent, fair. But when your life savings vanish because a bot sold your position at a price that didn’t exist two seconds ago… you realize: it was never fair. It was designed to fail for the many so the few could profit. And now we’re being told to ‘just use better tools’? That’s like telling someone who got hit by a car to ‘wear a better helmet’. The system is the problem. Not the user.

That’s why I stopped trading. I don’t want to be part of a machine that turns human desperation into profit.

Stephen Gaskell

US regulators need to ban leveraged crypto trading. Full stop. This is gambling dressed as finance. And it’s destroying people.