Consensus Mechanism Calculator: PoW vs PoS

Calculate Energy Usage Comparison

Compare Proof of Work (PoW) and Proof of Stake (PoS) energy consumption for cryptocurrency transactions

Comparison Results

Proof of Work (PoW)

Used by Bitcoin, Ethereum (pre-2022)

Proof of Stake (PoS)

Used by Ethereum (post-2022), Cardano, Solana

Key Differences

- PoW requires miners to solve complex puzzles (energy-intensive)

- PoS selects validators based on staked coins (energy-efficient)

- PoW security depends on computational power

- PoS security depends on economic stake

Distributed ledger technology is the backbone of every major cryptocurrency. It’s what lets Bitcoin, Ethereum, and others function without banks, governments, or any single company in charge. If you’ve ever wondered how digital money stays secure and doesn’t get duplicated, the answer lies in how this system shares and verifies data across thousands of computers - not one central server.

What Makes a Ledger "Distributed"?

Think of a traditional bank ledger. All transactions go through one place - the bank’s database. If that system goes down, everything stops. If someone hacks it, they can alter balances, erase records, or create fake money. Distributed ledger technology flips this model entirely. Instead of one central record, every participant in the network holds a copy. These copies are updated in real time, and no one person controls them.

This isn’t just about having backups. It’s about trust without a middleman. When you send Bitcoin to a friend, that transaction isn’t approved by a bank. It’s broadcast to a global network of computers. Each one checks the details: Is the sender actually the owner? Do they have enough coins? Has this exact coin been spent before? Only when enough of these computers agree does the transaction become official.

How Transactions Get Verified

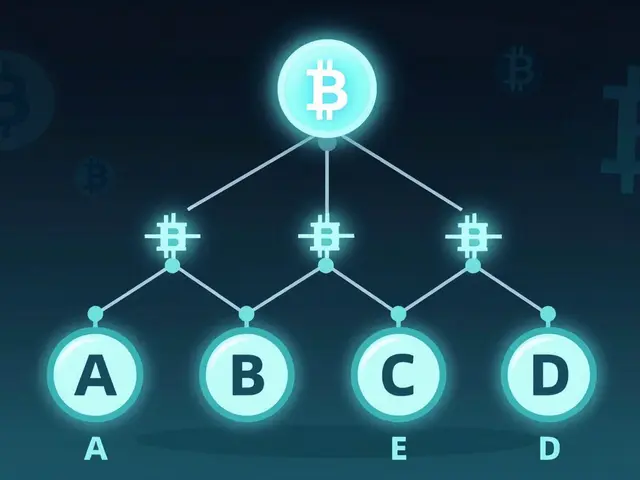

Every new transaction gets packaged into a block. But before that block gets added to the chain, it must pass a test - a consensus algorithm. This is the rulebook that tells the network how to decide what’s real and what’s fake.

Bitcoin uses something called Proof of Work. Miners compete to solve a complex math puzzle. The first one to solve it gets to add the next block and is rewarded with new Bitcoin. This process takes energy, but it’s what makes tampering expensive. If someone tried to change an old transaction, they’d have to redo every block after it - and outpace every other miner on the network. That’s practically impossible.

Other networks use different rules. Ethereum switched to Proof of Stake, where validators are chosen based on how much cryptocurrency they lock up as collateral. The more you stake, the higher your chance of being selected. If you try to cheat, you lose your stake. No mining rigs. Less energy. Same security.

Either way, the result is the same: no single authority decides. The network decides - together.

The Role of Cryptography

Behind every transaction is a digital signature. You have a private key - a long, random string only you know. When you send crypto, you sign it with that key. Anyone on the network can check that signature using your public key, which is like your address. But they can’t reverse-engineer your private key from it. That’s cryptography at work.

This means only you can spend your coins. Even if someone knows your public address, they can’t touch your funds unless they have your private key. Lose that key? You lose access. Steal it? They own your coins. There’s no customer service line to reset it. That’s the trade-off for control.

Public vs. Private Ledgers

Not all distributed ledgers are the same. Most cryptocurrencies run on public, permissionless networks. That means anyone can join, send transactions, or run a node. No approval needed. This is what makes Bitcoin truly decentralized.

But some companies use private, permissioned ledgers. Only approved participants can join. These are often used by banks or supply chains to track goods. They’re faster and more efficient, but they’re not decentralized. You’re trusting a small group of insiders - not the network. That’s not the same as crypto.

True cryptocurrency relies on openness. If you can’t join freely, it’s not crypto. It’s just a database with a fancy name.

Why It’s Hard to Hack

One of the biggest myths is that blockchain is "unhackable." That’s not true. The code can be flawed. Exchanges get hacked. Private keys get stolen. But the ledger itself? Extremely hard to tamper with.

Here’s why: imagine someone tries to change a transaction from 6 months ago. They’d need to recalculate every block after it - on every single node in the network. And they’d need to do it faster than the network adds new blocks. Even if they controlled half the network, they’d still need more computing power than the rest of the world combined. That’s why Bitcoin’s ledger has never been altered since 2009.

It’s not magic. It’s math, incentives, and scale working together.

Blockchain vs. Distributed Ledger Technology

People say "blockchain" when they mean "distributed ledger." But they’re not the same thing.

Blockchain is one way to build a distributed ledger. It links data in blocks, each connected to the last using cryptography. That’s why it’s called a chain. But other distributed ledgers don’t use blocks. Some use directed acyclic graphs (DAGs), like IOTA or Nano. Others use different structures entirely.

So blockchain is a subset of DLT - not the whole thing. But because Bitcoin made blockchain famous, most people use the terms interchangeably. For practical purposes, it doesn’t matter. What matters is the outcome: trust without a central authority.

Real Benefits Beyond Cryptocurrency

DLT isn’t just for money. It’s being tested in voting systems, land registries, medical records, and supply chains. Imagine proving you own your house without going to a government office. Or tracking medicine from factory to pharmacy to make sure it’s not counterfeit. Or letting farmers get paid instantly when their crops are delivered - no middlemen.

These aren’t sci-fi ideas. Governments in Estonia and Georgia already use DLT for land titles. Walmart tracks pork in China using blockchain. The tech works. It just needs time to scale and for people to trust it.

What Still Doesn’t Work Well

DLT isn’t perfect. Speed is still a problem. Bitcoin can only handle about 7 transactions per second. Visa handles over 1,700. Ethereum improved after its upgrade, but fees spike during busy times.

Energy use used to be a big issue - especially with Proof of Work. But Ethereum’s switch to Proof of Stake cut its energy use by over 99%. Other networks are following suit.

And then there’s regulation. Governments are still figuring out how to handle crypto. Some ban it. Others try to control it. That uncertainty slows adoption.

But the core idea - a shared, tamper-proof record maintained by many - keeps getting stronger.

Final Thought: Trust Through Code

Distributed ledger technology doesn’t make you trust people. It makes you trust the system. You don’t need to believe in a bank. You don’t need to trust a politician. You just need to understand the rules - and know that the rules can’t be changed by one person.

That’s revolutionary. And it’s why cryptocurrency, for all its volatility, isn’t going away. It’s not about getting rich overnight. It’s about building something more open, more fair, and more resilient than what came before.

Is distributed ledger technology the same as blockchain?

No. Blockchain is one type of distributed ledger technology, but not the only one. Blockchain organizes data into blocks linked together with cryptography. Other distributed ledgers use different structures, like directed acyclic graphs (DAGs). All blockchains are distributed ledgers, but not all distributed ledgers are blockchains.

How does distributed ledger technology prevent double-spending?

Double-spending happens when someone tries to spend the same digital coin twice. Distributed ledger technology stops this by requiring network consensus. Every transaction is checked by multiple nodes. If a user tries to send the same coin to two people, only the first transaction gets confirmed. The second one is rejected because the network already recorded the first spend. The ledger’s shared state makes it impossible to alter past transactions without controlling most of the network.

Do I need to be a tech expert to use cryptocurrency?

No. You don’t need to understand how distributed ledger technology works to use Bitcoin or Ethereum. Wallet apps and exchanges handle the technical details for you. But if you want to truly own your crypto - not just hold it on an exchange - you need to understand private keys. Losing your key means losing your coins. No one can recover it for you. That’s the trade-off for control.

Can distributed ledger technology be hacked?

The ledger itself is extremely hard to hack because it’s replicated across thousands of nodes. To change a transaction, you’d need to control more than half the network’s computing power - and do it faster than the network updates. That’s called a 51% attack. It’s theoretically possible but practically unfeasible on large networks like Bitcoin. Most hacks happen at exchanges, wallets, or through stolen private keys - not the ledger.

Why do some cryptocurrencies use less energy than others?

It depends on the consensus mechanism. Proof of Work (used by Bitcoin) requires miners to solve hard math problems, using lots of electricity. Proof of Stake (used by Ethereum, Cardano, Solana) selects validators based on how much crypto they hold and lock up. No mining means almost no energy use. Ethereum’s switch to Proof of Stake cut its energy consumption by over 99%.

Are public and private ledgers equally secure?

Public ledgers are more secure against censorship and single-point failure because they’re open to everyone. Private ledgers are faster and more efficient but rely on trust in a small group of participants. If those participants collude or get hacked, the ledger can be manipulated. Public ledgers spread risk across thousands of independent nodes, making them more resilient.

Benjamin Jackson

Really appreciate how you broke this down. It’s easy to get lost in the tech jargon, but this feels like a conversation with someone who actually gets it. No fluff, just clarity. That’s rare.

Louise Watson

Trust the code, not the people.

Liam Workman

Love how you framed this-not as magic, but as math + incentives + scale. 🤓 It’s like the internet’s version of a fair game where everyone plays by the same rules, and no one gets to change them mid-match. That’s the real win. Not the price charts. Not the hype. Just… fairness. 🌍✨

Colin Byrne

While your exposition is technically accurate, it fundamentally misunderstands the sociopolitical implications of distributed ledger technology. The notion that decentralization equates to fairness is a neoliberal fantasy. The infrastructure still relies on energy-intensive hardware, often manufactured under exploitative labor conditions in the Global South, and the ‘trustless’ system merely replaces bank executives with algorithmic oligarchs who control mining pools and validator sets. You speak of resilience-but resilience for whom? The 0.1% who hold the majority of Bitcoin? The rest are merely nodes in a system designed to extract value under the guise of liberation. This is capitalism with a blockchain tattoo.

Alexis Rivera

Colin raises a valid point about power structures, but I think we’re missing the bigger picture. DLT isn’t about replacing one elite with another-it’s about giving people the tools to build alternatives. Look at El Salvador’s adoption, or the way small farmers in Kenya are using blockchain for microloans. The tech doesn’t dictate the outcome; people do. We’re at the start of a long shift, not the endgame. And yes-it’s messy. But so was the printing press. So was the telephone. The question isn’t whether it’s perfect. It’s whether it’s possible.

John Doe

Exactly. And let’s not forget the NSA’s backdoor in SHA-256. Or how the U.S. Treasury is quietly pushing CBDCs under the banner of ‘financial inclusion.’ This isn’t decentralization-it’s a Trojan horse. The ‘nodes’ you think are free? They’re running software patched by corporations with ties to the Fed. You’re being sold a myth. The ledger isn’t tamper-proof-it’s tamper-obsessed. They want you to believe it’s safe so you hand over your data, your identity, your life. Wake up. The system always wins.

Michelle Sedita

John, you’re not wrong-but you’re also not helping. The fear is real, but the solution isn’t to retreat into paranoia. It’s to learn, to audit, to run your own node. The system only stays strong if people care enough to participate. You don’t have to trust the network-you just have to verify it yourself. That’s the whole point.

Ryan Inouye

Wow. So the Canadian philosopher and the American dreamer are now running a support group for crypto cultists? Let me guess-you all think your private keys are sacred, but your taxes? Nah. You’re just using blockchain to avoid the IRS while pretending you’re a revolutionary. The only thing decentralized here is your grip on reality.

Eric von Stackelberg

Let me be perfectly clear: the entire premise of distributed ledger technology is a mathematical illusion. The consensus algorithms are deterministic, yes-but they are also predictable. Every mining pool, every validator set, every exchange is monitored, indexed, and cataloged by state actors. The blockchain does not protect you. It records you. Every transaction. Every address. Every signature. You think you’re anonymous? You’re not. You’re just invisible to the average user. The state sees everything. And when they decide to freeze, seize, or surveil-they will. This is not freedom. This is surveillance with a digital stamp.

Emily Unter King

Eric, your analysis is technically sound but dangerously reductionist. The architecture of DLT enables transparency at a systemic level-something no centralized ledger has ever achieved. Yes, metadata is collected. But so is every credit card transaction, every Google search, every Fitbit step. The difference? With DLT, you own the key. You control the narrative. You can choose to remain pseudonymous. You can audit the chain. You can fork it. That agency? That’s revolutionary. And yes-it’s imperfect. But so is democracy. We don’t abandon it because it’s flawed. We improve it.

Finn McGinty

How dare you reduce this to a technical debate? This isn’t about code-it’s about civilization. The very notion that a decentralized ledger can replace institutions built over centuries is not merely naive-it is an affront to the social contract. You speak of ‘agency’ and ‘transparency,’ yet you ignore the human cost: the collapse of financial intermediaries that provided stability, jobs, and accountability. What you call liberation is chaos dressed in open-source robes. And you wonder why the world hesitates?