Impermanent Loss Calculator

Input Parameters

About This Calculation

This calculator uses the standard AMM formula (x * y = k) to determine impermanent loss when token prices change.

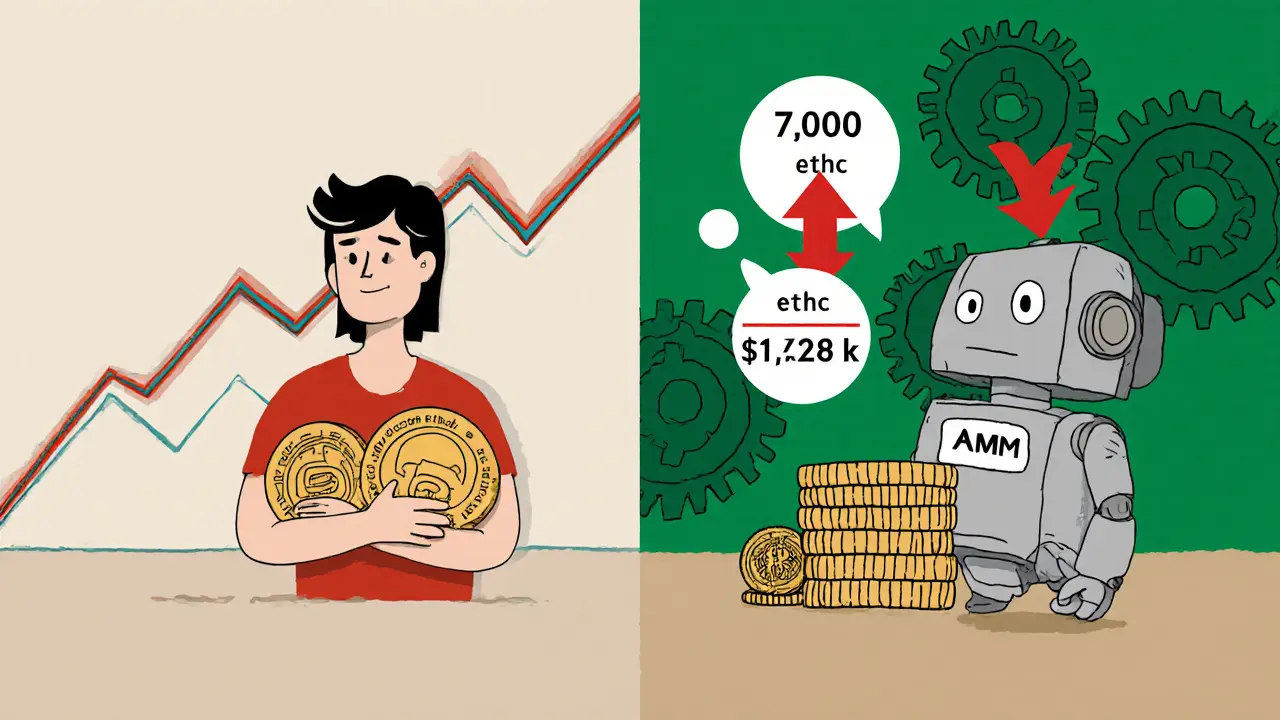

When you deposit ETH and USDC into a decentralized exchange like Uniswap to earn trading fees, you’re not just helping the network-you’re taking on a hidden risk called impermanent loss. It’s not a glitch. It’s not a hack. It’s math. And if you don’t understand it, you could lose money-even when prices go up.

What Is Impermanent Loss?

Impermanent loss happens when the value of the two tokens you put into a liquidity pool changes relative to each other. The pool automatically rebalances to keep the product of the two token amounts constant (x * y = k), which sounds fair until you realize: you’re no longer holding the same mix of assets you started with. Say you deposit 1 ETH and 2,000 USDC into a 50/50 pool when ETH is $2,000. Your total deposit is $4,000. A week later, ETH jumps to $4,000. If you’d just held your tokens, you’d now have $6,000: 1 ETH worth $4,000 and 2,000 USDC unchanged. But inside the pool? The algorithm sold some of your ETH to buy USDC as the price rose, keeping the ratio balanced. Now you might only have 0.707 ETH and 2,828 USDC. That’s $4,242 total. You’re up $242 from your original $4,000-but you lost $1,758 compared to just holding. That’s impermanent loss: $1,758. It’s called “impermanent” because if ETH drops back to $2,000, your pool value returns to $4,000. But if you withdraw before that happens? The loss becomes real.Why Does It Happen?

Automated Market Makers (AMMs) like Uniswap don’t use order books. They use formulas. The most common one is x * y = k. For every trade, the protocol adjusts the ratio of tokens in the pool to keep that formula true. When one token’s price rises, the AMM sells some of it to buy the other. When the price falls, it buys more of the cheap one. This keeps the pool balanced-but it also means you end up with fewer of the asset that went up in value, and more of the one that dropped. The bigger the price swing, the bigger the loss. Here’s how it scales:- 1.5x price change → ~2% loss

- 2x price change → ~5.7% loss

- 3x price change → ~13.4% loss

- 5x price change → ~25.5% loss

Not All Pools Are Equal

Impermanent loss isn’t the same everywhere. It depends entirely on what you’re pairing. Stablecoin pairs like USDC/USDT or DAI/USDC? Almost no impermanent loss. These tokens are designed to stay near $1. Even during market chaos, their price difference rarely exceeds 0.1%. Curve Finance dominates here-users report losses under 0.05%. Stablecoin + volatile token like ETH/USDC? That’s where most losses happen. You’re exposing half your capital to wild swings. A 2x ETH move means a 5.7% loss on your entire deposit-even if you made fees. Two volatile tokens like ETH/SUSHI? Danger zone. Both assets can move in opposite directions. The loss can be huge, and fees rarely make up for it. Concentrated liquidity (Uniswap V3, Orca on Solana)? This changes the game. Instead of spreading your money across all prices, you pick a range-say, $1,800 to $2,200 for ETH. Your capital only works within that range. If ETH stays there, you earn more fees and less loss. If it moves outside? You’re fully exposed again. But for traders who know the range, this cuts impermanent loss by 30-50%.

Can You Offset It With Fees?

Yes. But only if trading volume is high enough. Uniswap V2 charges 0.3% per trade. To break even on a 2x price move, you need trading volume equal to 33 times your deposited liquidity. That’s a lot. For a $10,000 pool, you’d need $330,000 in trades just to cover the loss. In practice, most small liquidity providers don’t hit that threshold. But in popular pools-like ETH/USDC on Uniswap-volume is massive. In Q3 2023, Uniswap generated over $1.8 billion in annual fees across all pools. Some providers made more in fees than they lost. The trick? Pick pools with high volume and low volatility. ETH/USDC is a classic example. SushiSwap’s MIM/UST pool in 2022? Disaster. UST depegged. Impermanent loss was the least of your problems.How to Protect Yourself

You can’t eliminate impermanent loss. But you can manage it.- Start with stablecoins. If you’re new, use USDC/USDT. You’ll earn small fees with near-zero risk.

- Use concentrated liquidity. If you’re active, try Uniswap V3 or Orca. Set tight price ranges around where you think the asset will trade.

- Don’t overallocate. Experts recommend putting no more than 15-20% of your crypto portfolio into volatile liquidity pools.

- Use calculators. Tools like Pintail’s impermanent loss calculator (used by over 142,000 people) let you plug in price changes and see your potential loss before you deposit.

- Monitor with dashboards. Zapper.fi and DeBank show real-time impermanent loss estimates. Check them weekly.

- Withdraw during low volatility. If the market is calm and your assets are close to your original ratio, it’s a good time to exit.

What About ILP (Impermanent Loss Protection)?

Some protocols now offer insurance. Bancor V3 covers up to 100% of impermanent loss for up to 100 days-if you lock your tokens in their specific farms. It’s not free: you pay a 0.1% fee. But for $187 million in protected liquidity as of September 2023, it’s working. Uniswap V4 (coming in 2024) might let anyone add custom protection via “hooks.” That could make ILP mainstream. But right now, it’s niche. Don’t assume protection exists unless the protocol clearly says so.

Who’s Losing Money-and Who’s Winning?

Data from CoinGecko’s 2023 survey shows 57% of DeFi users say impermanent loss is the most misunderstood risk. 43% left volatile pools after losing money unexpectedly. Those who win? They’re not gamblers. They’re careful. - Users on Curve Finance with USDC/USDT: gained 4-6% annual yield with near-zero loss. - Solana users on Orca with concentrated ETH/SOL pools: reduced loss by 30-40% during the FTX crash. - Institutional investors: 67% stick to stablecoin pools. Only 12% touch volatile pairs. The losers? Those who jumped into ETH/SUSHI or MIM/UST pools thinking “high APY = high reward.” They forgot: high APY often means high risk-and impermanent loss eats returns alive.The Future of Impermanent Loss

The industry knows this is a problem. That’s why: - Uniswap V3’s concentrated liquidity is now the fastest-growing model. - SushiSwap’s Trident reduced ETH/USDC impermanent loss by 35%. - dYdX’s V4 (2024) will blend AMM and order books to cut loss further. - Delphi Digital predicts impermanent loss will affect only 18-22% of DEX volume by 2025, down from 34% in 2023. But here’s the truth: as long as AMMs use x*y=k, impermanent loss will exist. It’s not a bug-it’s the cost of decentralization. The smart move isn’t to avoid liquidity provision. It’s to do it with eyes wide open.Final Advice

If you’re thinking about providing liquidity: - Don’t chase APY. Chase stability. - Never put more than you can afford to lose. - Use calculators. Always. - Start small. Test with stablecoins. - If you’re not monitoring your positions, you’re gambling. Impermanent loss doesn’t mean you’re bad at crypto. It just means you didn’t read the fine print. Now you have. Use that knowledge.Is impermanent loss the same as losing money?

No. Impermanent loss is an opportunity cost, not a direct loss. You don’t lose tokens-you lose potential gains compared to just holding. If the price ratio returns to your deposit level, the loss disappears. But if you withdraw before that, it becomes permanent.

Can you make money even with impermanent loss?

Yes. If trading fees and rewards are high enough, they can outweigh the loss. For example, in a high-volume pool like ETH/USDC on Uniswap, many providers earn more in fees than they lose from price changes. But this only works if volume is high and volatility isn’t extreme.

Do stablecoin pools have impermanent loss?

Technically, yes-but it’s so small it’s negligible. Stablecoin pairs like USDC/USDT rarely deviate more than 0.1% from parity. Most providers report losses under 0.05%, even during market crashes. That’s why 67% of institutional DeFi users only provide liquidity to stablecoin pools.

What’s better: Uniswap V2 or V3?

Uniswap V3 is better for active users who know price ranges. It reduces impermanent loss by up to 50% for assets trading within your set range. But if you’re passive or unsure of price movement, V2 is simpler and safer. V3 requires more management.

Should I avoid DEXs because of impermanent loss?

No. Impermanent loss is a known, measurable risk-not a reason to avoid DeFi. Many users earn consistent returns by sticking to stablecoin pools or using concentrated liquidity. The key is understanding the math, not avoiding it.

Henry Lu

bro u just described impermanent loss like it's some deep secret the banks don't want u to know lmao. it's basic AMM math. if u can't handle price divergence u shouldn't be near a liquidity pool. i've been doing this since 2020 and still see newbs crying about 'loss' when they're just bad at portfolio management. stop pretending this is rocket science.

nikhil .m445

Dear friend, I must respectfully point out that impermanent loss is not a risk-it is a mathematical inevitability. The AMM model is fundamentally flawed for retail participation. One must consider the opportunity cost relative to HODLing. I recommend using only stablecoin pairs, as volatility introduces unnecessary entropy into one’s capital structure.

Rick Mendoza

impermanent loss is just a fancy term for being dumb enough to put your money in a pool instead of just holding. if you're losing money when the price goes up you're doing it wrong. end of story. also why is everyone using USDC and not DAI? dai is real money. 😤

Lori Holton

Let me ask you this: who benefits from the widespread dissemination of this 'impermanent loss' narrative? Is it the DeFi protocols? The liquidity miners? Or perhaps the very institutions that created the centralized exchanges we're all trying to escape? The timing of this article feels… suspicious. CoinGecko’s 2023 survey? Who funded that? And why does every 'solution' involve locking tokens in a protocol that charges a fee? The real impermanent loss is your autonomy.

Bruce Murray

Just wanted to say this was super helpful. I’ve been scared to try LP for months, but now I get it. I’m starting with USDC/USDT on Curve with $500. No rush. Just wanna learn. Thanks for the clarity.

Barbara Kiss

Impermanent loss isn’t a flaw-it’s a mirror. It reflects the quiet arrogance of thinking we can outsmart markets without owning the outcome. The pool doesn’t punish you for being wrong-it rewards you for being patient. You don’t lose tokens. You lose the illusion that you’re in control. The real gain? Learning to dance with volatility instead of fighting it. And yeah, that’s beautiful.

Aryan Juned

bro i just put 10 ETH into ETH/SUSHI pool bc APY was 800% 😎 and now im down 40% but i still believe 🤞✨ the moon is coming back!! also i made a meme about it and got 5k likes on twitter. who cares about math when u got vibes? 🚀🚀🚀

Teresa Duffy

YES! This is exactly why I started with stablecoins. I was so nervous at first but now I earn 3-4% a year with zero stress. It’s boring, but it’s my financial zen. You don’t need to chase moonshots to win in DeFi. Just be consistent. You got this 💪

Sean Pollock

ok so if u r not using V3 u r basically giving free money to whales. and also why are u using USDC? its centralized. use FRAX or FEI. and also did u check the slippage on your tx? i bet u did it on metamask and paid 50gwei. no wonder u lost. u need to use 1inch + aragon + compound for protection. its not hard. u just lazy.

Carol Wyss

I felt so overwhelmed reading this at first… but you broke it down so gently. Thank you. I’m going to start small, like $100 in USDC/USDT. I’m not trying to get rich-I just want to learn. And if I lose it? Oh well. At least I tried. You made me feel like it’s okay to be a beginner.

Student Teacher

Wait-so if I deposit ETH/USDC and ETH goes up, I end up with less ETH than I started with? But I still have the same total dollar value? So it’s not really a loss… it’s just a rebalance? I think I get it now. Thanks for the examples. This is the clearest explanation I’ve seen.

Ninad Mulay

Back home in Mumbai, my uncle thinks crypto is magic. He asked me why I don’t just put all my money in ETH/USDC. I showed him this post. He said, 'Beta, if the math is this complicated, then it’s not for us.' He’s right. We’re not gamblers. We’re farmers. We plant seeds, wait, harvest. Not all of us need to chase the storm.

Mike Calwell

so like… is this just a thing where u get less if the price goes up? so dont do it if u think the price will go up? why is this even a thing? why cant they just let u keep your tokens? this is dumb.

Jay Davies

While the article provides a generally accurate exposition of impermanent loss, it omits the critical distinction between realized and unrealized loss. Furthermore, the reliance on CoinGecko’s survey is methodologically suspect, as it lacks peer-reviewed sourcing. The assertion that concentrated liquidity reduces loss by 30–50% is anecdotal and unsupported by longitudinal data. A more rigorous treatment would reference on-chain analytics from Nansen or Chainalysis.

Grace Craig

The notion that impermanent loss is an 'opportunity cost' is a euphemism designed to sanitize a structural flaw in decentralized finance. The AMM paradigm, while elegant in theory, is an institutionalized form of wealth redistribution-from the uninformed to the algorithmically optimized. One cannot call this financial innovation; it is financial exploitation dressed in open-source code.

Ryan Hansen

I’ve been in and out of liquidity pools since 2021. I started with ETH/USDT, lost 20% on a 3x move, got scared, went to stablecoins, made 5% over 18 months. Then I tried V3 with a 10% range around $3,500–$3,900 on ETH. Did that for six months. Made 12% in fees, lost 3% in IL. Then ETH went to $4,200 and I got swept out. Lost another 8%. Then I went back to stablecoins. Now I’m just doing USDC/DAI on Curve. I made $18 last month. It’s not glamorous. But I sleep. And I still have all my money. I don’t care about APY. I care about not waking up in a cold sweat wondering if I just lost half my savings because I didn’t understand x*y=k. This isn’t trading. It’s accounting. And if you’re not treating it like that, you’re just gambling with a fancy UI.

Derayne Stegall

YOOO IM JUST STARTED WITH 0.5 ETH IN ETH/USDC AND I ALREADY GOT 0.03 ETH IN FEES IN 2 WEEKS 😱💸 I’M A GENIUS 😎🔥 #DEFI #ILMUSTBEHACKED

Usnish Guha

You say 'don't chase APY'-but that's exactly what the entire DeFi industry was built on. You're lying to yourself if you think people are in this for 'stability'. They're in it to get rich quick. And when they lose, they blame impermanent loss instead of their own greed. This article is a band-aid on a hemorrhage. The system is rigged. The only people who win are the ones who built it.

rahul saha

so like… if u put 1 eth and 2000 usdc and eth goes to 4000… u end up with less eth? but more usdc? so u kinda traded ur eth for usdc automatically? its like the bot is selling high and buying low… but u still end up with less? that’s wild. i thought i was smart but turns out the bot is smarter than me 😅