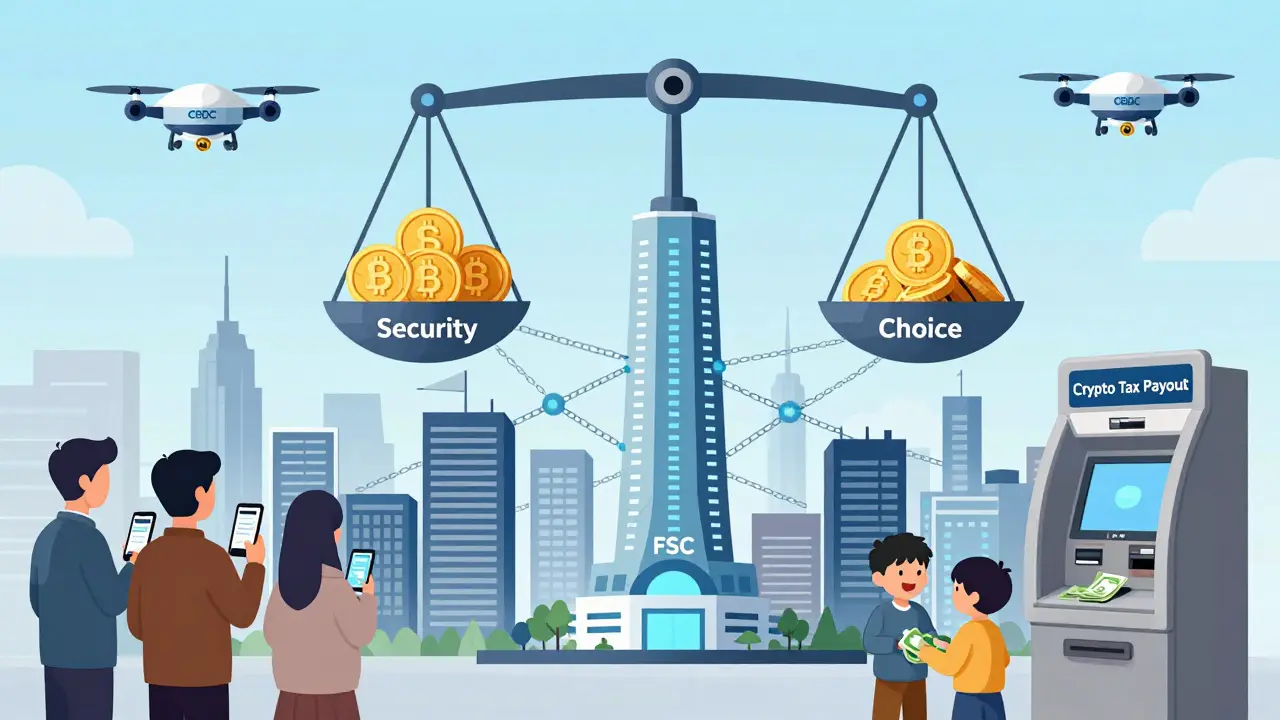

South Korea doesn’t just regulate cryptocurrency-it controls it. If you’re trying to trade crypto here, you’re not just signing up for an app. You’re walking into one of the strictest, most tightly monitored digital asset markets on the planet. There’s no anonymity. No credit card buys. No unlicensed exchanges. And if you make money? The government is taking 20%. This isn’t speculation. It’s policy. And it’s working-for security, at least.

Only Four Exchanges Are Legal

You can’t just open an account on Binance or Bybit and start trading in South Korea. The government shut that down. Since March 2021, only exchanges that meet strict licensing rules are allowed to operate. As of late 2024, just four platforms have passed the test: Upbit, Bithumb, Coinone, and Korbit. Together, they handle over 95% of all crypto trading in the country. That’s not a coincidence. It’s by design. These exchanges don’t just need a business license. They need ISMS-P certification-a top-tier cybersecurity standard from the Korea Internet & Security Agency. They also have to partner with major Korean banks like KB Kookmin, Shinhan, and NH Nonghyup to verify your identity. No bank partnership? No license. That’s why hundreds of smaller or foreign platforms have been forced to close their doors to Korean users.Real Name, Real Bank Account, No Exceptions

Since 2018, every crypto trader in Korea has had to link their exchange account to a real-name bank account. That means your name on the exchange must match your name on your bank account. No aliases. No VPNs. No anonymous wallets. If you try to deposit from an account under a different name, the transaction gets blocked. Period. This rule was created to stop money laundering and fraud. And it works. Unlike in other countries where fake accounts and stolen IDs plague crypto platforms, Korean exchanges have had zero major hacks since this system went live. Upbit, the largest, processes $2.8 billion in daily trades and has never lost customer funds to a breach. That kind of security doesn’t happen by accident.Your Crypto Is Locked Down

Exchanges in Korea aren’t allowed to keep most of their users’ crypto online. At least 70% of all customer holdings must be stored in cold wallets-offline, air-gapped, and physically secured. The rest is kept in hot wallets for trading, but even those are monitored with multi-signature systems and real-time alerts. They also need to carry cyber insurance worth at least 1 billion KRW (around $750,000) per exchange. If something goes wrong, you’re covered. That’s not standard in most countries. In the U.S. or Europe, exchanges often don’t insure customer assets at all. In Korea, it’s mandatory.

Altcoins? Limited Selection

Here’s the trade-off: security comes at a cost. Korean exchanges list far fewer coins than global platforms. Upbit and Bithumb offer around 200 to 300 cryptocurrencies. Binance? Over 600. Coinbase? More than 200, plus DeFi tokens, staking, and NFTs. Many newer or smaller projects simply don’t apply to list on Korean exchanges. Why? Because the compliance cost is too high. Getting approved means legal teams, audits, bank partnerships, and ongoing security reviews. For a startup with a $500,000 budget, that’s impossible. Traders complain. Reddit threads and Naver Cafés are full of posts like: “Why isn’t $PEPE on Upbit?” or “I found a new AI coin on Binance, but I can’t buy it here.” The answer? Regulation. The government prioritizes safety over choice. If you want access to every new token, you’ll need to use an offshore platform-and risk breaking Korean law.You Can’t Use Credit Cards or International Transfers

Forget using your Visa or Mastercard to buy Bitcoin. Korean banks don’t allow it. Same with PayPal, Apple Pay, or international wire transfers. The only way to fund your account is through a direct bank transfer from your real-name Korean account. This rule prevents money laundering through third-party sources. It also makes it harder for foreign investors to flood the market. The Korean Won (KRW) is now the third most-traded fiat currency for Bitcoin and Ethereum globally, behind only USD and EUR. That’s because Koreans are the ones trading-and they’re doing it legally, with traceable funds.Taxes Are Coming-And They’re Heavy

Starting January 1, 2025, Korea will begin taxing crypto profits. If you make more than 2.5 million KRW (about $1,850) in a year from trading, selling, or staking, you owe 20% in capital gains tax. That’s not optional. The tax office will get data directly from the four licensed exchanges. No hiding. You’ll need to file this with your annual income tax return. No receipts? No deductions. No exceptions. The government already has your trading history. They know how much you made. This isn’t like the U.S., where many people still don’t report crypto. In Korea, you’re being watched.

Who’s Getting Hurt-and Who’s Winning

Critics say this system is too heavy-handed. The Korea Fintech Industry Association argues that the rules stifle innovation. New exchanges can’t compete. Small developers can’t get listed. Traders can’t access global DeFi tools. Some users even report that their bank blocks transfers to crypto platforms altogether, especially during market spikes. But the data tells another story. In a 2024 survey of 1,200 Korean crypto traders, 87% said they felt secure using their exchange. The global average? 62%. Users praise the customer service, the speed of withdrawals, and the peace of mind that comes with knowing their funds won’t vanish overnight. Institutional players are stepping in, too. Samsung Securities and KB Securities launched crypto custody services in 2024. Big money is trusting Korea’s system. That’s not something you see in countries with weak regulation.What’s Next? CBDCs and More Control

The government isn’t slowing down. In early 2025, South Korea will launch a pilot for its own Central Bank Digital Currency (CBDC). This isn’t just a digital won-it’s a way for the state to track every transaction, even outside the crypto market. Stablecoins like USDT and USDC now have to prove they’re 100% backed by reserves and submit monthly audits. That’s stricter than the EU’s MiCA rules. Korea is setting the pace, not following it. The Financial Services Commission says their goal is clear: protect investors without killing innovation. They’re doing that through regulatory sandboxes-testing new blockchain tech under controlled conditions. But for regular traders? The rules won’t change. You’ll still need your real name, your real bank, and your tax paperwork.How to Start Trading Legally in Korea (2026)

If you’re in Korea and want to trade crypto, here’s the real path:- Choose one of the four licensed exchanges: Upbit, Bithumb, Coinone, or Korbit.

- Download their official app (Google Play or App Store-no third-party APKs).

- Complete Level 3 KYC: upload your ID, take a video selfie, and link your real-name bank account.

- Deposit KRW via bank transfer only. No credit cards. No foreign wires.

- Trade only the coins listed on the exchange. Don’t expect new memecoins or obscure DeFi tokens.

- Track your profits. If you make over 2.5 million KRW in a year, set aside 20% for taxes.

Can I use Binance or Coinbase in South Korea?

No. Binance, Coinbase, and other foreign exchanges are blocked from operating legally in South Korea. While some users access them via VPN, doing so violates Korean financial regulations. Transactions made through these platforms won’t be protected by Korean law, and you may face tax penalties if the government detects your activity. Only Upbit, Bithumb, Coinone, and Korbit are licensed and legal.

Why can’t I buy crypto with my credit card in Korea?

Korean banks are prohibited from processing crypto purchases via credit cards or digital wallets to prevent money laundering and speculative debt. All crypto funding must come from verified, real-name bank accounts. This ensures every transaction is traceable and tied to a government-registered identity.

What happens if I make over 2.5 million KRW in crypto profits?

You owe 20% in capital gains tax on the amount above 2.5 million KRW. The tax applies to profits from trading, selling, or staking. Exchanges report your transaction history directly to the tax office, so hiding earnings is nearly impossible. Failure to report can lead to fines or legal action.

Are there any crypto exchanges in Korea that aren’t licensed?

Yes, but they’re illegal. Since 2021, over 200 unlicensed exchanges have been shut down by the Financial Services Commission. Using them puts your funds at risk-no insurance, no legal recourse, and no protection if the platform disappears. Only the four licensed exchanges are safe and compliant.

Can I trade DeFi tokens or use wallets like MetaMask in Korea?

You can use MetaMask or other wallets to hold crypto, but accessing DeFi protocols like Uniswap or Aave from within Korea is often blocked by banks and internet providers. Many Korean users report that their bank freezes transfers to decentralized platforms. Even if you can access them, those transactions aren’t regulated, so you lose all legal protections.

Is crypto trading legal in South Korea?

Yes-but only under strict conditions. Trading is legal if you use licensed exchanges, complete real-name verification, and pay taxes on profits. The government doesn’t ban crypto; it controls it. This makes Korea one of the few countries where crypto trading is both legal and heavily regulated.

Crystal Underwood

Let me get this straight-you people are actually praising a state-controlled crypto dictatorship? 🤡 This isn't regulation, it's financial fascism. They're not protecting you, they're controlling you. You think Upbit's 'security' is a feature? Nah. It's a cage. You're not trading crypto-you're begging the government for permission to own digital money. Welcome to North Korea, but with better Wi-Fi and worse privacy.

Raymond Pute

It’s fascinating how the Korean model weaponizes bureaucracy as a form of financial deterrence-essentially turning the entire crypto ecosystem into a compliance theater where liquidity is channeled through four state-sanctioned oligopolies, each operating under ISMS-P certification like some kind of crypto TSA checkpoint. The irony? The very mechanisms designed to prevent illicit activity-real-name banking, cold storage mandates, tax reporting-are the same ones that stifle decentralization, which, by definition, should be antithetical to identity verification. You can’t have ‘decentralized finance’ when the state holds the master key to every wallet. Korea didn’t solve crypto’s problems-they just outsourced them to the Ministry of Finance.

Jack Petty

They’re not regulating crypto-they’re burying it alive under paperwork. 70% cold storage? Cute. That’s just a fancy way of saying ‘your money’s in a vault while the government watches the key.’ And don’t get me started on the 20% tax-this isn’t revenue, it’s a wealth extraction protocol. Welcome to the Matrix, where your gains get taxed and your freedom gets revoked. They’re not building a financial future. They’re building a panopticon with Bitcoin.

Meenal Sharma

While the regulatory framework in South Korea may appear overly restrictive from a libertarian perspective, it is, in fact, a model of prudent governance. The absence of systemic hacks, the transparency of tax compliance, and the institutional trust generated through mandatory bank linkage demonstrate a sophisticated understanding of financial risk mitigation. One must question whether the pursuit of speculative freedom justifies the erosion of systemic integrity. The Korean approach prioritizes stability over spectacle-a virtue increasingly rare in global markets.

Tressie Trezza

I get why people hate it, but honestly? I’d rather have a system where my money doesn’t vanish overnight. I’ve seen friends lose everything on unregulated exchanges. Korea’s rules feel like a seatbelt-annoying, but life-saving. Maybe we’re too obsessed with ‘freedom’ and not enough with safety. I’d trade 200 altcoins for zero hacks any day.

Calvin Tucker

It is not hyperbole to assert that South Korea has engineered the most successful state-managed cryptocurrency ecosystem in human history. The confluence of real-name verification, cold storage mandates, and institutional-grade insurance creates a financial substrate that is, by global standards, extraordinarily resilient. The fact that this system operates without a single major breach since 2018 is not an accident-it is a triumph of governance over chaos. To dismiss it as authoritarian is to misunderstand the nature of order.

mary irons

Okay, but… what if the government just… decides to freeze everything? Like, what’s to stop them from turning off the taps tomorrow? They control the banks, the exchanges, the tax data, the CBDC. This isn’t security-it’s dependency. And dependency is just control with better PR. I’m not saying they’re evil… I’m just saying I wouldn’t leave my life savings here if I had a choice.

Katie Teresi

USA should copy this. We’re a joke. People buy crypto on credit cards like it’s Amazon Prime. Koreans don’t play. They follow the rules. That’s why their system works. Stop crying about ‘freedom’-you want safety? Then shut up and comply. This is how you stop scammers. This is how you stop thieves. This is how you win.

Moray Wallace

I appreciate the rigor of Korea’s approach. It’s clear they’ve prioritized consumer protection over market expansion. That said, I wonder if this model can scale globally. Not every country has the institutional capacity to enforce real-name banking across all exchanges, or to audit stablecoins monthly. Korea’s success is tied to its unique socio-political context. Replicating it elsewhere may require more than just copying rules-it needs cultural alignment.

Dahlia Nurcahya

Hey, I get that it’s restrictive-but isn’t that kind of the point? We’ve seen what happens when crypto’s wild west is left unchecked. Korea’s taking the pain now so people don’t get burned later. I know people miss memecoins, but I’d rather have peace of mind than a 1000x gamble. Maybe we’re all just too addicted to risk. Korea’s saying: ‘You’re worth more than a HODL.’ And honestly? That’s kind of beautiful.

Steven Dilla

LOL imagine being this rich in crypto and still having to file taxes like a normal person 😭 I love it. Korea’s got the balls to say ‘no’ to scams, no-coin scams, and credit card debt-fueled pump-and-dumps. Meanwhile, the US is letting 15-year-olds buy SHIB with their allowance. We need this. I’m moving to Seoul. 🇰🇷🔥

josh gander

Look-I used to be one of those guys screaming about ‘freedom’ and ‘decentralization.’ But then I watched my cousin lose $40k on an unregulated exchange that vanished overnight. No insurance. No recourse. No justice. Korea’s system? It’s clunky. It’s slow. But it’s safe. And in crypto, safety is the rarest asset of all. The government’s not your enemy here-they’re the only thing standing between you and a digital dumpster fire. I’d rather have 200 coins and peace of mind than 600 coins and nightmares.

Akhil Mathew

Interesting how Korea treats crypto as infrastructure, not speculation. In India, we’re still debating whether to ban it. But Korea? They built a fortress around it-and made it work. The real lesson isn’t about bans or taxes. It’s about trust. When the government becomes a reliable custodian instead of a distant regulator, people stop fearing the system. Maybe the future isn’t about removing intermediaries… but making them trustworthy.