Shield Airdrop Eligibility Checker

Check Your Eligibility

Determine if you would have qualified for the Shield DAO SLD airdrop in 2021 based on participation criteria. The airdrop was distributed to users who actively contributed to the project before mainnet launch.

You qualified for the Shield DAO airdrop!

Based on the criteria from August-September 2021, you would have been eligible to claim SLD tokens.

You did not qualify for the Shield DAO airdrop.

The airdrop was only distributed to users who completed specific participation criteria from the Shield DAO project before September 2021.

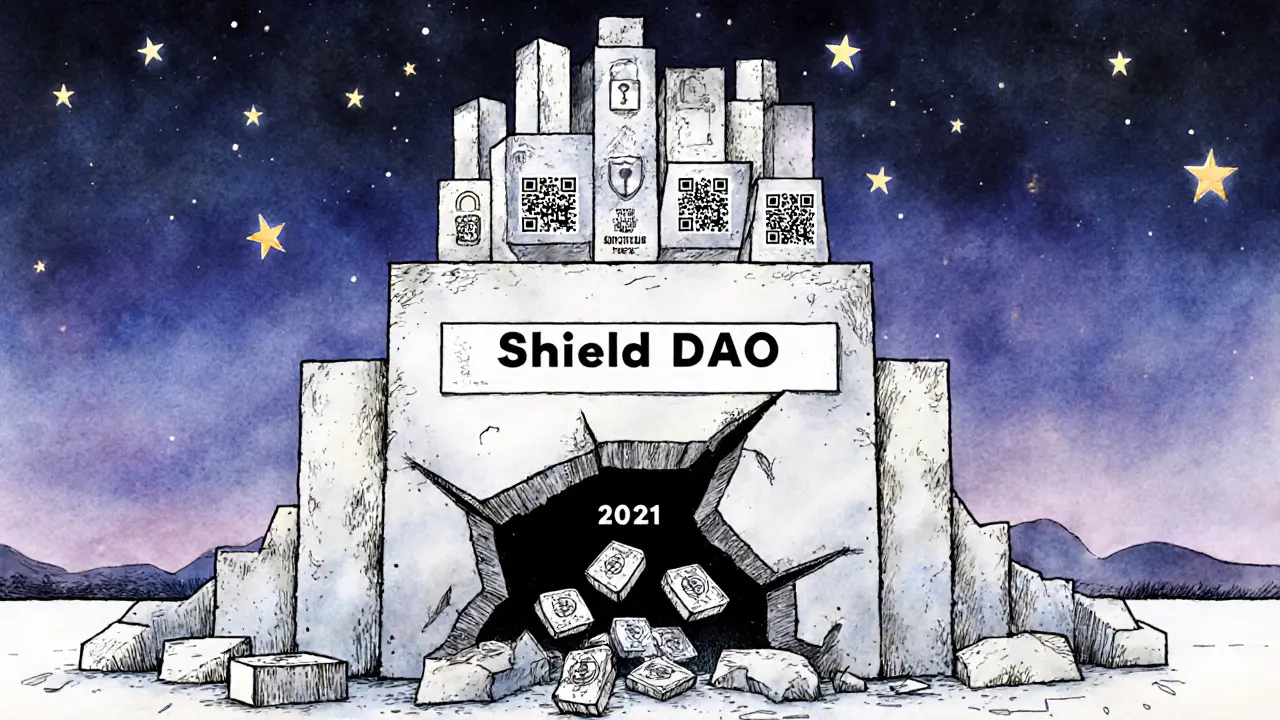

Back in 2021, if you were active in DeFi and spent time on testnets or bug bounties, you might’ve gotten a free batch of SLD tokens from Shield DAO. It wasn’t a flashy, viral airdrop like some others that year-but it was one of the more thoughtful ones. Shield wasn’t trying to buy attention with massive token dumps. They were building something complex: a decentralized derivatives protocol built on non-cooperative game theory. And they wanted people who actually understood what they were doing to be part of it.

What Was Shield DAO?

Shield DAO started as ShieldEX, a project focused on making derivatives trading in DeFi less messy. Most on-chain options require you to manually roll positions, pay gas fees repeatedly, and keep track of expirations. Shield’s solution? Perpetual Options-options that don’t expire and don’t need rolling. Think of them like perpetual futures, but for options. That’s a big deal in DeFi, where complexity kills adoption.

The team rebranded to just "Shield" in early 2021, updating their UI and sharpening their focus. They weren’t just another yield farm. They were trying to bridge the gap between traditional finance traders and DeFi. Their tech ran on both Ethereum’s Kovan testnet and Binance Smart Chain (BSC), which made things more complicated-but also more realistic for real-world use.

The SLD Airdrop: Who Got Tokens and Why

In August 2021, Shield launched its first and only airdrop. A total of 4,085,754 SLD tokens were distributed to about 2,000 early participants. This wasn’t open to everyone. You had to have done something meaningful.

- Used Shield’s Kovan or BSC testnet to trade or simulate options

- Applied for Shield’s Initial Token Offering (ITO)

- Participated in either the first or second bug bounty program

- Joined one of the Shield Gleam campaigns (social media or referral drives)

That’s it. No random wallet snapshots. No holding a token for a week. No buying into a presale. Shield rewarded contributors-people who tested their code, found bugs, or helped build the user base before the mainnet launch.

The bug bounty inclusion stood out. Most projects ignore security researchers in airdrops. Shield didn’t. If you found a critical flaw in their smart contracts, you got rewarded. That’s rare. It showed they valued quality over quantity.

How to Claim the SLD Airdrop (Back in 2021)

Claiming wasn’t automatic. You had to take action.

- Go to the Shield airdrop claim page.

- Connect your MetaMask wallet.

- Switch your network from Ethereum Mainnet to Binance Smart Chain.

- Click "Claim" if you were eligible.

That last step-switching to BSC-tripped up a lot of people. The tokens were issued on Ethereum, but the claiming interface only worked on BSC. If you didn’t know how to add a custom network in MetaMask, you were stuck. Shield posted guides on Medium, but not everyone found them.

There was a second claiming window on August 12, 2021, for those who ran into issues the first time. If you missed both, you were out of luck. The deadline was September 12, 2021. Any unclaimed tokens went into a community pool, not back to the team.

What Happened to the SLD Token?

Here’s where things get confusing.

Shield’s tokenomics listed a max supply of 1 billion SLD. But as of 2025, CoinMarketCap shows both circulating and total supply as 0 SLD. That doesn’t mean the tokens vanished-it means the project’s token model changed, or the data feed stopped updating.

The contract address-0x1ef6...95a084-is still live on Ethereum. You can check it. But no one’s trading it. No DEX lists it. No wallets show meaningful balances. The token lost momentum after 2021.

Why? Shield’s mainnet launch was delayed. The team shifted focus. By 2023, their website began promoting something called "Shield Protocol"-a blockchain-based 2FA system that replaces Google Authenticator and Amazon Cognito. It’s a completely different project. Same name. Different tech. Different team, possibly. The new Shield Protocol has nothing to do with derivatives or SLD tokens.

Many people now confuse the two. If you search "Shield airdrop" today, you’ll find posts about NFT mystery boxes and SWAG gaming platforms. Those are from the 2FA Shield. Not the derivatives one. The original Shield DAO is effectively inactive.

How Shield’s Airdrop Compared to Others in 2021

2021 was the year of the airdrop gold rush. Uniswap gave away 400 million UNI. SushiSwap gave away 100 million SUSHI. Even obscure DeFi apps handed out tens of millions in tokens just to get users.

Shield gave away less than 4.1 million SLD. But they didn’t give them to bots or speculators. They gave them to people who:

- Tested their complex derivatives engine

- Reported real security flaws

- Helped shape the UI before launch

Compare that to Skyren DAO, a newer model that launched in 2023. Skyren doesn’t do one-time airdrops. It runs a DAO that farms airdrops from dozens of projects, using AI to optimize which ones to chase. It’s a full-time airdrop farming platform with 216% APY claims. Shield was the opposite: one quiet, targeted drop for builders, not gamblers.

Shield’s approach was smarter in theory. It attracted serious contributors. But in practice, DeFi moves fast. Without a mainnet launch, community momentum faded. The token didn’t get listed. No liquidity was added. And without trading, the token became irrelevant.

Could You Still Claim SLD Today?

No. The claiming window closed on September 12, 2021. The official page is offline. The domain now redirects to the new Shield Protocol 2FA site.

If you think you were eligible but never claimed, there’s no way to recover those tokens. The smart contract doesn’t allow late claims. The community pool was distributed to other protocol participants, not to latecomers.

Some people still hold SLD tokens in their wallets from back then. But unless you’re holding them as a historical artifact, they have no value. You can’t swap them. You can’t stake them. You can’t use them in any DeFi app today.

What You Can Learn from the Shield DAO Airdrop

The Shield airdrop teaches you two things:

- Not all airdrops are made equal. Some are for hype. Others are for substance.

- Participating in testnets and bug bounties still matters-even if no one tells you it will pay off.

If you’re active in DeFi now, don’t ignore early access opportunities. The next big protocol might not advertise its airdrop. It might just give tokens to the people who showed up when it was still in alpha.

Shield’s story isn’t a success story. But it’s a cautionary one. Good tech doesn’t always win. Timing, execution, and community follow-through matter just as much. The tokens are gone. The project is quiet. But the lesson? Stay involved early. Build. Test. Report. You never know who’s watching.

Was the Shield DAO airdrop real?

Yes. The Shield DAO airdrop was a real event that took place between August 5 and September 12, 2021. It distributed 4,085,754 SLD tokens to users who participated in testnets, bug bounties, or Gleam campaigns. The airdrop was documented on Shield’s official Medium blog and claimed via a public interface.

Can I still claim SLD tokens from the Shield airdrop?

No. The claiming period ended on September 12, 2021. Any unclaimed tokens were redistributed to Shield’s community pool. The official claim page is no longer active, and the smart contract does not support late claims.

What is the SLD token contract address?

The SLD token contract address on Ethereum is 0x1ef6...95a084. You can view it on Etherscan, but it currently holds no circulating supply and has no active trading pairs. The token is effectively inactive as of 2025.

Why did Shield switch from ShieldEX to Shield?

Shield rebranded from ShieldEX to Shield in early 2021 to reflect a strategic upgrade in their UI and product focus. The new name signaled a move toward a more professional, scalable derivatives infrastructure, with Perpetual Options as the core innovation. The rebrand also coincided with the airdrop launch.

Is the new Shield Protocol the same as the old Shield DAO?

No. The current Shield Protocol is a completely different project focused on blockchain-based 2FA security. It has no connection to the original Shield DAO derivatives platform or the SLD token. The shared name causes confusion, but they are separate entities with different teams, tech, and goals.

Why did SLD tokens disappear from exchanges?

SLD never listed on major exchanges. After the airdrop, Shield’s mainnet launch was delayed, community interest faded, and no liquidity pools were created. Without trading volume or exchange support, the token became inactive. Data aggregators like CoinMarketCap eventually stopped reporting its supply.

Did Shield DAO ever launch its mainnet?

Shield DAO never officially launched its mainnet derivatives platform. After the 2021 airdrop, development slowed. The team shifted focus to a new project-Shield Protocol 2FA-leaving the original derivatives protocol unfinished. As of 2025, there is no active mainnet for SLD or Perpetual Options.

dhirendra pratap singh

This is why DeFi is a dumpster fire 😭. People build cool stuff, then just vanish like it was a dream. I had SLD tokens and now I can’t even sell them to buy ramen. RIP my 2021 hopes.

Ashley Mona

Honestly? I think Shield did something *beautifully* right - rewarding real contributors instead of bots. 🌱 I spent weeks testing their Kovan deploy, and when I got the airdrop, it felt like a handshake, not a cash grab. Still wish they’d launched mainnet though.

Edward Phuakwatana

The structural brilliance of Shield’s model was in its non-cooperative game theory foundation - essentially creating a Nash equilibrium where rational actors were incentivized to report vulnerabilities rather than exploit them. The tokenomics were designed to align long-term stakeholder behavior, not short-term speculation. The failure wasn’t technical - it was sociological. The DeFi ecosystem at large has become a casino, not a laboratory. No liquidity? No problem. No community? No problem. No mainnet? Oh, that’s just a feature, not a bug.

Suhail Kashmiri

Lmao people still talking about this? I told my cousin who’s into crypto to stay away from Shield - I knew they were sketchy the second I saw they used BSC for claiming. Why not just use ETH? Because they wanted to confuse people. Classic scam move. And now they’re selling 2FA? Yeah right. That’s just laundering their reputation.

Kristin LeGard

Americans always think they invented blockchain. Meanwhile, in India, we had real devs building actual infrastructure while these guys were busy doing airdrop bingo. Shield was legit. The fact that you didn’t get tokens means you didn’t do the work. Grow up.

Arthur Coddington

I don’t even care about the tokens anymore. I just miss the days when crypto felt like a movement. Now it’s just influencers with Discord servers selling NFTs of cats wearing hats. Shield was the last real thing. And now? Dead. Like my soul after watching another crypto influencer say 'DYOR'.

Phil Bradley

I remember when I first used Shield’s testnet - it felt like being in a secret club. No one was shouting 'TO THE MOON'. We were just fixing bugs, chatting in Discord, and wondering if anyone would ever care. Turns out… no one did. But I still believe in what they were building. It’s not dead. It’s just sleeping. Maybe someone will revive it someday.

Stephanie Platis

The fact that the claiming interface required switching to BSC - while the token was deployed on Ethereum - was a catastrophic UX failure. Furthermore, the lack of a centralized, easily accessible FAQ - coupled with the absence of a clear, persistent documentation link - rendered the entire process inaccessible to non-technical users. This was not a design oversight; it was an exclusionary tactic.

Michelle Elizabeth

I didn’t even know Shield existed until last week. I was scrolling through old Medium posts and found this. It’s kind of poetic, isn’t it? A beautiful, thoughtful project… buried under the noise. Like a haiku in a rock concert.

Joy Whitenburg

so i was on kovan like 3 times and i never claimed... oops?? 😅 but honestly, i still think they were cool for even trying. most projects just wanna get rich quick. shield was like... 'hey, if you care enough to test this weird derivative thing, you deserve something'. i miss that.

Kylie Stavinoha

Shield DAO represents a lost paradigm - one where innovation was prioritized over inflationary tokenomics. Their use of non-cooperative game theory to incentivize security research was philosophically aligned with the original ethos of open-source development. The fact that their model was abandoned in favor of a 2FA project suggests a fundamental misalignment between vision and execution. Perhaps the lesson is not that the airdrop failed, but that the culture around it did.

Diana Dodu

They didn't just abandon the project - they *stole* the name. Shield Protocol 2FA is a Chinese company. They bought the domain, rebranded everything, and now they're selling it to banks. This isn't a coincidence. This is a corporate takeover. The original team? Gone. The tokens? Worthless. And the people who built it? Forgotten.

Raymond Day

I got 12,000 SLD. Sold it for $18 in 2021. Still laugh about it. 😂 Meanwhile, my buddy who just joined Discord on launch day got 200k UNI and now owns a Tesla. Life’s unfair. But hey - at least I helped find a critical reentrancy bug. That’s something, right?

Noriko Yashiro

I was part of the Gleam campaign. Shared their post 5 times. Got 50 SLD. Felt proud. Now I keep them as a digital trophy. Not for value - for memory. Sometimes the best returns aren’t financial.

Atheeth Akash

I tested their contracts for 3 weeks. No reward, no thanks. But I still respect them. Most teams just vanish after airdrop. Shield at least tried. Maybe next time they’ll do better. I’ll be there.

James Ragin

Let me tell you something. The entire Shield DAO was a honeypot. The airdrop? A trap to collect wallet addresses. The 2FA project? A front for data harvesting. CoinMarketCap shows zero supply because the tokens were never meant to be traded - they were meant to be mapped. Your wallet was the product. You didn’t get tokens. You got tracked.

Michael Brooks

I still have my SLD tokens in a cold wallet. Never claimed them. Never sold them. Just... kept them. Like a fossil. It’s not about the money. It’s about remembering the early days. When crypto still felt like building something real, not just flipping a chart.

David Billesbach

You think this was a failure? Nah. This was a controlled demolition. Shield knew the market was overheating. They seeded a few tokens to the smartest people, then vanished before the bubble burst. The 2FA project? That’s the real product. The airdrop was just a smoke screen to fund it. They played everyone. And we fell for it.

Ashley Mona

I just read your comment about the honeypot theory... and honestly? I didn’t think of it that way. But now I’m kinda scared. What if you’re right? 😳 I spent so much time on their testnet. I thought I was helping. What if I was just feeding data?