ACA Crypto: What It Is, How It Works, and What You Need to Know

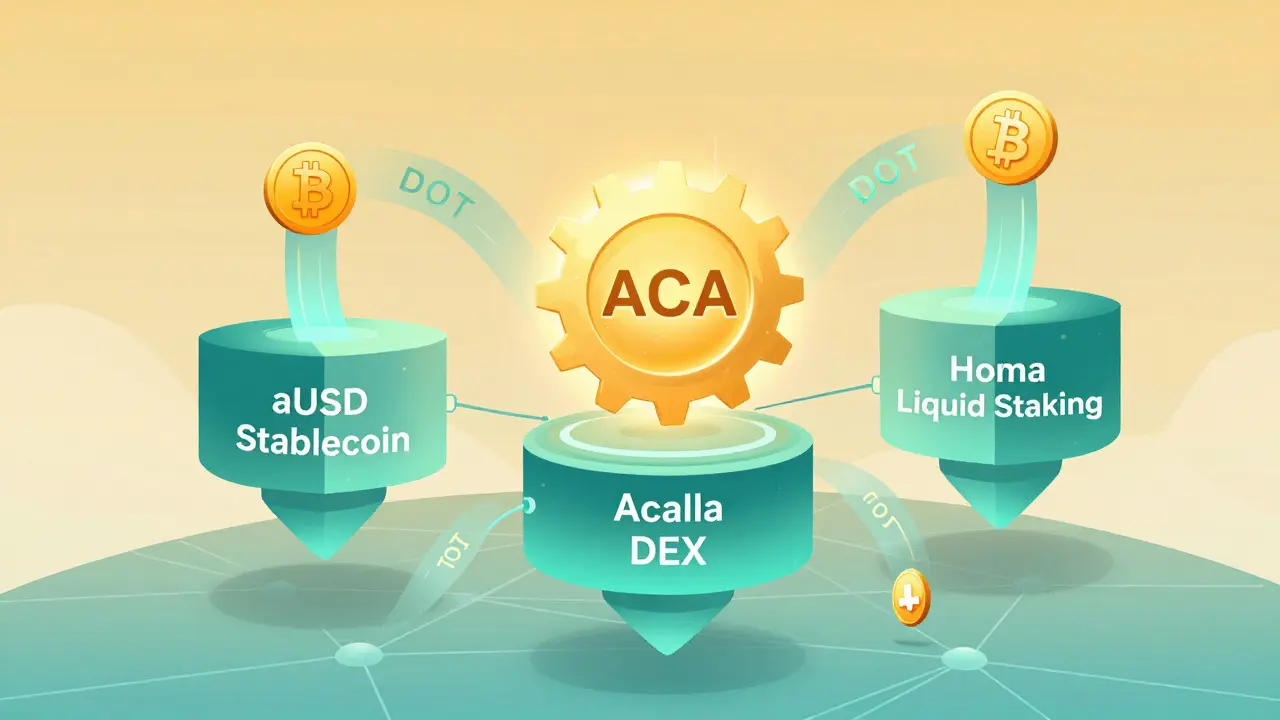

When you hear ACA crypto, a blockchain-based token designed for governance and protocol incentives. Also known as Acala Token, it powers the Acala network — a cross-chain DeFi hub built on Polkadot that lets users lend, borrow, and trade without relying on centralized platforms. Unlike meme coins with no purpose, ACA is tied to real infrastructure: it’s used to vote on system upgrades, pay transaction fees, and secure the network through staking. If you’ve ever wondered why some tokens matter while others vanish, ACA is one of the few that actually has a job.

ACA crypto doesn’t exist in a vacuum. It connects to DeFi protocols, decentralized financial systems that operate without banks or middlemen like lending platforms and automated market makers. It also relies on blockchain governance, the process where token holders decide how a network evolves — meaning if you hold ACA, you can influence things like fee structures, new asset listings, or even how rewards are distributed. This isn’t theoretical. Projects like Acala have used ACA voting to shut down risky features and approve upgrades that improved security. Compare that to tokens with no voting power — they’re just digital collectibles with no control.

But here’s the catch: ACA isn’t for everyone. If you’re looking for quick flips, you’ll find better opportunities elsewhere. Its value comes from long-term participation — staking, voting, using Acala’s services. Most of the posts in this collection don’t talk about ACA directly, but they cover the same ground: what makes a token useful, how governance works, and why some projects survive while others collapse. You’ll find deep dives into similar tokens like TULIP, CYI, and MOO — all built for specific functions, not hype. You’ll also see how exchanges like AscendEX and Eterbase handled token listings, and how scams like fake airdrops prey on people who don’t understand what they’re actually buying. This isn’t a list of price predictions. It’s a collection of real stories about how crypto systems actually work — and fail.