Acala aUSD Stablecoin Calculator

Note: Acala's stablecoin system uses a dynamic collateral ratio. Current minimum ratio is 125%.

Acala token burns occur when aUSD deviates from $1.00 to maintain stability.

Acala Token (ACA) is the native cryptocurrency of the Acala network - a specialized DeFi platform built on Polkadot designed to be the financial backbone for the entire ecosystem. Unlike general-purpose blockchains, Acala doesn’t try to do everything. It focuses on one thing: making decentralized finance fast, cheap, and cross-chain compatible. If you’re holding or considering ACA, you need to understand what it actually does - not just its price history.

What Does Acala Actually Do?

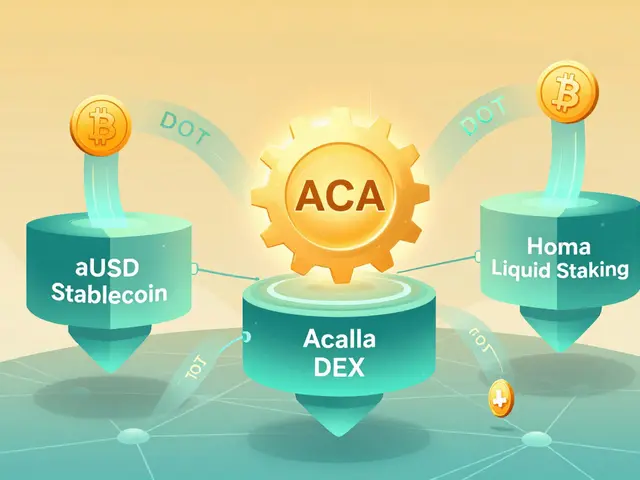

Acala isn’t just another crypto coin. It’s the fuel for a full DeFi system. Think of it like a bank, exchange, and stablecoin issuer all rolled into one - but running on Polkadot, not Ethereum. The platform has three core pieces:- aUSD: A decentralized stablecoin pegged to the US dollar. You can create it by locking up DOT, BTC, ETH, or even ACA itself as collateral.

- Acala DEX: A decentralized exchange that lets you trade crypto without a middleman, using an automated market maker (AMM) model.

- Homa: A liquid staking protocol that lets you stake your DOT tokens and still use them elsewhere - you get LDOT in return, which earns staking rewards and can be used as collateral.

All of this runs on a blockchain that’s fully compatible with Ethereum. That means developers who know Solidity can easily move their apps over without rewriting everything. Transactions cost about one-tenth of what they do on Ethereum, making it attractive for users tired of high gas fees.

How Does ACA Token Work?

ACA isn’t just a trading asset - it has real utility inside the network. Here’s how it’s used:- Pay transaction fees: You can pay for swaps, loans, or staking in ACA, DOT, ETH, BTC, or USDT. This flexibility is rare in DeFi.

- Governance: ACA holders vote on protocol upgrades, fee changes, and new features. The more ACA you hold, the more voting power you have.

- Stability mechanism: When the aUSD stablecoin gets out of balance, the system automatically burns ACA tokens to reduce supply and stabilize its value. This is a key part of how it stays pegged to $1.

Unlike Bitcoin or Ethereum, ACA can’t be mined. It’s a Proof-of-Stake token. You earn more ACA by staking it, or by providing liquidity to the Acala DEX.

ACA Supply: Fixed or Not?

There’s confusion online about how many ACA tokens exist. Some sources say 1 billion. Others say 1.6 billion. The truth? Both are partially right.At launch in January 2022, 1 billion ACA were minted. But the Acala Foundation reserved another 600 million for future incentives - ecosystem grants, team rewards, and liquidity mining. These are being released gradually over time. As of late 2023, about 1.16 billion ACA are in circulation. The maximum supply is capped at 1.6 billion. So yes, more ACA will enter circulation, but not all at once.

ACA Price History and Market Position

ACA reached its all-time high of $0.2025 in early 2021. By December 2023, it was trading around $0.0135. That’s a 93% drop from its peak. Market cap hovered near $16 million, and daily trading volume ranged between $1.8 million and $4.5 million.Why the steep decline? Partly because the broader crypto market crashed. But also because Acala’s growth has been slower than expected. While platforms like Uniswap on Ethereum see over $1 billion in daily volume, Acala’s DEX averages less than $2 million. Liquidity is thin, which makes large trades expensive due to slippage.

Still, ACA has strong institutional backing. Coinbase, Figment, Credora, and Current.com all use or support Acala’s infrastructure. That’s not something you see with every small-cap crypto.

How Is Acala Different From Other Polkadot DeFi Projects?

Polkadot has many DeFi projects. Moonbeam, Astar, and Parallel Finance all offer lending, swaps, or staking. But Acala is the only one built from the ground up as a full DeFi hub.| Platform | Market Cap | Key Feature | ACA Advantage |

|---|---|---|---|

| Acala | $16M | Full-stack DeFi (aUSD, DEX, Homa) | Multi-collateral stablecoin, cross-chain fee payments |

| Astar Network | $127M | General-purpose dApp platform | More apps, less DeFi depth |

| Moonbeam | $76M | EVM-compatible smart contracts | No native stablecoin or liquid staking |

| Parallel Finance | $48M | Lending and borrowing | Limited to credit markets, no DEX or liquid staking |

Acala’s biggest edge? The ability to mint aUSD using DOT, BTC, or ETH as collateral. No other Polkadot DeFi project offers that. And because LDOT (liquid DOT) can be used as collateral for aUSD, you can stack DeFi services on top of each other - something that’s hard to do elsewhere.

Who Uses Acala? Real User Feedback

User experiences are mixed. On Reddit, some praise the low fees: “Minting aUSD with DOT cost me 0.5% in fees - way cheaper than MakerDAO’s 2.5%.”But others hit roadblocks: “I tried to swap 5,000 LDOT on Acala’s DEX. Slippage was 8.2%. On Coinbase, it was 0.3%.”

That’s the core problem: Acala is technically advanced, but it’s still small. Liquidity is limited. If you’re trading small amounts (under $500), it works great. If you’re moving $10,000+, you’ll feel the pinch.

Developers like the EVM compatibility. “I ported a Solidity contract from Ethereum in two weeks,” said one contributor on Acala’s GitHub. But setting up multi-collateral vaults? “Too complex,” said another. The interface isn’t beginner-friendly.

What’s Next for Acala?

Acala isn’t standing still. In late 2023, they announced a major upgrade called “HyFi” - Hybrid Finance. The goal? Connect DeFi with traditional finance. Partners like Current.com are testing it to let businesses hold aUSD as a stable, digital cash equivalent.By mid-2024, Acala plans to expand aUSD to Ethereum and Cosmos chains. That’s huge. Right now, aUSD only works on Polkadot. If it becomes usable on other networks, adoption could jump.

They’re also integrating Chainlink oracles for more accurate collateral pricing. And they’re working on better tools for institutional users - things like compliance checks and audit trails.

Is ACA a Good Investment?

That depends on what you’re betting on.If you believe Polkadot will become a top-tier blockchain for enterprise and DeFi, then Acala is one of its most important projects. It’s the only one offering a full suite of financial tools. If Polkadot grows, ACA should grow with it.

If you’re looking for a quick flip, ACA is risky. It’s a low-volume token with a tiny market cap. It can swing 20% in a day on low liquidity. It’s not for day traders.

The real value of ACA isn’t in speculation. It’s in utility. If you’re building on Polkadot, using aUSD, or staking DOT, ACA is the token you’ll need to interact with the network. It’s not just a coin - it’s a key to the system.

How to Get Started With ACA

If you want to try Acala:- Buy ACA on Kraken, Gate.io, or KuCoin.

- Connect your wallet (MetaMask or Polkadot.js) to app.acala.network.

- Deposit DOT, ETH, or BTC to mint aUSD.

- Use LDOT to earn yield while still trading it.

Start small. Try minting $100 worth of aUSD. See how the fees work. Test swapping LDOT. You’ll learn more in 30 minutes than reading a dozen articles.

Acala isn’t the biggest DeFi project. But it’s one of the most focused. It doesn’t chase hype. It builds infrastructure. And in crypto, infrastructure lasts longer than flash-in-the-pan tokens.

Is ACA a stablecoin?

No, ACA is not a stablecoin. It’s the governance and utility token of the Acala network. The stablecoin is called aUSD, which is pegged to the US dollar. ACA is used to pay fees, vote on upgrades, and help stabilize aUSD through its tokenomics.

Can I mine ACA tokens?

No, you cannot mine ACA. Acala uses a Proof-of-Stake consensus mechanism. New tokens are released gradually through staking rewards and ecosystem incentives, not mining. You can earn ACA by staking your tokens or providing liquidity to the Acala DEX.

Why is ACA’s price so low compared to its all-time high?

ACA’s price dropped because of the broader crypto bear market and slower-than-expected adoption of Polkadot’s DeFi ecosystem. While Acala has strong technology, it still competes with Ethereum-based platforms that have far more liquidity and users. The 93% drop from its $0.20 peak reflects market sentiment, not necessarily failure.

Is ACA better than ETH or DOT for DeFi?

ACA isn’t meant to replace ETH or DOT. It works alongside them. ETH powers Ethereum DeFi. DOT is Polkadot’s native token for security and governance. ACA is the DeFi utility token on Polkadot - it’s what you use to access Acala’s stablecoin, exchange, and liquid staking. You need DOT to stake. You need ACA to pay fees and govern the system.

Can I use ACA on other blockchains?

Currently, ACA only exists on the Acala blockchain, which is part of Polkadot. But Acala plans to expand aUSD to Ethereum and Cosmos by mid-2024. ACA itself may be bridged later, but as of now, it’s not available on other chains. Always check official sources before using bridges.

Is Acala safe to use?

Acala’s code has been audited by multiple security firms, and it’s backed by institutional partners like Coinbase and Figment. However, like all DeFi protocols, it carries smart contract risk. Always start with small amounts, understand how collateralization works, and never invest more than you can afford to lose.

Scott Sơn

This Acala thing is wild - like someone took a DeFi salad, threw in DOT, BTC, ETH, and called it a ‘hub’ 🤯 I’ve seen dApps with more liquidity than a puddle after a drizzle. aUSD? Cute. But if I can’t swap $10k without my slippage hitting double digits, it’s just a fancy demo.

Frank Cronin

Oh wow. Another ‘infrastructure’ project that thinks ‘EVM-compatible’ means ‘worth anything.’ You know what’s truly innovative? A system where users don’t need a PhD in tokenomics just to mint a stablecoin. Acala’s not a hub - it’s a graveyard for overhyped Polkadot moonboys.

Stanley Wong

I get why people are skeptical but I think we’re missing the point here. Acala isn’t trying to be Uniswap on steroids - it’s trying to be the plumbing. Most DeFi projects are flashy storefronts with leaky pipes underneath. Acala’s just quietly fixing the pipes so everything else can run without flooding the basement. Yeah it’s slow. Yeah liquidity’s thin. But when the market turns, the ones with solid infrastructure are the ones still standing. Not the ones with the prettiest charts.

miriam gionfriddo

ACA at $0.0135?? LMAO. Someone’s been holding since 2021 and still thinks this is a ‘long-term play.’ Bro, the market cap is less than my monthly coffee budget. And don’t even get me started on the ‘1.6B max supply’ lie - they’ve already released 1.16B and the foundation still has 440M left to dump. This isn’t deflationary, it’s a timed bomb.

Nicole Parker

I’ve used Acala to mint aUSD with my DOT and honestly? It felt like using a Swiss watch to open a soda can - overengineered but it worked. I didn’t lose money, the interface was clunky but not broken, and the fees were crazy low. I think people forget that DeFi isn’t about being the biggest, it’s about being the most reliable. Acala’s not sexy, but it’s steady. And in crypto, that’s rare.

Kenneth Ljungström

Just tried the Homa protocol yesterday - staked my DOT, got LDOT, then used LDOT as collateral for aUSD. It felt like magic. 🤖✨ No one’s talking about how cool it is that you can earn yield on your staked DOT AND use it like cash. That’s not just DeFi - that’s DeFi with brain cells. Acala’s the only one doing this right on Polkadot. Keep building, team.

Brooke Schmalbach

ACA’s utility? Please. You can pay fees in ACA? Cool. So can you pay your rent in it? No. Can you buy a coffee with it? No. Can you even trade it without losing 5% to slippage? Nope. It’s a governance token pretending to be a utility token. The whole thing feels like a corporate PowerPoint deck that forgot to include the ‘how to use’ slide.

Cristal Consulting

Start small. Try $100. Do it. You’ll learn more in 30 mins than reading this whole thread. Seriously. Just go to app.acala.network, connect your wallet, and mint aUSD. No theory. Just do. Then come back and tell me it’s not worth it.

Tom Van bergen

If you believe in Polkadot you believe in ACA. If you don’t believe in Polkadot you believe in nothing. It’s that simple. Everything else is noise. The market will eventually realize that cross-chain DeFi isn’t a trend - it’s the future. And Acala is the only one building the bridge. The rest are just waving flags on the shore.

Sandra Lee Beagan

As someone from Canada watching this unfold - I find it fascinating how North American crypto culture treats ‘liquidity’ like a religion. Acala’s not meant for traders. It’s meant for builders. The fact that Coinbase and Figment are backing it? That’s not a coincidence. This is enterprise-grade. The UI is rough? Yes. But enterprise tools were always ugly at first. Think SAP in 1998.

Ben VanDyk

‘Acala is the only one offering multi-collateral aUSD.’ Yeah. And? That’s like saying ‘this toaster is the only one that burns bread evenly.’ Cool. But if no one’s buying toast, who cares?

michael cuevas

They’re adding Chainlink oracles? That’s cute. But if your stablecoin can’t even handle $500 trades without blowing up, why are we talking about oracles? Fix the basics first. Then we’ll talk about ‘HyFi.’

Nina Meretoile

I used to think crypto was just gambling. Then I used Acala. Now I see it as… possibility. Like a tiny digital economy that doesn’t need banks. Yeah it’s small. Yeah it’s messy. But it’s real. And real things take time. I’m not here for the price. I’m here for the future. 🌱

Barb Pooley

Remember when they said Bitcoin was a bubble? Then Ethereum? Then Solana? Now Acala? It’s all the same playbook. Institutional backing? That’s just the last step before the rug pull. They’re not building infrastructure - they’re building a Ponzi with a whitepaper.

Shane Budge

How many users actually use Homa daily?

sonia sifflet

You think ACA is dead? Wait till the HyFi upgrade hits. They’re going to integrate with traditional banks. Then watch the price explode. You’re all just too dumb to see it. This is the next wave. Get in now or get left behind.

Lore Vanvliet

Wow. So you all think Acala’s ‘infrastructure’ is going to save crypto? Meanwhile, I’m over here trying to pay my rent with aUSD and my landlord just laughed and said ‘I don’t accept digital fairy dust.’ 😭 This isn’t the future - it’s a niche hobby for people who think ‘gas fees’ are a personality trait.