Acala DeFi: What It Is, How It Works, and Why It Matters in Blockchain

When you hear Acala DeFi, a decentralized finance platform built on the Polkadot network that enables cross-chain lending, stablecoins, and automated yield. Also known as Acala Network, it’s one of the few DeFi projects designed to connect multiple blockchains without relying on bridges that often break. Unlike isolated DeFi apps on Ethereum or Solana, Acala DeFi acts like a financial hub—letting users move assets between chains, earn interest in stablecoins, and trade without leaving the platform.

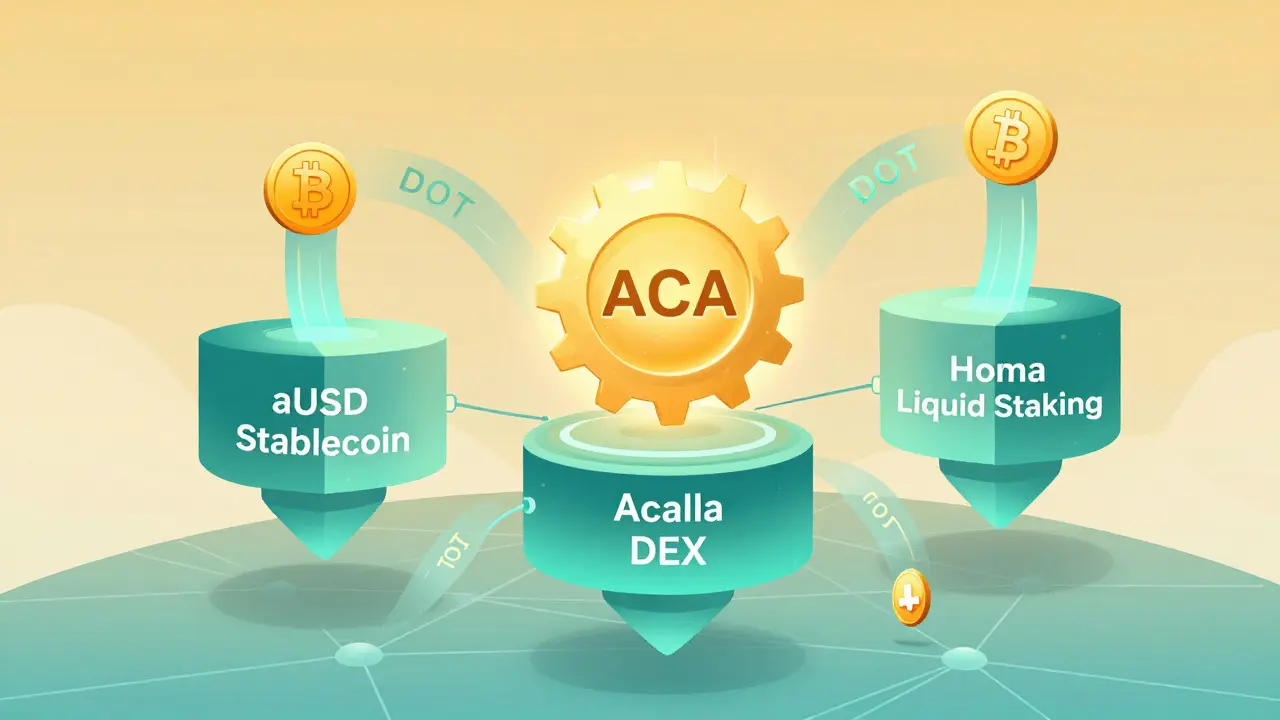

Acala DeFi isn’t just another yield farm. It runs on its own blockchain, fully integrated into the Polkadot ecosystem, which means it inherits Polkadot’s security and speed. Its native token, ACALA, the governance and utility token powering the Acala network, used for staking, fees, and voting on protocol changes, gives holders real control over upgrades and fee structures. The platform’s core product, hUSD, a decentralized stablecoin pegged to the US dollar, backed by crypto collateral and minted through smart contracts on Acala, is used across DeFi apps on Polkadot, Kusama, and even Ethereum via cross-chain bridges. This makes hUSD one of the most widely adopted stablecoins outside of Ethereum.

What sets Acala DeFi apart is how it handles risk. Instead of relying on volatile crypto as collateral, it lets users lock assets like DOT, BTC, or ETH and mint hUSD without needing to sell. This keeps users exposed to price movements without liquidating holdings. It also offers automated staking and liquidity mining, letting users earn rewards just by holding or providing liquidity—no manual compounding needed. The platform’s focus on usability and interoperability makes it a go-to for traders and long-term holders who want to stay within the Polkadot universe without jumping between apps.

But Acala DeFi doesn’t exist in a vacuum. It’s part of a larger shift in DeFi—away from isolated chains and toward interconnected ecosystems. That’s why you’ll see it mentioned alongside projects like Polkadot, cross-chain DeFi, and stablecoin protocols. It’s not trying to beat Ethereum. It’s trying to work with it, and with others. That’s why users who care about security, low fees, and true multi-chain access keep coming back.

Below, you’ll find real reviews, breakdowns, and warnings about platforms that claim to be like Acala DeFi—or worse, try to copy it. Some are scams. Others are misunderstood. All of them teach you something about what real DeFi looks like when it works—and what happens when it doesn’t.