Acala Token: What It Is, How It Works, and What You Need to Know

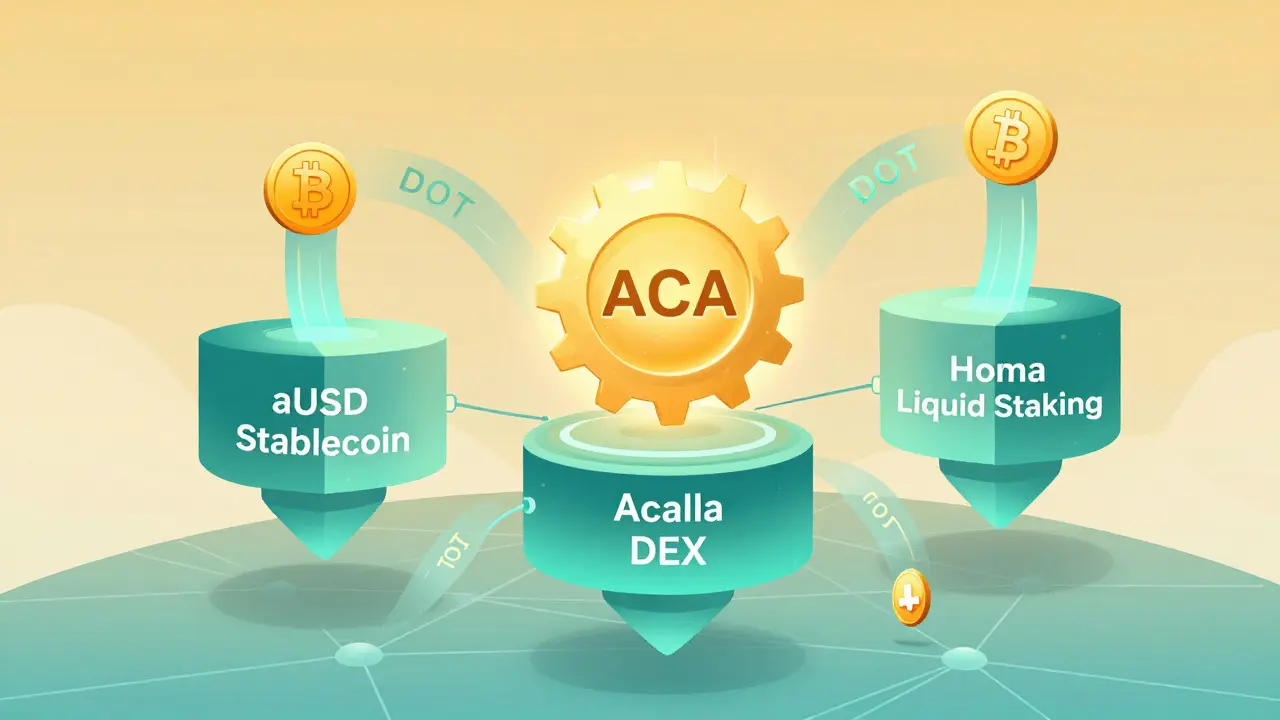

When you hear Acala Token, the native currency of the Acala network, a decentralized finance platform built on Polkadot. Also known as ACA, it’s not just another crypto coin—it’s the fuel for one of the most practical DeFi ecosystems in Web3. Unlike meme tokens with no real use, Acala Token powers lending, stablecoin issuance, and cross-chain swaps—all inside a secure, scalable network designed to connect blockchains.

Acala Token isn’t just a payment method. It’s used for governance, staking, and paying transaction fees on the Acala network. Holders vote on upgrades, changes to interest rates, and even which new chains get connected. This makes ACA more like a shared ownership stake than a speculative asset. And because Acala runs on Polkadot, it inherits the security and interoperability of one of the most trusted blockchain frameworks today. That means ACA-based apps can talk to Bitcoin, Ethereum, and other chains without needing risky bridges or middlemen.

The Acala network’s main product, aUSD, is a decentralized stablecoin backed by crypto assets—no bank, no central authority. Acala Token secures this system: if someone tries to drain the collateral, ACA holders can vote to freeze or adjust the system. It’s a self-correcting finance machine, built for real users, not just traders. This isn’t theory—it’s how people in places with unstable currencies are already using it to store value and access loans without a bank account.

Related to this are the tools and platforms built on top of Acala: decentralized exchanges like Acala Swap, lending protocols, and cross-chain bridges that move assets between Polkadot and Ethereum. These aren’t separate projects—they’re all powered by ACA. That’s why you’ll see ACA mentioned in posts about DeFi yields, staking rewards, and blockchain interoperability. It’s the invisible thread tying them together.

What you’ll find in the posts below aren’t hype pieces or empty price predictions. They’re real breakdowns of how Acala works, how it compares to other DeFi platforms, and what’s actually happening with its tokenomics. You’ll see how ACA fits into broader trends like cross-chain finance, Polkadot’s growth, and the shift away from centralized stablecoins. No fluff. Just clear, practical info that helps you understand whether Acala Token is something you should pay attention to—or ignore.