Bitcoin Confirmations: What They Are and Why They Matter

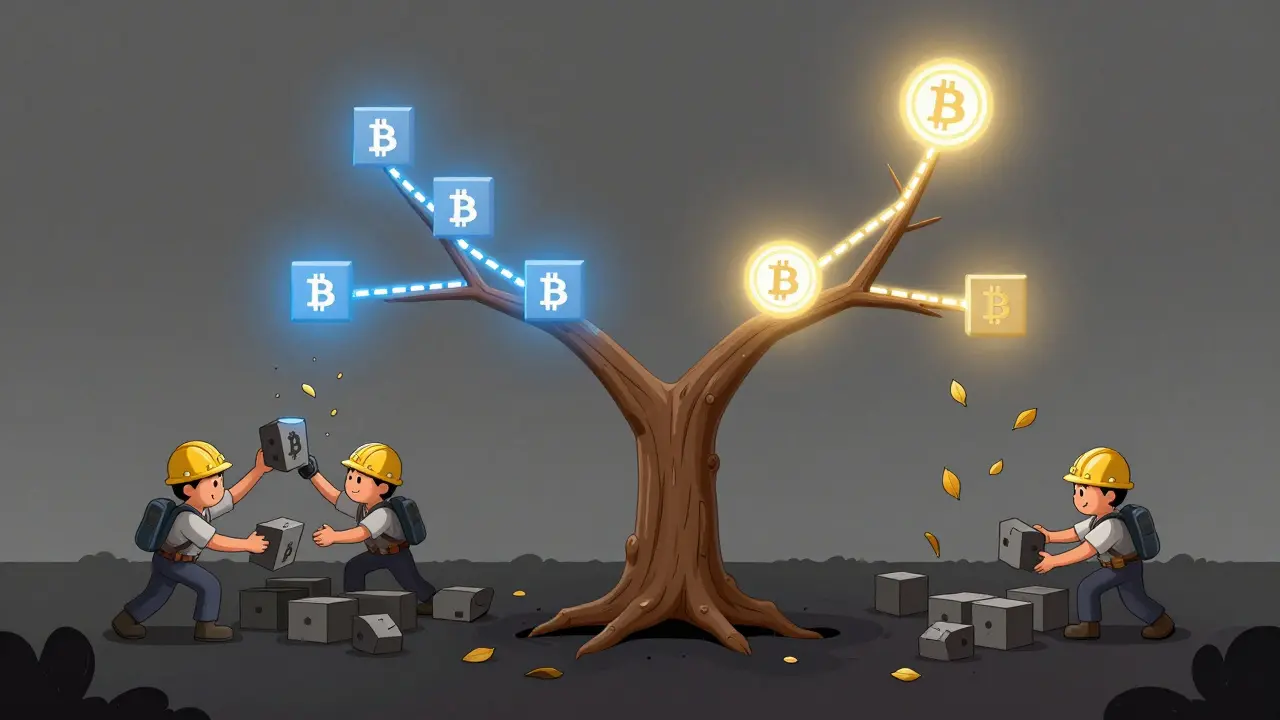

When you send Bitcoin, a decentralized digital currency that runs on a public ledger called the blockchain. Also known as BTC, it doesn’t rely on banks or middlemen — but that also means you need another way to know your transaction actually went through. That’s where Bitcoin confirmations, the process of verifying a transaction by adding it to the blockchain through mining come in. Every time a new block is added to the chain, your transaction gets one confirmation. It’s not instant — and that’s by design.

Think of confirmations like a security checkpoint. One confirmation means the network has seen your transaction. Six confirmations? That’s when most exchanges and wallets say it’s safe to consider the funds final. Why six? Because after that many blocks, it becomes practically impossible to reverse the transaction, even with massive computing power. This isn’t just theory — it’s how the network stays secure. If confirmations were faster or fewer, double-spending attacks would be easy. And we’ve seen what happens when people treat unconfirmed transactions as final: funds vanish, trust breaks, and scams thrive.

Some services ask for just one confirmation, especially for small amounts. Others, like big exchanges or custodians, wait for ten or more. It’s not about being overly cautious — it’s about matching risk to value. Sending $10? Maybe one is fine. Sending $10,000? You don’t want to gamble. The blockchain, the public, immutable ledger that records every Bitcoin transaction doesn’t lie. But humans do — and so do scammers who pretend your transaction is done before it really is. That’s why understanding confirmations isn’t just technical knowledge — it’s protection.

You’ll see this in posts about exchanges like AscendEX or ARzPaya, where users ask why their Bitcoin hasn’t shown up yet. Or in stories about failed airdrops like WNT or HGT, where people confuse token claims with actual blockchain activity. Even in cases like TradeOgre’s shutdown or Upbit’s $34B fine, the root issue often ties back to poor handling of transaction verification. This collection doesn’t just list facts — it shows you real cases where ignoring confirmations led to real losses.

Below, you’ll find guides that cut through the noise. Some explain how confirmations work on different networks. Others warn you about fake platforms that pretend to process Bitcoin instantly. A few even show you how to check your own transaction status without relying on third parties. Whether you’re sending your first Bitcoin or managing a portfolio, knowing how confirmations protect you isn’t optional — it’s the first line of defense.