Finality Calculator

Recommended Confirmations

Imagine you send 1 BTC to a friend. You see it show up in their wallet. Two minutes later, it disappears. Then it reappears. Then it vanishes again. This isn’t a glitch in your phone-it’s how blockchains handle uncertainty. Welcome to chain reorganization and finality: the invisible rules that decide which transactions stick and which get erased.

What Happens When Two Miners Win at the Same Time?

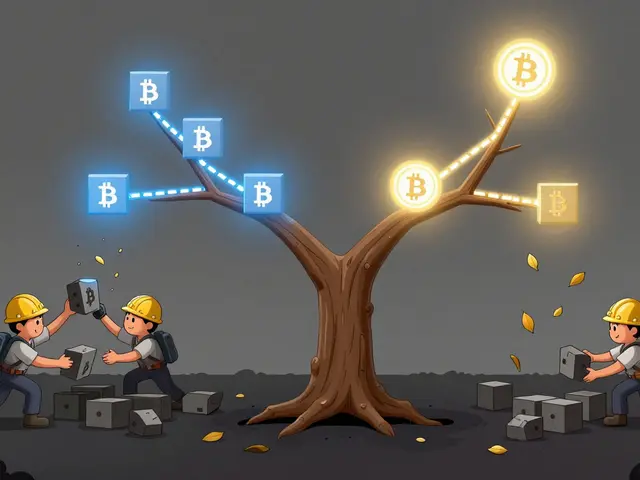

Bitcoin doesn’t have a boss. No central server tells everyone what’s true. Instead, miners compete to add the next block. Sometimes, two miners solve the puzzle almost at once. One block gets published on the East Coast, another on the West Coast. Both are valid. Both get broadcast. Now the network has two competing chains-like two roads branching off from the same intersection. This is called a fork. And it’s normal. Bitcoin’s network handles these forks automatically. The rule is simple: the longest chain wins. Not the first one. Not the one you saw first. The one with the most computational work behind it. If one chain grows two blocks longer than the other, every node switches to it. The shorter chain gets abandoned. Those blocks become orphaned. Transactions inside them? They go back into the memory pool to be mined again. One-block reorgs happen about 0.6% of the time in Bitcoin. That’s roughly once every 3-4 days. Two-block reorgs? Almost unheard of-0.002% of blocks. Anything longer than six blocks? Never happened in 14+ years of Bitcoin’s history. The longest recorded reorg was four blocks back in March 2013, caused by a software bug.Why Six Confirmations? It’s Not Magic-It’s Math

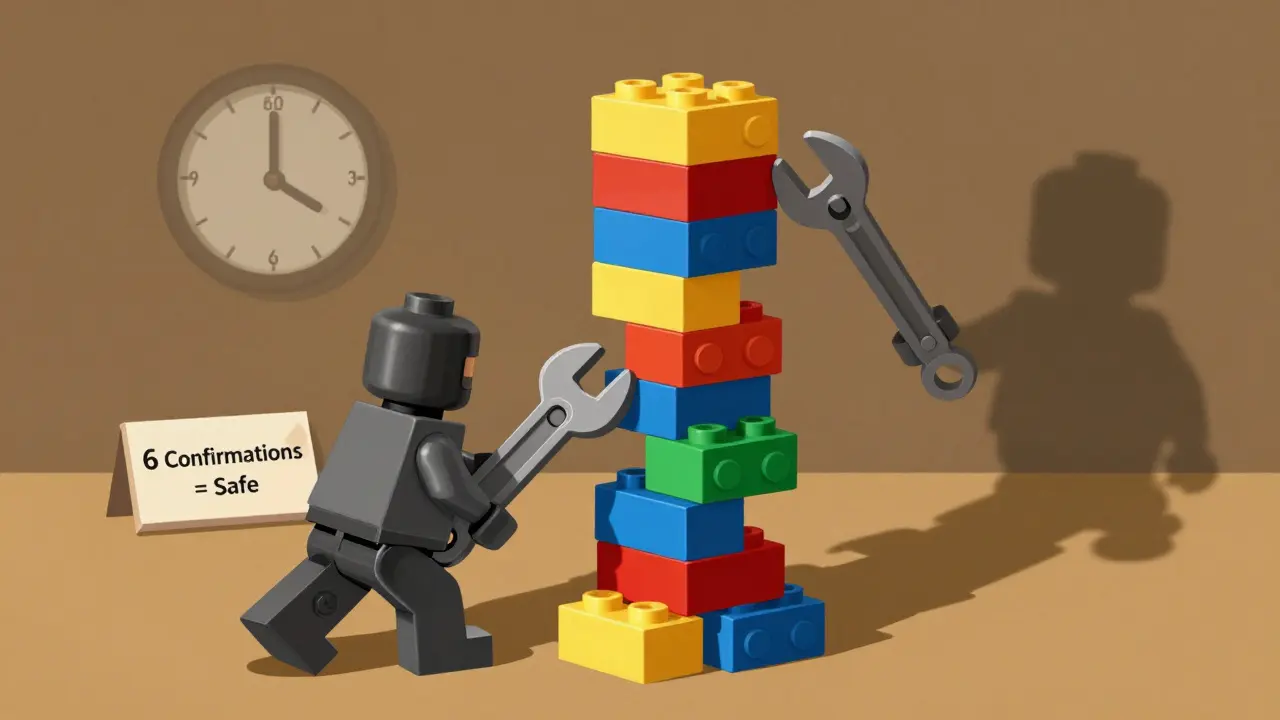

When you send crypto, you don’t wait for one confirmation. You wait for six. Why? Because each new block added on top of yours makes it harder to rewrite history. Think of it like building a tower of Legos. The bottom block is your transaction. Each new block is a layer on top. To erase your transaction, someone would have to rebuild the entire tower from the bottom up-faster than the network keeps adding new layers. And they’d need more computing power than the rest of the network combined. Satoshi’s original whitepaper showed this mathematically. After six blocks, the chance of a successful reorg attack drops below one in a million for transactions under $1 million. That’s why exchanges like Coinbase and Binance require six confirmations for most deposits. It’s not tradition-it’s probability. But here’s the catch: six confirmations in Bitcoin takes about an hour. For a $5 coffee? Overkill. For a $5 million wire transfer? Barely enough. That’s why big exchanges ask for 30+ confirmations (5+ hours) for large deposits. The value you’re securing should match the depth you wait for.Finality: When a Transaction Can’t Be Undone

Bitcoin gives you probabilistic finality. That means: the more blocks on top, the more certain you are. But it’s never 100%. There’s always a tiny, theoretical chance a reorg could undo your transaction. Ethereum changed that. After The Merge in September 2022, it switched from proof-of-work to proof-of-stake. Now, instead of miners, validators-people who lock up ETH-vote on which chain is real. When two-thirds of validators agree on a block, it gets marked as “justified.” After another round of voting, it becomes “finalized.” Finalized means irreversible. No reorg. No guessing. Under normal conditions, this happens every 6.4 minutes. That’s deterministic finality. No math. No waiting. Just a hard stop. This matters for apps. If you’re building a DeFi protocol or a NFT marketplace, you don’t want to wait an hour for a transaction to be “safe.” With Ethereum’s finality, you can act after 15 blocks (about 3 minutes) and know it won’t vanish.

How Other Chains Handle It

Not all chains are built the same. BNB Smart Chain uses “Fast Finality.” It achieves confirmation in about 3 seconds with 12 blocks. It’s not proof-of-stake like Ethereum-it’s a variation called delegated proof-of-stake. Validators are elected, and they sign off in quick succession. Speed over decentralization. Cosmos uses Tendermint, which gives you instant finality. One block, one vote, done. But if the network splits (say, due to a major internet outage), it stops processing transactions entirely. It chooses safety over availability. Bitcoin? It keeps going-even if there’s chaos. It just might take longer to agree on what’s real. This is the trade-off: speed vs. resilience. Deterministic finality feels better for users. But probabilistic finality? It’s tougher to break.The Real Risk Isn’t Technical-It’s Social

Here’s something most people miss: even “finalized” transactions can be reversed. Not by hackers. Not by reorgs. By people. In June 2016, Ethereum’s DAO was hacked. $60 million in ETH was stolen. The community didn’t sit back. They voted to hard fork the chain. They rewrote history. The stolen funds were frozen. The original chain became Ethereum Classic. The new one became today’s Ethereum. Finality isn’t just code. It’s social consensus. If enough people agree to change the rules-even the “unchangeable” ones-they will. That’s why Arthur Breitman, co-founder of Tezos, says: “The real security threshold isn’t a fixed number of blocks. It’s the economic value being secured relative to the chain’s hash rate.” If you’re moving $10 million on Bitcoin, you need more than six confirmations. You need to ask: is the network’s total mining power bigger than the value you’re protecting? If yes, you’re safe. If no? You’re gambling.What Developers Actually Do

Most apps don’t wait for finality-they build around it. Wallets like Electrum show a transaction as “confirmed” after one block, but warn users for larger amounts. Exchanges hold deposits for hours. DeFi protocols use “reorg protection”: they wait 15+ blocks before triggering payouts, even on Ethereum. Blockchain developers spend months learning how to handle reorgs. A 2023 survey of 250 engineers found that 72% had seen their apps break because a transaction disappeared during a reorg. The fix? Never assume a transaction is final until you’ve waited longer than the network’s typical reorg depth. And that’s why cross-chain bridges are so dangerous. If you’re moving ETH from Ethereum (6-minute finality) to Bitcoin (60-minute probabilistic finality), you have to assume Bitcoin might roll back. The $600 million Nomad Bridge hack in 2022 happened because the bridge trusted Ethereum’s finality but didn’t account for Bitcoin’s uncertainty.

What’s Changing Now

The future of finality is hybrid. Ethereum’s upcoming Prague hard fork (late 2024) will make validator exits faster and improve finality speed. Bitcoin developers are exploring “client-side finality”-a way for wallets to detect reorgs faster without changing the protocol. It’s like giving your phone a better alarm system for chain changes. Polkadot is building “asynchronous backing,” blending probabilistic and deterministic elements. Enterprise chains like Hyperledger Fabric skip mining entirely-they use consensus algorithms that finalize instantly. That’s why banks love them. But here’s the reality: most public blockchains will stick with probabilistic finality for the foreseeable future. Why? Because it’s more resistant to censorship. More resilient to attacks. More aligned with the original promise of decentralization.What You Should Do

If you’re sending crypto:- For under $100: 1-2 confirmations is fine.

- For $100-$10,000: Wait for 6 confirmations (Bitcoin) or 15 blocks (Ethereum).

- For over $10,000: Check the exchange’s policy. Some require 30+ for Bitcoin. Some wait 24 hours.

- Never trust a transaction after one block.

- Implement reorg detection-track chain height changes.

- Use different thresholds based on value. Don’t treat a $5 payment the same as a $500,000 transfer.

- Document your finality assumptions. Your users deserve to know how safe their funds are.

- Ask: Do I need speed or resilience?

- Enterprise use? Look at Hyperledger or Cosmos.

- Decentralized apps? Ethereum or Bitcoin, but understand their trade-offs.

- Never assume finality is automatic. Always verify how it’s implemented.

Frequently Asked Questions

What causes a chain reorganization?

A chain reorganization happens when two miners find valid blocks at nearly the same time, creating a temporary fork. The network resolves it by following the chain with the most accumulated proof-of-work (in Bitcoin) or the most validator attestations (in Ethereum). The shorter chain is discarded, and its transactions are re-added to the mempool for mining.

Can a blockchain transaction ever be reversed?

Yes-but only under specific conditions. In proof-of-work chains like Bitcoin, reorgs can reverse transactions if they’re deep enough and an attacker controls massive computing power. In proof-of-stake chains like Ethereum, finalized blocks cannot be reversed by technical means. However, even finalized transactions can be undone by a community-led hard fork, as happened with Ethereum after The DAO hack in 2016.

Why does Bitcoin need six confirmations but Ethereum only needs 15 blocks?

Bitcoin uses probabilistic finality-each block adds security gradually. Six blocks (about 60 minutes) reduces reorg risk to less than one in a million for most transactions. Ethereum uses deterministic finality: once a block is finalized (every ~6.4 minutes), it’s mathematically impossible to reverse without a majority of validators colluding. So 15 blocks (about 3 minutes) on Ethereum is equivalent to 6+ confirmations on Bitcoin.

Are reorgs dangerous for users?

For most users, no. One-block reorgs are common but harmless-they mostly affect miners and exchanges. The real risk comes when you accept a payment too early. If you’re a merchant and you ship goods after just one confirmation, you risk losing both the payment and the product if a reorg occurs. Always wait for enough confirmations based on the value involved.

Can a 51% attack reverse transactions on Bitcoin?

Yes, technically. If one entity controls over half of Bitcoin’s total mining power, they could build a longer chain in secret and then broadcast it, reversing recent transactions. But this is extremely expensive and unlikely. The cost to execute a 51% attack on Bitcoin today exceeds $10 billion per day. The network’s hash rate makes it economically irrational.

How do exchanges decide how many confirmations to require?

Exchanges base their requirements on transaction value and risk tolerance. For small deposits (under $10,000), most require 3-6 Bitcoin confirmations. For large deposits (over $100,000), they often require 10-30 confirmations or even 5+ hours of confirmation time. Some, like Binance, use dynamic thresholds based on real-time network conditions and historical reorg data.

Althea Gwen

So basically, Bitcoin is like that one friend who says they’ll pay you back… but then their wallet glitches and they forget? 😅 I just want my coffee without doing math. 🤷♀️

Jess Bothun-Berg

Wait-so you’re telling me that after SIX confirmations, it’s still not 100% final? That’s not security-that’s a gamble with a 0.000001% chance of disaster. And you call this ‘trustless’? Pfft. 😒

Steve Savage

Love this breakdown. It’s wild how we treat blockchain like magic, but it’s really just math + social agreement. Think about it: if everyone suddenly agreed Bitcoin’s history was wrong, it’d be wrong. The tech’s just the scaffold. The real power? Us. We’re the ones who decide what’s real. That’s beautiful. And terrifying. 🤔

Joe B.

Let’s be real: probabilistic finality is a scam designed by cryptoeconomists to sell more ASICs. If you can’t guarantee finality, you don’t have a ledger-you have a consensus-based hallucination. And don’t get me started on Ethereum’s ‘finality’-validators are just centralized nodes with staking badges. It’s not decentralization, it’s oligarchy with a whitepaper. 🤖💸

Rod Filoteo

THEY'RE LYING. The 2013 reorg? That was a CIA backdoor. They’ve been testing chain rewriting since Snowden. And now they want us to trust 6 confirmations? LOL. I only trust transactions that are printed on paper, buried in a vault, and signed by my dog. 🐕💣

Layla Hu

Thanks for explaining this clearly. I’ve been confused about why exchanges ask for so many confirmations. Now it makes sense. I’ll wait longer next time.

Nora Colombie

Why are we even talking about Bitcoin? America invented the internet, so of course it’s the most secure. China’s blockchain? Useless. Europe’s? Too slow. Only the U.S. has the grit to build real tech. And if you don’t like it, move to a country that doesn’t have 5G.

Greer Dauphin

Wait… so if I send $5000 in ETH and it finalizes in 3 minutes, but then the network gets hacked and they roll it back… I’m SOL? 😅 I feel like I’m playing Jenga with my life savings. But hey, at least it’s ‘decentralized’… right? 🤷♂️

Bhoomika Agarwal

Bitcoin? Pfft. India’s blockchain project will make this look like a toddler’s drawing. We don’t need ‘six confirmations’-we need one, fast, and unbreakable. And guess what? We’re building it. With chai and code. ☕️🇮🇳

Reggie Herbert

Incorrect. The 0.6% reorg rate is misleading-it’s measured per block, not per transaction. And the 6-confirmations rule is a heuristic, not a mathematical guarantee. You’re conflating probability with certainty. Also, ‘finality’ is a marketing term. There’s no such thing in PoW. Only risk attenuation.

Tatiana Rodriguez

I just cried reading this. Not because it’s sad-but because it’s so beautifully honest. We built a system that’s supposed to be unchangeable… but the moment it becomes too expensive to maintain, we change it anyway. That’s humanity. We don’t worship code-we worship outcomes. And when the outcome is worth more than the principle? We rewrite the rules. That’s not a flaw. It’s the point. 💔✨

justin allen

Y’all are overthinking this. Bitcoin’s just a meme. The real winners are the ones who sold at $60k. If you’re still waiting for confirmations, you’re already late. Also, the Fed owns 78% of all BTC. Wake up. 🚨

samuel goodge

Brilliantly articulated. One thing I’d add: the social layer of finality is the most fragile-and the most powerful. The DAO fork proved that. But here’s the deeper truth: we don’t need more blocks. We need better tools to measure trust. What if wallets could show you the economic weight behind each confirmation? Like: ‘This transaction is secured by $12B in hash power.’ That’s the future. Not more confirmations. More transparency.