Blockchain: How It Works, Why It Matters, and What’s Really Happening Today

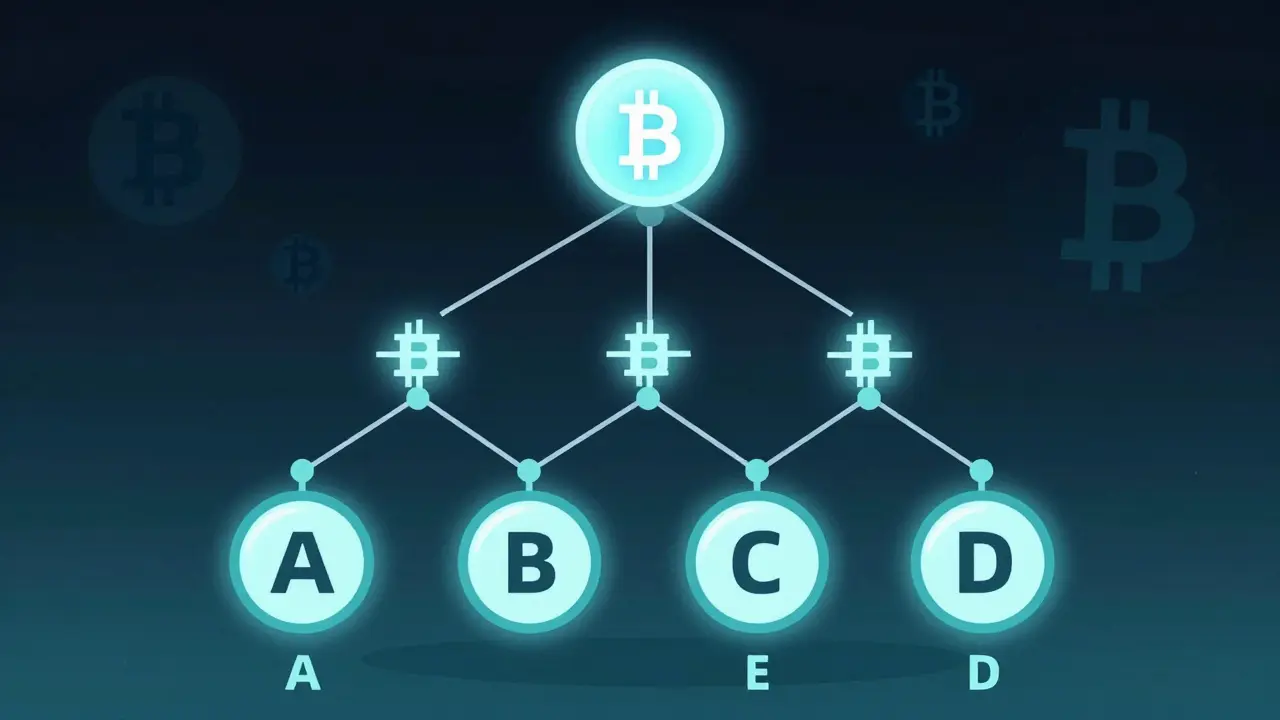

When you hear blockchain, a digital ledger that records transactions across many computers so that records can't be changed retroactively. Also known as distributed ledger technology, it's the backbone of Bitcoin and thousands of other projects—not because it’s flashy, but because it’s stubbornly reliable. It doesn’t need banks, governments, or middlemen to verify who owns what. Instead, it uses math, cryptography, and a network of strangers to keep things honest. That’s why it’s showing up everywhere—from tracking food supply chains to securing AI data and replacing traditional financial systems.

One of its biggest uses is in smart contracts, self-executing agreements coded directly into blockchain networks. These run automatically when conditions are met, like sending crypto when a payment is confirmed. That’s how platforms like Voltage Finance and Curve Finance operate without staff handling transactions. But smart contracts aren’t foolproof—poor code can cost millions, which is why blockchain security, the practice of auditing and protecting blockchain systems from exploits. Also known as smart contract auditing, it’s become a multi-million dollar industry. You’ll see posts here about audits costing $1,000 or $300,000, depending on how much is at stake. And you’ll also see why some projects, like MyBit or Lox Network, vanished after promising big things but never delivering real security or adoption.

Blockchains don’t exist in a vacuum. They’re shaped by laws. Countries like South Korea force traders to use real-name bank accounts. Vietnam slaps fines on businesses that accept Bitcoin. The EU demands strict anti-money laundering rules under MiCA. Meanwhile, the Philippines froze $150 million in crypto assets from unlicensed platforms. These aren’t random crackdowns—they’re reactions to how blockchain enables both freedom and fraud. That’s why some exchanges, like dYdX, block users in the U.S. or Canada: they’re trying to stay legal while claiming to be "decentralized." It’s messy. It’s real. And it’s exactly what you’ll find in the posts below.

You’ll read about how Bitcoin’s SHA-256 hashing algorithm keeps the network safe after 15 years, why airdrops like 1MIL or Landshare are mostly scams, and how GameFi tokens like Voxies and Fellaz try to turn gaming into ownership. You’ll see what happens when a DEX like Cybex dies from zero traffic, and why Canada’s Bitcoin ETF became the blueprint for the world. There’s no fluff here—just real stories about what blockchain actually does, who it helps, who it hurts, and why most projects fail.