Blockchain Finality: What It Is and Why It Matters for Crypto Security

When you send crypto, you need to know it’s final—not just pending, not just confirmed, but truly done. That’s where blockchain finality, the point at which a transaction is permanently settled and cannot be reversed comes in. It’s not just a technical detail. Without it, crypto would be useless. Imagine sending Bitcoin, seeing it land, then hours later it vanishes because someone rolled back the chain. That’s what blockchain finality prevents.

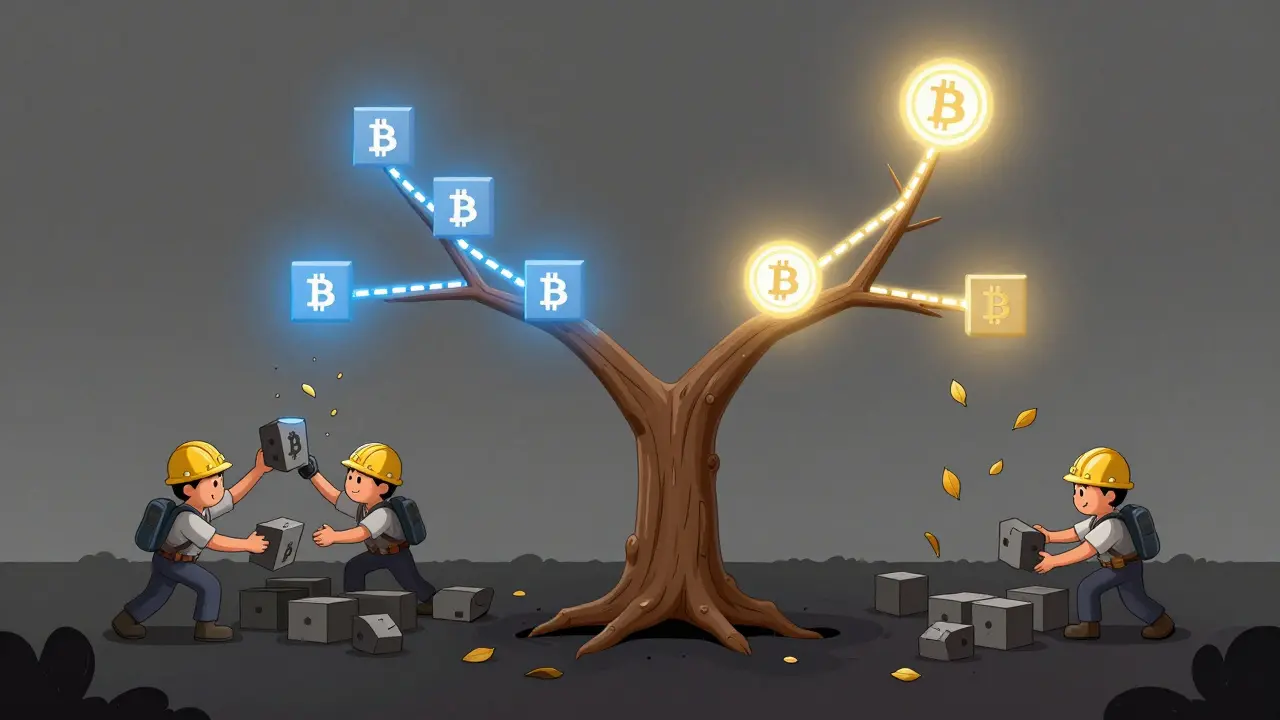

Finality doesn’t happen by magic. It’s built into how networks reach consensus, the process by which nodes agree on the state of the ledger. Bitcoin uses proof-of-work and waits for six blocks to be added—this is probabilistic finality. Ethereum switched to proof-of-stake and now uses finality gadgets, cryptographic mechanisms that guarantee irreversible blocks within minutes. Different chains have different ways, but they all aim for the same thing: certainty. When a transaction has finality, you can trust it like cash in your pocket.

Why does this matter to you? Because without it, exchanges can’t safely credit deposits, DeFi protocols can’t lock up your funds, and smart contracts can’t execute reliably. Look at what happened with some smaller chains that had weak finality—they got reorged, users lost money, and trust collapsed. Even big networks like Solana have had moments where finality broke under load. That’s why the posts below cover everything from exchange security to DeFi risks: they all tie back to whether the underlying blockchain can truly finalize transactions. You’ll find real examples—like Japan’s strict licensing rules, Upbit’s $34B fine, or why TradeOgre got shut down—all of which stem from failures in trust, and trust starts with finality. Whether you’re trading, staking, or just holding, understanding this concept keeps you from getting caught in the blind spots of the system.