Chain Reorganization: What It Is and Why It Matters in Blockchain Networks

When a chain reorganization, a process where a blockchain network replaces part of its recorded history with a longer, more valid version. Also known as blockchain reorg, it’s not a bug—it’s built into how decentralized ledgers stay secure and consistent. Think of it like a traffic reroute: if a faster, clearer road suddenly appears, your GPS updates your route—even if it means undoing a few turns you just made. That’s what happens when nodes on a blockchain find a longer chain of blocks that better reflects the true state of transactions. It’s automatic, it’s necessary, and it’s happening right now on Bitcoin, Ethereum, and dozens of other networks.

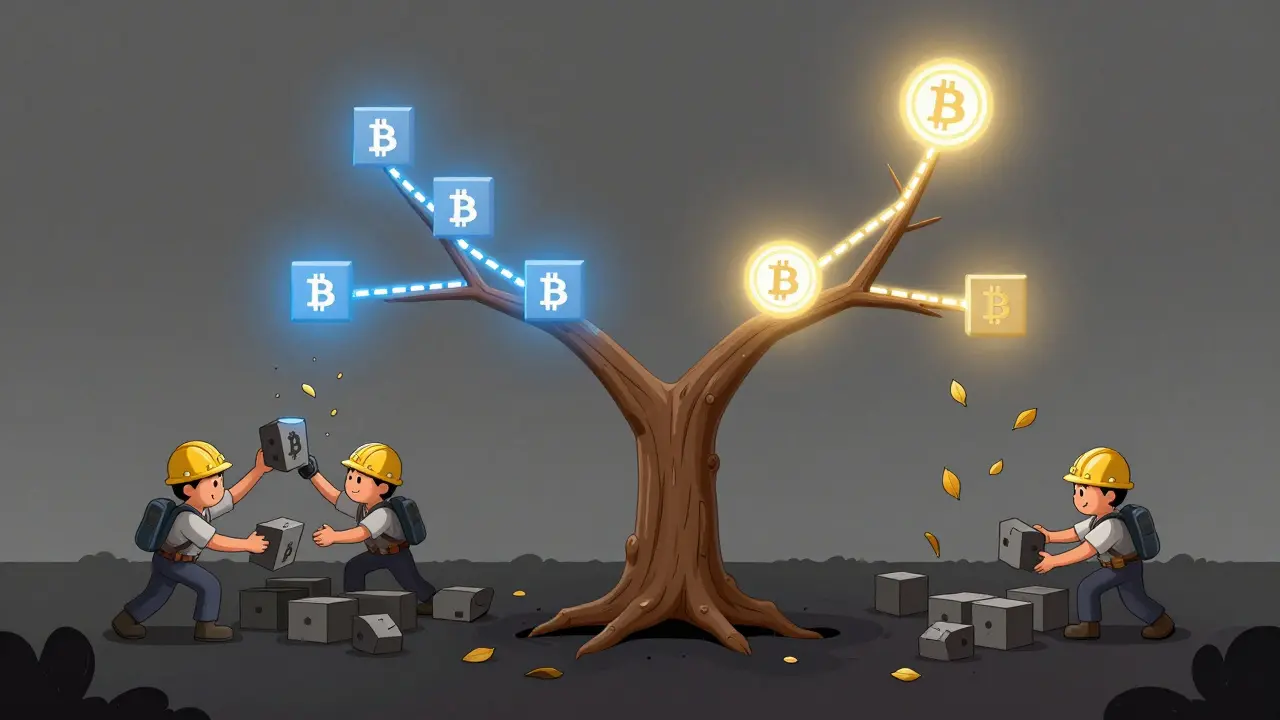

Chain reorganizations are tied directly to blockchain consensus, the system that lets decentralized networks agree on which transactions are valid. In proof-of-work chains like Bitcoin, miners compete to add the next block. Sometimes two miners solve it at nearly the same time, creating two competing chains. The network waits. Then, when one chain grows longer—adding more blocks—the shorter one gets abandoned. The transactions in the discarded blocks? They’re not erased. They’re just put back into the pool to be mined again. This is normal. But if you’re running an exchange or sending large payments, even a 2-block reorg can cause problems. That’s why exchanges like AscendEX and Upbit wait for 6 or more confirmations before crediting deposits—it’s not paranoia, it’s risk management.

Reorgs become dangerous when they’re too deep or happen too often. A 5-block reorg on Bitcoin? Rare. A 10-block reorg? Almost unheard of. But on smaller chains with less hashing power—like some meme coin networks or new L2s—reorgs can happen daily. That’s why projects like YodeSwap and LongBit failed: users couldn’t trust that their transactions would stick. When a chain reorganization becomes a pattern, it’s not a technical glitch—it’s a sign of weak security. That’s why regulators in Japan and South Korea now require exchanges to monitor reorg frequency as part of their compliance checks. A network that reorgs too often isn’t just unreliable; it’s vulnerable to double-spends and manipulation.

Understanding chain reorganization helps you spot real threats. If you see a coin’s price drop suddenly after a reorg, it’s not market panic—it’s likely a failed double-spend attempt. If a platform claims to offer instant confirmations on a low-hash-rate chain, run. Real security isn’t about speed. It’s about depth. The longer the chain, the harder it is to rewrite. That’s why Bitcoin’s 14-year history is its strongest feature—not its code, not its brand, but the sheer weight of its accumulated blocks.

What you’ll find below are real stories of how chain reorganizations impacted users, exchanges, and entire networks—from the quiet reorgs that went unnoticed, to the ones that cost people millions. You’ll see how platforms like ARzPaya and TradeOgre handled them, how scams like CovidToken exploited confusion around them, and why even the most advanced DeFi protocols still struggle to fully protect against them. This isn’t theory. It’s what’s happening on the chains you use every day.