Cybex DEX: What It Is, How It Works, and Why It Matters in DeFi

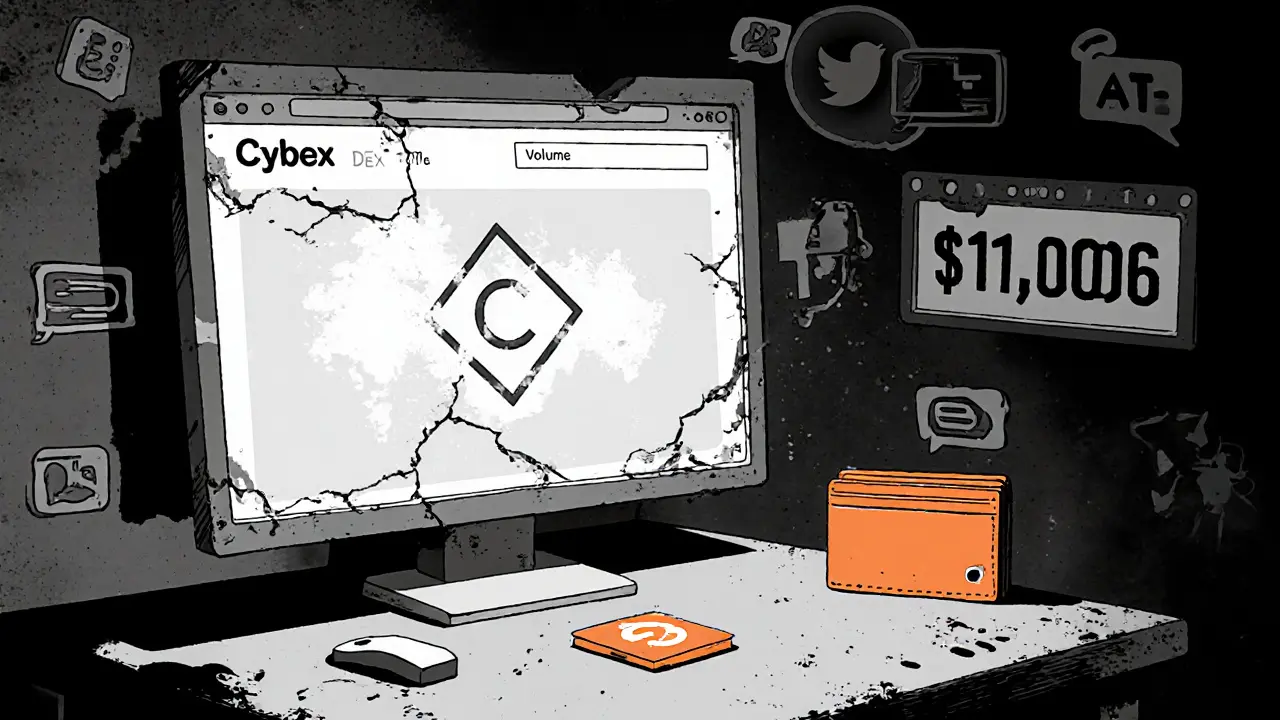

When you trade crypto without handing over your keys, you’re using a Cybex DEX, a decentralized exchange that lets users trade directly from their wallets without a middleman. Also known as a non-custodial exchange, it runs on blockchain logic—no bank, no CEO, no account freeze. That’s the whole point. Unlike Binance or Coinbase, Cybex DEX doesn’t hold your funds. You sign trades with your private key, and smart contracts do the rest. This isn’t just convenience—it’s control. And in a world where exchanges get hacked or shut down, that matters.

Cybex DEX is part of a broader shift toward DeFi trading, a system where financial services like lending, borrowing, and swapping run on open protocols instead of banks. It’s not alone—Uniswap, SushiSwap, and dYdX are in the same space. But Cybex DEX stands out because it’s optimized for speed and low fees, especially on blockchains like Binance Chain and Ethereum L2s. It’s built for traders who want to swap tokens in seconds, not minutes, and pay pennies instead of dollars in gas. That’s why users tired of Ethereum’s spikes turn to it. And it’s why regulators watch it closely—because if you can trade without KYC, you’re harder to track.

What you won’t find on Cybex DEX? Customer support lines, fiat on-ramps, or insurance for lost keys. That’s the trade-off. You get freedom, but you also get full responsibility. If you mess up a transaction, there’s no reset button. That’s why the people who use it best are those who already understand wallets, gas limits, and slippage settings. It’s not for beginners who just want to buy Bitcoin and forget about it. It’s for those who want to move fast, stay private, and own their assets—every step of the way.

What you’ll find in the posts below? Real-world breakdowns of how Cybex DEX compares to other platforms, what happens when liquidity dries up, and why some traders swear by it while others avoid it entirely. You’ll also see how it fits into the bigger picture of decentralized finance—where trust isn’t given, it’s coded. No fluff. No hype. Just what works, what doesn’t, and why.