Defunct Crypto Exchange: What Happens When a Crypto Platform Dies

When a defunct crypto exchange, a cryptocurrency trading platform that has permanently closed, stopped operations, or vanished without warning. Also known as a failed crypto exchange, it leaves users with locked funds, no customer support, and often no legal recourse. This isn’t rare—over 200 crypto exchanges have shut down since 2017, and many of them took millions in user funds with them. The most infamous cases like Mt. Gox, FTX, and Celsius didn’t just disappear—they collapsed under poor management, fraud, or regulatory pressure, and ordinary people lost everything.

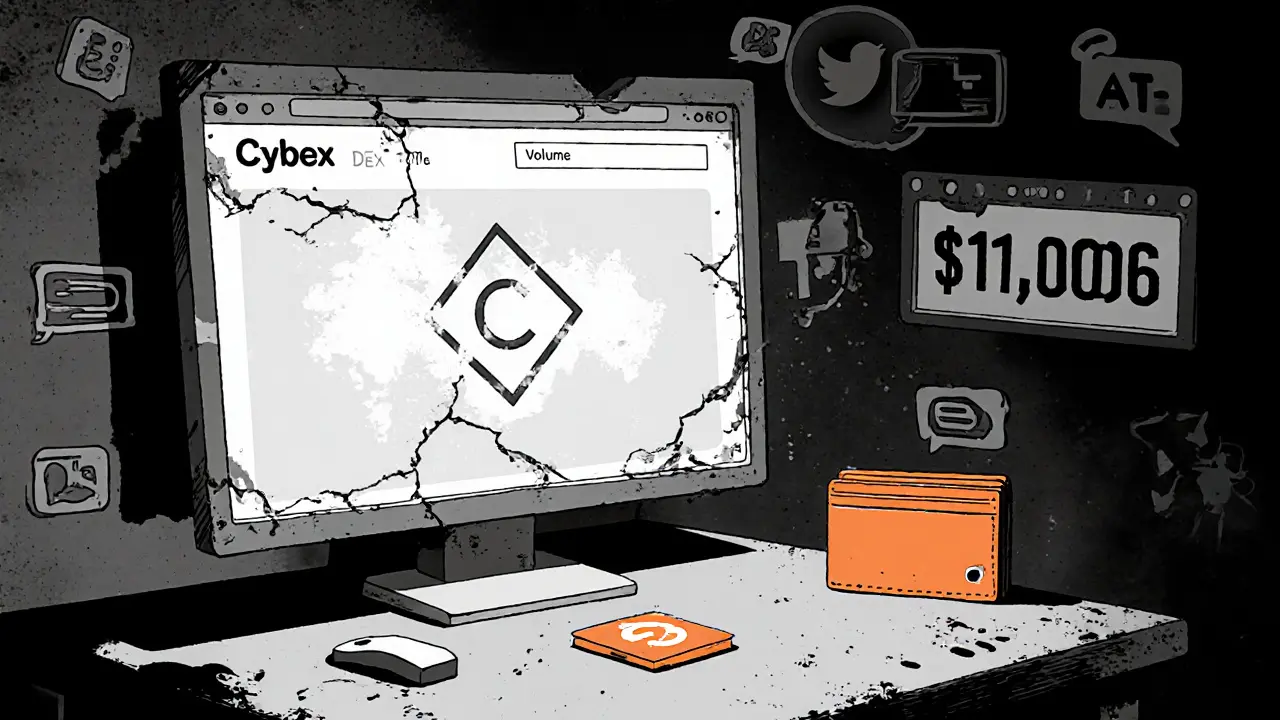

A crypto exchange shutdown, the permanent closure of a platform where users trade or store digital assets doesn’t always come with a warning. Some platforms slowly fade away—updating less, responding to support tickets slower, then going silent. Others crash overnight, with founders disappearing and websites replaced by blank pages. In many cases, the exchange wasn’t even properly licensed. That’s why abandoned crypto platform, a service that once offered trading or staking but now has no active development, team, or customer service is often a red flag long before the site goes dark. These platforms usually have low trading volume, no clear business model, and rely on hype to attract users—exactly what happened with projects like MyBit (MYB) and Lox Network (LOX), both of which are now dead tokens with zero real-world use.

When a defunct crypto exchange dies, your coins don’t just sit there waiting. They’re often moved, stolen, or frozen by regulators. In the Philippines, $150 million in crypto assets were seized from unlicensed exchanges, trapping users who thought they were safe. In Vietnam and China, crypto trading is outright banned, so even active exchanges there operate in legal gray zones—and can vanish at any moment. Even platforms that claim to be decentralized, like dYdX, still block users in certain countries, showing that control and compliance are still central to how these services operate. The lesson? If an exchange feels too good to be true—low fees, crazy rewards, no KYC—it probably is. And when it dies, you won’t get your money back.

What you’ll find below are real cases of exchanges that vanished, tokens that became worthless, and users who lost everything. You’ll see how regulators stepped in, how scams spread after the collapse, and what steps—however slim—can help you recover lost assets. This isn’t theory. These are the stories of people who trusted the wrong platform. Don’t be next.