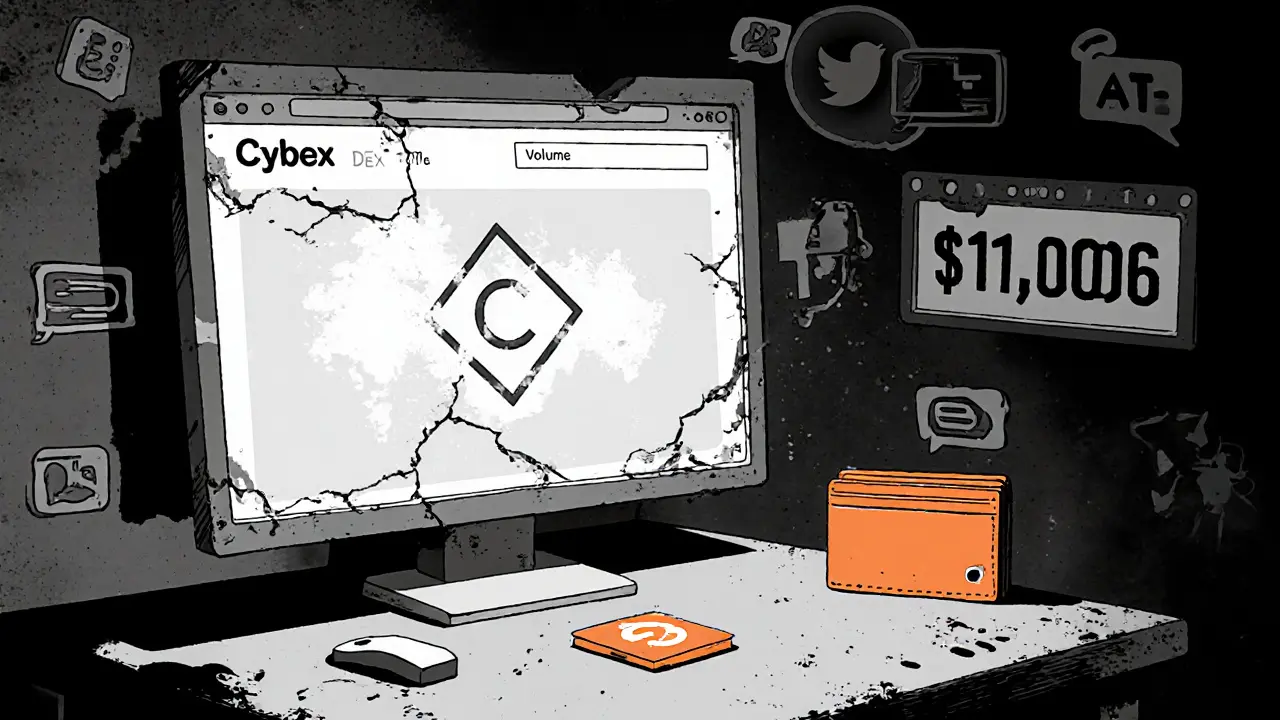

DEX Failure: Why Decentralized Exchanges Crash and What It Means for You

When a DEX failure, a breakdown in a decentralized exchange where users can’t trade, withdraw, or access funds. Also known as DeFi exchange collapse, it’s not just a technical glitch—it’s a trust crisis. Unlike centralized platforms like Binance or Coinbase, DEXs run on code, not companies. No customer support, no human backup. If the smart contract breaks, your money might vanish with it.

Most DEX failures, happen because of low liquidity, flawed code, or sudden market shocks. Liquidity crisis is the biggest killer. Take Voltage Finance—it’s fast and cheap, but if no one’s trading, your swap might fail or slippage crushes your trade. Then there’s smart contract exploits, when hackers find a loophole in the code and drain funds. Flash loans are often used in these attacks, letting criminals borrow millions instantly to manipulate prices and empty pools. Even big names like dYdX aren’t immune—they block users in the U.S. and UK, proving that "decentralized" doesn’t mean free from control. And when a DEX dies, users don’t get refunds. They get silence.

Real-world cases show how this hits regular people. The Philippines froze $150 million in assets from unlicensed exchanges, trapping users who thought they were safe. Vietnam fines businesses for accepting crypto payments—even though people still use it. These aren’t isolated events. They’re signs of a system still finding its feet. DEX failure isn’t rare. It’s predictable. And if you’re using a DEX without checking its liquidity, audit history, or team activity, you’re gambling.

What you’ll find here aren’t just stories of collapse. You’ll see the patterns behind them: how audits fail, why some tokens vanish overnight, and how scams mimic real projects. From the $1 million fine for crypto payments in Vietnam to the abandoned MyBit coin that’s now worth pennies, this collection shows what happens when hype outpaces reality. You’ll learn how to spot a dying DEX before it’s too late—and how to protect your funds when the code doesn’t work the way it should.