Ethereum Finality: What It Is and Why It Matters for Crypto Security

When you send ETH or interact with a DeFi app, you need to know that transaction is final—not just confirmed, but truly done. That’s where Ethereum finality, the point at which a transaction is permanently settled on the blockchain and cannot be reversed. It’s the backbone of trust in Ethereum’s network. Before Ethereum switched to proof of stake in 2022, finality was shaky. Blocks could be reorganized, and transactions might vanish if a longer chain appeared. Now, thanks to the proof of stake, a consensus system where validators stake ETH to secure the network, finality is built into the protocol itself. Validators vote on blocks, and once enough votes pile up, the block becomes final. No more reorgs. No more uncertainty.

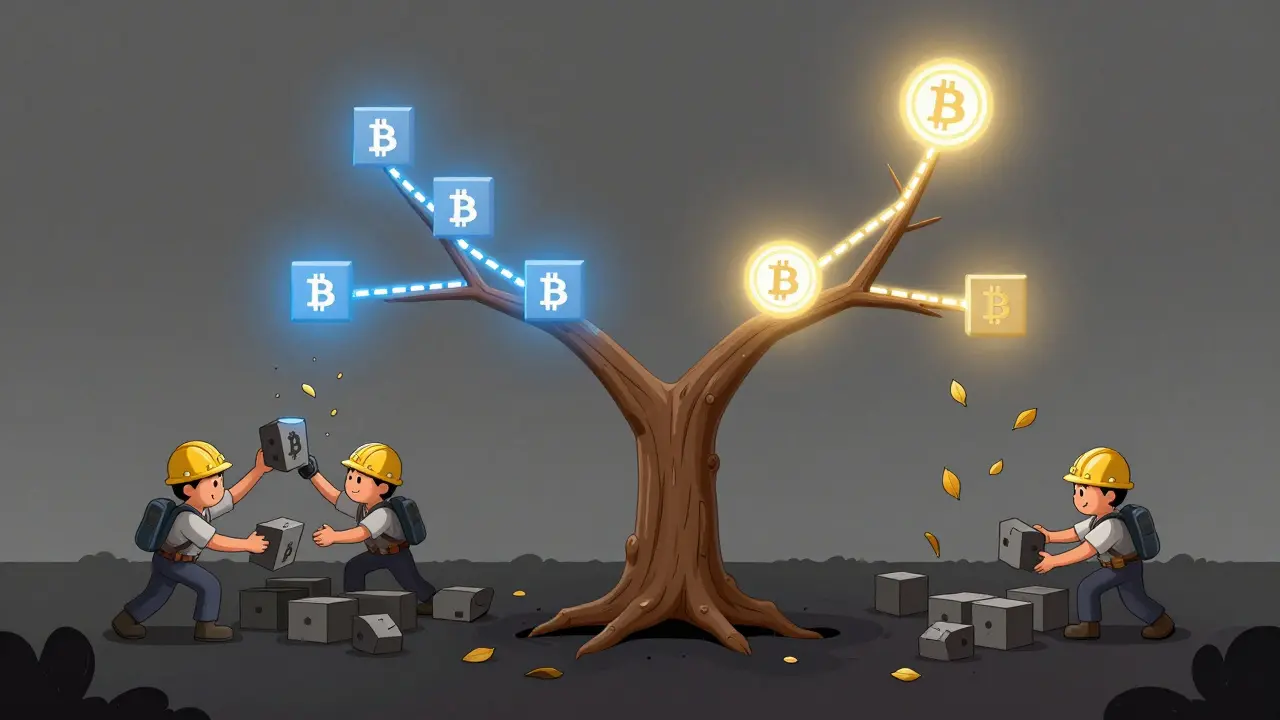

This shift didn’t just make Ethereum faster—it made it safer. Finality means exchanges can instantly credit deposits, DeFi protocols can lock funds without fear of reversal, and smart contracts can execute with confidence. It’s why Ethereum can now support billions in locked value. The system uses something called finality gadgets, a technical layer that confirms when a block has reached irreversible consensus. These gadgets work with the Casper FFG consensus algorithm to guarantee that once a block is finalized, even a majority of malicious validators can’t undo it. That’s a massive upgrade from the old proof of work days, where 6 confirmations were needed just to feel safe.

But finality isn’t magic. It depends on honest validators and enough stake behind them. If too many validators go offline or get slashed, finality slows down. That’s why monitoring validator health matters—not just for developers, but for anyone holding ETH or using Ethereum-based apps. The security of your assets ties directly to how reliably Ethereum finalizes blocks. You don’t need to understand the math behind it, but you do need to know it’s happening. Below, you’ll find real-world examples of how finality impacts exchanges, DeFi, and even regulatory compliance. Some posts show how exchanges rely on finality to avoid double-spending. Others expose scams that pretend to offer "instant finality" on fake chains. You’ll see what works, what doesn’t, and why Ethereum’s approach is now the standard others try to copy.