Failed Crypto Platform: What Happens When a Crypto Project Dies

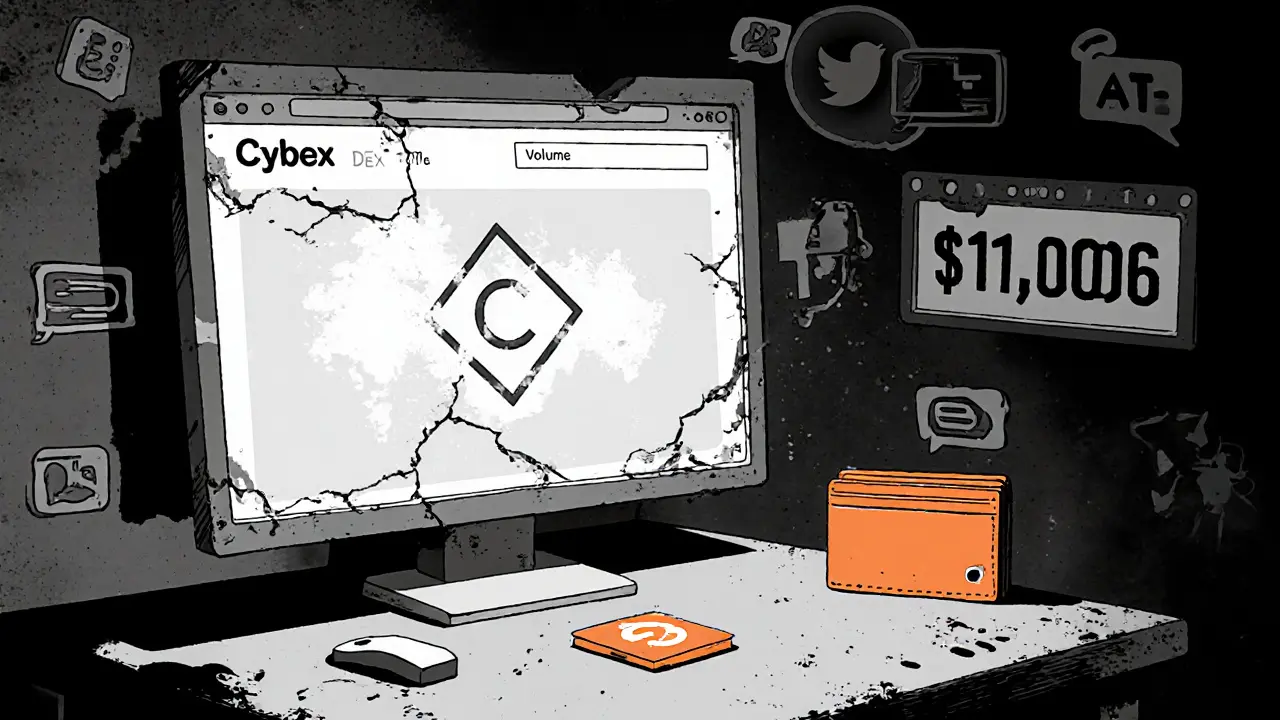

When a failed crypto platform, a blockchain project that collapsed due to fraud, mismanagement, or lack of adoption. Also known as a crypto project collapse, it leaves behind frozen wallets, empty whitepapers, and users who lost everything. This isn’t rare. In 2023 alone, over $2 billion in crypto value vanished from projects that disappeared without warning. You might think it’s just bad luck, but most collapses follow the same pattern: hype, withdrawal, then silence.

Behind every abandoned crypto token, a digital asset with no active development, community, or exchange listings is a story of broken promises. Take MyBit (MYB) — once promoted as a way to tokenize real estate, it vanished after 2018. Its token still trades for pennies, but no one’s building anything. Same with Lox Network (LOX), which promised to stop phone theft using blockchain but never got past a website. These aren’t isolated cases. They’re symptoms of a system where anyone can launch a token, promise moonshots, and walk away with cash.

What makes a crypto scam, a deliberate deception to steal funds under false pretenses different from a genuine failure? Often, it’s intent. A failed platform might just run out of money. A scam starts with theft. Voltage Finance, for example, isn’t a scam — it’s niche and underused. But 1MIL airdrops or fake Landshare campaigns? Those are pure fraud. They mimic real projects, trick you into connecting wallets, then drain your funds. The real danger isn’t volatility — it’s pretending to be something you’re not.

And it’s not just about money. When a platform fails, it hits real people. In the Philippines, $150 million in crypto assets got frozen because exchanges weren’t licensed. Users couldn’t access their funds. In Vietnam, businesses got fined for accepting Bitcoin. These aren’t edge cases — they’re the new normal. Regulation is catching up, but most users still don’t know how to spot a red flag before it’s too late.

You’ll find posts here that break down exactly how these collapses happen. Some show you how audits failed, others reveal how teams disappeared with funds. You’ll see how airdrops are weaponized to lure victims, and how even supposedly "decentralized" platforms like dYdX block users based on location — exposing the gap between theory and reality. This isn’t theory. It’s documented. These are real projects, real losses, and real lessons. What you’re about to read isn’t just history — it’s your armor against the next one.