Polkadot DeFi: What It Is, How It Works, and What You Need to Know

When you hear Polkadot DeFi, a decentralized finance ecosystem built on the Polkadot blockchain that connects multiple blockchains to share security and data. Also known as cross-chain DeFi, it lets you move assets and run apps across different networks without relying on bridges that often break or get hacked. Unlike Ethereum, where everything runs on one chain, Polkadot uses a relay chain and parachains—specialized blockchains that work together. This design means DeFi apps on Polkadot can be faster, cheaper, and more secure because they don’t compete for space or gas fees.

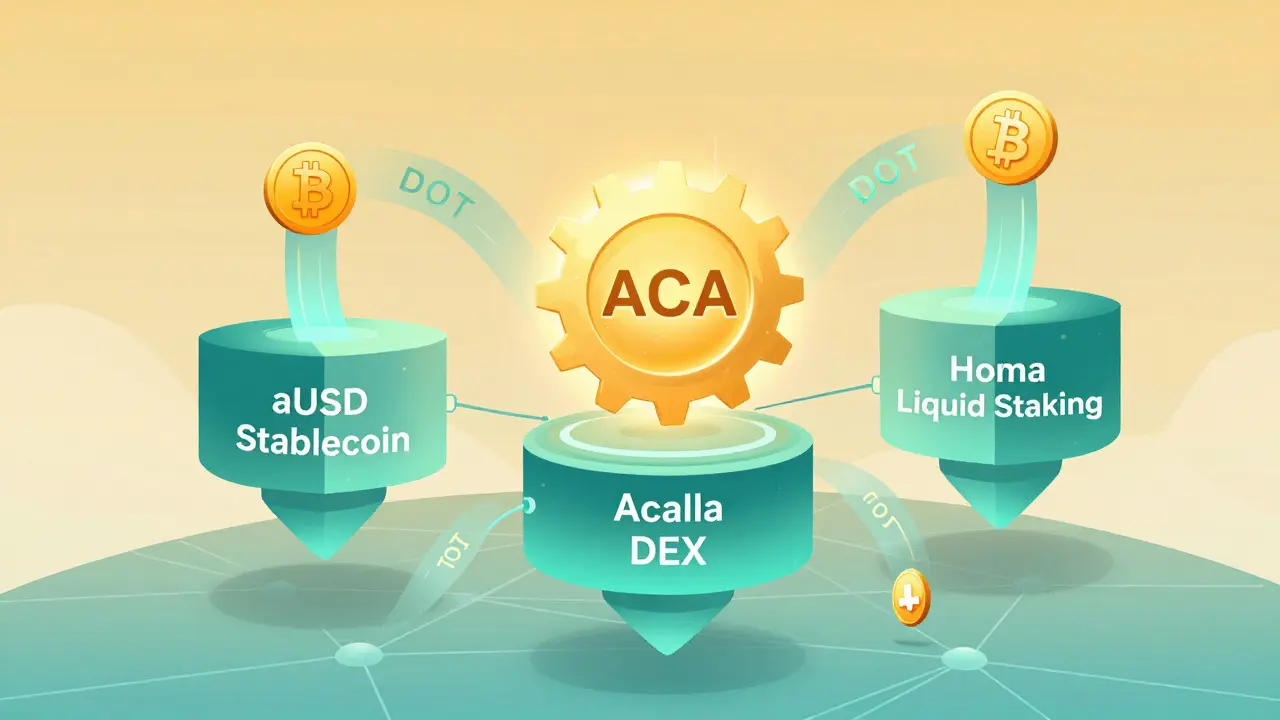

One of the biggest advantages of Polkadot, a multi-chain network designed to connect independent blockchains into a single interoperable system. Also known as the blockchain of blockchains, it is how it handles upgrades. If a parachain like Acala or Moonbeam needs a change, it can update without slowing down the whole network. That’s why projects like parachains, independent blockchains that connect to Polkadot’s relay chain to share security and communication can experiment with new DeFi features—like automated yield strategies or cross-chain lending—without risking the entire system. And because Polkadot’s security model is shared, even smaller parachains get protection from the same validators that secure the relay chain.

But Polkadot DeFi isn’t just about tech—it’s about choice. You can trade tokens on a DEX like Acala, stake DOT to earn rewards, or borrow stablecoins on Moonbeam—all while keeping your assets on the chain that works best for each task. No more paying $50 in gas to swap two tokens. No more waiting hours for a transaction to confirm. And unlike Ethereum, where most DeFi apps are crowded and expensive, Polkadot’s ecosystem is still growing, which means better rates and fewer bottlenecks for early users.

What you’ll find in the posts below isn’t hype. It’s real breakdowns of platforms that actually work—or didn’t. You’ll see reviews of exchanges that support Polkadot assets, warnings about fake airdrops pretending to be tied to Polkadot projects, and honest takes on which DeFi tools are worth your time. Some posts cover how to safely store DOT and KSM, others explain why certain parachains failed. There’s no fluff. Just facts about what’s live, what’s dead, and what to watch out for in 2025.