CYI Slippage Calculator

Calculate how much CYI you'd actually receive when buying with current market conditions (as of October 2024).

Current price: $0.000307

Slippage: 8.7% (Average for CYI)

Estimated Purchase

Enter amount to see results

Slippage: $0.00 (0.00%)

Most people hear about Bitcoin or Ethereum and assume that’s all there is to crypto. But the real action now isn’t just about buying and holding-it’s about CYI by Virtuals, a crypto token built for one thing: letting an AI agent hunt for the best yield farming opportunities on its own. If you’ve ever spent hours scrolling through DeFi protocols trying to find the next high APY, CYI is designed to do that for you. But here’s the catch-it’s not magic. It’s code, data, and risk, all wrapped in a shiny AI label.

What Exactly Is CYI?

CYI is the native token of the Virtuals Protocol’s AI agent system, specifically built to power an autonomous agent focused on decentralized finance (DeFi) yield farming. Unlike other tokens that just represent ownership or access, CYI fuels an AI that scans multiple DeFi platforms-like Uniswap, Pendle, and Curve-on the Base blockchain to find the most profitable staking and liquidity pool opportunities. It doesn’t just report results. The goal, as outlined by Virtuals in late 2024, is for this AI to eventually control its own wallet and automatically reinvest earnings for token holders.

The token runs on Base, Coinbase’s Ethereum Layer 2 network. That means lower fees and faster trades than on Ethereum mainnet. It’s not on BSC or Solana. It’s not on Arbitrum. It’s on Base. That limits its reach but also keeps costs low for users already in the Coinbase ecosystem.

How Does CYI Work?

Here’s how it’s supposed to work: You buy CYI. The AI agent, called CYI Agent, uses your token holdings as a signal of trust and interest. Every day, it analyzes 27 different DeFi protocols on Base, checks current APYs, liquidity depth, risk scores, and historical performance. Then it sends you a recommendation: “Stake 1,000 USDC in Curve pool X, withdraw from Y after 7 days.”

Right now, you still have to act on those recommendations yourself. You open your wallet, go to the protocol, approve the transaction, and confirm. The AI doesn’t move your money yet. But according to Virtuals’ roadmap, that changes in early 2025. The plan is for the CYI AI to gain full control of a wallet funded by pooled token holder deposits, then auto-deploy capital based on its analysis-and distribute profits back to CYI holders.

That’s the big promise: an AI that works like a hedge fund manager, but without the fees, human bias, or sleep schedule.

Where Can You Buy CYI?

You can’t buy CYI on Coinbase, Binance, or Kraken. It’s only available on decentralized exchanges-specifically Uniswap V2 and V3 on the Base network. To get it, you need a Web3 wallet like MetaMask, connected to Base. You’ll need to bridge ETH from Ethereum to Base (using Coinbase’s bridge or LayerZero), then swap it for CYI on Uniswap.

Here’s the problem: liquidity is thin. As of October 2024, the daily trading volume for CYI/VIRTUAL (the main trading pair) was around $2,600. That’s tiny. If you try to buy $500 worth, you might see the price jump 10-15% during your transaction because there aren’t enough sellers. Slippage averages 8.7%, according to Dextools. That means you pay more than you expected-and you might not even get the amount you wanted.

Current Market Stats (as of October 2024)

Here’s what the numbers look like:

- Price: ~$0.000307 USD (0.138 JPY)

- Market Cap: ~$3 million USD

- Rank: #3529 on CoinMarketCap

- Circulating Supply: 9.8 billion CYI

- All-Time High: 1.29 JPY (~$0.0085 USD)

- All-Time Low: 0.101 JPY (~$0.000067 USD)

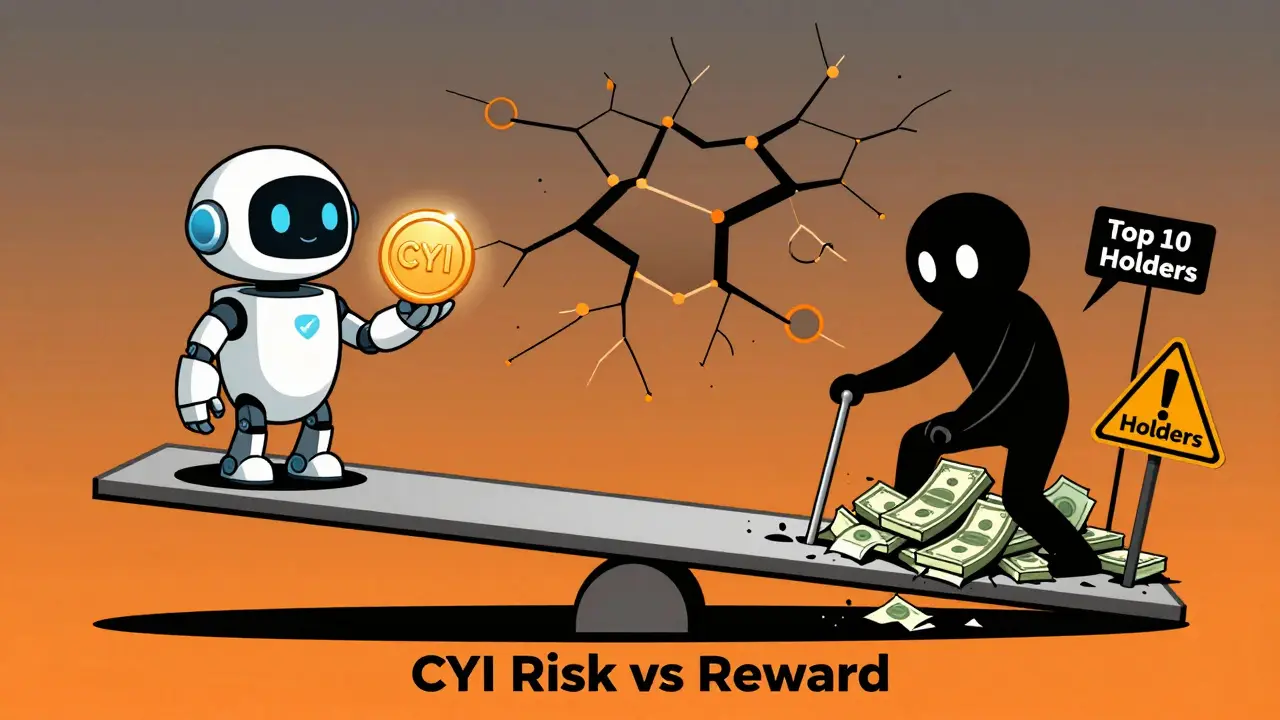

- Top 10 Holders: Own 72% of total supply

- Unique Holders: 1,842 wallet addresses

That concentration is a red flag. If those top 10 wallets dump even 5% of their holdings, the price could crash. And there’s no vesting schedule or team lock-up publicly disclosed. You’re trusting anonymous developers with a token held mostly by a handful of wallets.

Why CYI Is Different From Other AI Crypto Tokens

Virtuals has built several AI agents: Luna (general assistant), Aixbt (Bitcoin news), and CYI (DeFi yield). CYI is the only one focused purely on financial returns. Luna might tell you what’s trending on Twitter. CYI tells you where to put your money to earn the most.

Compare CYI to AAVE or Yearn.finance. Those are established DeFi protocols with billions in locked value. CYI’s market cap is a fraction of a percent of theirs. But it’s not trying to be them. It’s trying to be their smart assistant.

That’s its niche. If you’re already active in DeFi on Base and want an AI to do the research for you, CYI is one of the few options. If you’re looking for a stable, widely adopted token with strong security audits and community governance-this isn’t it.

Is CYI Safe?

Let’s be blunt: no, not really. Not yet.

First, the AI’s decision-making process is a black box. There’s no public documentation on how it’s trained, what data sources it uses, or how it weighs risk versus reward. Senior analyst Elena Rodriguez from Blockchain Council pointed out this lack of transparency in September 2024. How do you trust an AI that won’t explain its logic?

Second, the planned wallet control feature raises serious security questions. If the AI starts moving funds automatically, what happens if it gets hacked? What if it makes a bad call and drains the pool? The SEC already warned in October 2024 that autonomous AI agents giving investment advice might be considered unregistered financial advisors. That’s a legal minefield.

Third, the community is small. Only 1,238 people follow CYI on Twitter. The Discord has 4,215 members, but most are general Virtuals users-not CYI specialists. There’s no dedicated support channel. GitHub has open issues from users complaining about poor documentation.

Who Is CYI For?

CYI isn’t for beginners. It’s not for people who just want to HODL. It’s for:

- DeFi enthusiasts who already use Base and understand liquidity pools

- Traders tired of manually checking APYs every day

- Early adopters willing to take high risk for potential high reward

- Those who believe AI will soon manage capital better than humans

If you’re not comfortable connecting your wallet to a DEX, understanding slippage, or bridging assets between chains-you should stay away.

But if you’re one of those people who spends 30 minutes a day checking DeFiLlama and tweaking your positions? CYI could save you hours. And if the AI actually starts managing wallets in early 2025 as promised? You might be looking at a new kind of passive income.

What’s Next for CYI?

The roadmap is clear: full wallet control by Q1 2025. That’s the make-or-break moment. If the AI starts generating consistent, safe yields and distributes profits to holders without glitches or hacks, CYI could become a pioneer. If it fails? The token could lose 90% of its value overnight.

Virtuals CEO Alex Masmej says AI-managed capital will be standard in DeFi within three years. That’s ambitious. But Delphi Digital’s Tom Frost says current AI agents aren’t ready for direct fund management. He’s probably right. Most AI models still hallucinate. What if the CYI agent thinks a high-yield farm is safe-and it’s a rug pull?

For now, CYI is a bet on the future. Not a product you can rely on today.

Final Thoughts

CYI by Virtuals isn’t just another meme coin. It’s one of the first real attempts to merge AI with DeFi in a way that could change how people earn from crypto. But it’s still in its infancy. The tech is promising. The execution is shaky. The risks are high. The potential reward? Maybe life-changing-if everything goes right.

Buy CYI if you’re comfortable betting on a high-risk, high-reward experiment. Don’t buy it if you’re looking for stability. And don’t invest more than you’re willing to lose-because if the AI goes rogue, or the team disappears, or regulators shut it down, you won’t get your money back.

The future of DeFi might be AI-driven. But we’re not there yet. CYI is the first step. And like all first steps, it’s a little unsteady.

Kenneth Ljungström

This CYI thing is wild 😅 I’ve been manually juggling APYs on Curve and Uniswap for months-imagine if the AI actually worked. I’m not investing big, but I’m watching it like a sci-fi movie. If it doesn’t rug, I might just throw in $200 for fun.

Sandra Lee Beagan

The black-box AI governance model is a red flag from a DeFi governance standpoint. Without transparent risk-weighting algorithms or on-chain audit trails, we’re essentially delegating capital allocation to an opaque ML model with no recourse. The regulatory exposure alone-especially under MiCA or SEC guidance-makes this a high-risk speculative instrument, not a yield product.

Shane Budge

Liquidity is trash. $2.6k volume? That’s a meme, not a market.

sonia sifflet

You people are so naive. This isn’t AI-it’s a pump-and-dump with fancy buzzwords. Top 10 wallets own 72%? And you think this is ‘innovation’? It’s a rug waiting to happen. Anyone who buys this is either desperate or dumb. I’ve seen this script a hundred times. Don’t be the last one holding the bag.

Jonathan Sundqvist

Why the hell is this even on Base? If you’re gonna do AI DeFi, go big. Ethereum, Arbitrum, Solana-those are real chains. Base is just Coinbase’s playground for newbies who can’t even use a wallet properly. This token’s got zero chance unless it moves to a real chain.

Doreen Ochodo

If you’re tired of checking DeFiLlama every day, this could be your ticket. Not a get-rich-quick scheme-just a tool. But only if you’re already deep in Base. Don’t come in blind.

Yzak victor

I get the hype but also the fear. AI managing wallets? Sounds like a dream until it turns into a nightmare. What if it auto-swaps into a scam pool because it misread a liquidity signal? We’ve seen bots do dumb stuff before. This needs a kill switch. And a public audit. And a team with faces. Not just a whitepaper and a Discord.

Holly Cute

Let’s be real-this is the crypto equivalent of a TikTok finance guru telling you to ‘buy the dip’ while they short it. The AI doesn’t ‘hunt yield,’ it hunts liquidity. And right now, the only thing it’s hunting is your wallet. The all-time high was $0.0085? That’s a pump by insiders. The current price? That’s the dump. And the fact that the team won’t lock their tokens? Classic. I’d rather lose money on a rug pull I can see coming than one wrapped in AI jargon.

Josh Rivera

Oh wow, an AI that doesn’t even know how to stop a rug pull? Brilliant. So now we’re outsourcing our financial survival to a bot that probably thinks ‘high APY’ means ‘safe’. Next they’ll release an AI that tells you to invest in your cousin’s NFT collection. This isn’t innovation. It’s delusion with a whitepaper.

Neal Schechter

For anyone thinking of dipping in: make sure you understand slippage and bridging first. If you don’t know what a Layer 2 is, don’t touch this. But if you’re already on Base and know your way around a wallet? This could be worth a tiny gamble. Just don’t go all-in. And maybe wait until Q1 2025 to see if the wallet control actually launches without a meltdown.

Madison Agado

It’s funny how we call this ‘AI-powered’ like it’s sentient. It’s just a script that reads API endpoints and makes trades. The real question isn’t whether the AI works-it’s whether we’re ready to surrender financial agency to code that can’t explain itself. Are we trading for profit… or just outsourcing our responsibility to something that doesn’t care if we lose?

Billye Nipper

I’m so excited for this!!! It’s the future!!! Imagine waking up and your money is working for you!!! No more stress!!! The AI will do everything!!! Just trust the process!!! And don’t worry about the 72% concentration or the thin liquidity or the anonymous devs or the SEC warning or the fact that the whole thing has less than 2k holders!!! This is it!!! This is the next big thing!!!