VOLT.WIN isn't a cryptocurrency you buy to hold. It's not a project with a team, a roadmap, or real-world use. It's a speculative token built on the TitanX blockchain with a single goal: to create extreme price swings through aggressive token burning. If you're looking for a long-term investment, VOLT.WIN isn't it. If you're chasing a quick, high-risk gamble, you need to understand exactly what you're getting into.

How VOLT.WIN Works: Burn, Burn, Burn

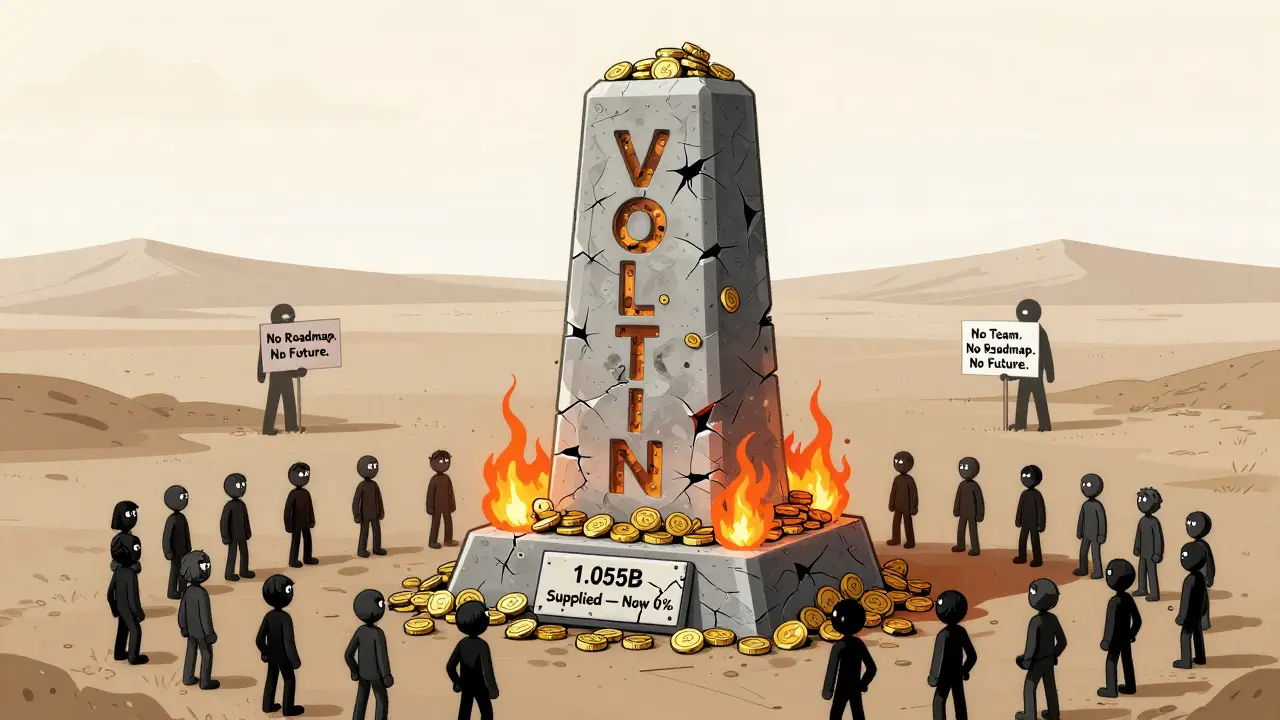

VOLT.WIN's entire design revolves around destroying tokens. Its creators claim a total supply of 1.055 billion VOLT, with 100% of those tokens distributed within the first 10 days after launch. After that, the system goes into full deflation mode. Here's the math: 80% of every transaction fee is used to buy back VOLT tokens and immediately burn them. Another 8% goes into a bonded liquidity pool to keep trading alive. That means nearly 90% of every trade actively reduces the number of VOLT tokens in circulation.This is meant to create scarcity. Less supply, the theory goes, should mean higher prices. But this only works if people keep buying. Once demand dries up, the burning mechanism becomes a one-way street to zero. Unlike Binance Coin (BNB), which burns tokens quarterly using real profits from its exchange, VOLT.WIN has no revenue stream. There's no business. No product. Just code that burns tokens based on trading volume.

Price Chaos: No One Knows What It's Worth

Try to find the price of VOLT.WIN and you'll hit a wall. One exchange says $0.0013. Another says $0.0007. CoinCodex listed it at $0.002466 just months ago. The price swings wildly because there's almost no trading volume. Coinbase reported $21,340 in 24-hour volume in December 2023. Uniswap, where most trading happens, showed only $2,070. That's less than the cost of a single Bitcoin ATM transaction.This tiny volume means even small trades move the price. One user reported a 15% price drop just trying to sell $500 worth of VOLT. Slippage isn't a minor issue-it's the norm. Experienced traders say you need to set slippage tolerance at 5-10% just to get your trade to go through. That means you could buy at $0.001 and instantly lose 10% of your value before the trade even confirms.

Why the Numbers Don't Add Up

The data on VOLT.WIN is a mess. Coincarp says 419 million tokens are circulating. Coinbase says 569 million. CoinGecko says 550 million. Which one is right? No one knows. The official contract address is 0x66b5228CfD34d9f4d9f03188d67816286C7c0b74, but even that doesn't resolve the confusion. Wallets holding VOLT.WIN? Only about 1,247 unique addresses as of late 2023. That's not a community. That's a handful of people.Market cap numbers are even more unreliable. One source says $747,872. Another says $0. The token has been ranked anywhere from #4604 to #5109 by market cap. These aren't minor differences-they show that no platform can agree on basic facts. If you can't trust the data, you can't make a smart decision.

It's Not a Coin. It's a Casino Chip.

VOLT.WIN has no utility. You can't pay for anything with it. It doesn't power a platform. It doesn't reward content creators or secure a network. It doesn't even have a whitepaper or a known development team. The entire value proposition is based on the hope that someone else will pay more for it tomorrow.Compare that to Bitcoin, which has a global network of miners and users. Or even BNB, which powers one of the largest crypto exchanges. VOLT.WIN has none of that. Its only advantage is extreme volatility. In October 2023, it surged 271% in a single day. That’s the kind of spike that attracts gamblers. But it also crashed 98% from its all-time high of $0.0798. That’s not a market. That’s a trap.

What the Experts Say

Analysts don't see a future for VOLT.WIN. CoinCodex predicted a 26.72% price drop by November 2025 and suggested short-selling the token could yield over 37% profit. BeInCrypto acknowledged the burn mechanism but questioned its sustainability without real development. The consensus? No ecosystem. No team. No updates. No future.There's no official website. No Telegram group with active support. No GitHub repository showing code progress. The only documentation comes from third-party sites like Coincarp, which themselves admit they can't predict its value in five years. The project appears completely dormant since launch.

Who Should Avoid VOLT.WIN

If you're new to crypto, stay away. You need to understand gas fees, decentralized exchanges, slippage, and wallet security just to trade this token. Even then, the lack of reliable data makes it impossible to know if you're being ripped off.If you're looking to build wealth over time, this isn't an asset. It's a lottery ticket with terrible odds. The chances of VOLT.WIN becoming a major token are near zero. The odds of it vanishing within a year? Extremely high. Messari's 2023 report found that 92% of tokens under $1 million market cap disappear within 18 months.

Who Might Trade It (And Why)

The only people who might profit from VOLT.WIN are experienced crypto traders who treat it like a high-frequency gambling tool. They watch for sudden spikes-like that 271% one-day jump-and try to exit fast. They use tight stop-losses. They never invest more than they can afford to lose. They know it's not an investment. It's a bet on chaos.Even then, the risks are enormous. Low liquidity means you might not be able to sell when you want to. Price data is unreliable. There's no safety net. No customer support. No recourse if something goes wrong.

The Bottom Line

VOLT.WIN is not a cryptocurrency. It's a speculative experiment with a burning mechanism and zero real-world value. It thrives on hype, not fundamentals. It survives on volatility, not utility. It doesn't have a team, a plan, or a future. It has one purpose: to let a few people make quick, risky profits while the rest lose money chasing phantom gains.If you're thinking of buying VOLT.WIN, ask yourself: Are you investing in a project? Or are you gambling on a math formula that only works while people keep feeding it money? The answer should decide everything.

Is VOLT.WIN a good investment?

No. VOLT.WIN has no utility, no development team, no roadmap, and no real adoption. Its only value comes from extreme price swings driven by speculation. It's not an investment-it's a high-risk gamble with a very high chance of total loss.

Where can I buy VOLT.WIN?

VOLT.WIN trades almost exclusively on Uniswap v3 using the VOLT/TITANX trading pair. You won't find it on major exchanges like Binance or Coinbase. To buy it, you need a crypto wallet like MetaMask, some Ethereum (ETH) for gas fees, and the ability to use a decentralized exchange. Even then, liquidity is so low that small trades can cause massive price swings.

Why is VOLT.WIN's price so inconsistent across exchanges?

Because trading volume is extremely low-often under $25,000 per day. With so few buyers and sellers, even small trades can drastically change the price. Different exchanges report different prices because they're not trading the same volume. Some may show outdated or fake data. There's no centralized authority to verify the real price.

What's the difference between VOLT.WIN and Binance Coin (BNB)?

BNB is backed by a real business: Binance, the world's largest crypto exchange. Binance uses its profits to buy back and burn BNB tokens quarterly. VOLT.WIN has no business, no revenue, and no team. Its burns come from trading fees alone, with no source of income to sustain them. BNB has utility and adoption. VOLT.WIN has only speculation.

Can I trust the circulating supply numbers for VOLT.WIN?

No. Different sources report wildly different numbers-419 million, 550 million, 569 million. This inconsistency is a red flag. It suggests either poor data collection or deliberate manipulation. Without transparent, audited on-chain data, you can't know how many tokens are actually in circulation or how much is being burned.

Is VOLT.WIN likely to survive long-term?

Almost certainly not. The token has shown no development since launch, no partnerships, no updates, and no community growth. Industry data shows that 92% of tokens under $1 million market cap vanish within 18 months. VOLT.WIN fits that pattern perfectly: ultra-low cap, zero utility, no team. It's not a coin-it's a dead project waiting to be forgotten.

Patricia Amarante

Been watching this token for months. Zero utility, zero team, just a burning machine. If you're not trading it like a slot machine, you're already losing.

Don't say I didn't warn you.

Mark Cook

lol imagine thinking this is crypto 😂

it's a digital fidget spinner for degens.

also why is everyone acting like this is news? it's been dead since October.

Greg Knapp

you guys are all so naive

the real scam is that they let you think this is a token at all

it's a honeypot designed to drain wallets with gas fees

they don't even need to rug pull

you just keep paying to trade it into oblivion

and you call that investinglol

Sally Valdez

USA is getting flooded with this garbage because the government won't crack down on these offshore crypto scams

it's not just dumb money

it's a national security issue

they're laundering through wallets and we're just sitting here debating slippage

get your priorities straight

George Cheetham

There's something almost poetic about VOLT.WIN

It's not trying to be anything more than a mathematical experiment in scarcity

Like a candle burning at both ends-beautiful, destructive, and fleeting.

Maybe we shouldn't call it a coin.

Maybe it's just a moment.

A flash in the pan of crypto's chaotic adolescence.

And maybe that's okay.

Not every project needs to change the world.

Some just need to remind us how wild this space still is.

But still-don't put your rent money in it.

Florence Maail

you all know this is a CIA operation right?

they need to kill crypto by flooding the market with fake tokens so people give up

then they can push CBDCs without backlash

why do you think the price is so inconsistent? because they're manipulating the feeds

they control the data

they control the exchanges

they control YOU

wake up

they're not even trying to hide it anymore 😭

Shruti Sinha

Low liquidity + no team + no whitepaper = textbook pump and dump.

It’s not even worth the gas to trade it.

Save your ETH for something that actually exists.

Sean Kerr

YOOOOO I bought VOLT at 0.0008 and it spiked to 0.0015 in 4 hours!!!

TOOK PROFIT AND BOUGHT MORE ETH!!!

THIS IS THE ONLY WAY TO PLAY!!!

don't be a hodler, be a trader!!!

if you're not moving fast, you're already dead!!!

😭🙌🔥

Terrance Alan

Everyone keeps saying it's a gamble but nobody talks about the psychological trap

It's not about the money

It's about the dopamine hit from watching the price jump

That 271% spike? That's not profit

That's a neurological addiction

You're not trading crypto

You're chasing a ghost in a machine

And when the ghost stops moving

You'll still be staring at the screen

Waiting for it to come back

And you'll keep feeding it gas fees

Just to feel something

Again

And again

And again

Until your wallet is empty

And your soul is too

Sammy Tam

Man VOLT.WIN is like that one weird cousin who shows up at Thanksgiving with a glitter mustache and insists they're a famous artist

Everyone's like 'uh... okay' but nobody has the heart to tell them to go home

Meanwhile the turkey's getting cold

And the kids are confused

And the whole thing is just... a vibe

And somehow that vibe is still trading at $0.001

Somehow

It's beautiful

And tragic

And kind of genius

Also don't put your life savings in it

Kayla Murphy

You got this! Even if it crashes tomorrow, you're still learning

Every trade is a step toward mastery

Stay curious, stay sharp, and never stop studying the charts

And remember-your potential is infinite

Just like the burn rate of VOLT

Keep going, warrior 💪✨

Chevy Guy

So the government knows about this and lets it live

And the exchanges list it

And the data sites keep updating fake numbers

And people still trade it

Who's really in control here

And why does it feel like we're all just extras in a movie no one wrote

Amy Copeland

How is it even possible that someone still thinks this is a legitimate asset?

Did you skip the part where there's no team?

No code updates?

No whitepaper?

It's not even a meme coin-it's a ghost coin.

You're not investing.

You're participating in a digital séance.

And you're paying for the medium.

How embarrassing.

Samantha West

The philosophical underpinnings of VOLT.WIN reveal a postmodern critique of value itself.

It exists not as an instrument of exchange, but as a mirror to the epistemological collapse of financial ontology in decentralized systems.

Its burning mechanism is not economic-it is performative.

It performs scarcity while negating substance.

It is a zero-sum existential tableau.

And yet, we trade it.

Not because we believe in its utility.

But because we are terrified of the void.

And so we gamble on the ghost.

Not for profit.

But to prove, in some infinitesimal way, that we still believe in meaning.

Even if it is a mathematical abstraction.

Even if it has no team.

Even if it is, in every sense of the word,

Nothing.