Cross-Chain Swap Fee Calculator

Swap Token Details

Swap Result

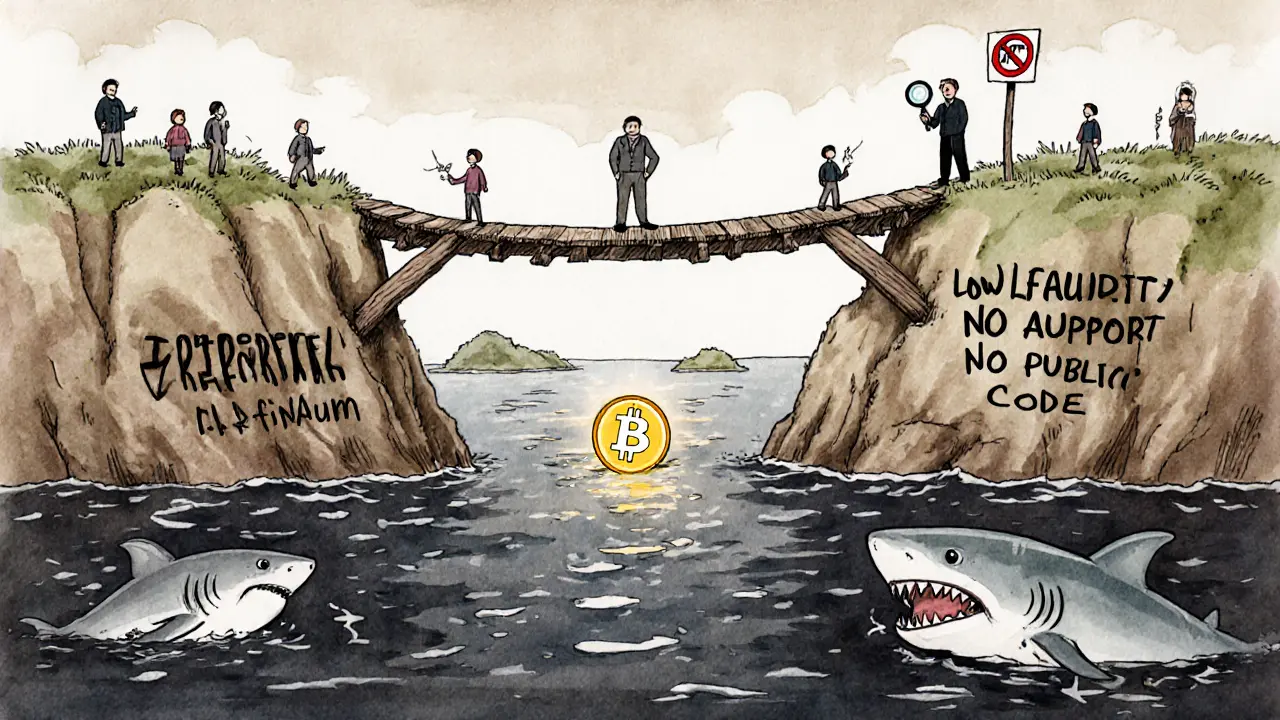

Market Sentiment: Fear (31) - Low Liquidity (TVL < $50M)

Elk Finance isn’t a crypto exchange. That’s the first thing you need to know if you clicked this article looking for a place to buy or sell crypto like Binance or Coinbase. Elk Finance is a cross-chain decentralized exchange-a protocol that moves tokens between blockchains without needing a middleman. And while it’s often mentioned alongside OKX Chain, they’re not the same thing. OKX Chain is a blockchain built by the OKX exchange. Elk Finance is a DeFi app that runs on top of multiple chains, including OKX Chain. Confusion between the two is common, but mixing them up could cost you.

What Elk Finance Actually Does

Elk Finance’s core product is called ElkNet. It lets you swap tokens across different blockchains-say, trading ETH for BNB without having to go through a centralized exchange or multiple bridges. You send your token on one chain, and ElkNet handles the rest: locking it up, signaling the other chain, and releasing the equivalent on the destination network. It’s fast, cheap, and designed to work without trusting a single company.

The protocol uses its own token, ELK, which powers governance and fee discounts. As of October 2025, ELK trades at $0.037048. That’s down from its all-time high of over $0.15. The market sentiment is "Fear," with a Fear & Greed Index of 31. Technical indicators show it’s trading below both its 50-day and 200-day moving averages, which usually signals weakness. Some analysts predict it could hit $0.12 by mid-2025, but that’s a 225% jump from current levels. Right now, it’s a high-risk, low-liquidity play.

Elk Finance supports Ethereum, BNB Chain, Avalanche, Fantom, and OKX Chain. It doesn’t support Bitcoin or Solana. That’s a limitation. If you’re holding SOL or BTC and want to swap into something on OKX Chain, you’ll need to use another bridge first. ElkNet’s strength is its multi-chain focus, but its weakness is its small user base. Compared to Uniswap or PancakeSwap, Elk Finance has minimal total value locked (TVL). There’s no official public number, but community estimates suggest under $50 million-tiny compared to top DEXes.

OKX Chain: The Blockchain Behind the Name

OKX Chain (OKC) is the blockchain developed by OKX, the third-largest crypto exchange by volume. Unlike Elk Finance, OKX Chain is infrastructure. It’s an EVM-compatible chain, meaning it runs Ethereum-based smart contracts. That’s why you can use MetaMask to interact with Elk Finance on OKC. OKC’s native token is OKT, and it uses a delegated proof-of-stake system with 21 validators chosen by staking weight.

One unique feature of OKX Chain is its dual-address system. You can have an "ex..." address (native OKC) and a "0x..." address (EVM), and both point to the same wallet balance. That’s rare. Most chains force you to choose one format. This makes it easier for users moving between centralized and decentralized apps.

OKX Chain also has a cross-chain bridge that connects Ethereum, Tron, Algorand, and OKC. That’s how assets get into and out of the network. But here’s the catch: the bridge is operated by OKX, a centralized company. That’s a trade-off. You get speed and low fees, but you’re trusting OKX to secure the bridge. Elk Finance uses this bridge to move assets, but it doesn’t control it. So if the OKX bridge goes down, Elk Finance can’t function on OKC.

Why People Use Elk Finance (and Why They Avoid It)

People use Elk Finance for one reason: cross-chain swaps without KYC. If you don’t want to sign up for OKX or Binance, and you need to move tokens between chains, Elk Finance is one of the few options that doesn’t require identity verification. That’s a big deal for privacy-focused users.

But there are downsides. First, liquidity is thin. If you try to swap a small-cap token, you might get a terrible price or the transaction might fail. Second, the ELK token’s price is volatile. It dropped 40% in the last three months. If you’re using ELK for fee discounts, you’re effectively paying fees in a token that’s losing value. Third, there’s no customer support. If something goes wrong with your swap, you’re on your own. No email, no live chat, no help desk.

Users who’ve tried it say the interface is clean and the gas fees are low-especially on OKX Chain. But they also warn that the protocol feels "unfinished." There are no audit reports publicly available from reputable firms like CertiK or SlowMist. That’s a red flag. In crypto, if a project doesn’t publish audits, you’re taking on extra risk.

Elk Finance vs. OKX Exchange: Big Differences

OKX Exchange is a centralized platform. You deposit fiat, buy crypto, store it in their wallet, and trade it. They hold your keys. Elk Finance is the opposite: you keep your keys, you interact directly with smart contracts, and you pay gas fees in the chain’s native token (like OKT or ETH).

Here’s a quick comparison:

| Feature | Elk Finance | OKX Exchange |

|---|---|---|

| Type | Decentralized Protocol | Centralized Exchange |

| Ownership of Funds | You control your wallet | OKX holds your funds |

| KYC Required | No | Yes |

| Supported Chains | Ethereum, BNB Chain, Avalanche, Fantom, OKC | 317+ spot currencies across multiple chains |

| Trading Fees | 0.1% swap fee + gas | 0.03%-0.15% maker/taker |

| Customer Support | None | 24/7 email, live chat, FAQs |

| Best For | Privacy-focused cross-chain swaps | Beginners, fiat on-ramps, staking |

OKX Exchange is better if you want to buy crypto with a credit card, earn interest on your holdings, or trade high-volume pairs like BTC/USDT. Elk Finance is better if you’re moving tokens between DeFi apps and don’t want to hand over your private keys.

Is Elk Finance Safe?

Safety in DeFi comes down to three things: audits, liquidity, and team transparency. Elk Finance checks none of them well.

No public audit reports. No team doxxing. No clear roadmap. The website lists a few advisors, but no developers with LinkedIn profiles or GitHub activity. That’s unusual for a protocol handling cross-chain value. Most successful DeFi projects, even small ones, publish their code and invite audits.

The ELK token’s price action also raises questions. It’s been in a steady decline since early 2024. Trading volume is low. The token’s distribution isn’t fully transparent. There’s no clear mechanism to prevent large holders from dumping. If you’re holding ELK, you’re betting on a team that hasn’t shown it can execute.

That said, the technology itself isn’t broken. ElkNet has worked for thousands of swaps. No major exploits have been reported. The risk isn’t in the code-it’s in the project’s sustainability.

Who Should Use Elk Finance?

If you’re a DeFi power user who already has wallets set up on multiple chains, and you’re comfortable with the idea of losing money on a token that’s falling in value, Elk Finance might be worth trying for a small swap.

Don’t use it if:

- You’re new to crypto and don’t know how to use MetaMask

- You want to deposit USD or EUR

- You need customer support when things go wrong

- You’re planning to hold ELK as a long-term investment

- You’re trading large amounts-liquidity is too thin

Use it if:

- You’re swapping between supported chains and want to avoid KYC

- You’re comfortable with high volatility and no support

- You’re experimenting with cross-chain DeFi and understand the risks

What Comes Next for Elk Finance and OKX Chain?

OKX Chain is growing. It’s adding more dApps, NFT marketplaces, and developer tools. OKX is investing heavily in making it a hub for DeFi in Asia. That could mean better liquidity for Elk Finance in the future-if the protocol can keep up.

Elk Finance’s future depends on three things: attracting more users, securing audits, and stabilizing its token. Without any of those, it risks becoming another forgotten DeFi project. The cross-chain space is crowded now. Anyswap, Multichain, and LayerZero are all bigger, better-funded, and more transparent.

If Elk Finance wants to survive, it needs to publish audits, reveal its team, and launch a liquidity incentive program. Until then, treat it like a beta test-not a reliable exchange.

Is Elk Finance a crypto exchange?

No, Elk Finance is not a crypto exchange. It’s a decentralized cross-chain swap protocol. You don’t deposit funds into it. You connect your wallet and swap tokens directly between blockchains using smart contracts. It’s more like Uniswap than Binance.

Can I buy ELK on OKX Exchange?

Yes, ELK is listed on OKX Exchange. You can trade it against USDT, BTC, and other major pairs. But remember: OKX Exchange is a centralized platform, while Elk Finance is a separate DeFi protocol. Buying ELK on OKX doesn’t give you access to ElkNet-you still need to connect your wallet to the Elk Finance website to use the swap feature.

Is Elk Finance available in the United States?

Elk Finance doesn’t restrict users by location. Since it’s a decentralized protocol, anyone with a crypto wallet can access it. But OKX Chain, which Elk Finance uses as one of its networks, is operated by OKX, which is not available in the U.S. That means U.S. users can’t easily deposit fiat into OKX Chain or use its bridge. You’d need to get assets onto OKC via another chain first.

Why is the ELK token price falling?

The ELK token has been in a bearish trend since early 2024. The main reasons are low adoption, thin liquidity, and lack of developer activity. Unlike major DeFi projects, Elk Finance hasn’t launched staking, yield farming, or governance incentives to drive demand. Without user growth or utility upgrades, the token’s price reflects market skepticism.

Should I use Elk Finance instead of Uniswap?

Only if you need to swap tokens across different blockchains. Uniswap is better for swaps within Ethereum-it has deeper liquidity, higher security, and more audits. Elk Finance is only worth considering if you’re moving assets between chains like Ethereum and OKX Chain. For single-chain swaps, stick with Uniswap or PancakeSwap.

Kristi Malicsi

So basically Elk Finance is like that one friend who says they can get you anywhere but never shows up on time?

You gotta trust the process but also know they might just vanish after taking your keys.

Rachel Thomas

This whole thing is a scam. Everyone knows OKX is just a front for the Chinese government. You think they let some random DeFi app run wild on their chain? LOL.

Sierra Myers

I tried ElkNet last week to swap some ETH for BNB and it worked fine. Gas was like $0.02 on OKC. But yeah, the ELK token is trash. Bought some at $0.05 and now it’s $0.037. Classic.

SHIVA SHANKAR PAMUNDALAR

The real question is not whether Elk Finance works but whether we should trust any protocol that doesn’t have a team photo. In a world where anonymity is power, who are we really delegating our assets to?

Shelley Fischer

It is imperative to clarify the distinction between decentralized protocols and centralized exchanges. Elk Finance operates as a non-custodial, cross-chain bridge, whereas OKX Exchange functions as a fiduciary custodian. Confusing the two represents a fundamental misunderstanding of blockchain architecture.

Puspendu Roy Karmakar

I’ve used Elk for small swaps between Ethereum and OKC. Fast, cheap, no KYC. But I only use like $50 at a time. If you’re thinking of putting in more, wait till they audit and show who’s behind it. Don’t be that guy who loses everything because they didn’t check.

Evelyn Gu

I mean... I just... I don’t know... I feel like I’m putting my life savings into something that doesn’t even have a LinkedIn page for its devs? Like, I get it, decentralization is cool, but when the team is more ghost than human, and the token’s been falling since 2024, and there’s no customer support, and the website looks like it was built in 2021... I just... I don’t know what to feel anymore... I’m torn between hope and dread... and I think I’m gonna cry if I try to swap more than $20...

imoleayo adebiyi

I’ve been using this for a few months now. No issues. But I never hold ELK. I only use it for swaps. That’s the key. Don’t invest in the token. Use it as a tool. Simple.

Vaibhav Jaiswal

Man, I saw someone on Twitter say Elk Finance is the future. Then I checked the TVL and laughed so hard I spilled my tea. $50 million? Bro, Uniswap has 1000x that. This isn’t DeFi. It’s a hobby project with a fancy website.

Abby cant tell ya

You’re all being so naive. ELK is a rug pull waiting to happen. Look at the chart. Look at the lack of audits. Look at the fact that nobody knows who made this. You think you’re being smart? You’re just the next victim.

Savan Prajapati

Don’t use it. Too risky. End of story.

Michael Labelle

I respect the idea behind Elk. Decentralized swaps are needed. But you can’t build trust on silence. If you’re serious about this, release the team, get audited, and start engaging. Otherwise, you’re just another ghost in the blockchain graveyard.

Joel Christian

I tried elk finace and it workd but the ui is so slow and i think i lost 0.02 eth because of gas issues. not worth it.

jeff aza

The lack of formal audits, combined with the negligible TVL and the tokenomics structure that incentivizes dumping over utility, represents a classic DeFi death spiral. The protocol’s reliance on OKX Chain’s centralized bridge introduces a systemic single point of failure - which fundamentally undermines its decentralized ethos. This isn’t innovation; it’s a high-risk architectural compromise.

Vijay Kumar

Everyone’s acting like this is the first time someone built something without an audit. You think Uniswap had one in day one? You think SushiSwap didn’t get rug-pulled? This is crypto. You adapt or you die.

Vance Ashby

I like the concept. But I won’t touch ELK. I’ll use the swap, but I’m not holding the token. And I definitely won’t be using it for big amounts. Just a little test. 😅

Brian Bernfeld

I’ve helped five friends set up Elk swaps. All worked fine. But I always tell them: never hold ELK, never deposit more than you can lose, and always check the contract address yourself. The tool’s useful, but the project’s a gamble. Treat it like a beta app - not a bank.

Ian Esche

This is why America needs to stop letting foreign chains like OKX control our DeFi. If you’re swapping on a Chinese-backed blockchain, you’re already compromised. No audits, no transparency - just crypto colonialism.

Christina Oneviane

Oh wow, so Elk Finance is the crypto version of a Tinder date who says they’re "just looking" but then ghost you after you send them your wallet address? Iconic.