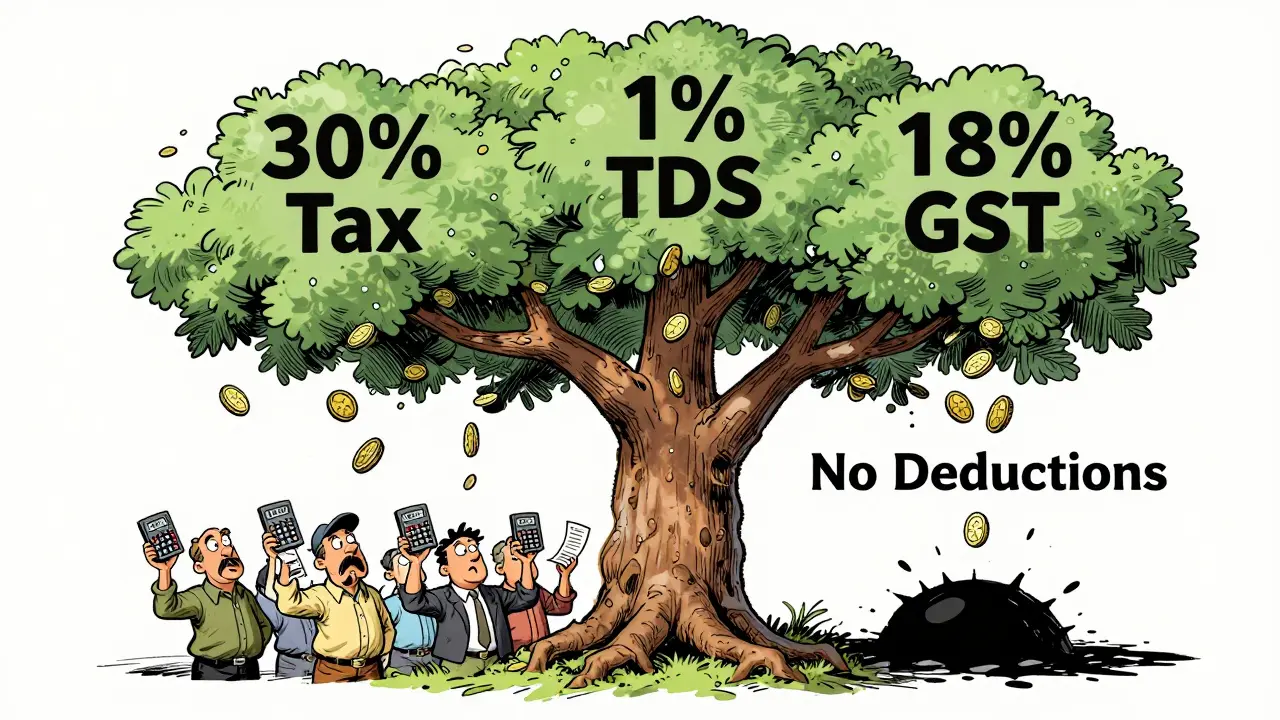

India’s 30% tax on cryptocurrency gains isn’t just another rule-it’s one of the strictest crypto tax systems in the world. If you’re trading Bitcoin or any other digital asset in India, this tax changes everything. No matter how long you hold your coins, how much you lose on other trades, or how small your profit is, the government takes 30% of every gain. And that’s just the start.

How the 30% Tax Actually Works

Since April 1, 2022, every time you sell, trade, or exchange Bitcoin, Ethereum, or any other virtual digital asset (VDA), you owe 30% tax on the profit. That’s not a capital gains rate-it’s a flat rate with no exceptions. Even if you held your Bitcoin for five years, you still pay 30%. If you held it for five minutes, same thing.

The math is simple: Sell price minus buy price = taxable gain. Then multiply that by 30%. For example, if you bought 1 BTC for ₹30,00,000 and sold it for ₹40,00,000, your gain is ₹10,00,000. Your tax? ₹3,00,000.

But here’s the twist: you can’t deduct anything else. Not the transaction fees you paid on WazirX or CoinDCX. Not the gas fees on Ethereum. Not even the cost of a hardware wallet. Only the original purchase price counts. That means if you spent ₹5,000 in fees over the year, you still pay tax on the full gain. No breaks.

The Loss Offsetting Trap

This is where most traders get blindsided. If you lose money on one coin but make money on another, you still pay tax on the profit. India doesn’t let you offset losses.

Let’s say you:

- Bought ETH for ₹2,00,000 and sold it for ₹1,50,000 → ₹50,000 loss

- Bought SOL for ₹1,00,000 and sold it for ₹1,60,000 → ₹60,000 gain

You made a net profit of ₹10,000 across both trades. But under Indian tax law, you owe 30% tax on the ₹60,000 gain. The ₹50,000 loss? Gone. You can’t use it to reduce your tax bill. You can’t carry it forward to next year. It just disappears.

That’s not how taxes work anywhere else. In the U.S., you can net losses against gains. In Germany, if you hold crypto for over a year, you pay zero. In Singapore? No capital gains tax at all. India treats every trade like it’s a standalone event-with no mercy.

The 1% TDS: Hidden Withholding

On top of the 30% tax, there’s a 1% Tax Deducted at Source (TDS) that kicks in when you transfer crypto worth more than ₹50,000 in a year. If you’re active, this hits you every time you sell or swap.

For example, if you sell ₹2,00,000 worth of Bitcoin, the exchange withholds ₹2,000 (1%) before giving you the cash. That money goes straight to the government. You get a TDS certificate, and you can claim it as a credit when filing your return-but it still means less cash in your pocket right away.

Worse, not all platforms handle TDS the same way. Some deduct it automatically. Others don’t. If you use P2P platforms like Binance P2P or CoinSwitch, you might be on the hook to report and pay it yourself. That’s a compliance nightmare for casual traders.

The New 18% GST on Exchange Fees

In July 2025, India added another layer: 18% GST on services provided by crypto exchanges. That includes trading fees, withdrawal fees, and even staking rewards processed through Indian platforms.

So now, if you pay ₹100 in trading fees on ZebPay, you’re actually paying ₹118. The extra ₹18 is GST. And yes, that’s on top of your 30% capital gains tax and the 1% TDS.

This three-tier system-30% income tax, 1% TDS, 18% GST-is unique to India. No other country combines all three on crypto. It’s not just high-it’s complex.

Why This Tax Is So Harsh Compared to the Rest of the World

Compare India’s rules to other major markets:

| Country | Capital Gains Tax Rate | Loss Offset Allowed? | TDS on Transfers? | Additional Taxes? |

|---|---|---|---|---|

| India | 30% flat | No | Yes (1%) | 18% GST on fees |

| United States | 0%, 15%, or 20% | Yes | No | No |

| Germany | 0% after 1 year | Yes | No | No |

| Singapore | 0% | Yes | No | No |

| United Kingdom | 10% or 20% | Yes | No | No |

| Canada | 50% of gain taxed at income rate | Yes | No | No |

India’s system is designed to discourage trading, not support it. Most countries reward long-term holding. India taxes short-term and long-term the same. Most countries let you recover losses. India doesn’t. Most countries don’t tax fees. India does.

What Traders Are Actually Doing

Since the tax hit, trading volumes on Indian exchanges dropped 40-60%. Many retail traders moved to international platforms like Binance, Bybit, or OKX. But here’s the catch: if you’re an Indian resident, you still owe taxes on global trades. The government can track your bank transfers and crypto deposits. Ignoring it doesn’t make it go away.

Some traders now only hold crypto long-term, hoping to ride out volatility without triggering taxes. Others use P2P trading to avoid TDS-but that creates its own risks. If you don’t report, you’re still liable. And the Income Tax Department has been auditing crypto users since 2023.

There’s no legal loophole. No way to hide. The only thing you can do is track every transaction.

How to Stay Compliant

If you’re trading in India, you need to keep records for every single trade. That means:

- Date and time of purchase

- Amount paid (in INR)

- Exchange or wallet used

- Date and time of sale

- Amount received (in INR)

- Transaction ID and fee paid

Use software like Koinly or ClearTax-they now have India-specific modules that auto-calculate your gains, apply the 30% rule, and flag TDS and GST. Manual tracking? You’re looking at 40-50 hours a year if you’re active.

When filing your ITR, you must use Schedule VDA (Virtual Digital Assets). It’s a new form that asks for every gain, every loss, and every TDS amount. No shortcuts. No estimates. If you get audited, they’ll ask for proof of every transaction since 2022.

What’s Next? Will It Change?

Experts agree: the current system is unsustainable. It’s driving traders away, not bringing in revenue. The government collected far less than expected in crypto taxes because most people stopped trading.

There’s talk of revising the loss offsetting rule. Maybe allowing net losses to be carried forward. Maybe lowering the TDS threshold. But as of September 2025, no changes have been made. The 30% rate, the 1% TDS, and the 18% GST are still in full force.

Until then, traders in India are stuck with one of the harshest crypto tax regimes on Earth. It’s not about fairness. It’s about control.

Bottom Line

If you’re trading Bitcoin in India, you’re paying more tax than almost anywhere else. You can’t offset losses. You can’t deduct fees. You’re hit with three different taxes. And you’re being watched.

There’s no way around it: if you trade, you report. If you report, you pay. The only strategy left is to track everything, use tools, and accept that this is the reality in India in 2026.

Is the 30% crypto tax in India applied to every trade, even small ones?

Yes. The 30% tax applies to any profit from selling, swapping, or spending crypto-even if it’s just ₹1,000. The only exception is if you have zero gain (sell for the same price you bought). But if you make any profit, no matter how small, you owe 30% on that amount.

Can I avoid the 30% tax by holding crypto for more than a year?

No. Unlike stocks or real estate, India doesn’t offer long-term capital gains relief for crypto. Whether you hold Bitcoin for 1 day or 10 years, the tax rate is always 30%. There’s no discount for patience.

What happens if I don’t report my crypto gains?

The Income Tax Department can match your bank deposits with crypto withdrawals. If you’re caught not reporting, you’ll face penalties of up to 200% of the tax due, plus interest. In severe cases, you could be audited or even prosecuted for tax evasion. Ignorance isn’t a defense.

Do I pay tax if I swap one crypto for another?

Yes. Swapping Bitcoin for Ethereum is treated as a sale of Bitcoin and a purchase of Ethereum. You must calculate the gain on Bitcoin based on its value in INR at the time of the swap. That gain is taxable at 30%.

Can I use losses from 2021 to offset gains in 2025?

No. Losses from before April 1, 2022, can’t be used at all. Even losses from 2023 can’t be carried forward to 2024 or 2025. India’s tax law treats each financial year as completely separate for crypto gains and losses.

Do I owe GST if I buy crypto with INR from a friend via P2P?

No. GST only applies to services provided by exchanges or platforms. If you buy crypto directly from a friend, no platform is involved, so no GST applies. But you still owe 30% tax on any profit when you later sell it.

Danica Cheney

lol so india just taxed crypto into oblivion 🤡 no wonder everyone's moving to binance. i don't even bother reporting mine anymore. they can't track me if i don't cash out. simple.

Kyle Pearce-O'Brien

This is the inevitable outcome of a state that confuses fiscal policy with moral authoritarianism. The 30% flat rate isn't taxation-it's expropriation dressed in bureaucratic legalese. When you eliminate loss offsetting and slap on TDS + GST, you're not collecting revenue-you're engineering voluntary compliance collapse. The government isn't regulating crypto; it's performing a ritual sacrifice of its own digital economy.

Matthew Ryan

I've been tracking my trades with Koinly since last year. It's a pain but way better than guessing. The 1% TDS really adds up if you trade weekly. Just wish they'd let us offset losses. It's not like we're making millions here.

Robin Ødis

Let me break this down for the uneducated: India's crypto tax isn't about revenue-it's about control. They know if you're trading, you're thinking independently. They know if you're using P2P, you're bypassing their banking surveillance. They know if you're holding long-term, you're rejecting fiat dependency. This isn't a tax policy-it's a psychological weapon. And the 18% GST on fees? That's the cherry on top of a sundae of authoritarianism. You don't pay tax on your gains-you pay for the privilege of existing in a financial system they refuse to understand.

Brittany Novak

I've been auditing crypto users since 2023. I've seen people get hit with 200% penalties because they thought 'it's just crypto so it doesn't count.' Wrong. The IT department has AI that cross-references bank deposits with wallet addresses. If you're an Indian resident, your global trades are fair game. You think you're smart hiding on Binance? They'll find you. They always do.

Joshua Herder

You people are missing the real point. The 30% tax doesn't hurt the rich-it hurts the people trying to build something. The guy who bought BTC at 20k and sold at 25k? He pays 30% on 5k. That's 1.5k gone. Meanwhile, the hedge fund that moved 50 million in a day? They have accountants who write off fees as 'operational costs.' This isn't taxation. It's class warfare disguised as fiscal reform. And the GST on fees? That's just the state saying 'we want you to suffer while you try to get out of poverty.'

Brittany Coleman

I get why India did this. Crypto is chaotic. People lose everything. But punishing everyone because some got burned? That's not policy. That's fear. I wish they'd just let people trade and learn. Instead, they made it a prison with extra fees. I still believe in crypto. I just wish the rules were kinder.

laura mundy

India's tax system is a joke. I've seen traders in the UK pay 10% and still report everything. Here? 30% with no deductions? And you can't even use losses? That's not taxation-that's theft. The fact that they're now taxing exchange fees too? That's the final insult. You're not just taxing gains-you're taxing the act of trading itself. This isn't capitalism. It's feudalism with a digital interface.

Jacque Istok

Funny how everyone acts shocked. The 30% tax? Been there. The 1% TDS? Predictable. The GST on fees? Classic. But the real kicker? People still think they can 'outsmart' it. You can't. If you're an Indian resident, your bank account is linked to your wallet. Every transfer leaves a trail. Use Koinly. Track everything. Or get ready to explain why you have 12 lakh in your account after selling ETH in 2024. Good luck with that.

Mendy H

This post is so naive. Of course they're taxing hard. India doesn't want crypto to succeed. It wants to be the center of financial control. They see decentralized systems as a threat to their centralized power. The 30% tax isn't about revenue-it's about deterrence. They want you to quit. And honestly? It's working. Trading volumes are down 60%. Mission accomplished.

Molly Andrejko

If you're just starting out with crypto in India, don't panic. It's hard, but you can do it. Use tools. Keep records. Don't try to be a hero and do it all manually. I started last year and thought I'd never keep up. Now I have a folder with every transaction. It's tedious, but it keeps me sane. And if you're worried about audits? Just be honest. They'll respect that more than you think.

sabeer ibrahim

Why do foreigners always think they know better? India has its own system. We don't need your US-style capitalism. 30% tax? It's fair. You think crypto is magic? It's just digital money. We're not letting you dodge taxes like in Singapore. And if you're using P2P to avoid TDS? You're just cheating the system. We're watching. Always.

David Bain

The structural absurdity of India's crypto tax regime lies in its failure to recognize the fungibility of value. By taxing each transaction as an isolated capital event while disallowing loss aggregation, the state effectively imposes a transactional tax under the guise of capital gains. This violates the very principle of net worth accounting. Furthermore, the imposition of GST on exchange services-services which are, by definition, facilitative rather than consumptive-constitutes a regulatory overreach that distorts market efficiency. One must ask: is this policy designed to generate revenue, or to eliminate participation?

Deeksha Sharma

I used to trade daily. Now I just hold. It's easier. I know it's not ideal, but I don't want to deal with the paperwork. I still believe in crypto. I just think India needs time to catch up. Maybe next year they'll change the rules. Until then, I'll wait. Patience is part of the journey.

Freddie Palmer

I just checked my Koinly dashboard. I made ₹42,000 in gains this year. Tax is ₹12,600. TDS was ₹420. GST on fees? ₹312. Total paid? ₹13,332. I'm okay with it. I know it's a lot, but at least I'm not hiding. I'm proud I'm doing this right. I wish more people would just be honest instead of trying to find loopholes.

Taybah Jacobs

Thank you for this comprehensive breakdown. It is clear, well-researched, and serves as a vital resource for those navigating this complex landscape. The level of detail provided-particularly regarding Schedule VDA and the interplay between TDS and GST-is invaluable. I encourage all traders to adopt disciplined record-keeping practices. Compliance is not merely a legal obligation; it is an act of personal integrity in an increasingly opaque financial ecosystem.

Alisha Arora

I'm sorry but this is just ridiculous. People are losing money and you're still taxing them? What kind of system is this? I have a cousin in India who lost 80% on his altcoins and still got hit with tax on the one coin he made 20% on. That's not fair. That's not smart. That's just cruel.

Danica Cheney

lol same. my cousin got audited last year for a 5k profit. they asked for his 2021 transaction history. he didn't even own crypto then. total nightmare.