Nigeria Crypto Mining Profitability Calculator

Mining Calculator

Results

Key Requirements

Can you legally mine cryptocurrency in Nigeria? The short answer is: yes - but only if you jump through a maze of rules, licenses, and financial hurdles. As of 2025, mining crypto isn’t banned outright, but the government has made it extremely difficult to do so without running into serious legal trouble. If you’re thinking about setting up a mining rig in Lagos or Abuja, you need to understand exactly what’s allowed - and what will get you fined, shut down, or worse.

It’s Not Illegal, But It’s Heavily Regulated

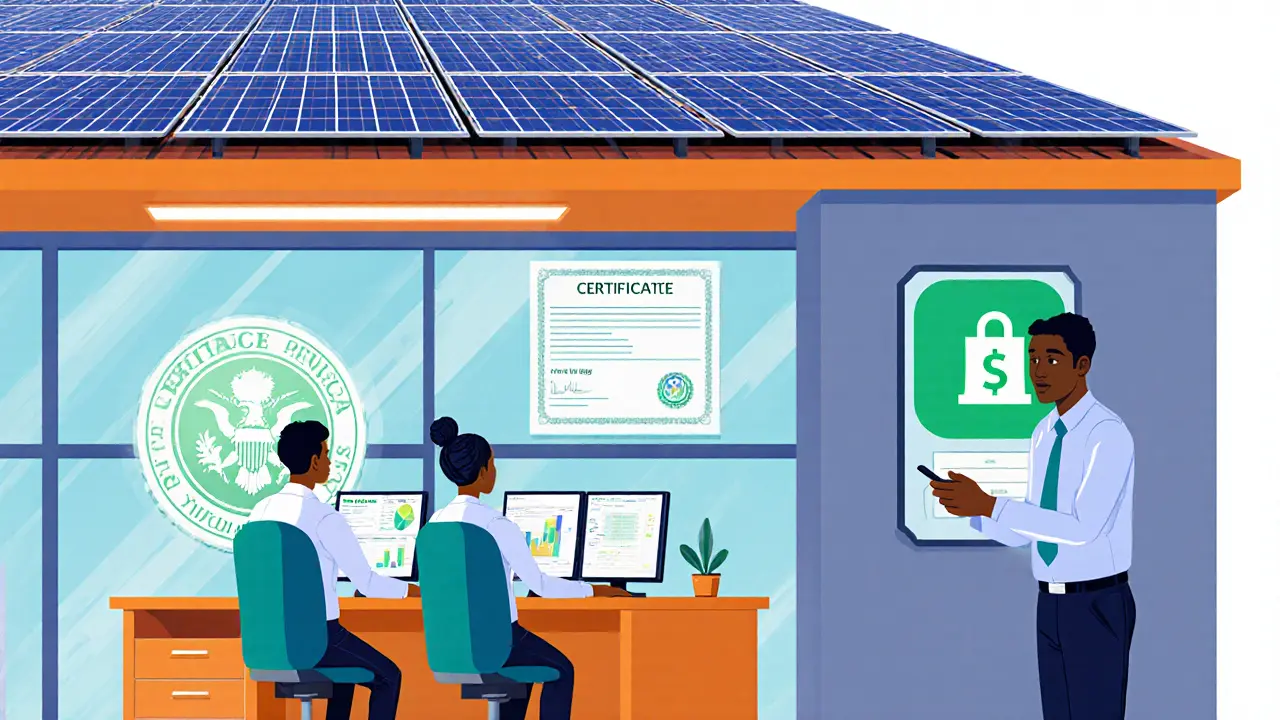

Nigeria doesn’t have a law that says, "Mining Bitcoin is forbidden." But that doesn’t mean you’re free to go buy 50 ASIC miners and plug them in. The real control comes from the Investments and Securities Act (ISA) 2025, which reclassified all virtual assets - including mined cryptocurrencies - as securities. That change means any mining operation that connects to exchanges, offers mining-as-a-service, or sells the coins it produces now falls under the Securities and Exchange Commission (SEC) of Nigeria. You can’t just mine and cash out anymore. You need a license.What the SEC Requires to Operate Legally

If you’re running a crypto mining business - even if you’re just a solo miner selling your output - you’re now considered a Virtual Asset Service Provider (VASP). And under SEC rules, VASPs must meet strict conditions:- Be a registered Nigerian company with a physical office in the country

- Have a minimum paid-up capital of ₦50 million ($33,500)

- Obtain a fidelity bond (insurance) covering at least ₦20 million ($13,400)

- Implement full KYC and AML procedures for every user or client

- Submit monthly transaction reports to the SEC

These aren’t suggestions. They’re mandatory. And the SEC isn’t playing around. Since late 2024, only two Nigerian exchanges - Quidax and Busha - have received provisional licenses. Dozens of others are still waiting. If you’re mining without this license, you’re technically operating illegally, even if you’re not breaking any direct mining ban.

Banks Still Won’t Touch You (Unless You’re Licensed)

In 2021, the Central Bank of Nigeria (CBN) told all banks to stop serving crypto businesses. That rule was lifted in late 2023 - but only for companies with SEC licenses. If you’re not licensed, banks will still refuse your account. No bank account means no way to pay for electricity, buy hardware, or transfer profits. Most unlicensed miners rely on peer-to-peer (P2P) platforms like Paxful or LocalBitcoins to sell their coins. But even those platforms now require proof of licensing for larger transactions. Without a license, your cash-out options shrink fast.Taxes Are Now a Major Risk

The Nigeria Tax Administration Act (NTAA) 2025, which takes effect in 2026, turns up the heat even more. Under this law, any unlicensed VASP - including miners - faces:- ₦10 million ($6,693) fine in the first month of non-compliance

- ₦1 million ($669) added every month after that

- Automatic suspension of business operations

- Seizure of mining equipment if linked to tax evasion

This isn’t theoretical. The SEC now works directly with the Economic and Financial Crimes Commission (EFCC) and the Nigerian Financial Intelligence Unit (NFIU). They can request telecom records, track wallet addresses, and trace transactions back to individuals. If you’re mining and not reporting income, you’re not just breaking tax law - you’re risking criminal investigation.

Electricity Costs Are Killing Profitability

Even if you clear all legal hurdles, you still have to deal with Nigeria’s power grid. Most homes get only 4-6 hours of electricity per day. Mining rigs run 24/7. That means you need:- Expensive solar setups or diesel generators

- High-capacity batteries to store power

- Constant maintenance and fuel costs

A single ASIC miner like the Antminer S19 Pro uses 3,250 watts. Running that for a month in Lagos could cost over ₦70,000 ($470) in electricity alone - and that’s if you have stable power. Most miners end up spending more on fuel and inverters than they make from mining. In countries like Canada or Kazakhstan, electricity costs under $0.05 per kWh. In Nigeria, even with solar, it’s closer to $0.15-$0.25. That difference makes mining here a losing bet for most.

Who’s Actually Mining Successfully?

The only miners thriving in Nigeria right now are:- Large-scale operations backed by investors with SEC licenses

- Groups using offshore exchanges to cash out (but even that’s getting riskier)

- Miners who treat it as a side hustle, not a business - selling small amounts via P2P and paying taxes informally

There are no big mining farms in Nigeria like you’d see in Texas or Kazakhstan. The infrastructure just doesn’t support it. Even the most well-funded operations are small - maybe 50-100 rigs max. Anything bigger runs into power, security, and regulatory issues too fast.

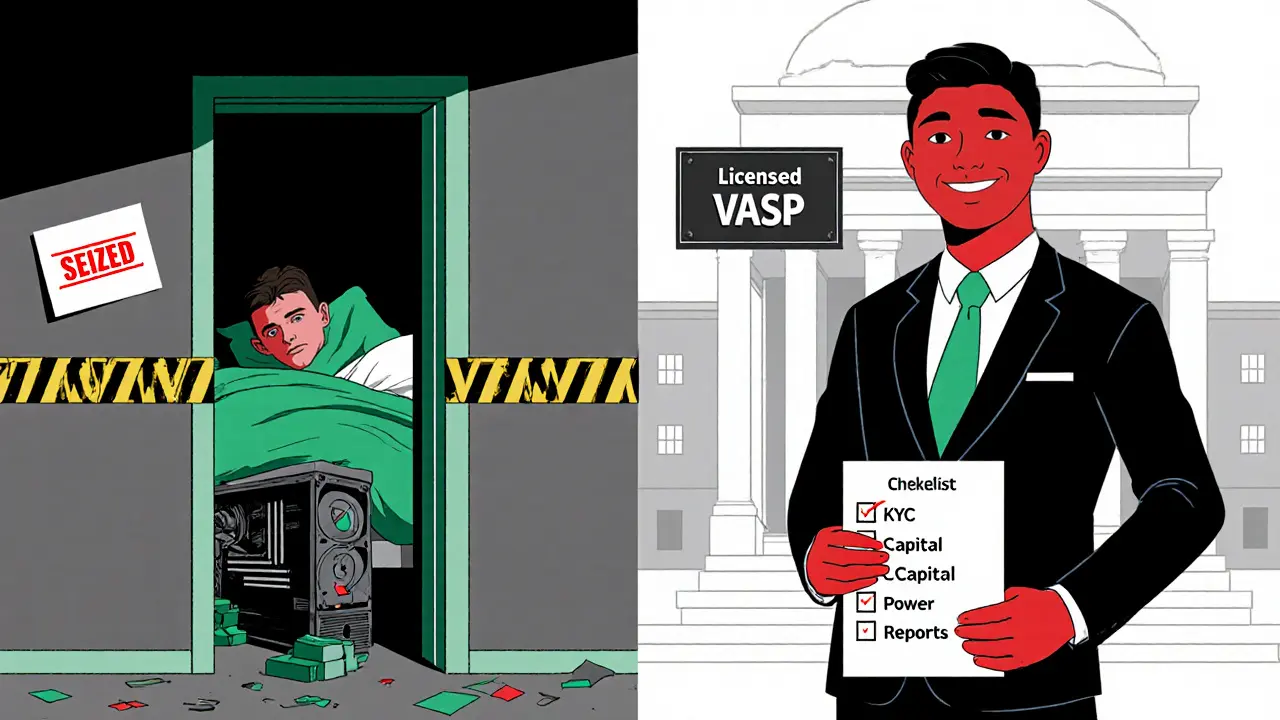

What Happens If You Get Caught?

If you’re mining without a license and the authorities find out:- Your mining equipment can be seized under the Anti-Money Laundering Act

- You could face criminal charges for tax evasion or operating an unlicensed financial business

- Your bank accounts (if any) will be frozen

- You’ll be added to a government watchlist that blocks future financial access

There have been at least three high-profile cases in 2025 where individuals were arrested for operating unlicensed mining pools. They weren’t charged with mining - they were charged with money laundering and tax fraud. The government isn’t going after hobbyists with one rig. But if you’re scaling up, you’re a target.

Is There a Legal Path Forward?

Yes - but it’s expensive and slow. Here’s what it takes:- Register a Nigerian company with the Corporate Affairs Commission (CAC)

- Open a corporate bank account with a licensed fintech partner (like Opay or PalmPay Business)

- Apply for an SEC VASP license - expect 6-12 months of review

- Install a reliable power system (solar + battery backup)

- Set up full KYC/AML software and hire a compliance officer

- Start reporting monthly to SEC and FIRS (Federal Inland Revenue Service)

Only a handful of Nigerian companies have done this. Most small miners give up before even starting. The cost to get compliant? At least ₦15 million ($10,000) upfront - not counting ongoing fees.

What About Mining for Personal Use?

The law doesn’t define "personal use." But if you’re mining a few coins a month, selling them on P2P, and paying taxes on the income, you’re unlikely to be targeted. The SEC and EFCC aren’t hunting individuals with one Antminer. But if your wallet shows $50,000 in annual activity and you’ve never filed a tax return? That’s a red flag.Where Are Nigerian Miners Going Instead?

Many who want to mine at scale are relocating. Countries like Canada, Georgia, and Kazakhstan offer:- Cheap, stable electricity

- Clear, friendly regulations

- Government incentives for tech investment

Nigeria’s high energy costs and legal risks make it a poor choice for serious mining. The country’s crypto activity is still huge - Nigerians traded $92.1 billion in crypto between July 2024 and June 2025, according to Chainalysis. But most of that is trading, not mining. The mining part? It’s shrinking.

The Future of Crypto Mining in Nigeria

The government isn’t trying to kill crypto. It’s trying to control it. The ISA 2025 and NTAA 2025 show a clear goal: bring crypto into the formal economy - on their terms. If you want to mine legally, you’ll need to play by their rules. If you don’t, you’re gambling with your money, your equipment, and your freedom.For now, mining crypto in Nigeria is possible - but only if you treat it like a regulated business, not a side hustle. Most people won’t make it through the paperwork. Those who do? They’re not just miners. They’re compliance experts.

Is crypto mining illegal in Nigeria in 2025?

No, crypto mining is not explicitly illegal in Nigeria. However, it is heavily regulated. Under the Investments and Securities Act (ISA) 2025, any mining operation that sells or exchanges mined coins must be licensed by the SEC. Operating without a license exposes you to fines, asset seizure, and criminal charges under tax and anti-money laundering laws.

Can I mine crypto as a hobby in Nigeria?

Technically yes - but you’re still legally required to report income from mined coins as taxable earnings under the Nigeria Tax Administration Act (NTAA) 2025. If you’re mining just a few coins per month and selling them via P2P platforms for personal use, you’re unlikely to be targeted. But if your activity exceeds ₦500,000 annually, the tax authorities may investigate. Don’t assume "hobby" means exempt.

Do I need a bank account to mine crypto in Nigeria?

You don’t need a traditional bank account to mine, but you need one to operate legally. Banks still refuse to serve unlicensed crypto businesses. Licensed miners can open corporate accounts with fintech partners like Opay or PalmPay Business. Unlicensed miners rely on peer-to-peer exchanges, but these platforms now limit large transactions to licensed users. Without a bank account, scaling your operation is nearly impossible.

How much does it cost to get a crypto mining license in Nigeria?

The upfront cost to get a SEC license as a VASP is at least ₦15 million ($10,000). This includes company registration (₦50,000), paid-up capital of ₦50 million, a fidelity bond of ₦20 million, legal fees, compliance software, and setting up a local office. Monthly compliance costs add another ₦200,000-₦500,000. Most small miners can’t afford this - which is why only two exchanges have been licensed so far.

What happens if I get caught mining without a license?

If you’re mining without a license and the SEC or EFCC investigates you, you could face fines of ₦10 million ($6,693) plus ₦1 million per month for non-compliance. Your mining equipment may be seized under the Anti-Money Laundering Act. You could also be charged with tax evasion or operating an unlicensed financial business, which carries criminal penalties. The government is actively tracking large wallet addresses and cross-referencing them with tax filings.

Is crypto mining profitable in Nigeria in 2025?

For most people, no. High electricity costs (often $0.15-$0.25 per kWh), unreliable power, and the cost of backup generators or solar systems eat into profits. Even with Bitcoin at $70,000, a single Antminer S19 Pro in Nigeria may break even or lose money after accounting for fuel, maintenance, and compliance. Only those with access to cheap renewable energy or investor backing can make it work.

Nitesh Bandgar

Let me just say - this is the most absurd regulatory nightmare I’ve ever seen! Nigeria’s trying to turn crypto mining into a corporate tax form with a side of existential dread. You need ₦50 million just to breathe? And then you’re still stuck with a generator that sounds like a jet engine at 3 a.m.? I’m not even mad - I’m impressed. Someone’s making bank off the paperwork, not the mining.

Chloe Walsh

So what you’re saying is… mining crypto in Nigeria is like trying to start a bakery but the government says you need a PhD in pastry law, a $10k oven, and a notary to witness your sourdough starter?

Anthony Allen

Interesting how the same country that’s one of the biggest crypto traders in Africa is making it nearly impossible to mine locally. It’s like saying ‘you can buy the car, but you can’t own the garage.’ The disconnect between trading volume and mining infrastructure says more about policy than technology.

Sarah Scheerlinck

I’ve seen this pattern before - governments fear what they can’t control. But here’s the thing: if you want people to follow the rules, make the rules doable. Right now, Nigeria’s just creating a black market for compliance. The miners who survive won’t be the ones with licenses - they’ll be the ones who never got caught.

karan thakur

This is a trap. The SEC doesn’t want to regulate crypto - they want to kill it quietly. Look at the fines, the equipment seizures, the bank bans. This isn’t about compliance. This is about control. And if you think they’re not watching your wallet addresses, you’re already being watched.

Evan Koehne

So the solution to Nigeria’s power crisis is… to make people buy solar panels and batteries just to mine Bitcoin? Brilliant. Next they’ll tax the wind for blowing too hard. At this point, the only thing more expensive than mining is pretending to be legal.

Vipul dhingra

You people are overthinking this. Mining is mining. If you can plug it in and it runs, you’re doing it right. The government doesn’t own your electricity. They don’t own your rig. Stop letting bureaucrats define what’s possible. The blockchain doesn’t care about your SEC license.

Jacque Hustead

It’s sad because Nigeria has so much potential - young, tech-savvy, resilient people. But when the system is rigged to favor only the ultra-rich with access to lawyers and capital, it pushes out the real innovators. Maybe the future isn’t mining in Nigeria… but building the tools that let people mine elsewhere without needing a license.

Robert Bailey

Just got back from Lagos. Saw a guy mining with a solar panel and a 12V battery. No license. No bank account. Just a phone and Paxful. He said, ‘I’m not a business. I’m just trying to feed my kid.’ He’s probably the real crypto pioneer here.

Wendy Pickard

There’s something deeply human about this. People aren’t mining for Wall Street - they’re mining for survival. The rules are written for corporations, but the reality is lived by single moms and students with one rig. Maybe the law needs to catch up to the people, not the other way around.

Jeana Albert

Oh please. ‘Hobby miners’? That’s what they say before they come with the police and take your entire setup. I know someone who mined 0.2 BTC last year and got audited. They seized his generator. He had to sell his car to pay the fine. This isn’t regulation - it’s extortion dressed in legal jargon.

Natalie Nanee

Let me be clear: if you’re mining without a license, you’re not just breaking rules - you’re betraying the community. Crypto is supposed to be decentralized, but it can’t thrive if people ignore the legal framework. You’re not a rebel - you’re a liability. And you’re making it harder for the rest of us to get legit.

Angie McRoberts

That guy in Lagos? He’s not a criminal. He’s a workaround artist. And honestly? That’s what innovation looks like when the system’s broken. The license costs more than the rig. The power costs more than the profit. The law says ‘no’ - but people still mine. That’s not defiance. That’s adaptation.

Grace Huegel

It’s ironic. The same people who scream about decentralization are now demanding government-issued licenses to participate in it. You can’t have a permissionless system and then require a 12-month approval process, a fidelity bond, and a compliance officer. That’s not regulation - that’s centralization with a fancy acronym.

The fact that only two exchanges got licensed in a country of 200 million people says everything. This isn’t about protecting investors. It’s about protecting power. And the real tragedy? The people who need crypto the most - the unbanked, the underpaid, the hopeful - are the ones being pushed out.

Meanwhile, the global miners? They’re laughing. They’re in Canada, in Georgia, in Texas - where the electricity is cheap, the rules are clear, and the government doesn’t treat you like a suspect the moment you plug in a GPU.

So yes, mining is ‘legal’ in Nigeria. But only if you’re rich enough to afford the legal team. And that’s not freedom. That’s a luxury tax on hope.

Megan Peeples

Wait - so you can trade $92 billion in crypto but you can’t mine it without a $10,000 investment? That’s not regulation. That’s discrimination. The government wants the tax revenue from the traders, but doesn’t want the messy, noisy, power-hungry miners in their backyard. So they make it impossible. Classic.