Nigeria Crypto Mining Feasibility Calculator

Mining Parameters

Mining Feasibility Analysis

Is crypto mining legal in Nigeria? The short answer is: yes - but only if you jump through a dozen hoops. There’s no law that says you can’t mine Bitcoin or Ethereum in your garage. But if you try to do it without following the rules, you could lose your equipment, your bank account, or worse - your freedom.

What’s Actually Banned - and What’s Not

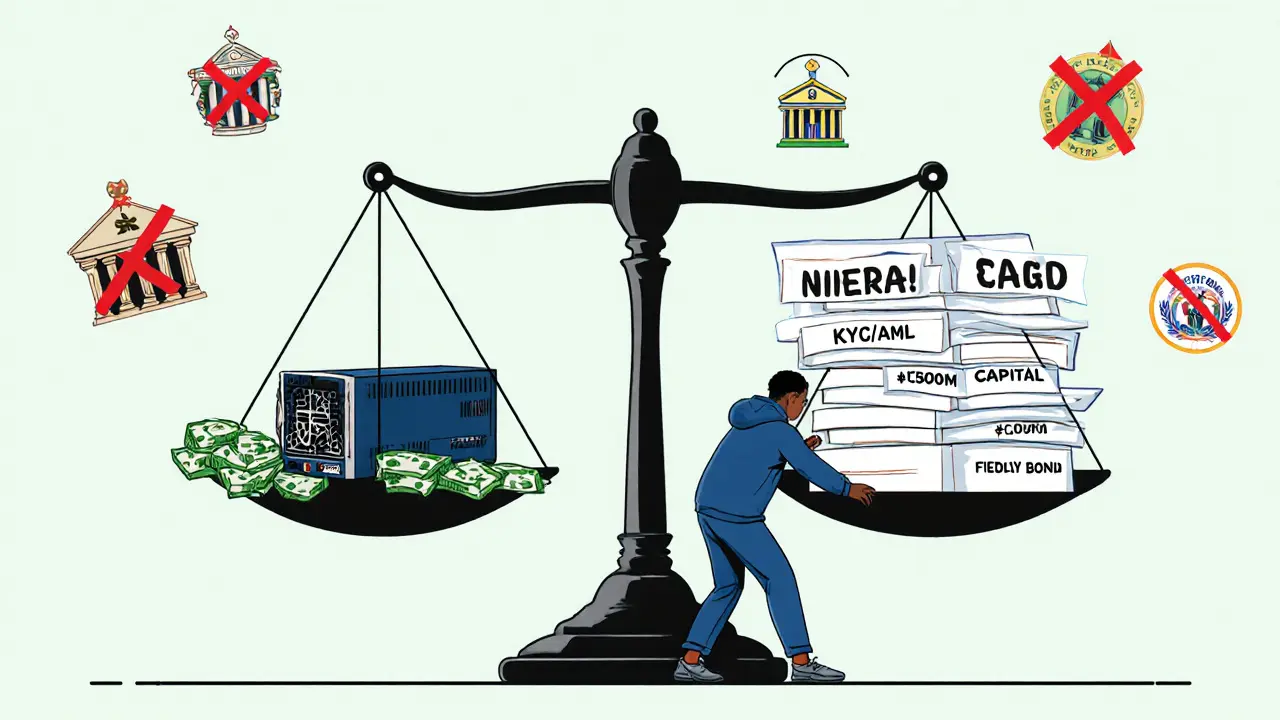

You won’t find a single law that says, “Thou shalt not mine crypto in Nigeria.” That’s the problem. Instead, the government built a maze of rules that make mining nearly impossible unless you’re a registered company with deep pockets. The Central Bank of Nigeria (CBN) banned banks from handling crypto transactions back in 2021. That didn’t stop people from trading - Nigerians moved over $92 billion in crypto between July 2024 and June 2025, according to Chainalysis. But it did kill the easy path for miners. No bank account? No paying for electricity. No paying for hardware. No cashing out profits. The real shift came in 2025 with the Investments and Securities Act (ISA 2025). This law didn’t ban mining. It made every crypto-related business a securities company. That means if you’re mining and selling the coins you earn, you’re now a Virtual Asset Service Provider (VASP). And VASPs? They need a license from the Securities and Exchange Commission (SEC).The SEC License: What It Costs and Who Can Get It

Getting an SEC license isn’t like applying for a business permit. It’s a full corporate overhaul. To qualify, you need:- A registered Nigerian company with a physical office in Lagos or Abuja

- At least ₦500 million ($335,000) in paid-up capital

- A fidelity bond (insurance) worth at least ₦100 million ($67,000)

- Full KYC and AML compliance systems

- Local management - no offshore directors allowed

The Tax Trap: Pay Up or Get Fined

The Nigeria Tax Administration Act (NTAA) 2025, which takes effect in January 2026, turns up the heat even more. Any VASP - including mining operations that sell coins - must register for taxes or face:- ₦10 million ($6,693) fine in the first month of non-compliance

- ₦1 million ($669) extra for every month after that

- License suspension or permanent revocation

Electricity: The Hidden Roadblock

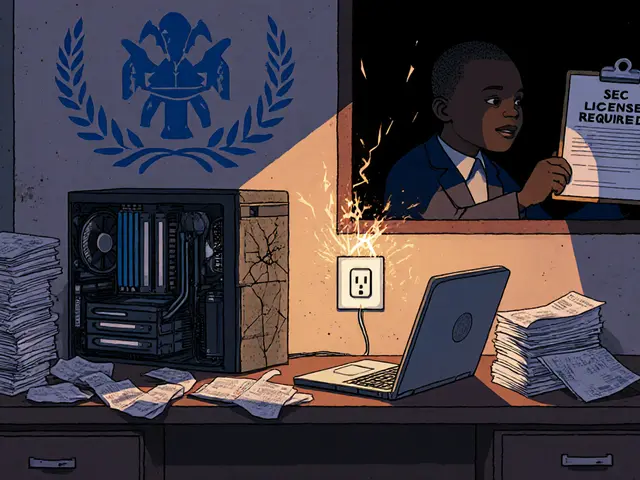

Even if you cleared every legal hurdle, Nigeria’s power grid will still stop you. A single ASIC miner like the Antminer S19 Pro uses about 3,250 watts. That’s more than a whole Nigerian household uses on average. Running it 24/7 costs around ₦45,000 ($30) per month in Lagos - and that’s if the power doesn’t cut out. Most homes get only 4-6 hours of grid power daily. Miners rely on diesel generators, which add another ₦30,000-₦50,000 ($20-$33) per month in fuel. That’s over ₦80,000 ($53) just to keep one machine running. At current Bitcoin prices, that’s barely enough to cover electricity - let alone hardware depreciation or cooling. Compare that to Kazakhstan, where electricity costs $0.03 per kWh, or Canada, where hydro power is cheap and reliable. Nigerian miners aren’t just fighting regulators - they’re fighting physics.Who’s Still Mining - And How

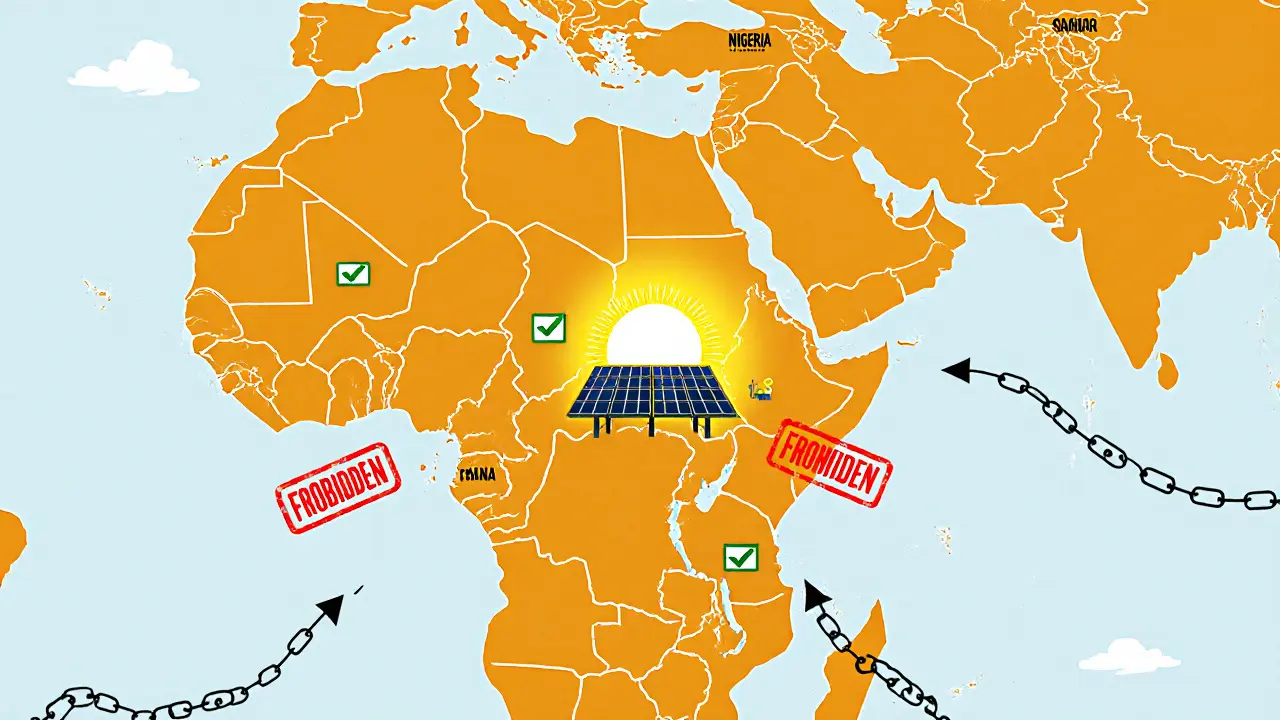

Despite all this, mining hasn’t disappeared. It just went underground. Some miners operate as “private pools,” pooling resources with friends to share costs and risks. Others use decentralized exchanges (DEXs) to swap mined coins directly for stablecoins like USDT, avoiding licensed platforms entirely. A few have moved their rigs to neighboring countries like Ghana or Kenya, where power is more stable and rules are looser. The most common workaround? Mining on solar-powered setups. A growing number of tech-savvy Nigerians are installing rooftop solar panels just to power their miners. It’s expensive upfront - $2,000-$5,000 for a full system - but it cuts monthly costs by 70%. It’s not legal, but it’s becoming practical.

What Happens If You Get Caught?

The SEC doesn’t go after individuals yet. But the EFCC does. In 2024, the EFCC seized over 200 mining rigs from unlicensed operators in Lagos and Abuja. Those rigs were auctioned off, and the owners were charged with operating an unregistered financial business. Some faced jail time. If you’re mining at home and don’t report income, you’re not breaking the mining law - you’re breaking the tax law. And tax evasion in Nigeria carries up to 10 years in prison. The message is clear: if you’re making money from crypto, the government wants a cut. And they’re building the tools to take it.The Future: Legal Mining Is Possible - But Only for the Rich

Nigeria isn’t banning crypto. It’s trying to control it. The ISA 2025 and NTAA 2025 are signs of maturity - not repression. The country wants to be a player in the global crypto economy, not a backwater. But that future only belongs to companies with lawyers, accountants, and millions in capital. For the average Nigerian with a few GPUs and a dream? The system is stacked against them. The only real path forward is to wait. The SEC is still approving new licenses. More exchanges will come online. More banks will open accounts for compliant firms. And if you’re patient, you might eventually join the system - legally. Until then, mining in Nigeria isn’t illegal. But it’s risky, expensive, and barely profitable. And the government is watching.Is it illegal to mine Bitcoin in Nigeria?

No, mining Bitcoin or other cryptocurrencies isn’t explicitly illegal in Nigeria. But if you sell the coins you mine, use an exchange, or earn income from mining, you’re required to register as a Virtual Asset Service Provider (VASP) with the SEC. Failure to comply can lead to fines, asset seizures, or criminal charges under tax and financial laws.

Can I use my bank account for crypto mining profits?

No. Banks in Nigeria are still prohibited from handling crypto-related transactions unless the business is licensed by the SEC. Even licensed exchanges must use special escrow accounts approved by the CBN. Most miners use P2P platforms like Paxful or Binance P2P to convert crypto to Naira, but those transactions are now monitored by regulators.

How much does it cost to start mining crypto in Nigeria?

For a legal operation, you need at least ₦500 million ($335,000) in paid-up capital, a physical office, and compliance systems - making it impossible for individuals. For a home miner using a single ASIC rig, expect to spend ₦1.2 million ($800) on hardware, ₦45,000 ($30) monthly on electricity (if grid power is available), and another ₦30,000-₦50,000 ($20-$33) on diesel backup. Most home miners lose money after accounting for depreciation and downtime.

Do I have to pay taxes on crypto mining income in Nigeria?

Yes. Under the Nigeria Tax Administration Act (NTAA) 2025, which takes effect in January 2026, all crypto mining income is taxable. You must register with the Federal Inland Revenue Service (FIRS) and report earnings. Fines start at ₦10 million ($6,693) for non-compliance, plus ₦1 million ($669) per month for ongoing violations. Tax evasion can lead to criminal prosecution.

Can I get a license to mine crypto in Nigeria?

You can’t get a license just to mine. Licenses are for Virtual Asset Service Providers (VASPs) - businesses that offer exchange, custody, or trading services. If you’re mining and selling coins, you need to register as a VASP. The SEC requires at least ₦500 million in capital, a Nigerian office, and full compliance with AML/KYC rules. Solo miners don’t qualify.

Are there any legal crypto mining companies in Nigeria?

There are no known companies that operate large-scale mining farms in Nigeria. The few licensed VASPs - like Quidax and Busha - are exchanges, not miners. Most mining in Nigeria is done by individuals or small groups using home setups. No licensed mining company has publicly announced operations yet, because the economics don’t work under current power and regulatory conditions.

Chris Hollis

Nigeria's crypto rules are just capitalism with extra steps. They want the money but won't give you the infrastructure. Classic.

Diana Smarandache

The regulatory framework in Nigeria reflects a profound misunderstanding of decentralized finance. To impose corporate securities law on individual miners is not oversight-it is suppression disguised as compliance.

Allison Doumith

People think they're fighting the system but they're just fighting physics and electricity bills The real revolution isn't crypto it's solar panels And yeah the government is watching But so are the sun and the wind And they don't care about your SEC license

Scot Henry

Honestly the way they've structured this it's like they want people to give up and move to Ghana. Smart move if you're trying to kill innovation.

Sunidhi Arakere

Mining in Nigeria is like running a marathon with weights tied to your legs. The rules are clear. The power is not. The cost is too high.

Vivian Efthimiopoulou

We are witnessing the birth pangs of a new financial order-one where sovereignty, infrastructure, and equity must converge. The Nigerian state is not anti-crypto; it is anti-chaos. But chaos, in this case, is the natural state of decentralized innovation. The real question is not whether mining is legal-but whether the state has the moral authority to demand compliance from those it has failed to empower.

Angie Martin-Schwarze

I just read this and cried a little. Not because I'm sad but because I know so many people trying to do this and it's just... so unfair. The power cuts, the diesel costs, the taxes-it's like they want you to fail but won't let you quit.

Fred Kärblane

Let's not sugarcoat this: the VASP framework is a regulatory moat. It's designed to protect incumbents and exclude disruptors. The SEC isn't regulating crypto-they're curating a cartel. And the real winners? The ones who already own the grid, the banks, and the compliance departments.

Janna Preston

So if I mine and never sell, am I fine? Or does just owning the rig count as a VASP now?

Meagan Wristen

I love how Nigerian youth are turning solar panels into mining rigs. It's beautiful. They're not just surviving the system-they're reimagining it. This isn't rebellion. This is adaptation with soul.

Becca Robins

so like... if i mine and just hodl in my wallet like a chill person... is that illegal? 🤔 i mean i dont even know what a vasp is 😅

Alexa Huffman

The fact that you can legally mine but not profit from it is a bureaucratic paradox. It’s like saying you can grow your own food but can’t sell the vegetables. The system is designed to make you feel guilty for trying.

gerald buddiman

I’ve seen guys in Lagos with 20 rigs running on solar... and they’re still broke. The hardware depreciates faster than the Naira. The government doesn’t care. They just want the tax.

Arjun Ullas

The Nigerian government is not hostile to cryptocurrency. It is hostile to unregulated financial autonomy. The ISA 2025 is a necessary step toward financial inclusion-if and only if the infrastructure and accessibility are scaled equitably. Until then, the policy remains exclusionary.

Steven Lam

Why should I pay taxes to a government that can't keep the lights on? That's not compliance. That's extortion.

Noah Roelofsn

They call it a VASP license but it’s really a wealth filter. You need a CFO, a lawyer, and a bank account that doesn’t freeze the moment you mention Bitcoin. Meanwhile, the guy with a rig in his bedroom is a criminal because he doesn’t have a corporate seal. This isn’t regulation. It’s class warfare dressed in compliance jargon.

Sierra Rustami

America doesn't have these problems. Nigeria needs to stop pretending it's a crypto hub. It's a power grid disaster with a lot of hustle.

Glen Meyer

They're not banning crypto. They're banning poor people from getting rich. That's the real story.

Christopher Evans

The regulatory structure is logically consistent but morally bankrupt. It assumes that financial innovation must be corporate, centralized, and compliant-and that individual agency is a risk to be contained. This is not progress. It is control.