Crypto Mining Nigeria: Risks, Reality, and What’s Really Happening

When you hear crypto mining Nigeria, the practice of using computing power to validate Bitcoin and other blockchain transactions in Nigeria. Also known as Bitcoin mining in Nigeria, it’s become a grassroots tech movement driven by young entrepreneurs, frustrated by inflation and limited banking access. Unlike in countries with cheap hydroelectric power, Nigeria’s miners fight daily with unstable grids, soaring electricity bills, and legal uncertainty.

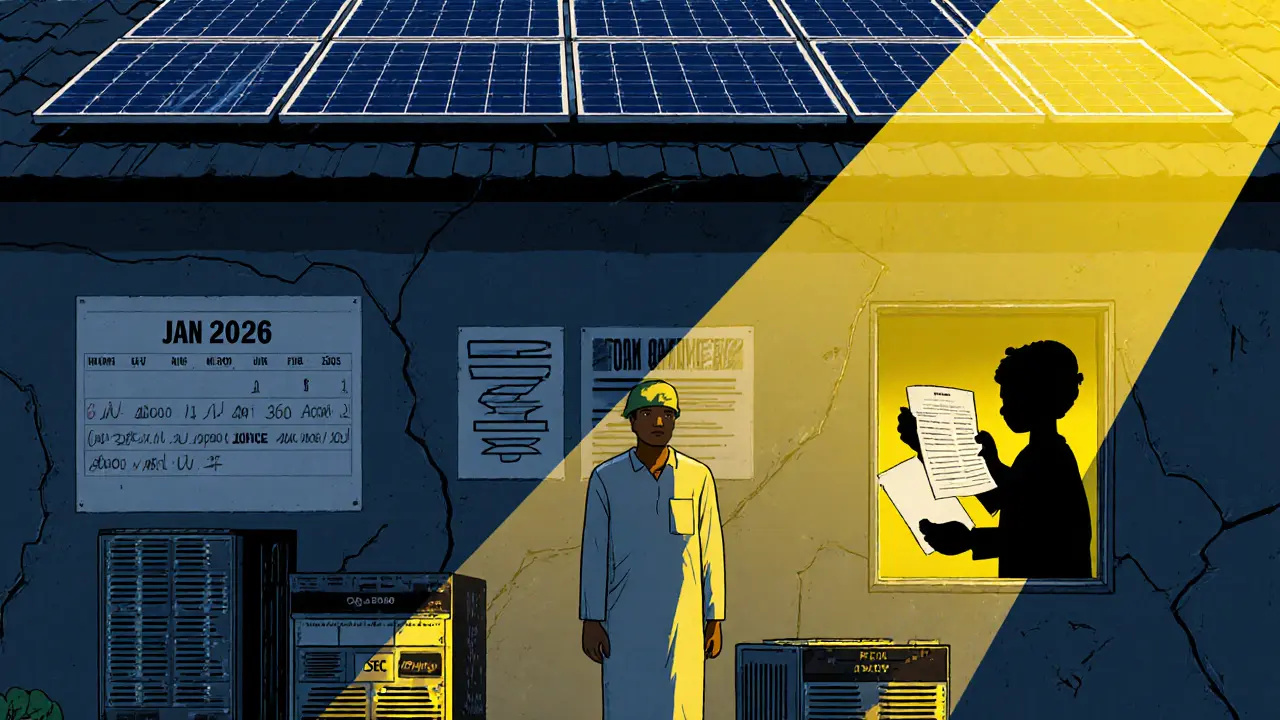

Most miners rely on crypto mining hardware, specialized machines like ASICs designed to solve complex cryptographic puzzles—but these machines need steady power. That’s why many set up shop in places with generators, often burning diesel to keep rigs running 24/7. The cost? Up to 30% of profits vanish just keeping the machines cool and powered. And while some claim you can earn $500 a month mining Bitcoin, few account for the wear and tear on gear, or the fact that Nigeria’s grid can shut down without warning.

The law doesn’t make it easier. While Nigeria’s Central Bank doesn’t outright ban crypto mining, it bans banks from serving crypto businesses. That means miners can’t open business accounts, cash out profits easily, or get insurance for their equipment. Some have been raided by police claiming they’re running illegal operations—even though mining itself isn’t illegal. The real target? Unlicensed crypto exchanges and pyramid schemes that pretend to be mining farms. That confusion has made legitimate miners wary.

What’s surprising is how many Nigerians still do it. Why? Because inflation hit 30% in 2024, and the naira lost over half its value against the dollar in two years. For many, mining isn’t a side hustle—it’s a survival tactic. A single rig running on solar power can earn enough Bitcoin to buy groceries for a family for weeks. Others pool resources, sharing generators and cooling setups in shared warehouses in Lagos or Abuja.

But here’s the catch: most people who start mining don’t know the difference between a real ASIC and a fake mining contract. Scammers sell "mining shares" for $50 that promise daily returns—then vanish. Legit mining requires technical know-how, access to spare parts, and the patience to wait months for a return on investment. It’s not passive income. It’s a high-risk, high-effort job.

So what’s next? Some Nigerian miners are turning to solar and wind to cut fuel costs. Others are partnering with data centers that have backup power. A few even export their rigs to neighboring countries with better electricity. But the biggest challenge isn’t tech—it’s trust. Without clear rules, no bank will touch them. Without legal protection, no one will lend them money. And without transparency, scams will keep thriving.

Below, you’ll find real stories and breakdowns of what’s actually working in Nigeria’s crypto mining scene. No fluff. No promises of easy money. Just what miners are doing, what’s costing them, and how they’re staying ahead—despite everything.