Crypto Mining Restrictions: What’s Banned, Who’s Affected, and Why It Matters

When we talk about crypto mining restrictions, government rules that limit or ban the process of validating blockchain transactions using computational power. Also known as cryptocurrency mining bans, these rules are no longer just theoretical—they’re shutting down operations, freezing assets, and forcing exchanges to change how they operate. It’s not about stopping blockchain tech. It’s about control: who uses energy, who hides behind anonymity, and who follows the rules.

Look at what’s happening in South Korea. The Upbit penalties, a $34 billion fine threat for failing to verify user identities, wasn’t just a slap on the wrist—it was a wake-up call. Exchanges that ignored KYC crypto, the requirement to know your customer before letting them trade are now facing legal chaos. Canada didn’t wait for warnings. When they seized $40 million from TradeOgre shutdown, a crypto exchange that operated without any user verification, they proved they could track even privacy-focused coins like Monero. These aren’t isolated cases. They’re part of a global shift.

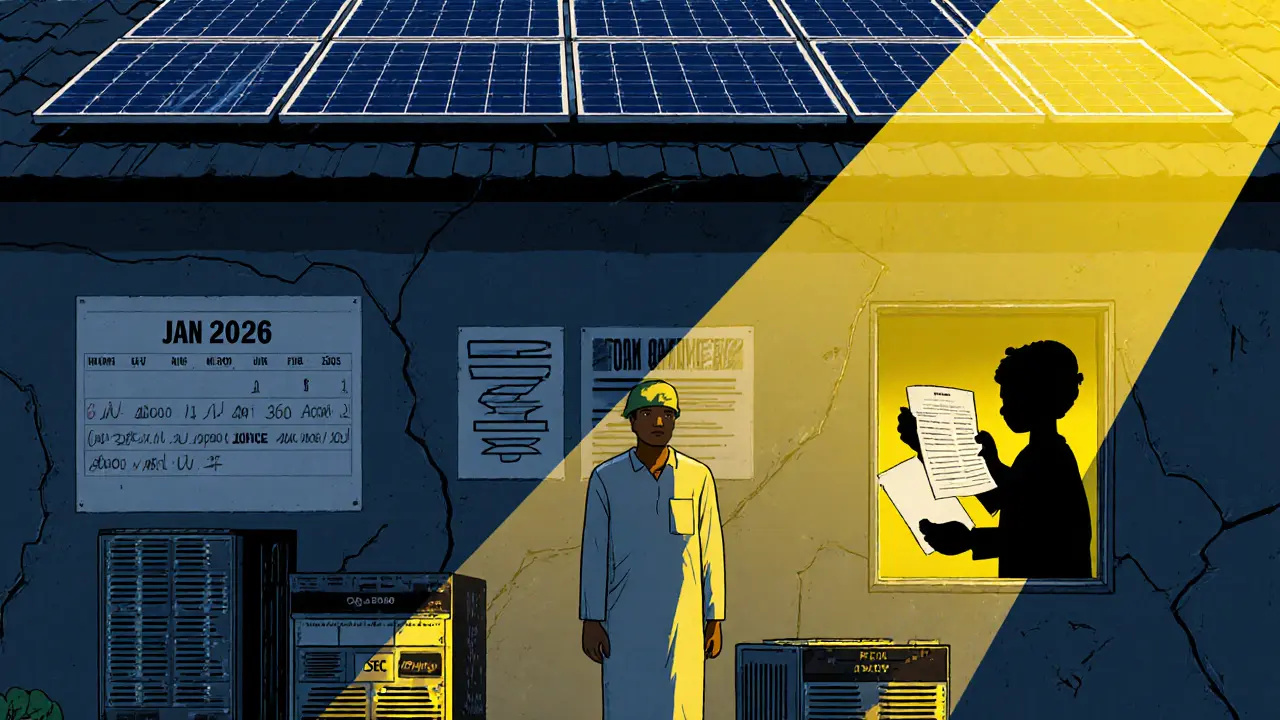

And it’s not just exchanges. Mining itself is under fire. Countries like China banned it outright over energy concerns. Others, like Kazakhstan and Russia, now demand licenses, taxes, and proof of legal power use. Even if you’re not mining, these rules affect you. If your favorite exchange gets hit with a fine or shuts down in your country, your access vanishes. If a project gets labeled non-compliant, its token drops faster than a dropped phone. AML crypto, anti-money laundering rules that force tracking of every transaction means even small trades now leave digital footprints. No more hiding.

What you’ll find below isn’t a list of news headlines. It’s a real-world map of how these restrictions play out. You’ll see how fake airdrops like HyperGraph (HGT) and CovidToken exploit confusion around regulation. You’ll learn why exchanges like Bitsonic and Poloniex stopped serving users in certain countries. You’ll understand why LongBit and AnimeSwap are scams—because they pretend to operate where real rules exist. And you’ll see how projects that ignore crypto mining restrictions don’t just fail—they disappear overnight, taking people’s money with them.